Get the free Designated Beneficiary Change Form

Get, Create, Make and Sign designated beneficiary change form

Editing designated beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out designated beneficiary change form

How to fill out designated beneficiary change form

Who needs designated beneficiary change form?

The comprehensive guide to the designated beneficiary change form

Understanding the designated beneficiary change form

A designated beneficiary change form is a crucial legal document that allows individuals to update their selected beneficiaries for various financial accounts and estate plans. This form plays a vital role in ensuring that your assets are distributed according to your wishes upon your death. Proper usage helps avoid unwanted distributions or legal complications.

The importance of this form in estate planning and financial management cannot be overstated. It grants control over who will receive your assets, which can include everything from life insurance policies to retirement accounts, thereby providing peace of mind. A correctly filled form aligns your intentions with your assets.

Who needs to use this form?

Almost everyone can benefit from understanding and utilizing a designated beneficiary change form. Individuals need this form to clarify their intentions regarding family, friends, or charitable organizations that they wish to benefit from their estate.

Organizations also require these forms, particularly for employee benefits where changes in personnel may necessitate revisions to beneficiary designations. Major life events such as marriages, divorces, or the death of a beneficiary may trigger the need for updates.

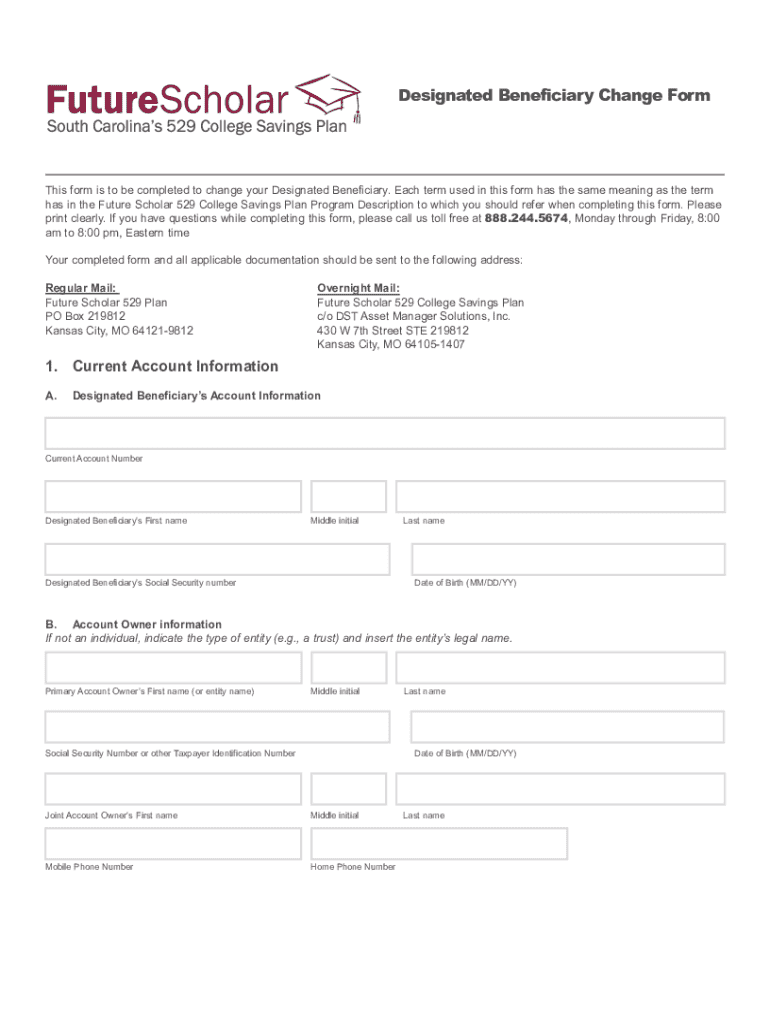

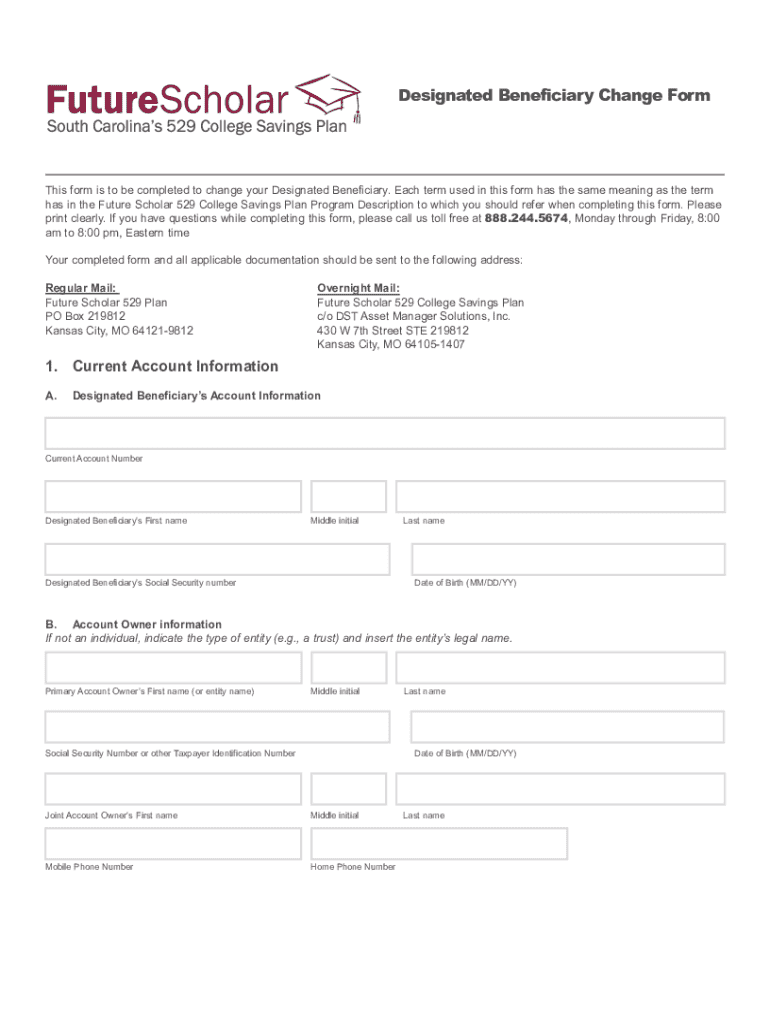

Key elements of the form

The designated beneficiary change form consists of several key sections that require detailed attention. Each section serves a purpose, guiding users through the necessary information to ensure accurate processing. Common sections include personal information about the account holder, the details of the beneficiaries, and any necessary signatures.

Accurate information is paramount. Missing or incorrect details can invalidate your designation, leading to complications down the line.

Common terms explained

Understanding terminology associated with the form is essential for all users. For instance, a 'beneficiary' can be classified into primary and contingent categories. Primary beneficiaries are the first in line to receive assets, while contingent beneficiaries receive assets only if the primary beneficiaries are unable to.

The terms 'executor' and 'trustee' also appear frequently in discussions about estate management. An executor is responsible for executing the will, ensuring that the will’s terms are fulfilled, while a trustee manages assets held in trust until they are distributed.

Step-by-step instructions to complete the form

Completing the designated beneficiary change form requires meticulous attention to detail. Start by gathering all essential information, including your personal identification and the details of your beneficiaries. Documentation may include Social Security numbers, addresses, and dates of birth.

Once you have collected the necessary information, fill out each section methodically. When designating beneficiaries, clearly specify both primary and contingent beneficiaries to ensure clarity in your wishes.

After completing the form, it’s imperative to review your changes. Errors or omissions can lead to disputes or unintended consequences. Double-check names, relationships, and contact information for all parties involved.

Editing and updating your form

Updating your designated beneficiary change form is not just about filling it out correctly the first time. Life events such as marriage, divorce, or changes in your relationship with a beneficiary frequently necessitate updates to ensure that your designations reflect your current wishes.

It's advisable to review your beneficiary designations regularly, perhaps every few years, or after significant life milestones. Keeping your documents up-to-date can prevent potential disputes and ensure that your assets are directed as you intended.

How to use pdfFiller for editing

pdfFiller offers a simple yet powerful platform for editing beneficiary change forms. Users can take advantage of interactive tools designed to streamline the editing process. With pdfFiller, modifications can be made quickly without losing the integrity of the document.

Follow a straightforward step-by-step guide to utilize pdfFiller’s interactive tools, from uploading the document to saving your changes efficiently. This convenience encourages users to stay on top of updates.

Signing and validating your designated beneficiary change form

The signature on your designated beneficiary change form is of utmost importance, as it validates your requests. Without a signature, the changes made may be deemed invalid. The electronic signature enables you to finalize documents conveniently while maintaining legal standing.

With pdfFiller, electronic signatures are not only possible but secure. Utilize collaborative tools that allow multiple parties to sign, ensuring all relevant stakeholders can endorse your changes without delay.

Submitting your designated beneficiary change form

Once your form is signed and validated, it’s time for submission. Understanding the various submission options available helps ensure your document reaches the right hands. Typically, submissions can occur via mail, email, or fax, each with its own set of instructions.

Submitting the form by mail involves gathering all copies and addressing them accurately. For email, ensure the file format is correct, and if faxing, confirm receipt protocols with the receiving organization to ascertain successful delivery.

What happens after submission?

After you've submitted your designated beneficiary change form, confirming receipt of your submission is essential. Many organizations provide confirmation emails or notifications, which helps in tracking the status of your changes.

Understanding the approval process is equally important. Typically, there is a review period during which the organization may assess the validity of your changes. You may need to provide additional information if required, so remaining in contact with the organization ensures transparency.

Frequently asked questions about the designated beneficiary change form

As with any legal document, questions are bound to arise. For instance, can you contest a change after submission? Generally, once a form is submitted and processed, contesting a change can be difficult. It's advisable to double-check your form before submitting.

If you filled out the form incorrectly, promptly contact the organization to rectify the issue, as there may be corrective measures in place. Many organizations do not charge fees for updating beneficiary information, but it’s wise to confirm this directly with them.

The advantages of using pdfFiller

Utilizing pdfFiller equips users with a comprehensive document management solution that streamlines document creation and editing. This cloud-based platform enables access from anywhere, making it ideal for busy individuals and teams seeking efficiency.

pdfFiller not only helps with editing but also enhances collaboration by allowing multiple users to work on the same document. Features such as commenting and version tracking make it easier to navigate changes.

Security and compliance

Security is paramount when handling sensitive documents like beneficiary change forms. pdfFiller ensures that your information is secure and compliant with legal standards, safeguarding your data through encryption and other protective measures.

Final thoughts on managing your designated beneficiary change form

Timely updates to your designated beneficiary change form can significantly impact your financial future. By ensuring that beneficiaries are correctly listed, you empower your heirs and streamline the transfer process, sparing them from unnecessary complications.

The convenience of pdfFiller makes ongoing management a breeze. Utilize this platform for your future document needs and take a proactive stance in managing your affairs. Regular reviews and updates not only signify responsibility but can also maximize the benefits flowing to your designated beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete designated beneficiary change form online?

How do I edit designated beneficiary change form online?

Can I create an eSignature for the designated beneficiary change form in Gmail?

What is designated beneficiary change form?

Who is required to file designated beneficiary change form?

How to fill out designated beneficiary change form?

What is the purpose of designated beneficiary change form?

What information must be reported on designated beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.