Get the free 990

Get, Create, Make and Sign 990

Editing 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

Comprehensive Guide to Form 990: What Nonprofits Need to Know

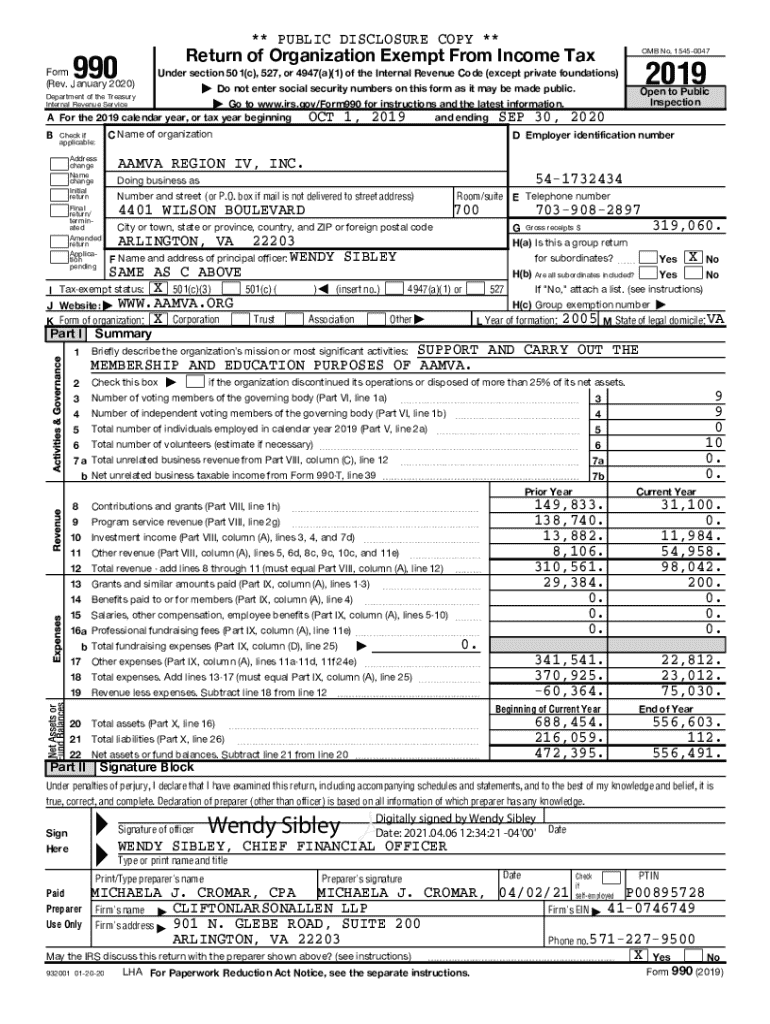

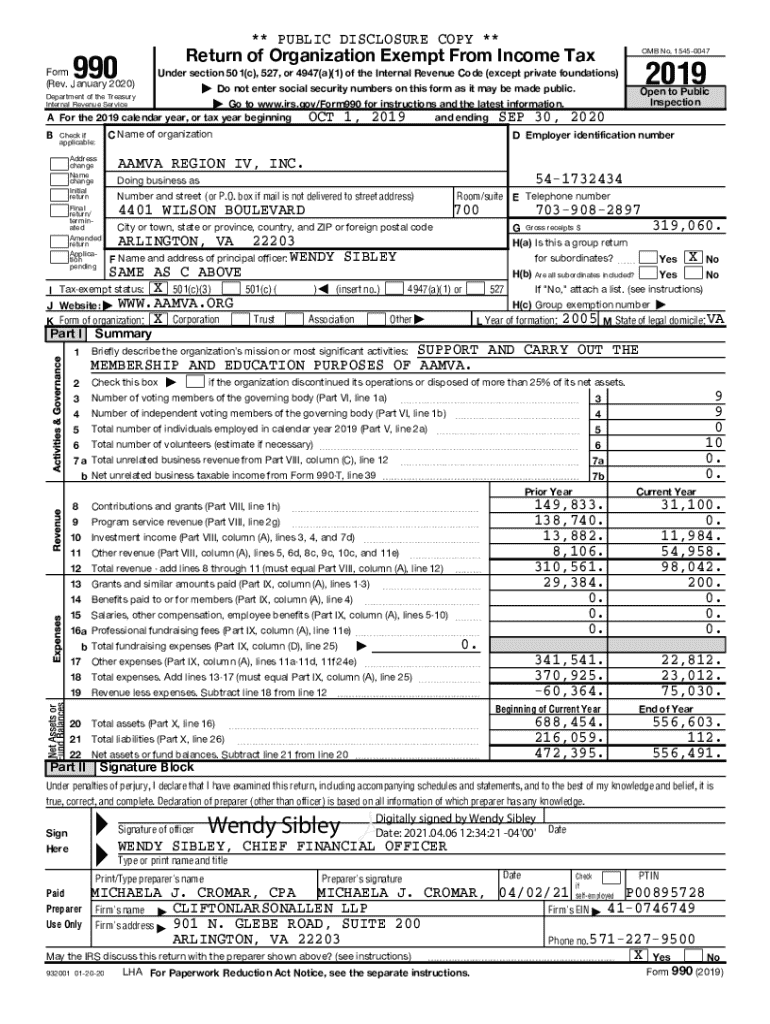

Understanding the 990 form

The 990 form is an essential document for nonprofit organizations, serving as an annual information return that enables the IRS and the public to gain insights into a nonprofit's financial activities and governance. This form is crucial not only for tax-exempt status maintenance but also for fostering transparency and accountability within the sector.

The significance of Form 990 extends beyond mere filing; it helps to assure donors, lawmakers, and the public about the organization's integrity and financial health, thus encouraging trust and support. By shedding light on revenue, expenditures, and leadership, nonprofits can demonstrate their commitment to mission and effective resource utilization.

Different types of 990 forms

There are several variations of the 990 form, each suited to different types and sizes of nonprofits. Understanding these distinctions is vital for compliance and accurate reporting.

Who must file the 990 form?

Typically, tax-exempt organizations under Internal Revenue Code Section 501(c)(3) must file a Form 990 or one of its variants annually. This requirement applies to public charities, private foundations, and other tax-exempt entities.

However, there are specific exemptions. For example, churches and certain religious organizations may not be required to file, nor do small organizations that did not receive any donations during the year. Understanding these nuances can help organizations navigate their reporting obligations effectively.

Filing requirements for the 990 form

Filing the 990 form involves adhering to strict deadlines and comprehensive disclosure requirements. Generally, the form must be submitted by the 15th day of the 5th month after the end of the organization's accounting period. To avoid penalties, it's wise for nonprofits to mark their calendars and establish reminders well in advance.

In addition to basic financial data, nonprofits are required to disclose significant information such as compensation for officers, directors, and key employees; donor contributions; and grants made. Each form type comes with different schedules and attachments that may further detail financial activities, necessitating careful preparation.

Consequences of failing to file

Nonprofits that fail to file their Form 990 on time face severe consequences. The IRS imposes penalties that can escalate with continued non-compliance, costing organizations both financially and in terms of public trust. Specifically, fines for late filing can reach up to $20 per day, capped at $10,000.

Moreover, consistent failures may result in the automatic revocation of the organization’s tax-exempt status, which significantly impairs fundraising efforts and can lead to an organization’s closure. Thus, timely and accurate filing cannot be overlooked, underscoring the importance of diligent compliance.

Step-by-step guide to filing the 990 form

Preparing financial documents

A robust filing begins with careful preparation of financial documents. Organizations should regularly track income, expenses, and any grants or donations received throughout the year to foster accurate reporting. This involves maintaining a consistent bookkeeping system and ensuring that all financial records are readily accessible.

Gathering required information

Each form of 990 requires diverse information. Keeping track of donor contributions, program activities, and impact-related achievements will ease this process. Establishing a comprehensive system for record-keeping can facilitate smooth auditing and reporting, which should include both numeric data and narrative descriptions of accomplishments.

Completing the 990 form

Completing the 990 form can be daunting. Breaking it down section by section allows organizations to focus on each part with clarity. Common areas where mistakes arise include inaccurately reporting financial data and misclassifying expenses, underscoring the importance of thorough reviews before submissions.

Reviewing and transmitting your form

Once the form is completed, it's crucial to have colleagues review the draft for accuracy. Collaboration at this stage can catch potential errors, ultimately leading to improved credibility of the submitted information. After review, decide on who will transmit the form, ensuring that it adheres to the deadline.

Filing electronically with pdfFiller

Using pdfFiller to file your 990 form streamlines the process because it offers user-friendly features tailored for nonprofit needs. Advantages include easy-to-use templates, electronic signing capabilities, and real-time collaboration tools, enhancing the overall filing experience.

Utilizing interactive tools for 990 form management

Nonprofits can leverage various interactive tools within the pdfFiller platform to enhance the filing process. These tools include seamless team collaboration features that allow multiple users to work on a document simultaneously, ensuring everyone's involvement in the submission process.

Additionally, e-signing capabilities increase efficiency, allowing for necessary approvals without the need for physical signatures. Instant status updates and alerts keep everyone informed about progress and impending deadlines, reducing the risk of oversight.

Enhancing your filing experience

To optimize your Form 990 filing experience, consider implementing best practices for data management. This includes organizing financial records in a cloud-based system that allows easy access and collaboration among team members. Utilizing last year's data during the preparation phase can also significantly cut down on repetitive work.

Moreover, utilizing bulk data import features can save time, especially if your nonprofit processes many contributions or transactions. These tools reduce manual input, decrease chances for errors, and bolster the integrity of the filed report.

Resources for nonprofits

Numerous resources are available to assist nonprofits in the Form 990 filing process. The pdfFiller platform features a comprehensive knowledge base and FAQs that address common concerns and provide detailed insights into specific elements of the form.

Moreover, webinars and video tutorials guide users through filling out Form 990 to ensure clarity and competence in the process. Financial management tools are also available through pdfFiller, offering additional support for healthy organizational accounting practices.

Best practices for filing the 990 form

Hiring a nonprofit tax professional can significantly streamline your filing process by providing expertise on complex tax issues and compliance requirements. Having a knowledgeable resource ensures accurate submissions and helps to proactively address any potential pitfalls.

Staying informed about changes in tax law and compliance standards also proves invaluable. Using organizational tools available through platforms like pdfFiller allows nonprofits to control their filing processes, ensuring that everyone involved remains up to date on deadlines and requirements.

Finally, emphasizing the importance of submitting accurate returns not only protects against penalties but also enhances donor confidence. Transparency, bolstered by diligent compliance, cements an organization's reputation in the nonprofit sector.

Addressing common questions and concerns

The importance of filing Form 990 cannot be overstated. Timely submissions are critical as they help maintain transparency and uphold public trust. Nonprofits must understand that failure to file can have far-reaching impacts beyond just penalties.

Additionally, many organizations often wonder if they also need to file state returns. The answer varies by state, with some requiring additional filings separate from the federal 990. Organizations should check with their state’s requirements to ensure full compliance.

Lastly, determining your organization's 990 deadline is crucial. This will typically match up with your fiscal year-end, but it is advisable to confirm details with IRS guidelines to maintain a smooth filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 990 straight from my smartphone?

How do I fill out 990 using my mobile device?

Can I edit 990 on an iOS device?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.