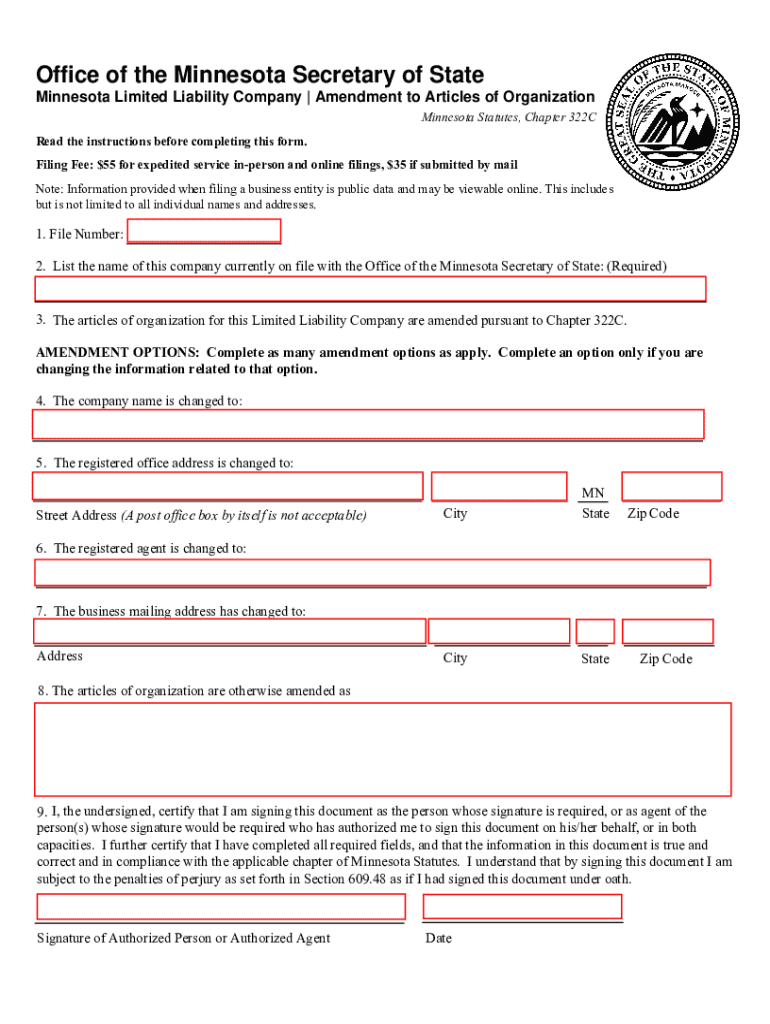

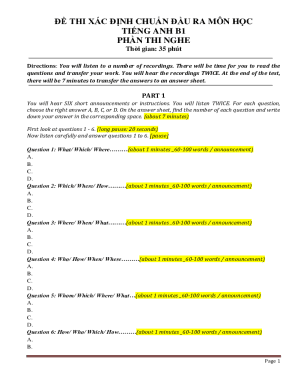

Get the free Minnesota Limited Liability Company | Amendment to Articles of Organization

Get, Create, Make and Sign minnesota limited liability company

Editing minnesota limited liability company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota limited liability company

How to fill out minnesota limited liability company

Who needs minnesota limited liability company?

Your Complete Guide to Minnesota Limited Liability Company Form

Understanding Limited Liability Companies (LLCs)

A Limited Liability Company (LLC) is a popular form of business organization that combines the advantages of partnerships and corporations. This structure provides owners, often referred to as members, with personal liability protection while offering the benefits of pass-through taxation.

Specifically, Minnesota LLCs allow for a flexible management structure and fewer formal requirements compared to corporations. Unlike sole proprietorships, an LLC shields its members' personal assets from business debts and liabilities. This is a considerable advantage for entrepreneurs and small business owners looking to safeguard their finances.

Benefits of forming a Minnesota

Forming a Minnesota LLC offers several substantial benefits, notably the significant liability and asset protection for its members. This means that in the event of lawsuits or debts, members' personal assets, such as homes and savings, are generally not at risk.

Tax advantages also play a pivotal role. Minnesota LLCs typically enjoy pass-through taxation, meaning that the profits and losses of the business are reported on the members' personal tax returns, thus avoiding double taxation. Additionally, Minnesota provides certain state-specific tax benefits for small businesses, making it an attractive state for LLC formation.

The ease of management and operation is another appealing factor. LLCs require less paperwork and fewer annual formalities compared to corporations. Moreover, they allow flexible ownership structures; both individuals and entities can be members.

Why choose to form your Minnesota ?

The local advantages of forming an LLC in Minnesota further bolster its appeal. The state fosters a supportive economic environment for small businesses, with resources tailored specifically to assist entrepreneurs. Additionally, Minnesota’s regulatory structure encourages LLC formations by streamlining processes to secure business licenses and permits.

Moreover, Minnesota boasts a robust small business community and a thriving market that accommodates various industries, allowing new LLCs to flourish. The state's commitment to supporting small businesses reinforces the decision to establish an LLC here.

Step-by-step guide to forming a Minnesota

Launching a Minnesota LLC involves several specific steps, and it's essential to follow them correctly to ensure compliance with state laws.

Managing your Minnesota post-formation

After establishing your Minnesota LLC, understanding the ongoing management and compliance requirements is vital for continued operation. Compliance includes filing annual reports and adhering to deadlines set forth by the Minnesota Secretary of State.

Annual reports typically require basic information about your business and must be submitted each year to maintain good standing. It's paramount to track these deadlines to avoid penalties or dissolution of your LLC.

Lastly, performing a Minnesota business entity search can help ensure the availability of your chosen LLC name. This step is crucial to avoid potential conflicts and safeguard your brand.

Additional considerations for owners in Minnesota

Interactive tools for Minnesota formation

pdfFiller offers an array of document creation tools to simplify the Minnesota limited liability company form process. The platform is designed for easy collaboration, enabling users to fill out, edit, sign, and manage their LLC documentation seamlessly, all from a cloud-based interface.

Using pdfFiller for your LLC formation documentation not only streamlines the process, but it also ensures that all necessary forms are filled out accurately to avoid errors. With a user-friendly design, managing your business documents becomes a hassle-free experience.

FAQs on Minnesota formation

Expert insights and support

With a focus on usability and efficiency, pdfFiller provides comprehensive support services to assist you throughout the LLC formation and management journey. Their platform not only simplifies the documentation process but also offers personalized assistance.

User testimonials highlight the importance of using pdfFiller, illustrating how it empowers users to efficiently navigate the complexities of managing their LLC documentation with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get minnesota limited liability company?

How do I execute minnesota limited liability company online?

How do I edit minnesota limited liability company straight from my smartphone?

What is Minnesota limited liability company?

Who is required to file Minnesota limited liability company?

How to fill out Minnesota limited liability company?

What is the purpose of Minnesota limited liability company?

What information must be reported on Minnesota limited liability company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.