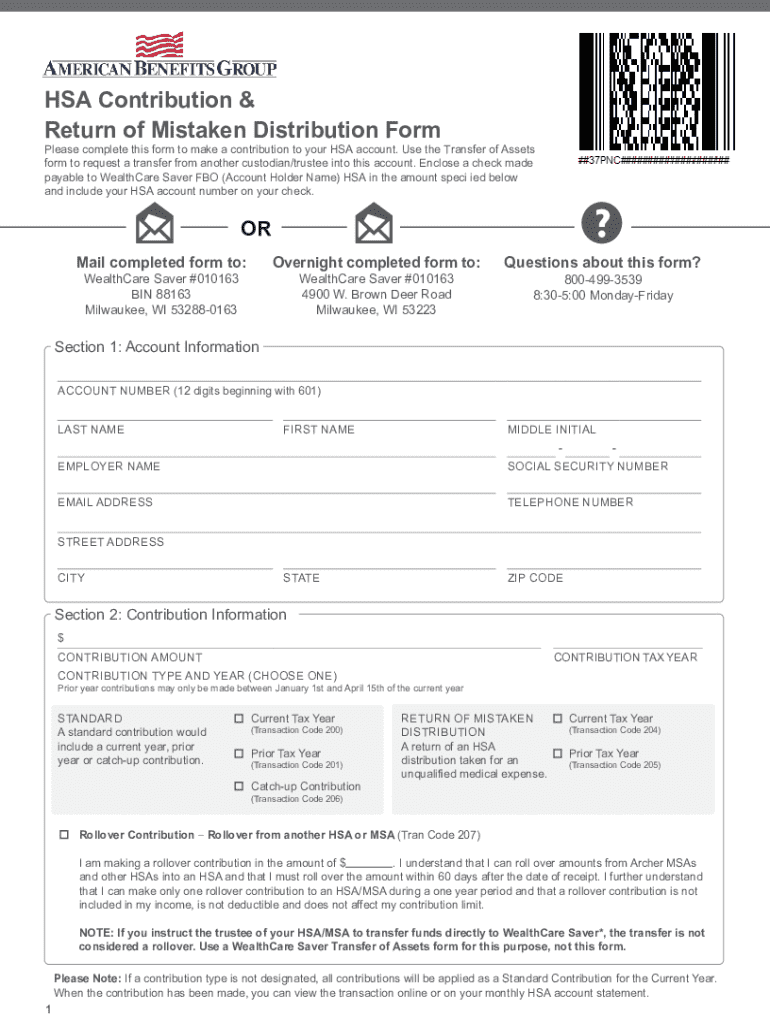

Get the free Hsa Contribution & Return of Mistaken Distribution Form

Get, Create, Make and Sign hsa contribution return of

Editing hsa contribution return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hsa contribution return of

How to fill out hsa contribution return of

Who needs hsa contribution return of?

Understanding HSA Contribution Return of Form: A Comprehensive Guide

. Understanding HSA contributions

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals save for medical expenses. HSAs provide a unique combination of tax benefits, allowing contributions to grow tax-free and be withdrawn tax-free for qualified medical costs. This makes HSAs not only a tool for immediate health-related expenses but also an effective way to save for future healthcare needs.

HSA contributions are vital for maximizing the benefits of this account. They allow individuals to build a financial cushion for unexpected medical expenses while enjoying tax savings. The contributions can be made by individuals, employers, or a combination of both.

. Overview of HSA contribution forms

The HSA contribution return of form is essential for anyone looking to manage their HSA contributions properly. There are typically two types of forms individuals encounter: employer contribution forms and individual contribution forms. Each serves a specific function in reporting how much money has gone into the HSA, whether through employer payroll deductions or personal contributions.

The purpose of the HSA contribution return of form is to accurately report and reconcile the amount contributed to the HSA for tax purposes. This ensures that individuals know their contributions do not exceed annual limits set by the IRS.

. Preparing to fill out the HSA contribution return of form

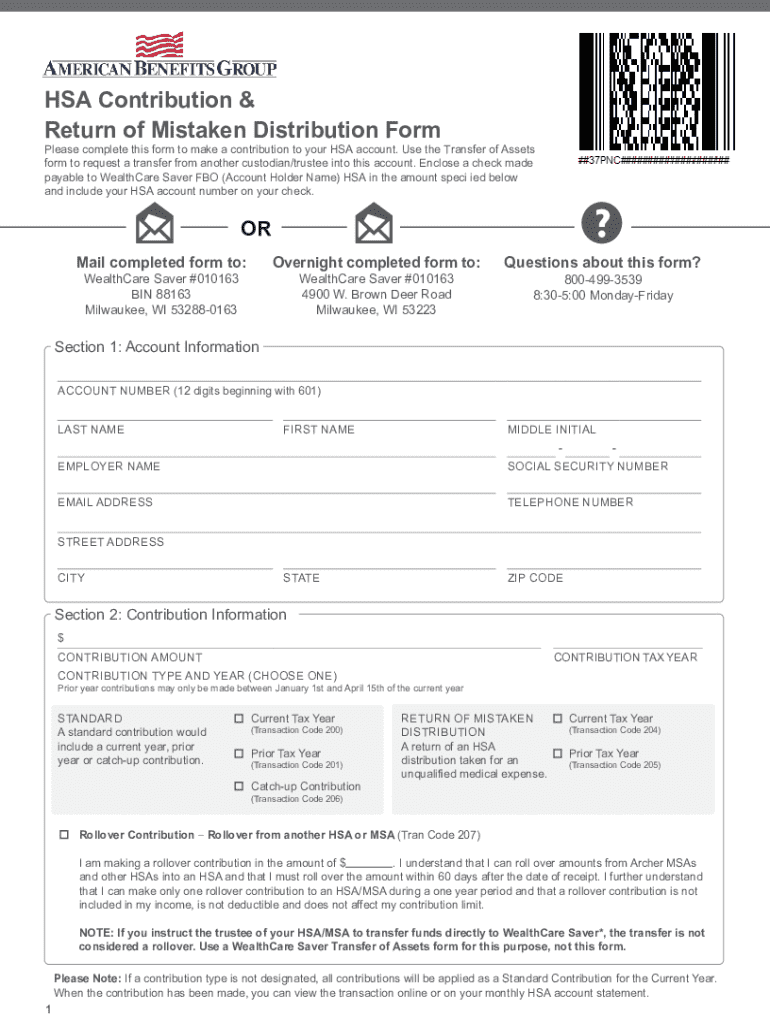

Before filling out the HSA contribution return of form, it’s crucial to gather all necessary information. This includes personal identification details such as name, Social Security number, and HSA account number, along with the specific amounts contributed and their sources.

To simplify the process, tools like pdfFiller can significantly help streamline documentation. This platform allows users to access forms quickly and offers various tools for easy filling, signing, and editing, ensuring you have everything you need right at your fingertips.

. Step-by-step guide to completing the HSA contribution return of form

Completing the HSA contribution return of form is straightforward when approached step by step. First, accessing the form can usually be done through the IRS website or financial institution. pdfFiller provides a user-friendly option ensuring the form is accessible anytime, anywhere.

Next, as you fill in your personal information, ensure you double-check key details such as your name and correct Social Security number to avoid unnecessary confusion later. Common mistakes include misspellings and incorrect account numbers, so take your time.

When reporting contributions, it is vital to include precise figures and understand the treatment of rollover contributions, which may have specific reporting guidelines.

Before finalizing the form, review it thoroughly. Utilize pdfFiller’s tools to make necessary edits, ensuring all information is both accurate and complete.

. Submitting your HSA contribution return of form

Once completed, it’s time to submit your HSA contribution return of form. You generally have two submission methods: electronic submission via a secure portal or mailing a paper copy to the mandated IRS address. Each method has its advantages, with electronic submissions providing swift confirmation of receipt.

It’s crucial to adhere to deadlines and keep in mind the annual contribution limits. The IRS sets clear rules on contribution limits, which can change annually. Be diligent about submitting your form before tax deadlines to avoid penalties.

. Common questions about HSA contribution returns

Frequently, individuals have questions regarding mistakes made on their forms. If you realize that a mistake has occurred after submission, it’s crucial to amend the form by following IRS guidelines to ensure accurate tax reporting. Common mistakes include underreporting contributions or failing to indicate rollover amounts.

Handling rejected forms or contributions is equally vital. Always communicate with the financial institution or the IRS if there are discrepancies or rejections to address any issues promptly.

. Leveraging pdfFiller for HSA form management

pdfFiller offers numerous interactive tools designed to simplify the management of HSA forms. One of the standout features is the ability to eSign the HSA contribution return of form directly on the platform, eliminating the need for printing and scanning. Moreover, users can collaborate with team members seamlessly, ensuring that all contributions and details are accurate before submission.

The benefits of using a cloud-based platform for HSA management extend to organizing documentation, storing completed forms securely, and maintaining easy access to submitted paperwork, drastically reducing the time needed for form management.

. Keeping track of your HSA contributions

Maintaining meticulous records of HSA contributions is critical for long-term financial health. This not only ensures compliance with IRS regulations but also provides individuals with a clear picture of their medical expenses and savings over time.

Using pdfFiller can aid in organizing this documentation effectively. Create folders for different years, track your contributions easily, and utilize provided templates for consistent record-keeping. Best practices include regularly reviewing contribution limits and adjusting contributions to optimize tax benefits.

. Understanding implications of your HSA contributions

Contributions to an HSA come with substantial tax benefits. They are tax-deductible and can lower your taxable income. However, it's crucial to understand the potential penalties for exceeding annual contribution limits or using funds for non-qualified expenses, which can lead to tax implications and additional penalties.

If you find yourself with excess contributions, options typically include withdrawing the excess funds or adjusting future contributions to stay within limits. Always consult with a tax professional for tailored advice based on your specific financial situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hsa contribution return of in Chrome?

How do I fill out the hsa contribution return of form on my smartphone?

How do I fill out hsa contribution return of on an Android device?

What is hsa contribution return of?

Who is required to file hsa contribution return of?

How to fill out hsa contribution return of?

What is the purpose of hsa contribution return of?

What information must be reported on hsa contribution return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.