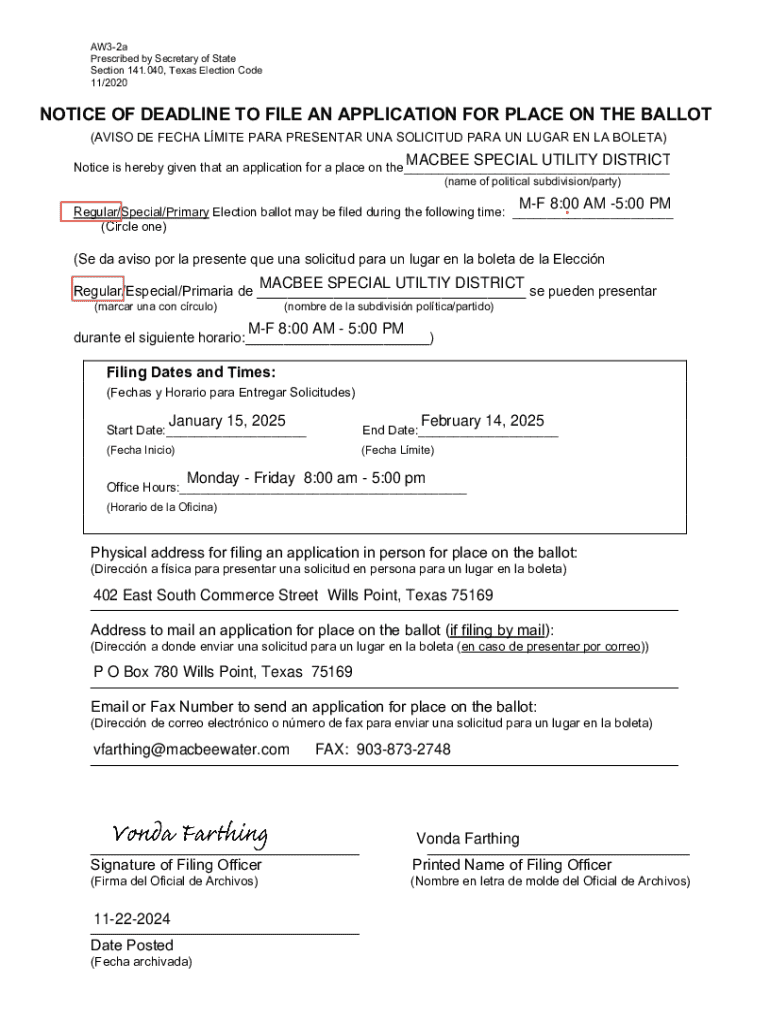

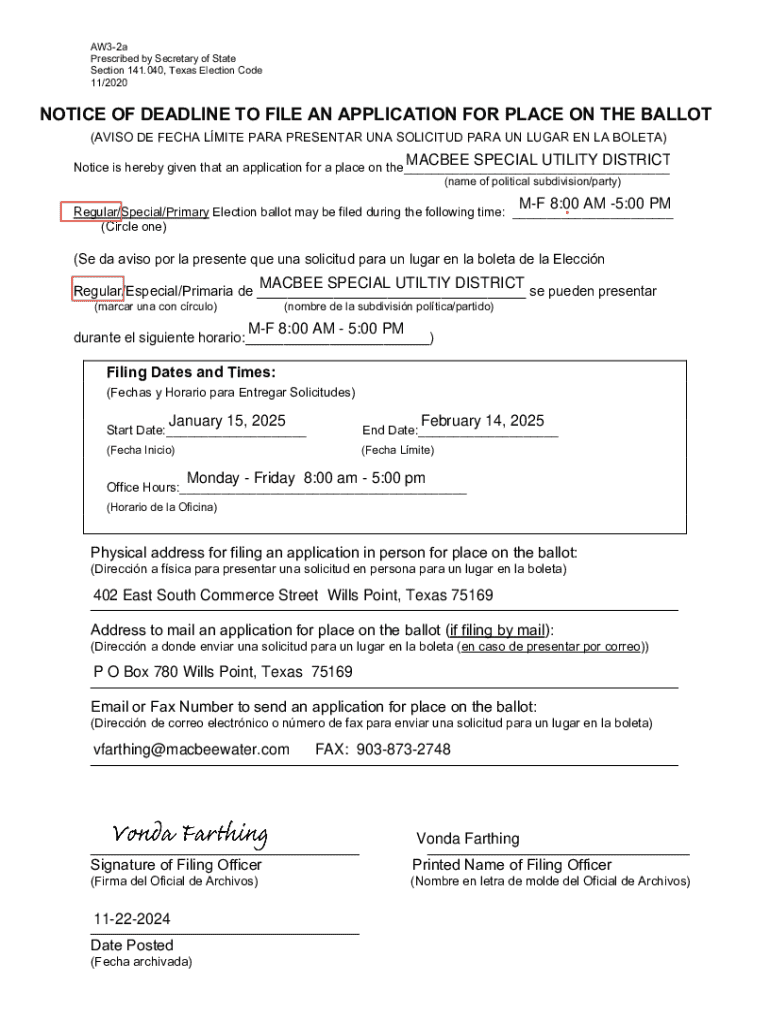

Get the free Aw3-2a

Get, Create, Make and Sign aw3-2a

How to edit aw3-2a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aw3-2a

How to fill out aw3-2a

Who needs aw3-2a?

A comprehensive guide to the AW3-2A form

Understanding the AW3-2A Form

The AW3-2A form is a vital document used primarily for tax reporting purposes, serving as a summary of income and taxes withheld throughout a given period. Organizations, businesses, and individuals utilize this form to report accurate financial transactions to the relevant authorities, ensuring compliance with tax regulations. The purpose of the form extends beyond mere compliance; it also facilitates financial accountability for individuals and teams alike.

Understanding the AW3-2A form is crucial as it plays a significant role in establishing financial transparency. For organizations, this not only builds trust with stakeholders but also aids in financial planning and forecasting. Furthermore, the consequences of inaccuracies in this form can lead to penalties or audits, underscoring its importance.

Who needs to use the AW3-2A form?

The AW3-2A form is primarily designed for: 1. **Businesses**: Companies must report withholding taxes and income to meet regulatory requirements. 2. **Employees**: Individuals receiving wages need to ensure their tax withholdings align with reported income. 3. **Freelancers and contractors**: Independent workers often rely on this form as a summary of their income and reported taxes.

Common scenarios for using the AW3-2A form include the annual tax season, when employees and businesses compile financial information for tax returns, or when there is an audit by authorities, necessitating proof of income and tax withholdings. Understanding who needs to use this form helps set the stage for efficient tax management.

Key features of the AW3-2A form

The AW3-2A form comprises several essential sections that allow for organized and clear reporting. Each section serves specific purposes, helping to ensure comprehensive documentation of financial activities.

Essential sections of the form

1. **Personal Identification Information**: This section request basic details such as the name, address, and Social Security number or Employer Identification Number (EIN) for businesses. 2. **Financial Reporting Components**: This includes fields for reporting total wages, taxes withheld, and any additional compensation or benefits relevant to the reporting period. 3. **Required Attachments and Documentation**: Certain documentation may be required to accompany the AW3-2A submission, such as pay stubs or 1099 forms to validate claims.

These sections not only simplify the completion process but also integrate with related tax forms, enhancing overall document management. Accurate completion of these sections is essential for establishing a coherent financial summary that aligns with local regulations.

Step-by-step guide to filling out the AW3-2A form

Filling out the AW3-2A form accurately begins with adequate preparation. Ensuring that all necessary documents are organized and readily available is crucial. This not only prevents frustration during the form-filling process but significantly reduces the likelihood of errors.

Preparation before filling out the form

Compile the following documents: 1. **Pay stubs**: Offering proof of income and tax withholdings. 2. **Previous AW3-2A forms**: To maintain consistency in reported data. 3. **Tax IDs**: Ensure you have the correct identification numbers, such as Social Security or EIN.

Keeping these documents organized will simplify the information retrieval process, making it easier to input accurate data on the AW3-2A form. Furthermore, digital document management tools, such as those offered by pdfFiller, can streamline this organization, providing users easy access anytime.

Detailed instructions for each section

1. **Filling out personal identification information**: Accuracy is crucial. Double-check spelling and numerical entries to avoid discrepancies in official records. Use the format stipulated by the respective agencies. 2. **Completing financial reporting components**: Ensure that all financial items reflect exact amounts to prevent issues with local tax authorities. Be vigilant of common mistakes such as miscalculating totals or omitting necessary information. 3. **Ensuring all required attachments are included**: Create a checklist to ensure that you’ve included all the requisite documents. Missing attachments can delay processing and create additional complications.

Utilizing digital tools, especially those offered by pdfFiller, can aid in seamlessly completing this form. With features like interactive forms, auto-fill capabilities, and secure eSigning options, users can easily navigate the complexities of the AW3-2A form.

Editing and managing the AW3-2A form

Editing the AW3-2A form after submission may be necessary. This process must be handled correctly to avoid complications with authorities.

Editing options available on pdfFiller

1. **Making corrections post-submission**: PdfFiller allows users to access their forms and make necessary edits even after submission if the platform supports it. This facility is especially beneficial if you discover errors after submitting your AW3-2A form. 2. **Collaboration features**: For team-based edits, pdfFiller supports real-time collaboration, enabling multiple users to contribute and refine a single document, thus ensuring all input is properly validated and accurate.

Once edits are complete, saving and storing your AW3-2A form securely remains vital. With pdfFiller, users can choose from various file formats for downloading, ensuring flexibility according to individual needs. Cloud storage linked to pdfFiller also offers robust advantages, such as easy access and retrieval from anywhere with internet connectivity.

Common questions about the AW3-2A form

Addressing common inquiries can streamline the experience of filling out the AW3-2A form. Questions often arise around the submission process and tracking status.

Frequently asked questions

1. **How do I track the status of my AW3-2A form?**: Users can typically track their submission status through the local tax authority’s website or the platform used for submission. 2. **What if I make a mistake on my form?**: Corrections can be made, provided they are handled per the specific guidelines for your jurisdiction. Always consult local guidelines for precise procedures. 3. **Can I submit the form electronically?**: Many regions allow for electronic submission, especially within user-friendly platforms like pdfFiller that concentrate on form accuracy and compliance.

Additionally, troubleshooting issues often related to attachment submissions or eSigning problems can help prevent delays in processing. Having knowledge of possible error messages and resolution steps can equip users for a smooth filing experience.

Linked topics and related documents

Familiarizing oneself with related forms and documents can enhance understanding and compliance across various financial responsibilities.

Other relevant forms to consider

1. **W-2 Form**: Essential for employees, summarizing wages and withholdings. 2. **1099 Form**: Used for freelance work outside traditional employment, a counterpart to the AW3-2A in its reporting purposes. 3. **Quarterly tax forms**: For mid-year reports to manage and predict tax liabilities.

Understanding these forms can provide additional insights into tax compliance and document management.

Tax compliance and regulatory insights

The AW3-2A form, alongside its counterparts, is a cornerstone of tax compliance, ensuring that individuals and businesses are accountable. Proper management of tax documents cultivates a culture of transparency and integrity—a key aspect that regulatory bodies strive to uphold.

Resources for further information regarding tax compliance can be found on official government websites, often providing updated guidelines and practice examples.

Importance of using pdfFiller for AW3-2A form management

Leveraging pdfFiller for the AW3-2A form management offers several key advantages, significantly streamlining the overall process of document creation and management.

Comprehensive document creation and management

PdfFiller’s features are expertly tailored to facilitate ease of use in completing forms. Its user-friendly interface makes navigating complex forms like the AW3-2A a seamless experience, even for those who may not be technologically inclined.

Benefits of a centralized document editing platform

1. **Seamless eSigning**: The platform allows users to sign documents electronically, eliminating paper clutter. 2. **Collaboration**: With tools for team input and review, document preparation becomes efficient and synchronized, ensuring all voices are heard, and all information is accurate. 3. **Accessibility**: Being cloud-based, pdfFiller enables users to manage their documents regardless of location, greatly enhancing operational efficiency.

By utilizing pdfFiller, users experience a marked increase in efficiency and a decrease in common errors associated with traditional document management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send aw3-2a to be eSigned by others?

Can I create an electronic signature for the aw3-2a in Chrome?

Can I create an eSignature for the aw3-2a in Gmail?

What is aw3-2a?

Who is required to file aw3-2a?

How to fill out aw3-2a?

What is the purpose of aw3-2a?

What information must be reported on aw3-2a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.