Get the free Automatic Contribution Arrangement Withdrawal Form

Get, Create, Make and Sign automatic contribution arrangement withdrawal

Editing automatic contribution arrangement withdrawal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out automatic contribution arrangement withdrawal

How to fill out automatic contribution arrangement withdrawal

Who needs automatic contribution arrangement withdrawal?

A comprehensive guide to the automatic contribution arrangement withdrawal form

Understanding automatic contribution arrangements

An automatic contribution arrangement (ACA) is a system designed to facilitate automatic enrollment of employees into retirement savings plans. This framework often involves employers automatically deducting a certain percentage of the employees' salaries to contribute to a retirement account, such as a 401(k). This arrangement can significantly enhance participation rates in retirement plans and encourage employees to save for their future.

The primary purpose of ACAs is to simplify the process of enrollment in retirement plans. Employees no longer need to take the initiative to enroll, which helps mitigate inertia—a common barrier to saving. The benefits are substantial, enabling automatic savings for employees who might otherwise overlook retirement planning.

Key components of an ACA include the automatic enrollment feature, which sets a default contribution rate, and the options for employees to defer or adjust their contribution rates as needed. These elements work in tandem to create a more accessible and efficient route to financial security through consistent savings.

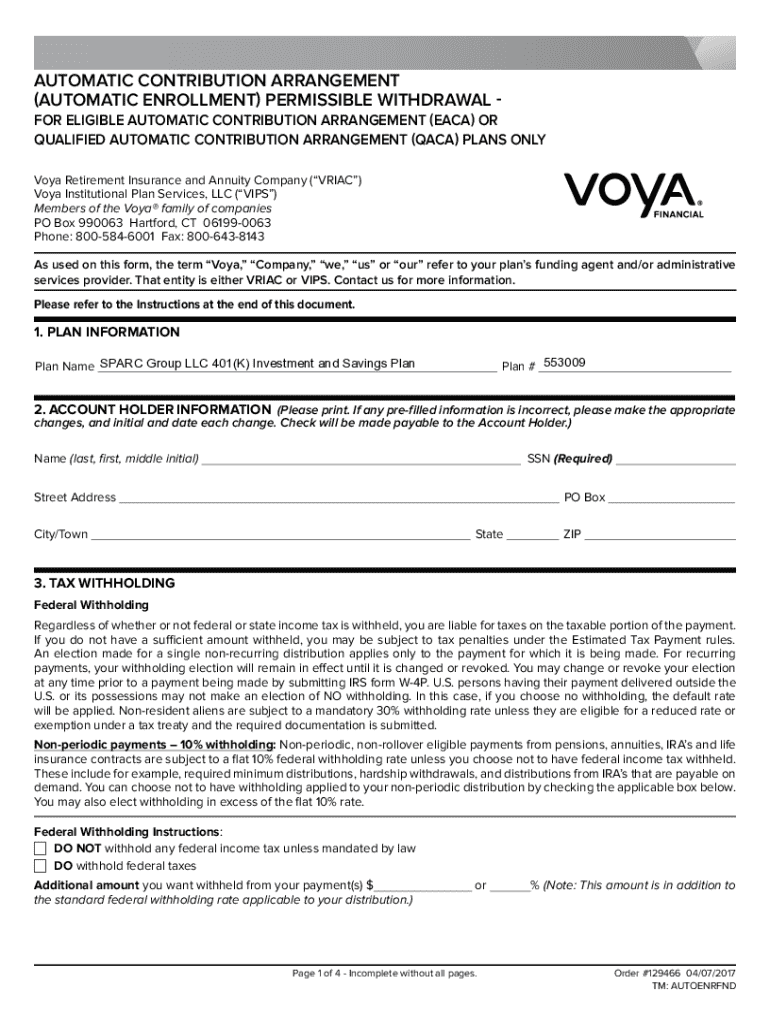

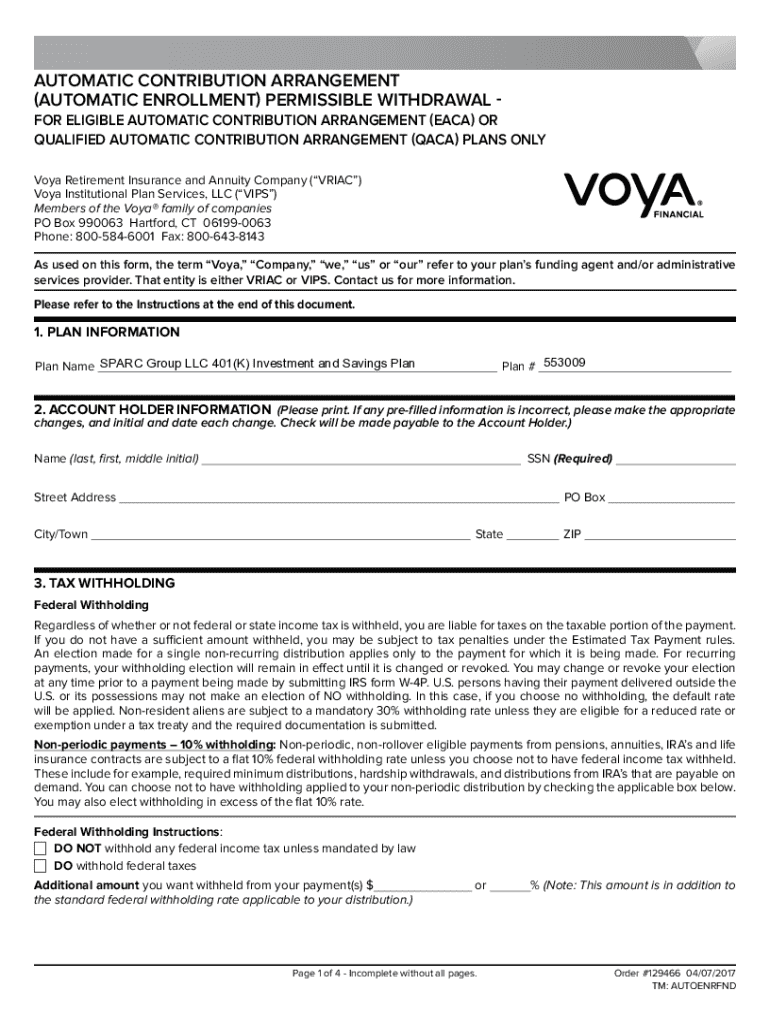

Overview of the withdrawal form

The automatic contribution arrangement withdrawal form serves as the official document that employees must complete to withdraw funds from their ACA accounts. This form is critical when circumstances change, such as a new job, financial need, or simply the desire to access contributed funds.

Various scenarios may necessitate a withdrawal request. For instance, employees might need immediate access to funds due to unexpected medical expenses or personal emergencies. Understanding who needs to fill out this form is essential.

How to complete the automatic contribution arrangement withdrawal form

Completing the automatic contribution arrangement withdrawal form requires careful attention to detail. Start by gathering all the necessary information, including personal identification and employment data. This initial step ensures that you have everything at your fingertips, streamlining the process.

Break down the form into manageable sections. Understanding each part—and the specific information needed—can prevent confusion and minimize errors. After filling out the required information, it’s crucial to submit the form correctly, whether online or in a physical format. Moreover, be aware of any deadlines associated with your submission to prevent delays in processing.

To ensure accuracy in your submission, it's recommended to double-check all entered information. Common mistakes include typos or missing signatures, which could delay the processing of your withdrawal.

Managing your withdrawal request

After submitting the withdrawal form, it's essential to understand what happens next. Depending on the plan, the processing time can vary, generally taking a few business days to a couple of weeks. During this time, you should expect notifications and updates from your plan administrator regarding your request's status.

If your plan allows, tracking your withdrawal status online can be both convenient and reassuring. Most retirement plans provide a secure portal where you can log in and see real-time updates about your request, which helps in managing your expectations about when you might receive your funds.

Frequently asked questions about the withdrawal process

Navigating the withdrawal process can raise many questions. Here are a few frequently asked queries that can assist you during your journey.

Understanding your rights and responsibilities

As an employee participating in an automatic contribution arrangement, you have specific rights that protect your interests. Notably, you maintain the right to withdraw your contributions under certain circumstances. Employers have the responsibility to ensure they comply with federal regulations, including providing clear and accessible forms and support to employees navigating this process.

This mutual understanding fosters a healthy relationship within the workplace, enhancing awareness around financial literacy and retirement planning.

Seeking additional support

For those who need assistance with the automatic contribution arrangement withdrawal form, various resources are available. Contact your plan administrator directly for personalized support, as they can guide you through the specific aspects of your plan.

Additionally, online resources, including FAQs and instructional pages, can provide valuable insights into common challenges and questions surrounding the withdrawal process.

Related topics and considerations

Withdrawing funds from your retirement accounts can have long-term implications on your financial future. It's essential to assess how these withdrawals might impact your overall retirement savings, potentially setting back your financial goals.

Moreover, exploring alternatives to withdrawals is prudent. Options like loans against your retirement savings can provide immediate relief without impinging on your long-term savings strategy. If your circumstances change, consider the possibility of re-enrollment in your ACA, which allows you to resume contributions and build your retirement fund.

Final thoughts on automatic contribution arrangement withdrawals

Evaluating financial decisions surrounding your retirement savings is crucial. Withdrawing from your retirement account is a significant step that should be approached thoughtfully. Staying informed about your options and understanding the implications of your actions will not only help in making better decisions but will also enhance your overall financial literacy.

Engaging with resources, like those provided by pdfFiller can help you streamline the withdrawal process. By empowering yourself with knowledge, you're not only advocating for your financial future but also investing in your long-term well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send automatic contribution arrangement withdrawal for eSignature?

Can I sign the automatic contribution arrangement withdrawal electronically in Chrome?

Can I edit automatic contribution arrangement withdrawal on an iOS device?

What is automatic contribution arrangement withdrawal?

Who is required to file automatic contribution arrangement withdrawal?

How to fill out automatic contribution arrangement withdrawal?

What is the purpose of automatic contribution arrangement withdrawal?

What information must be reported on automatic contribution arrangement withdrawal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.