Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Your Complete Guide to Form 10-Q

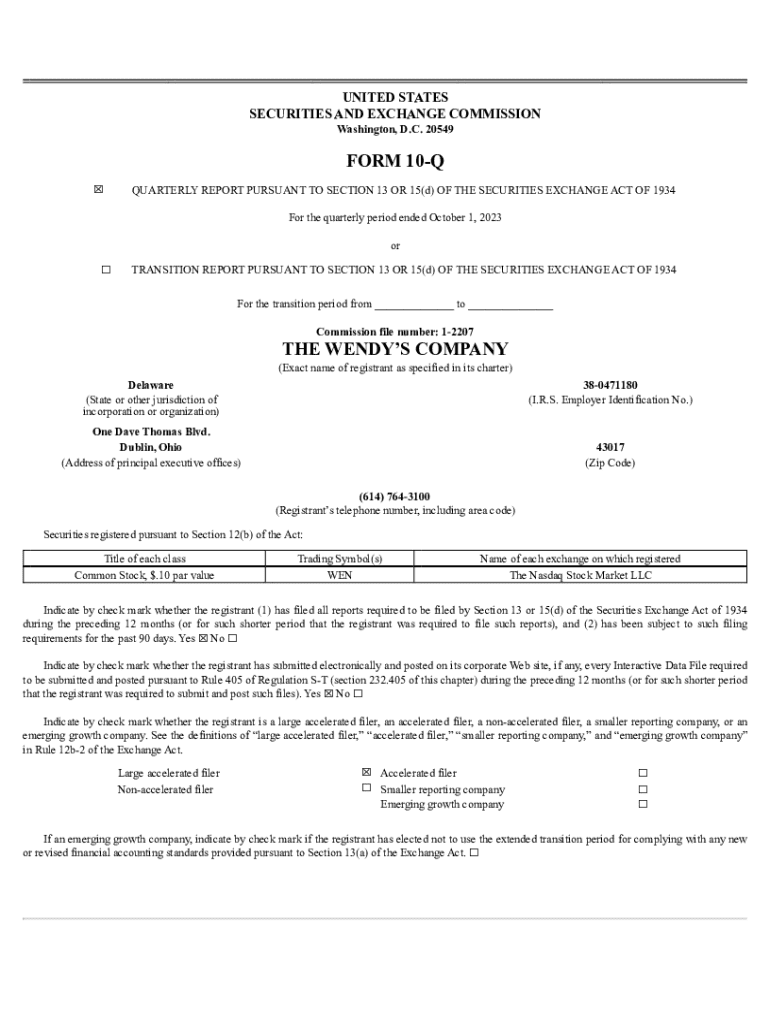

Overview of Form 10-Q

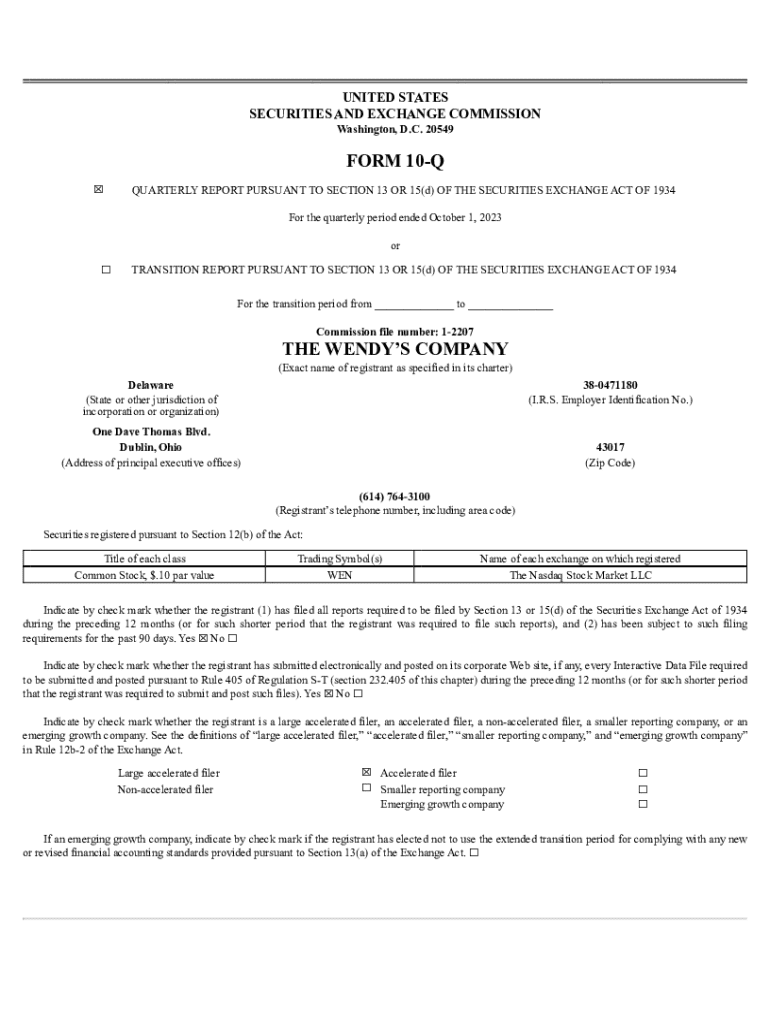

Form 10-Q is an essential document that public companies in the United States are required to file with the Securities and Exchange Commission (SEC) on a quarterly basis. This form provides a comprehensive overview of a company's financial performance during the fiscal quarter, including insights into earnings, expenses, and any material changes that have occurred since the last filing. The primary purpose of the Form 10-Q is to keep investors and other stakeholders informed about the company’s ongoing financial health and operational activities.

Investors rely heavily on Form 10-Q as it serves as a snapshot of a company’s financial condition and can significantly influence investment decisions. By providing timely and transparent financial updates, the form fosters trust and accountability in the corporate sector.

Key components of Form 10-Q

Form 10-Q comprises several key sections, each mandated by the SEC to ensure uniformity and thoroughness in reporting. Understanding these components is crucial for both the filers and the users of these documents.

Navigating the filing process

Filing a Form 10-Q is not just a regulatory requirement; it is a crucial step in maintaining transparency with stakeholders. Only public companies registered under the SEC are mandated to file this form, ensuring compliance with securities laws. The filing frequency generally occurs three times a year, with companies typically exempting their fourth quarter from this requirement as it is covered in the annual Form 10-K.

When preparing to file a Form 10-Q, companies need to be aware of their eligibility based on their public status and must adhere to regulations set forth by the SEC. Companies must also designate a filing date based on their fiscal year, laying out the groundwork for timely submissions.

Detailed walkthrough of content in Form 10-Q

A successful Form 10-Q filing requires precise attention to detail and a thorough understanding of the disclosures required. Each form is made up of various sections, with specific instructions that must be followed.

Each section of Form 10-Q has its own specific requirements, and understanding them can ease the process of completion. Companies should gather supporting documentation and data ahead of time to facilitate an accurate filing.

Filing deadlines and expectations

Publicly traded companies must adhere to strict deadlines for filing their Form 10-Qs, typically within 40 days after each quarter ends for larger companies (accelerated filers). Smaller reporting companies have a 45-day deadline, which allows them some added time. Understanding these timelines is critical for maintaining compliance with SEC regulations.

Failing to meet deadlines can lead to significant consequences, including potential fines and increased scrutiny from regulators, both of which can tarnish a company's reputation and diminish investor confidence. Companies should prioritize their reporting schedule to avoid any lapse in filing deadlines.

Consequences of non-compliance

Failure to comply with Form 10-Q filing requirements can have severe implications for companies. These can range from monetary fines to legal actions, and even more serious penalties such as restrictions on the ability to raise capital or trade on public exchanges.

For instance, companies like Tesla and numerous others have faced legal repercussions due to delayed filings or misstatements within their 10-Qs. The SEC closely monitors compliance, and companies who fail to follow regulations might find themselves facing audits or investigations.

Leveraging pdfFiller for Form 10-Q management

Managing Form 10-Q can be streamlined with tools like pdfFiller, which offers a cloud-based platform for creating, editing, signing, and managing documents efficiently. With its interactive tools, users can easily fill out the form, ensuring all required fields are completed accurately.

Finding existing Form 10-Q filings

Accessing existing Form 10-Q filings is crucial for analysis and research. The SEC's EDGAR database is the primary resource for accessing these documents, as it provides a comprehensive repository of financial filings from public companies.

By utilizing pdfFiller, users can not only view existing 10-Qs but also have the option to edit and manage templates right from their platform, facilitating a seamless experience in document handling.

Additional considerations

As companies navigate the evolving financial landscape, staying attuned to trends and insights related to Form 10-Q is paramount. Companies must pay attention to industry standards to remain competitive and compliant. It's essential to note that regulatory bodies can impose new filing requirements at any time, affecting how companies prepare their reports.

For instance, changes in requirements regarding disclosures on market risk can significantly influence how companies present their data. Proactive companies will start to anticipate these adjustments and adapt their reporting processes accordingly to remain compliant and transparent.

Frequently asked questions (FAQs)

Understanding Form 10-Q can raise several questions among companies and stakeholders. Here are some of the most common queries:

User testimonials and case studies

Many companies have successfully transformed their filing processes through the use of pdfFiller, which has not only improved efficiency but also enhanced accuracy. For example, Company X reported a reduction in filing errors by 30% after switching to pdfFiller's digital solutions.

Users appreciate the easy-to-navigate interface and the ability to collaborate in real time, leading to a more streamlined workflow in document management.

Connect with us for more insights

For teams seeking a comprehensive solution for document creation and management, pdfFiller is an invaluable resource. Our tools are designed to effortlessly support your filing processes, allowing you to focus on your core business instead of paperwork. Connect with us today to explore how we can help optimize your document handling and ensure compliance with required filings, including Form 10-Q.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-q in Gmail?

How can I get form 10-q?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.