Get the free Grocery Credit Worksheet

Get, Create, Make and Sign grocery credit worksheet

How to edit grocery credit worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out grocery credit worksheet

How to fill out grocery credit worksheet

Who needs grocery credit worksheet?

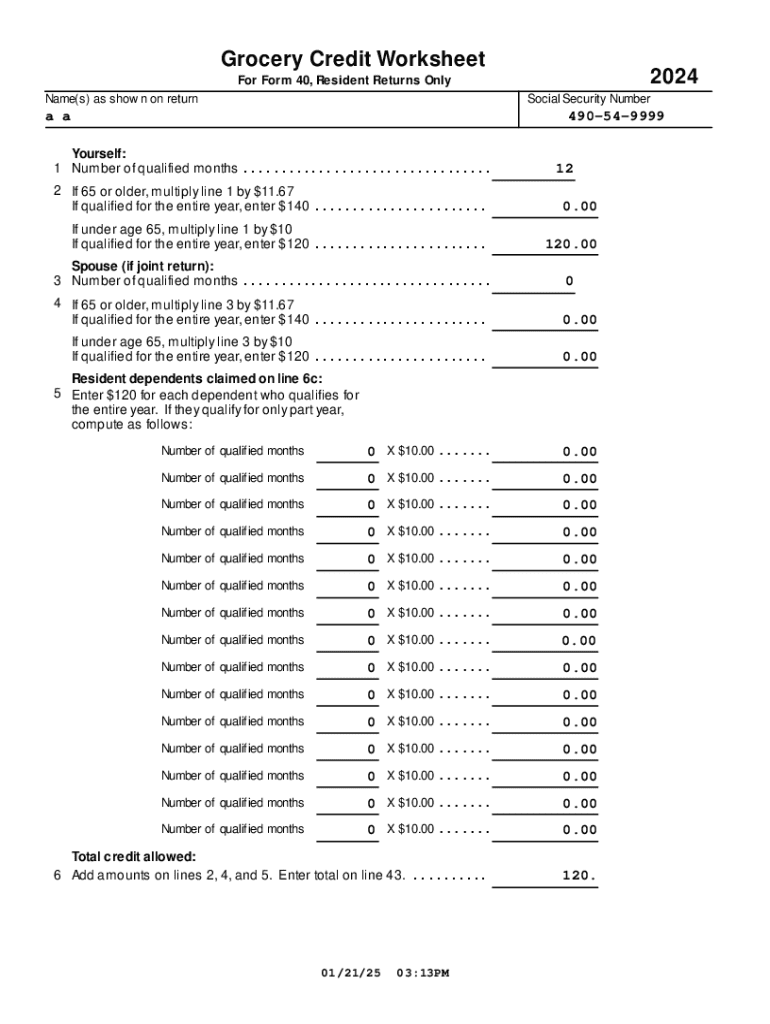

Understanding the Grocery Credit Worksheet Form

What is a Grocery Credit Worksheet?

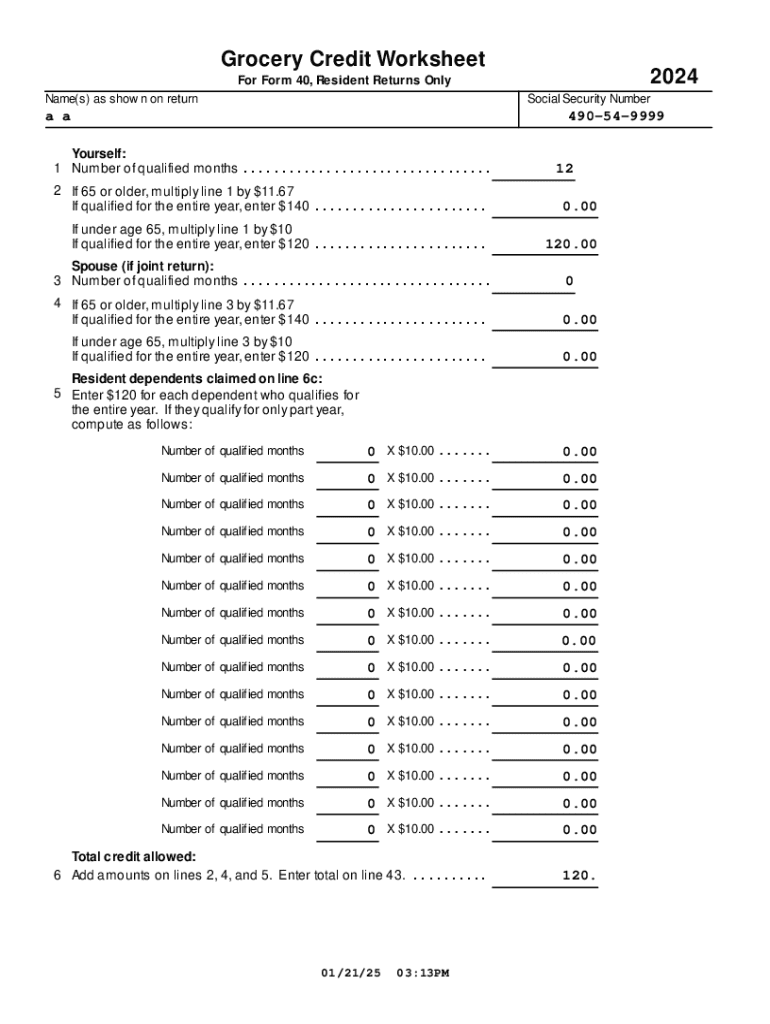

The Grocery Credit Worksheet is a crucial document used in tax preparation, specifically designed to help taxpayers calculate their eligible grocery credits. This worksheet serves as a guide to track various financial aspects tied to grocery purchases, enabling individuals to maximize their allowable credits based on their financial situation and state regulations.

Importance of the Grocery Credit Worksheet in tax filing

Using the Grocery Credit Worksheet can significantly impact your overall tax filing experience. By carefully detailing eligible grocery expenses, taxpayers can ensure they do not miss out on potential credits that could reduce their tax liabilities. This becomes particularly essential during tax season, where every deduction counts towards your refund or balance due.

Who needs to use the Grocery Credit Worksheet?

This form is especially beneficial for individuals and families who regularly purchase groceries and may qualify for tax credits based on their income and filing status. Anyone filing their taxes, particularly residents in states that offer a grocery credit, should consider filling out this worksheet to ensure they capture all possible benefits related to their grocery expenses.

Essential information required before filling out the form

Before you begin filling out the Grocery Credit Worksheet, gather the necessary essential information to streamline the process. This includes Personal Identifiable Information (PII), financial records, and previous tax returns, as they provide the necessary context for your credit eligibility.

Common mistakes to avoid when gathering information

Several common pitfalls can derail the completion of the Grocery Credit Worksheet. Not verifying income sources can lead to incorrect credit calculations. Additionally, failing to organize documentation can result in missing crucial details and delays in processing your application. Always double-check your data for accuracy and ensure that you’ve included all necessary records.

Step-by-step guide to filling out the Grocery Credit Worksheet form

The following sections outline a detailed approach to filling out the Grocery Credit Worksheet, making the process manageable and efficient.

Sections of the Grocery Credit Worksheet

The form generally consists of four main sections that guide you through the information needed to successfully complete your grocery credit calculation.

Understanding eligibility criteria

To ensure accurate calculations, review your entire income details to check eligibility status. Identify any applicable deductions that might lower your taxable income, making you eligible for a larger grocery credit. Lastly, it’s recommended to use an online calculator to verify your credit amount before submitting.

Online tools for managing your credit

In today’s digital age, utilizing online resources can enhance the efficiency of managing your Grocery Credit Worksheet tasks. pdfFiller offers customizable online calculators tailor-made for estimating your grocery credit easily.

What you might see after submission

Once you have submitted your Grocery Credit Worksheet, you may receive feedback regarding whether your credits were approved or denied. Understanding how each outcome impacts your tax filings is essential for future submissions.

Finding help for complicated situations

If you encounter complications while filling out the Grocery Credit Worksheet, know there are resources and tax professionals available to assist. Consider reaching out to financial advisors or tax assistance programs in your area for personalized help tailored to your specific circumstance.

Filing status impact on grocery credit

Your filing status has a substantial influence on your eligibility for grocery credits. Whether you are married, single, or filing as head of household can dictate how deductions and credits are calculated.

Frequently asked questions (FAQs) related to grocery credit

A series of frequently asked questions can clarify common uncertainties surrounding the grocery credit process:

Tips for maximizing your grocery credit

To maximize your grocery credit, meticulous record-keeping is essential. Maintain receipts, track expenses diligently, and take note of any monthly grocery purchases. Understanding your local regulations can also unlock potential credits; some states offer uplifting allowances for families or specific income brackets.

Overview of other forms related to grocery credits

In addition to the Grocery Credit Worksheet, several other forms may accompany your tax preparation, particularly for residents in specific states. It’s essential to familiarize yourself with these documents.

Tax credits relevant to grocery purchases

Understanding tax credits beyond grocery purchases can further enhance your financial planning. Having insight into child tax credits, earned income credits, and other relevant deductions could significantly influence your overall tax return.

Empowering you to edit, sign, and manage your forms

With pdfFiller's cloud-based solutions, users gain access to a robust platform for editing, signing, and managing all kinds of documents. This ensures that handling the Grocery Credit Worksheet and related forms aligns seamlessly with modern needs for efficiency and accessibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out grocery credit worksheet using my mobile device?

How do I complete grocery credit worksheet on an iOS device?

Can I edit grocery credit worksheet on an Android device?

What is grocery credit worksheet?

Who is required to file grocery credit worksheet?

How to fill out grocery credit worksheet?

What is the purpose of grocery credit worksheet?

What information must be reported on grocery credit worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.