Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Comprehensive Guide to Form 990

Understanding Form 990

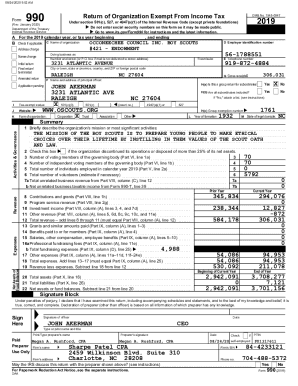

Form 990 is an essential tax document required by the Internal Revenue Service (IRS) for tax-exempt organizations in the United States. This form provides a detailed overview of an organization's financial activities, governance, and compliance with tax regulations. The primary aim of Form 990 is to ensure transparency, accountability, and responsible management of nonprofits, which are often funded by public donations. Organizations use this form to report their financial health and operational effectiveness, making it a vital tool for both the IRS and the public.

Filing Form 990 is crucial for tax-exempt organizations, as it maintains their status and informs the public about their operations. The process can seem daunting, with numerous sections requiring various financial details and governance practices. However, understanding the filing process can simplify what often appears as an overwhelming task. Organizations must file their Form 990 annually, even if they made no revenue, ensuring consistent reporting over time.

Variants of Form 990

Form 990 comes in several variants, each catering to different organizations based on their size and financial complexity. The main types include:

Choosing the right variant is key: larger organizations must file Form 990, while smaller entities typically opt for Form 990-EZ or the 990-N depending on their financials. Understanding these distinctions can help organizations maintain compliance while minimizing unnecessary complexity in their reporting.

Filing requirements

Not all organizations are required to file Form 990. The requirement primarily depends on the organization’s financial statistics and structure. Generally, any tax-exempt organization that earns $50,000 or more in gross receipts is required to file Form 990-N. Larger organizations with gross income of $200,000 or total assets exceeding $500,000 must file the complete Form 990. Furthermore, certain smaller nonprofits may be exempt from filing, especially if they meet specific criteria.

File deadlines can vary based on whether an organization operates on a calendar year or a fiscal year. Organizations typically face a deadline of the 15th day of the 5th month post their fiscal year-end. To avoid penalties for late filings or non-compliance, being aware of specific deadlines is essential for effective annual planning.

Detailed instructions for completing Form 990

Completing Form 990 requires attention to detail, as it captures several critical aspects of an organization’s operations. Here is a step-by-step breakdown of the main sections:

Common mistakes to avoid include inaccuracies in financial data, misrepresenting program service accomplishments, and failing to disclose potential conflicts of interest among board members. Ensuring a thorough review process can mitigate these issues and enhance the quality of the report.

Editing and managing your Form 990

For organizations looking to streamline the process of managing their Form 990, pdfFiller offers innovative tools that enhance document creation and editing. Users can easily upload templates and utilize interactive features to guide them through the filing.

With pdfFiller's features, the eSigning of Form 990 becomes a straightforward task. Collaborating with team members for review and feedback is efficient, as pdfFiller allows sharing features that facilitate real-time comments and changes. Tracking document edits provides clarity and keeps every team member informed of modifications.

Legal and compliance considerations

Understanding IRS regulations surrounding nonprofits is critical for legal compliance. Knowing the regulations helps ensure that your organization’s Form 990 is filled out accurately and within legislative guidelines. This may encompass understanding specific codes, reporting nuances, and jurisdictional statutes applicable to nonprofits.

Penalties often arise from non-compliance or late filing, affecting an organization’s standing with the IRS. Types of penalties may include monetary fines or disqualification from tax-exempt status. Avoiding late filings through strategic reminders and accounting practices can safeguard an organization’s interests and maintain operational stability.

Public inspection regulations

Form 990 must be made available to the public, aligning with transparency objectives important to nonprofits. This requirement means that organizations should be prepared to provide access to their Form 990 upon request, contributing to public trust and accountability.

To comply with public inspection rules, organizations can host their Form 990 on their websites or provide copies upon request. Keeping this information accessible enhances credibility and builds community confidence in the organization's operations.

The role of Form 990 in charity evaluation research

Form 990 serves as a critical resource for those researching and evaluating nonprofit organizations. Donors, researchers, and watchdog groups leverage the data contained in Form 990 to assess an organization’s financial health and operational efficacy. This element of transparency can significantly influence donor trust and engagement.

Accessing tools and resources for analyzing Form 990 can further enhance evaluations. Websites like GuideStar and Charity Navigator utilize this data to provide insights, ratings, and reviews that inform stakeholders about an organization's performance. Thus, the data encapsulated within Form 990 plays a pivotal role in shaping fundraising and investment decisions.

How to access and search for Form 990

Locating historical and current Forms 990 is a straightforward process with various online resources available. The IRS website hosts this information, allowing users to search for specific organizations and their filings easily.

Additionally, third-party databases such as Guidestar, Foundation Center, and the National Council of Nonprofits provide tools for accessing Form 990 data, improving the efficiency of searching and retrieving essential documents.

Additional insights and context

Form 990 has its roots in the Revenue Act of 1950, evolving through multiple amendments over the years to enhance its clarity and improve transparency in nonprofit reporting. Organizations have witnessed an influx of requirements aimed at protecting public interests and ensuring that donations are utilized effectively.

Future trends suggest an increasing push toward digital engagement and streamlined reporting processes. Nonprofits may see a rise in mandates surrounding transparency and accountability as funding sources demand more detailed insights into how organizations operate and allocate resources. Adapting efficiently to these changes will be crucial for sustaining nonprofit success and integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

Can I create an electronic signature for the form 990 in Chrome?

How do I fill out the form 990 form on my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.