Get the free W-8ben-e

Get, Create, Make and Sign w-8ben-e

How to edit w-8ben-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben-e

How to fill out w-8ben-e

Who needs w-8ben-e?

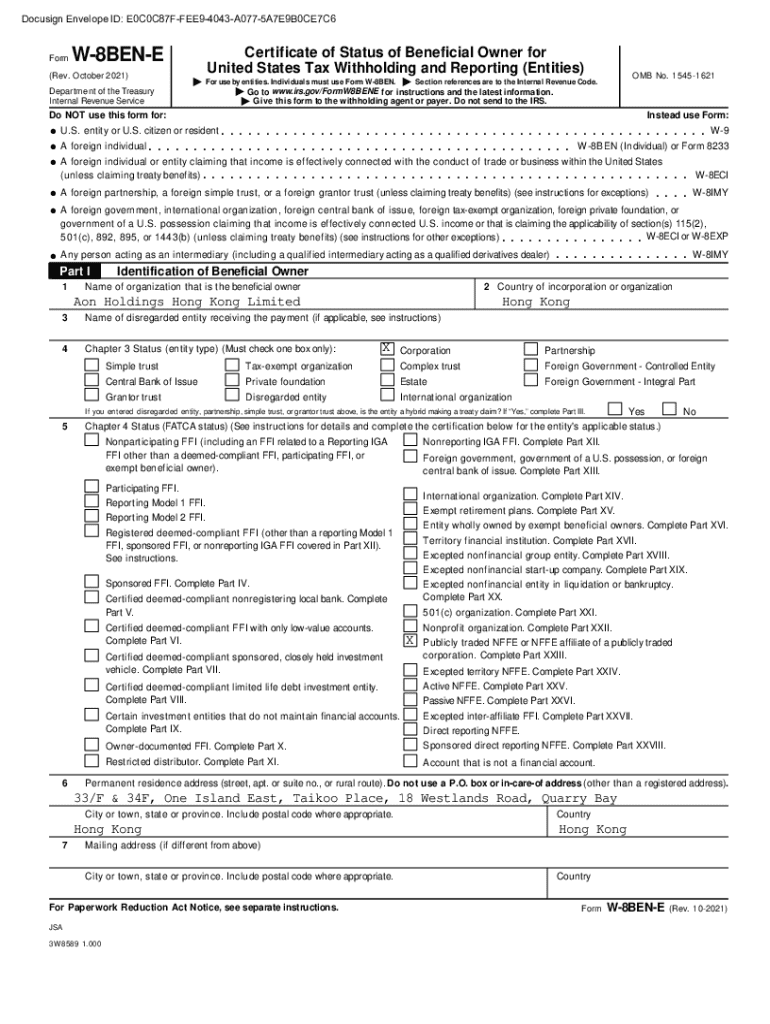

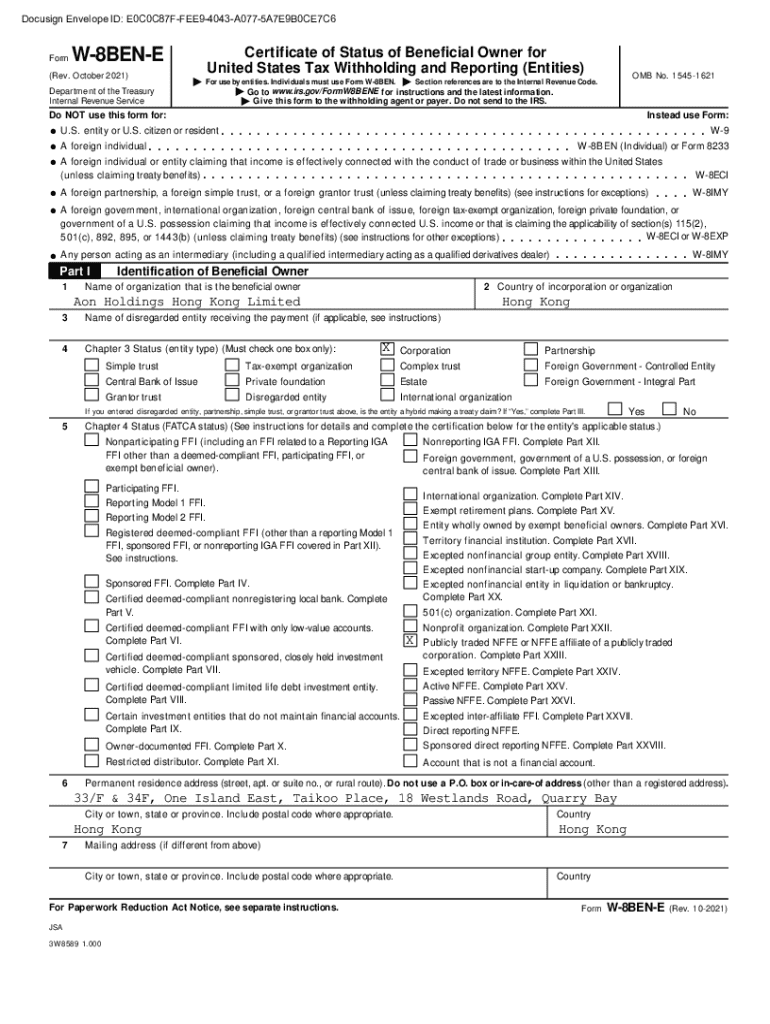

W-8BEN-E Form: A Comprehensive How-to Guide

Understanding the W-8BEN-E form

The W-8BEN-E form, officially known as the ‘Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)’ is crucial for foreign entities earning income from U.S. sources. This form is necessary because it helps foreign entities claim the benefits of reduced withholding tax rates specified in U.S. tax treaties. Failure to submit this form can result in higher tax withholding rates than required, leading to financial loss.

Properly completing the W-8BEN-E also provides numerous benefits. By submitting an accurate form, entities ensure that they are taxed at the correct rate, possibly benefiting from treaty rates that reduce or eliminate withholding taxes on specific types of U.S. income. Furthermore, it establishes compliance with U.S. tax laws, minimizing the risk of audits or penalties.

Key sections of the W-8BEN-E form

The W-8BEN-E form consists of several key sections, each serving a distinct purpose. Understanding these sections is vital for accurately completing the form.

PART : Identification of beneficial owner

This part requires essential information such as the entity's name, address, and Tax Identification Number (TIN). Accuracy here is crucial because any mistake can lead to compliance issues. The information must precisely match the records held by the respective tax authorities in the entity’s home country.

PART : Claim of tax treaty benefits

Foreign entities may be eligible for reduced withholding rates under U.S. tax treaties. To claim these benefits, it’s essential to identify applicable treaties between the U.S. and the entity's country. Filling out this section correctly can lead to significant tax savings; therefore, researching the specific treaty provisions is essential.

PART : Certification

This section involves certifying the accuracy of the information provided, confirming the beneficial ownership of the income and ensuring compliance with U.S. tax laws. It's important to note that only authorized individuals within the entity can sign the form. This highlights the necessity of understanding the signatory requirements.

Completing the W-8BEN-E form

Filling out the W-8BEN-E form can seem daunting, but following simple steps makes the process straightforward. Here’s how to approach it:

When it comes to data entry, accuracy is paramount. Double-check all entries to ensure they align with official records. Common mistakes include misspelling the name of the entity, providing incorrect TINs, or failing to check eligibility for tax treaty benefits. Each of these errors could result in the form being rejected or delayed.

Submission and management of the W-8BEN-E form

Once completed, the W-8BEN-E form must be sent to the recipient – typically the U.S. financial institution or withholding agent requesting it. The address might vary depending on the recipient, so it's essential to confirm where to send it. Holding on to copies of sent documents helps maintain a clear record for future reference.

Additionally, the W-8BEN-E does not have an expiration date, yet renewing or updating this form is necessary under certain conditions. Entities should consider resubmitting the W-8BEN-E if there are changes in beneficial ownership, tax treaty eligibility, or if the form is requested again by the withholding agent. The proactive management of this document can save considerable future hassles.

E-filing the W-8BEN-E can be more efficient than paper filing, particularly for entities using platforms like pdfFiller. This offers features that ensure data integrity, track submission status, and facilitate electronic signatures.

Special considerations

Digital signatures can streamline the submission process of the W-8BEN-E form. Entities that choose to sign electronically must meet specific eligibility requirements set forth by IRS guidelines. Using tools like pdfFiller allows for easy electronic signing and simplifies this process.

Entities must be cautious about late submissions or inaccuracies in their forms. Such issues can lead to severe consequences, including tax penalties and compliance scrutiny. If mistakes are detected, consulting with a tax professional or utilizing pdfFiller's resources to rectify and resubmit the form promptly is advisable.

Additional tools and resources

Understanding the distinctions between various W-forms is essential for proper compliance. The W-8BEN form is specifically for individuals, whereas the W-8BEN-E is tailored for entities. Assessing these differences can help ensure that foreign entities are filing the correct forms, avoiding potential legal ramifications.

For additional support, pdfFiller provides useful guides, interactive tools, and resources to assist in managing W-8BEN-E forms effectively. Utilizing these tools simplifies the filing process and ensures that entities maintain compliance with U.S. tax regulations.

Frequently asked questions (FAQs)

The W-8BEN-E may raise several questions. For instance, who needs to complete the form? Generally, any foreign entity receiving U.S. income is required to submit it to avoid higher withholding tax rates. Additionally, if an individual receives a notification that their W-8BEN-E is rejected, they must review the rejection notice carefully, rectify any issues and resubmit the form as soon as possible.

Amending a previously accepted W-8BEN-E involves filling out a new form and marking it as an amendment, specifying the changes. Staying proactive regarding such amendments ensures that entities are compliant and can reduce the risk of penalties.

Contact and support

For users navigating the complexities of the W-8BEN-E form, pdfFiller offers extensive support options. The platform’s customer service team can answer queries related to form completion and submission, guiding users through every step of the way.

Various links on the pdfFiller website connect users directly to customer support, providing quick assistance with document management, including filling out the W-8BEN-E form. Personalized help is also available, allowing entities to seek tailored solutions to their document-related challenges.

About pdfFiller

pdfFiller stands out as a comprehensive document management solution, allowing users to edit, sign, and collaborate on documents effortlessly. The platform excels in providing users with an intuitive interface and powerful tools that simplify the creation and management of various types of forms, including the W-8BEN-E.

User testimonials speak volumes about pdfFiller's capabilities, showcasing how clients have successfully managed their documentation online. The platform is dedicated to user satisfaction, continually evolving to meet the demands for secure and efficient document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit w-8ben-e online?

How do I make edits in w-8ben-e without leaving Chrome?

How do I fill out the w-8ben-e form on my smartphone?

What is w-8ben-e?

Who is required to file w-8ben-e?

How to fill out w-8ben-e?

What is the purpose of w-8ben-e?

What information must be reported on w-8ben-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.