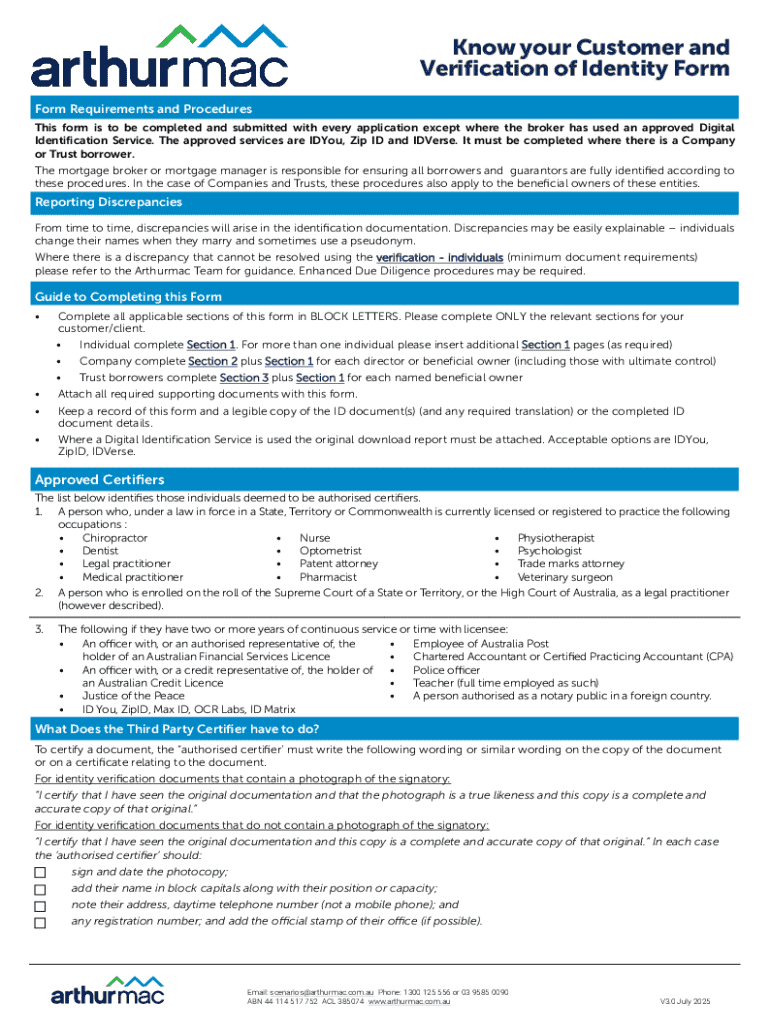

Get the free Know Your Customer and Verification of Identity Form

Get, Create, Make and Sign know your customer and

Editing know your customer and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out know your customer and

How to fill out know your customer and

Who needs know your customer and?

Know Your Customer and Form: A Comprehensive Guide

Overview of Know Your Customer (KYC)

Know Your Customer (KYC) is a crucial aspect of customer relationship management that mandates businesses to verify the identities, backgrounds, and risk factors of their clients. KYC is not solely an industry requirement; it reflects a significant commitment towards establishing trust, transparency, and accountability in business operations.

The importance of KYC cannot be overstated as it acts as the foundation upon which businesses can build effective relationships with their customers. By ensuring a thorough understanding of their clientele, companies can mitigate risks associated with fraud and non-compliance, allowing them to leverage insights for better customer engagement.

Understanding the KYC process

The KYC process generally unfolds in several key stages to ensure that a reliable customer profile is established. The primary components include customer identification and the verification of customer identity, which together form the backbone of KYC compliance.

During customer identification, businesses obtain personal information such as name, address, date of birth, and official identification numbers. The verification process then corroborates these details against official documents, ensuring authenticity through various checks, including government databases.

Additionally, businesses often collect and monitor a range of information including financial backgrounds and transaction patterns, fostering a deeper understanding of customer behaviors and risks.

KYC compliance requirements

KYC compliance operates within a regulatory framework that varies across regions and industries. Understanding these frameworks is indispensable for businesses that seek to operate legally and ethically.

Governments and regulatory bodies worldwide impose rigorous KYC norms. For instance, financial institutions often adhere to the Financial Crimes Enforcement Network (FinCEN) in the US, while globally recognized standards such as the Financial Action Task Force (FATF) provide guidelines for effective KYC.

Implementing KYC in your business

Establishing a robust KYC program requires a strategic approach, beginning with a thorough assessment of your business needs. This step is crucial to ensure that the KYC program aligns with the operational objectives and regulatory landscape of your specific industry.

After assessing needs, the next step involves designing the KYC workflow to integrate seamlessly into existing processes. This is where document management solutions like pdfFiller become invaluable, enabling users to create, manage, and verify documents efficiently.

Know your customer's customer

Understanding your customers extends beyond their basic demographics. 'Know Your Customer's Customer' deepens insights into customer behavior and preferences, enabling businesses to tailor services and anticipate needs effectively.

Techniques for gathering such insights include deploying surveys and feedback forms, as well as analyzing digital behavior. Analyzing data from surveys provides direct insights into customer preferences, while monitoring users’ online behaviors helps discern patterns that can influence product offerings.

Electronic KYC: Embracing digital solutions

Transitioning to electronic KYC processes simplifies the tracking of customer interactions and improves compliance efficiency. The digital age demands that businesses adapt traditional methods to more streamlined and user-friendly electronic solutions.

Tools for electronic KYC, like pdfFiller, facilitate seamless document management, allowing businesses to edit, sign, and store documents securely. Ensuring that customer data remains secure in this digital realm is essential; implementing data protection protocols is non-negotiable.

Geographic variability in KYC laws

KYC regulations vary significantly not only from industry to industry but also from country to country. Understanding regional legal requirements ensures that businesses can operate globally without fear of compliance violations.

For example, while the United States may have different KYC documentation requirements compared to jurisdictions in the European Union or Asia, the global shift towards increased regulatory scrutiny calls for uniformity in KYC practices wherever possible.

Ensuring customer due diligence

Customer due diligence (CDD) is an integral part of the KYC process designed to evaluate a customer's risk profile. By categorizing customers based on their risk factors, businesses can apply the appropriate level of scrutiny to maintain compliance and safeguard their operations.

The CDD process typically includes steps such as risk scoring and ongoing monitoring for any changes in a customer’s profile. For high-risk customers, enhanced due diligence may be warranted, requiring more extensive information and scrutiny.

Criticism and challenges of KYC

Despite its critical importance, KYC practices often face scrutiny and challenges. Privacy concerns arise when customers feel their personal data is overly monitored or misused. Moreover, the costs associated with implementing KYC processes can be significant for businesses, particularly smaller firms with limited resources.

Addressing these challenges requires proactive strategies, such as transparent communication with customers about data use and adopting technologies that minimize operational costs while ensuring compliance.

Case studies: Successful KYC implementations

Businesses successfully navigating KYC requirements often share valuable insights that can guide new implementations. Various industries—from finance to healthcare—have formulated models that not only comply with regulations but also enhance customer relationships.

Analyzing these case studies reveals practical lessons and best practices that other organizations can adapt. For instance, a major financial institution may implement a tiered KYC approach that scales compliance efforts based on customer risk, proving efficient and sustainable.

Future of KYC and document management

As the landscape of KYC continues to evolve, businesses must remain agile and prepared for future challenges. Trends such as technological innovations in artificial intelligence and machine learning are reshaping the way KYC processes are undertaken, enhancing efficiency and accuracy in customer verification.

Additionally, the evolving regulatory landscape necessitates continuous training and development for staff, ensuring compliance and best practices are infused across the organization. Embracing advanced document solutions like pdfFiller can streamline this process, allowing businesses to focus on core operations while staying compliant with KYC protocols.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my know your customer and in Gmail?

How do I fill out know your customer and using my mobile device?

How do I complete know your customer and on an iOS device?

What is know your customer?

Who is required to file know your customer?

How to fill out know your customer?

What is the purpose of know your customer?

What information must be reported on know your customer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.