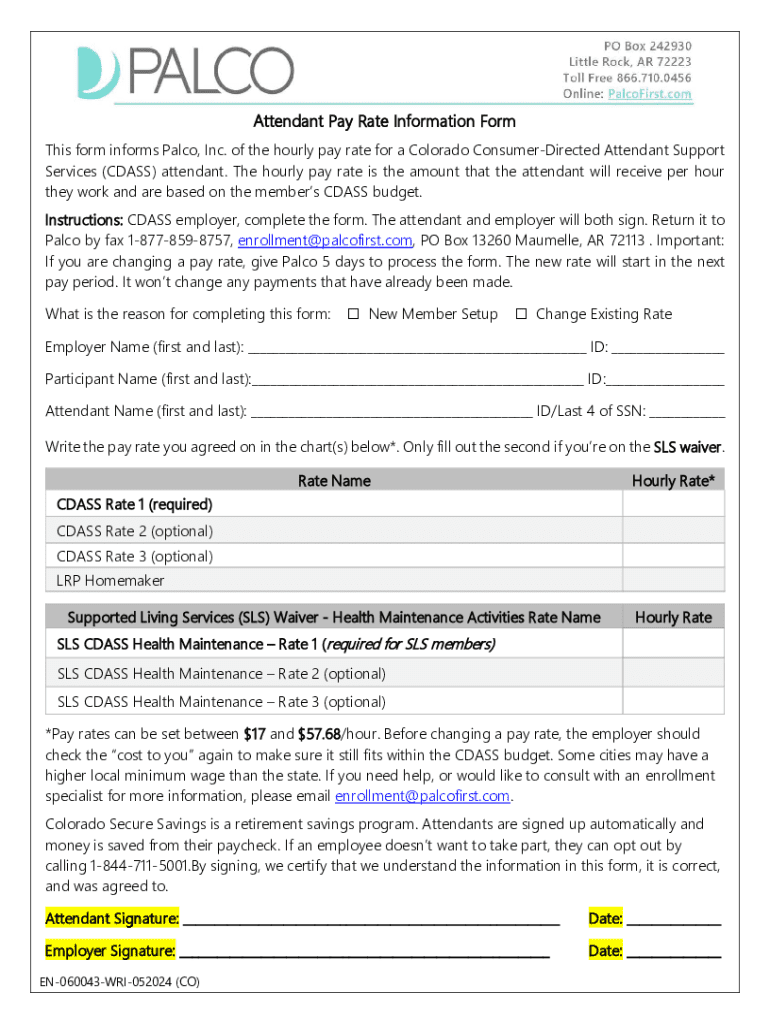

Get the free Attendant Pay Rate Information Form

Get, Create, Make and Sign attendant pay rate information

How to edit attendant pay rate information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out attendant pay rate information

How to fill out attendant pay rate information

Who needs attendant pay rate information?

Attendant Pay Rate Information Form: A Comprehensive Guide

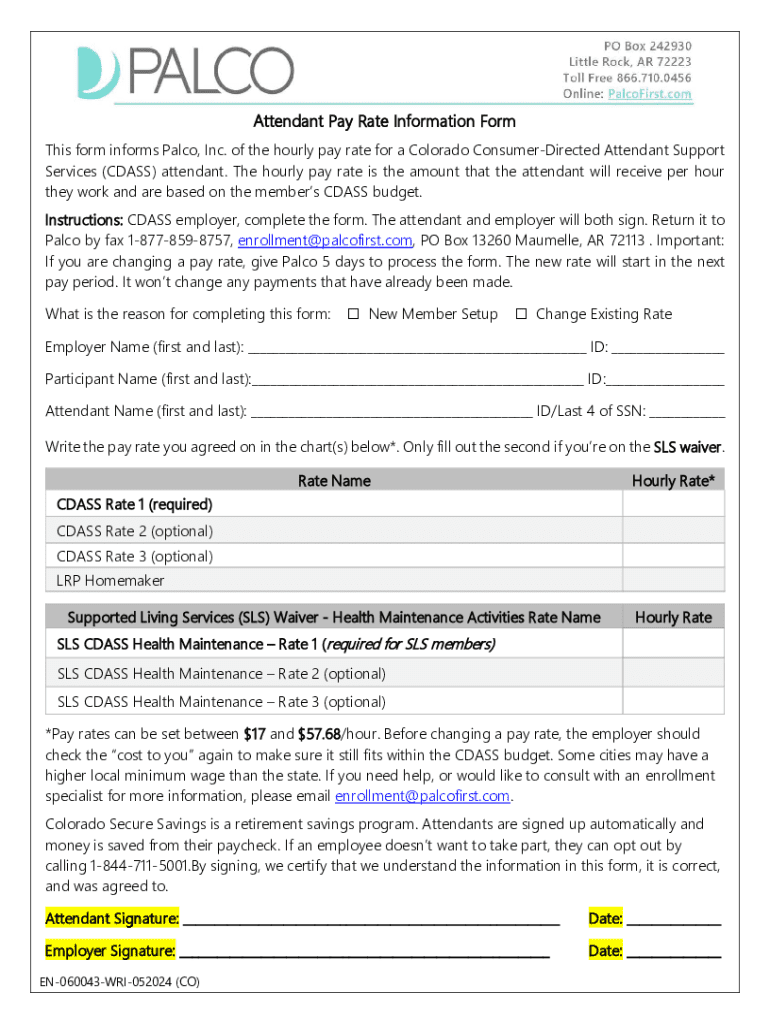

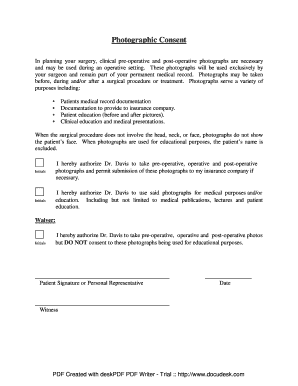

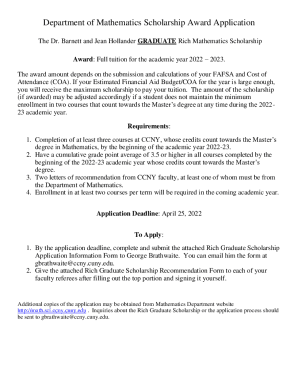

Understanding the attendant pay rate information form

The Attendant Pay Rate Information Form is a crucial document designed for employers and employees within various industries. This form serves as the foundational tool to accurately record and communicate an employee's pay structure. Its primary objective is to consolidate essential pay information in a standardized manner, ensuring clarity and consistency in compensation practices.

In the workplace, this form is vital for several reasons. It helps avoid discrepancies in pay, facilitates compliance with labor laws, and gives employees insight into their compensation structure. The accuracy of the information presented on the form directly influences payroll processes and employee satisfaction.

Key components of the attendant pay rate information form

Filling out the Attendant Pay Rate Information Form accurately requires attention to several key components. The essential fields include employee information, job titles, and detailed pay rate specifics. Each field plays a critical role in ensuring that all parties involved have a clear understanding of the employee's compensation.

Typically, the main sections of the form include the following:

Step-by-step guide: How to fill out the attendant pay rate information form

To correctly complete the Attendant Pay Rate Information Form, one must start by gathering all required information. This includes documentation such as prior pay stubs and detailed job descriptions, which provide a context for your pay structure.

Next, focus on completing the form accurately. Here’s how:

Common pitfalls include neglecting to provide all necessary details or miscalculating overtime rates. Always double-check calculations and ensure compliance with any local employment laws to avoid disputes down the line.

Editing and managing your form with pdfFiller

Managing the Attendant Pay Rate Information Form can be made seamless with pdfFiller's cloud-based features. This platform provides tools that enhance form management, allowing for easy editing and sharing of documents anytime and anywhere.

Key features include:

Organizing documents is also simpler with pdfFiller. Use naming conventions, tags, or folders to keep track of your forms, ensuring easy retrieval when needed.

eSigning the attendant pay rate information form

Utilizing electronic signatures for the Attendant Pay Rate Information Form provides a multitude of benefits, including speed, efficiency, and a reduced ecological footprint. Electronic signatures are legally binding and facilitate faster processing of documents.

The process for eSigning your form using pdfFiller is straightforward:

It's crucial to familiarize yourself with the legal implications of electronic signatures, including compliance with eSign laws and potential challenges in disputes. Always ensure that the signatories understand their obligations clearly.

Common challenges and solutions in filling out the attendant pay rate information form

When filling out the Attendant Pay Rate Information Form, individuals often face various challenges. Errors in data entry or lack of clarity regarding pay calculations can lead to misunderstandings and disputes. Recognizing these common errors is essential for smoother processes.

To mitigate potential issues, consider the following solutions:

Addressing disputes swiftly and professionally will contribute to a healthy workplace environment. When discrepancies arise, reference clear documentation and seek to resolve issues collaboratively.

Collaborating with your team on the form

Collaboration is a key component in managing the Attendant Pay Rate Information Form effectively. With pdfFiller's collaboration features, teams can work together efficiently. Assigning roles and permissions within the document ensures that each team member has the right access level, facilitating effective feedback and adjustments.

Here’s how you can optimize teamwork using pdfFiller:

Such proactive approaches in collaboration foster an environment of transparency and ensure accuracy in documentation, leading to more effective payroll management.

Analyzing pay rates: What you need to know

Understanding the implications of pay rates is essential for both employers and employees. Pay rates can vary widely between full-time, part-time, and casual employees; hence, careful analysis is necessary. For instance, full-time employees generally receive benefits that are calculated into their overall compensation, while part-time workers might have more variability in hours and earnings.

Several factors influence pay rates, including:

Additionally, consider how to calculate loaded rates of pay by factoring in benefits and entitlements such as leave. For example, when modeling salaries, it's essential to include any applicable allowances or regular bonuses, ensuring a holistic view of compensation.

Legal considerations and best practices for attendant pay rates

Adhering to legal standards is non-negotiable when determining pay rates. Various labor laws regulate pay equity, minimum wage compliance, and overtime provisions. Familiarizing yourself with these regulations ensures your agreements are enforceable and prevent costly legal disputes.

Employers must also understand the Better Off Overall Test (BOOT), which assesses whether employees are better off under a proposed pay agreement when compared to previous agreements. Staying compliant with all relevant legislation is pivotal.

Keeping informed about changes in the law can help organizations remain compliant and foster positive employee relations.

Using templates to simplify the process

Using pre-made templates for the Attendant Pay Rate Information Form can significantly streamline the data entry process. With templates, businesses can reduce the time spent on creating documents from scratch while ensuring all necessary fields are included.

Consider the following advantages of using templates:

Furthermore, pdfFiller allows for customization, enabling you to tailor templates suited to your specific needs or create entirely new forms as necessary. This adaptability is crucial, particularly in dynamic working environments.

Feedback and continuous improvement

Gathering feedback about the Attendant Pay Rate Information Form process is essential for continual enhancement of workflow. Engaging employees in this feedback loop not only shows that their input is valued but may provide insights that lead to better practices.

Consider implementing various techniques for improving your form and corresponding workflows:

By continuously refining the process, organizations can better align their practices with the needs of their employees, enhancing compliance and satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in attendant pay rate information?

How do I edit attendant pay rate information in Chrome?

How do I edit attendant pay rate information straight from my smartphone?

What is attendant pay rate information?

Who is required to file attendant pay rate information?

How to fill out attendant pay rate information?

What is the purpose of attendant pay rate information?

What information must be reported on attendant pay rate information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.