Get the free Form R2 (depository Agents)

Get, Create, Make and Sign form r2 depository agents

How to edit form r2 depository agents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form r2 depository agents

How to fill out form r2 depository agents

Who needs form r2 depository agents?

Understanding Form R2 Depository Agents Form

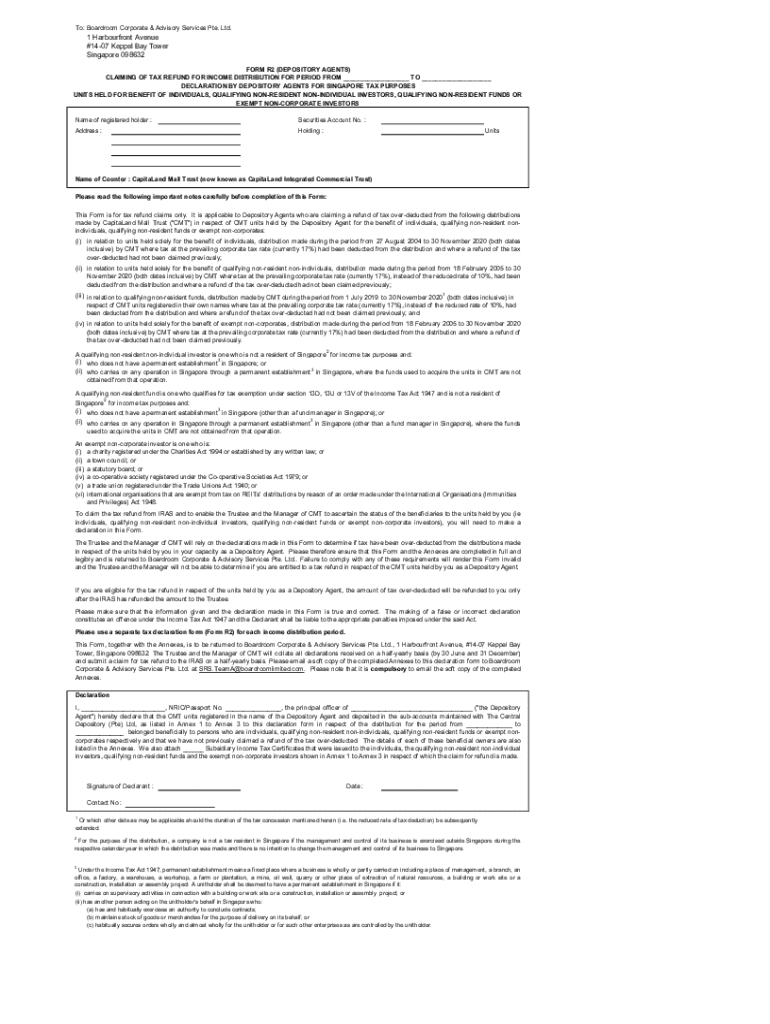

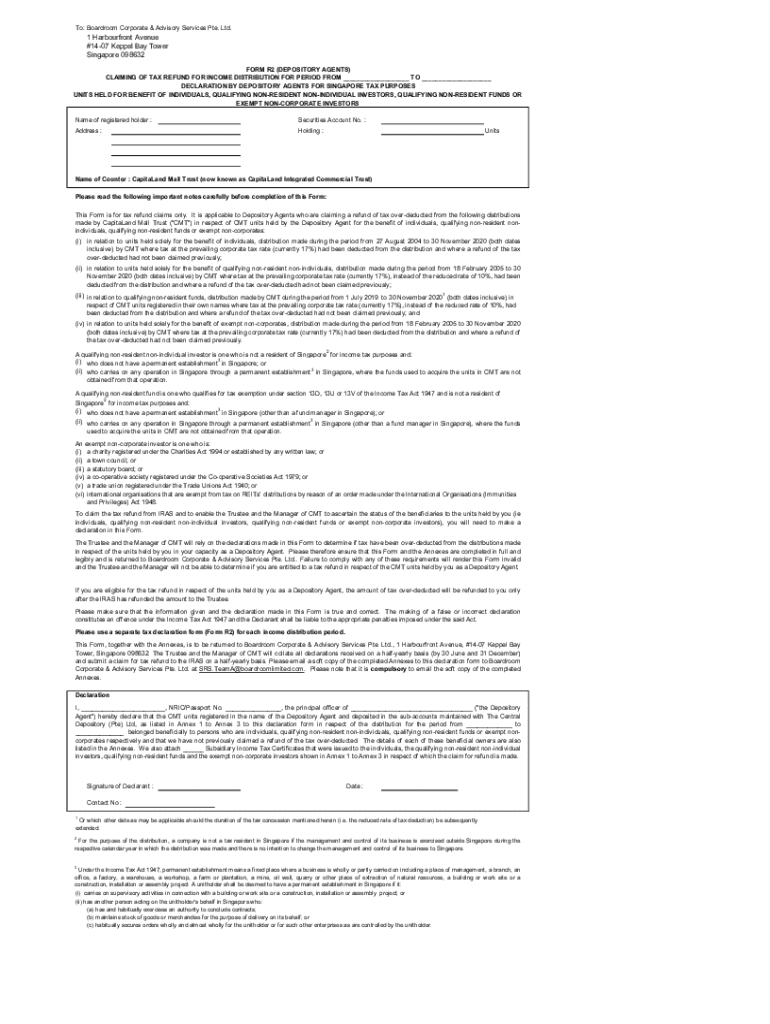

Overview of Form R2

Form R2 is an essential document utilized by depository agents for facilitating tax refunds for beneficial owners of stapled securities. Its importance can't be overstated, as it serves as a formal request for refund claims and ensures compliance with regulatory requirements. Form R2 helps streamline the tax refund process, ensuring that applicants can receive the benefits entitled to them in a compliant manner.

A depository agent is typically a financial institution or entity responsible for managing securities held in a deposit account. Understanding the nuances of stapled securities is crucial, as these involve paired securities, often combining stocks and trust units, complicating the tax refund process but also providing unique investment opportunities.

Who needs to use Form R2?

Eligibility to use Form R2 extends to various individuals and teams who are beneficial owners of stapled securities. Individuals seeking to reclaim tax refunds on distributions must ensure they meet specific eligibility criteria, which includes being the registered holder of the stapled securities during the relevant tax year.

Beneficial owners can be classified into two categories: individuals and non-individuals. It's essential to understand that non-individual owners, such as corporations or other entities, must also adhere to distinct requirements when submitting Form R2. Furthermore, the eligibility of foreign non-individuals and exempt non-corporate stapled securityholders requires particular attention to ensure compliance with tax laws and guidelines.

Understanding tax refunds associated with Form R2

Completing Form R2 provides potential tax refunds for various types of distributions, including dividends and interest from stapled securities. Understanding the classes of distributions that qualify for refunds is critical, as this can directly impact the financial return for the beneficial owners. For instance, dividends received in the form of staple units may be eligible for a refund, provided that the owner meets the requisite conditions.

Moreover, there's an important time limit for claiming refunds through Form R2. Applications must usually be submitted within a specific timeframe after the distribution date to be processed correctly. The timely submission of the form is vital to ensure that beneficial owners do not miss out on potential refunds due to lapses in deadlines.

Step-by-step instructions on completing Form R2

Filling out Form R2 requires specific personal identification information and declaration details to ensure accuracy and legitimacy. You must provide your name, tax identification number, and details of the stapled securities held. The declaration is a critical component, affirming the accuracy and truthfulness of the information submitted.

It's important to avoid common mistakes when completing Form R2, such as omitting information or not signing the declaration. To assist with the filling out process, interactive tools available on pdfFiller can streamline the entry of information and facilitate error-free completion.

Submission process for Form R2

Form R2 can be submitted both electronically and via traditional paper filing. Each submission method has its pros and cons. Electronic submission is often quicker and provides immediate confirmation, whereas paper filings might involve longer processing times. When submitting electronically through pdfFiller, ensure you receive a confirmation receipt, as this serves as proof of your submission.

The timing of your submission is crucial, as delays can impact your ability to claim a tax refund. Make sure to check the specific deadlines set forth by regulatory bodies to avoid any inconvenience.

What happens after submission?

Once Form R2 is submitted, the timeline for processing claims can vary depending on the jurisdiction and regulatory requirements. Generally, processing may take several weeks to several months, depending on the current volume of submissions and any backlog issues the tax authority may have.

A pivotal aspect to consider is whether an amended tax certificate will be issued in case of a refund. It is standard practice for the tax authority to update beneficial owners with an amended tax certificate that reflects their refund entitlement, visible in their tax record. Users should keep track of their refund application to ensure the refund is processed in a timely and accurate manner.

Frequently asked questions (FAQ)

Is an identification (ID) number required on the declaration form? Yes, an ID number is necessary for verifying your identity and ensuring accurate processing of your claim. What should you do if you miss the submission deadline? Consider extending your claim through any applicable procedures offered by tax authorities, but be aware that significant delays may reduce your refund chances.

To track the status of your refund claim, you can typically refer to the online portal provided by the relevant tax authority or consult your depository agent. Lastly, yes, multiple applications can generally be submitted for different distributions provided they're filed in accordance with the stipulated guidelines.

Tax refund procedures: A detailed breakdown

Understanding the complete tax refund process in relation to Form R2 is essential for maximizing your claim's efficiency. Initially, gather all the documentation required for your claim, including the original tax certificates and any supporting documents that demonstrate your ownership of stapled securities.

Common challenges in the tax refund procedures can include incomplete documentation or incorrect information provided on the application. Navigating these challenges proactively by working with a knowledgeable financial advisor or utilizing resources such as pdfFiller can help streamline the process and mitigate difficulties.

Updates and announcements related to Form R2

Recently, there have been important changes to the procedures related to Form R2, which individuals and teams must be aware of. Keeping up with announcements ensures that you comply with new eligibility criteria and any modifications in deadlines.

A specific update worth noting is the adjustment of eligibility criteria regarding certain foreign non-individual securityholders. These alterations may affect your ability to file and reclaim tax refunds, making staying informed essential for maximizing refunds and ensuring compliance.

Conclusion of the Form R2 process

The process surrounding Form R2 is multifaceted and crucial for individuals and teams looking to reclaim tax refunds linked to their stapled securities. Key takeaways include the importance of timely submission, precise completion, and understanding ongoing developments in tax refund policies.

Utilizing resources such as pdfFiller empowers users to efficiently manage the entire document lifecycle, from filling out to signing and submitting Form R2, ensuring compliance with tax regulations while maximizing potential refunds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form r2 depository agents online?

How do I make edits in form r2 depository agents without leaving Chrome?

How do I complete form r2 depository agents on an Android device?

What is form r2 depository agents?

Who is required to file form r2 depository agents?

How to fill out form r2 depository agents?

What is the purpose of form r2 depository agents?

What information must be reported on form r2 depository agents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.