Get the free Official Form 207

Get, Create, Make and Sign official form 207

How to edit official form 207 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 207

How to fill out official form 207

Who needs official form 207?

A comprehensive guide to official form 207

Understanding official form 207

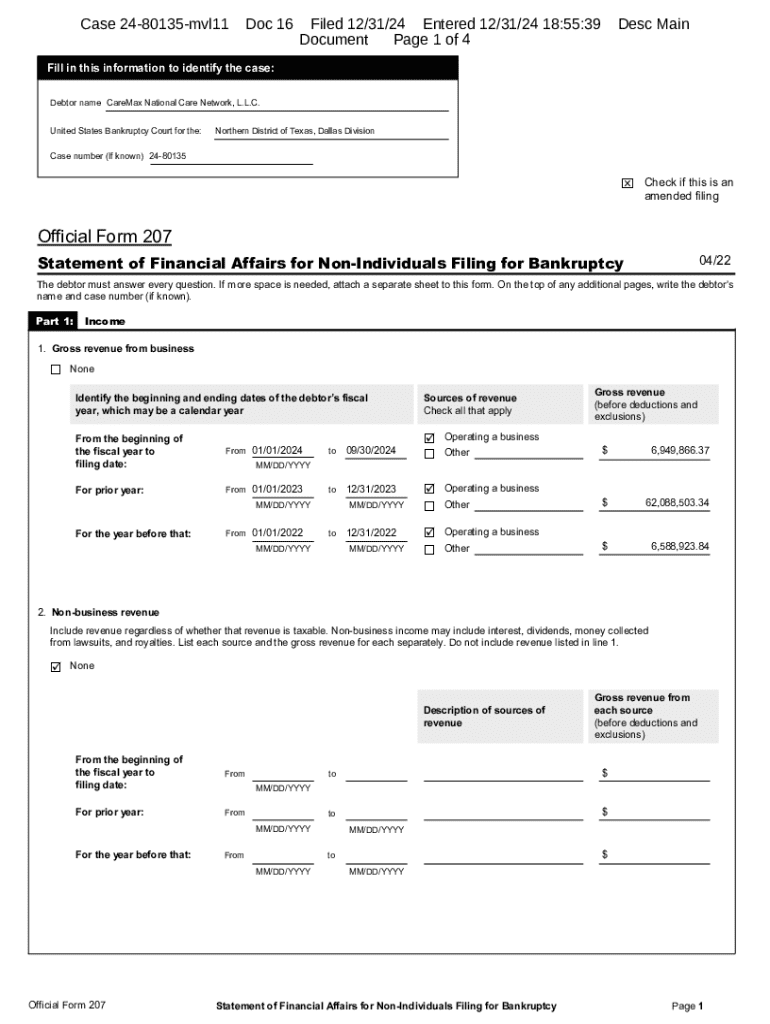

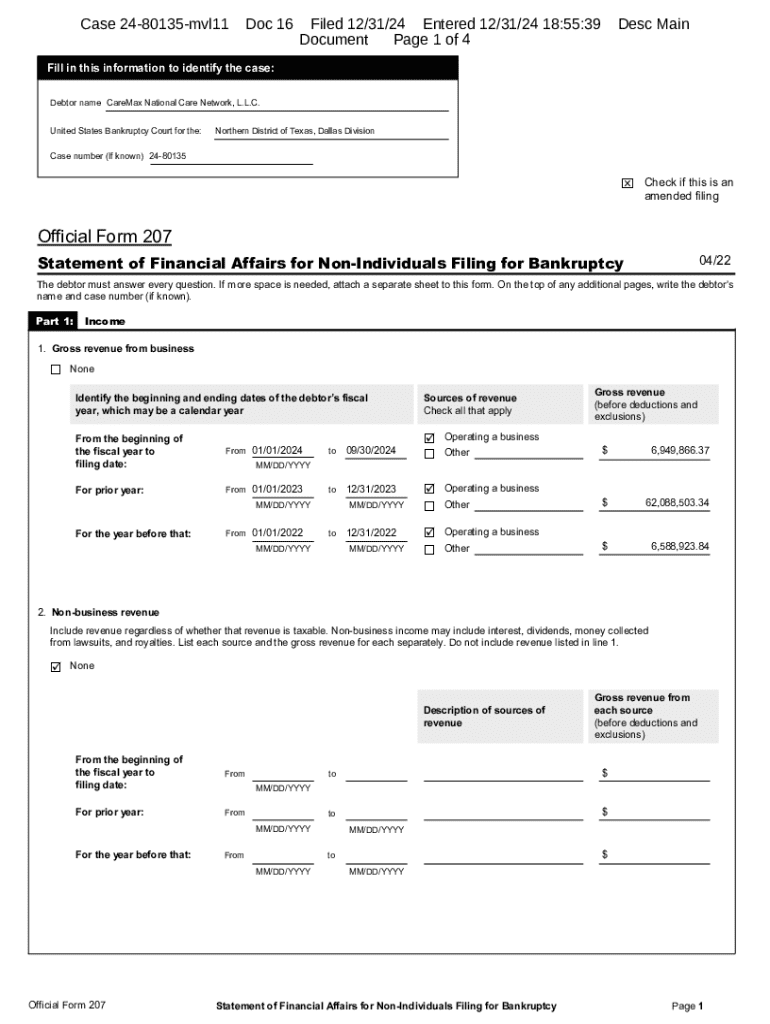

Official Form 207, often referred to simply as Form 207, is a vital document used in specific legal and administrative processes, primarily revolving around claims for benefits or assistance from various governmental departments. It acts as a standardized means to collect necessary information from individuals or entities seeking government benefits, ensuring that all applications are processed efficiently and consistently. Understanding the purpose and context of this form is essential for anyone engaging with legal systems or administrative bodies.

The significance of this form cannot be understated, as it sets the foundation for the validity of any submitted claims. It is crucial to utilize this form correctly within the specified legal frameworks to facilitate timely responses and resolutions to the requests made by applicants.

Importance of accurate completion

Accurate completion of Official Form 207 is paramount due to the serious implications of any errors that could arise during the submission process. Incorrect or incomplete information may lead to delays, denial of requests, or even legal consequences, thereby undermining the intended purpose of the application. Such errors can occur due to oversight, misunderstanding of requirements, or lack of adequate information, highlighting the necessity for meticulous attention to detail.

Conversely, achieving a high level of accuracy in filling out the form not only boosts the likelihood of approval but also accelerates the processing time. A systematic and organized approach to completing the form can dramatically increase the overall efficiency of the administrative process.

Features of official form 207

Official Form 207 comprises several key sections tailored to gather specific information from applicants. Each section plays an integral part in ensuring that the form captures all necessary data for review and processing. A breakdown of these sections reveals the level of detail required and the essential elements needed for a complete submission.

Common fields found in these sections often require personal identification numbers, documentation of eligibility, and other critical indicators of the claim’s legitimacy. By being aware of what is typically expected in these fields, applicants can compile the necessary information ahead of time, ensuring a smoother application process.

Step-by-step guide to filling out official form 207

Completing Official Form 207 effectively demands preparation and careful attention to detail. Understanding what information you need to gather and how to accurately input this information will significantly impact the success of your submission.

Preparing for submission

Start by assembling all necessary documents such as identification papers, proof of eligibility, and any other related materials that support your claim. Assessing your eligibility for using Form 207 is crucial; make sure you meet all the prerequisites set by the relevant authorities. This proactive step lays a strong foundation for completing the form accurately.

Filling out your form

When it comes to actually filling out the Form 207, meticulous care is necessary. A section-by-section approach is recommended.

In addition, utilizing tips for clarity and accuracy during this filling process is highly beneficial. Make sure to read each question thoroughly, avoiding assumptions that could lead to misunderstanding. Ensuring that the responses are articulated clearly can facilitate an efficient assessment.

Review and verification

Once you have completed the form, conducting a thorough review is crucial. Develop a verification checklist to help you ensure that every section has been accurately filled in and that no critical information has been overlooked. Time spent in this verification stage can preserve the effort put into the application and enhance its chances for success.

Taking these steps not only enhances your application’s integrity but can also significantly reduce stress for you and the reviewing authorities.

Editing and managing your official form 207

Utilizing tools like pdfFiller can greatly enhance your experience in managing Official Form 207 by allowing for seamless edits, corrections, and updates. This platform enables users to easily import the form, making the entire process of editing far more manageable than traditional paper methods.

Utilizing pdfFiller for PDF editing

Importing Official Form 207 into pdfFiller is straightforward. Users can upload their completed forms in PDF format, where they can utilize various editing tools to make adjustments, corrections, or updates as needed. With options for annotating and freely entering text fields, pdfFiller adds flexibility to the document management process.

Saving and storing your completed form

Once completed, saving your form securely is essential. pdfFiller offers cloud storage options, allowing users to store their forms using various organizational strategies. You can save completed forms with easily identifiable filenames and keep them in designated folders for quick access, which is invaluable when managing multiple forms.

eSigning official form 207

eSignatures have become a prevalent practice in today’s digital age, and understanding their implications is important when dealing with Official Form 207. A valid eSignature is not only legally binding but also assures the authenticity of your submission. Knowing how to properly execute an eSignature on this form can streamline the submission process.

Steps to eSign your completed form

Using pdfFiller to eSign your Official Form 207 is user-friendly. Simply follow these steps:

If additional signatures are required, pdfFiller also offers options for adding multiple signatories, ensuring that your form meets all requirements for submission.

Collaborating on official form 207

In scenarios where teamwork is required, pdfFiller shines with its collaboration features. Sharing your Official Form 207 with colleagues for input or review can be done effortlessly, streamlining the collective effort for achieving accuracy and completeness.

Team collaboration features in pdfFiller

Colleagues can provide comments and feedback directly on the form, enhancing communication and contributing to more effective documents. Real-time collaboration means that edits can be made instantly while maintaining an up-to-date version of the form.

Real-time editing and coordination

The benefits of working together in real-time cannot be understated, as this method reduces miscommunications and fosters a stronger team dynamic. Managing input from multiple users allows organizations to respond swiftly to any required adjustments or considerations, boosting overall efficiency in handling Official Form 207.

Troubleshooting common issues

Even with the most meticulous preparation, challenges can arise when working with Official Form 207. Addressing these common issues effectively ensures that the submission process remains as smooth as possible.

Addressing common errors in form 207

Common mistakes include missing signatures, incomplete fields, and incorrect documentation. Each of these can derail an otherwise successful process. Identifying these potential errors in advance and rectifying them saves time and reduces stress.

Technical support and resources

If you encounter challenges while using pdfFiller for your Form 207, reliable technical support is available. Utilizing the help resources offered by pdfFiller can provide you with answers when facing difficulties, ensuring that issues do not hinder your progress in submitting a well-prepared application.

Additional tips for successful form submission

Taking into consideration the time-sensitive nature of many applications, understanding submission deadlines for Official Form 207 is crucial. Timeliness is often a critical factor that can impact the outcome of your request.

By keeping these points in mind, you can ensure that your experience with Official Form 207 is not only efficient but also effective, leading to successful outcomes.

Conclusion on managing form 207 effectively

Using pdfFiller to manage Official Form 207 can significantly enhance your document-handling capabilities. The cloud-based platform offers tools that help streamline the process of filling out, signing, and managing your forms. By leveraging technology, users gain efficiency and accuracy while navigating administrative requirements.

Embracing these modern solutions enables you to manage forms like Official Form 207 more effectively, thereby increasing your potential for successful submissions. pdfFiller’s tools enhance not just comprehension but also the overall experience of engaging with important documents and processes, setting users up for future success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify official form 207 without leaving Google Drive?

How do I complete official form 207 on an iOS device?

How do I edit official form 207 on an Android device?

What is official form 207?

Who is required to file official form 207?

How to fill out official form 207?

What is the purpose of official form 207?

What information must be reported on official form 207?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.