Get the free New Sales Tax Accounts (6/1/24-6/31/24)

Get, Create, Make and Sign new sales tax accounts

Editing new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

New sales tax accounts form: A comprehensive how-to guide

Understanding sales tax accounts

A sales tax account is a state-specific account that businesses must establish to collect, report, and remit sales tax on taxable sales. This account is crucial for compliance with local tax regulations, ensuring that businesses contribute to state revenue. Each state has its requirements, emphasizing the necessity for businesses, whether individual entrepreneurs or larger organizations, to understand and maintain their sales tax accounts.

Registering for a sales tax account is important for several reasons. Firstly, it legally authorizes a business to collect sales taxes from customers, ensuring compliance and avoiding penalties. Secondly, it establishes a record of taxable transactions, which is essential for bookkeeping and financial reporting. Finally, having a sales tax account allows businesses to apply for tax exemptions on certain purchases.

Overview of the new sales tax accounts form

The new sales tax accounts form has been revamped to simplify the registration process for businesses. Key features of this form include a streamlined design, intuitive layout, and clear instructions that guide users step-by-step through the submission process. This improvements aim to reduce confusion and minimize errors during completion.

Compared to previous forms, the new sales tax accounts form reduces redundant fields, making it easier for users to complete. Key differences include an expanded section for business identification details and a more straightforward classification system for tax purposes. This form is applicable for new businesses registering for the first time and established businesses changing their sales tax status or addressing errors.

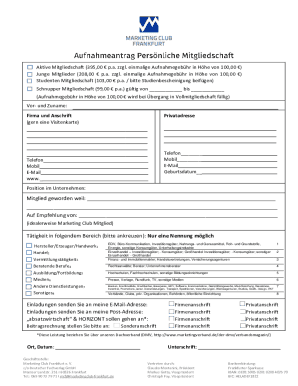

Preparing to fill out the new sales tax accounts form

Before diving into the new sales tax accounts form, it’s essential to gather all necessary information to ensure a smooth registration process. This includes essential business identification details, such as the federal Employer Identification Number (EIN) or Social Security Number for sole proprietors, as well as the business's legal name and address.

Moreover, financial information like estimated sales, projected tax liability, and existing licenses are also mandatory. Understanding your tax classification is crucial as it determines how your sales tax obligations are calculated. One common mistake is neglecting to double-check the accuracy of the business identification details as this could result in processing delays or application rejections.

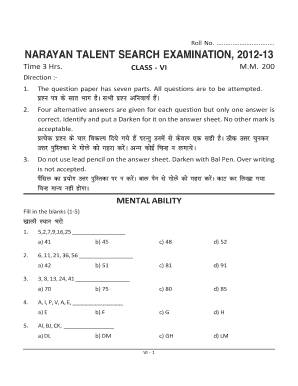

Step-by-step instructions for completing the new sales tax accounts form

Completing the new sales tax accounts form can be straightforward when following a systematic approach. Start with the contact information section, ensuring that all basic information is accurately filled out. Input your name, phone number, and email address precisely as they will be used for official communication.

The next step involves accessing the business information section. Here, you need to provide the name of your business, its structure (e.g., LLC, Corporation), and the physical address. It's important to enter the correct legal name as it appears on your business licenses to avoid discrepancies.

In the tax classification section, you'll select the type of business structure you operate under. It’s crucial to understand the different classifications as your tax obligations will depend on this selection. After filling out all necessary sections, take your time reviewing the information to catch any mistakes before submitting. Choose the appropriate submission method, whether online or by mailing the form.

Interactive tools to assist with the new sales tax accounts form

Utilizing interactive tools can significantly ease the process of filling out the new sales tax accounts form. Online form filling tools available through platforms like pdfFiller enhance usability by offering pre-filled information based on your previous submissions, ensuring accuracy and efficiency. These tools guide users step-by-step, decreasing the chances of errors that may occur during manual entry.

Additionally, calculation tools can help estimate potential tax liabilities based on input data, allowing for better financial planning. Features like PDF editing allow users to change or correct any part of their application easily. These resources eliminate many common issues associated with the traditional paperwork approach.

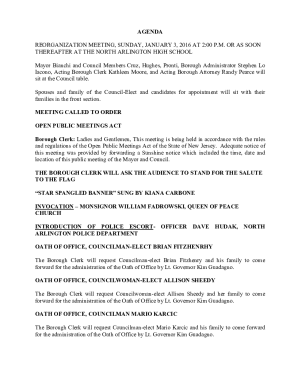

FAQ about the new sales tax accounts form

Processing times for the new sales tax accounts form can vary based on the state and volume of submissions. Typically, you can expect a turnaround of 4-6 weeks, but it could be extended during peak periods. Therefore, planning ahead can be beneficial to avoid delays in your authorization to collect sales tax.

If you make a mistake on your submission, most tax authorities provide a means to correct errors. You may need to contact them directly or amend your application, depending on the severity of the mistake. Tracking the status of your application is usually possible through your state’s taxation website, often requiring your application reference number to access real-time updates.

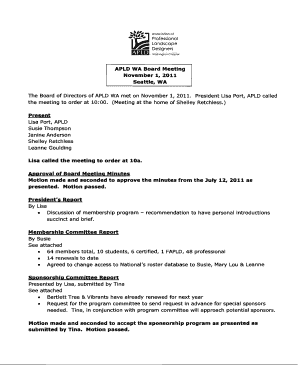

Editing, signing, and managing the new sales tax accounts form using pdfFiller

With pdfFiller, users can easily upload the new sales tax accounts form and edit it directly within the platform. This feature ensures any necessary changes can be made quickly and efficiently, reducing processing delays. The eSignature feature allows for secure signing, enabling users to finalize their applications without needing to print or scan documents.

Furthermore, pdfFiller simplifies collaboration with team members. Users can share the form with colleagues for their input or approval and track the document's progress through the editing stages. This collaboration streamlines the process, making managing sales tax accounts forms more straightforward for businesses.

Resources for further assistance

For additional help, various resources are readily available. Many state tax authority websites have dedicated sections for frequently asked questions and detailed guides to assist users with their sales tax accounts. These platforms often feature contact information where businesses can inquire about specific issues related to their accounts and forms.

Moreover, pdfFiller provides resources such as templates and user support to further streamline the form-filling process. Diverse users can find language assistance options across several state websites, ensuring accessibility for all business owners. Leveraging these resources can enhance understanding and reduce the stress associated with tax account management.

Maintaining your sales tax account post-submission

Once your new sales tax account is established, it’s crucial to keep your information updated. Any changes in business structure, ownership, or address should be reported to the appropriate tax authority to avoid penalties. Regularly reviewing account details ensures that your records are current, which is vital for efficient reporting and tax compliance.

Understanding sales tax compliance and filing requirements is essential for business success. Familiarize yourself with filing deadlines and the necessary documentation to remain compliant. Tools such as those offered by pdfFiller can assist in managing and tracking your sales tax obligations effectively, ensuring you are always aware of upcoming deadlines and requirements.

Leveraging pdfFiller for ongoing document management

pdfFiller is not just a tool for filling out the new sales tax accounts form; it provides a comprehensive solution for ongoing document management. Users can create templates for future forms, reducing the workload for subsequent submissions. This feature is particularly beneficial for businesses with repetitive documentation needs, streamlining the overall process.

Cloud-based document management offers additional advantages, such as secure access from any device, collaboration features, and storage solutions to keep documents organized. Whether you’re at home, the office, or on the go, pdfFiller ensures that your important documents are always at your fingertips, facilitating chronicling, completing, and converting documents as needed.

Common challenges and solutions when using the new sales tax accounts form

Navigating the new sales tax accounts form may present challenges, particularly for first-time users. Troubleshooting submission issues is often a priority, as errors in data input or file format can block successful submissions. If issues arise, check your documentation for required fields, and ensure all parts of the form are filled out correctly.

Handling rejection is another concern, particularly when businesses need their tax accounts open quickly. If your application is rejected, review feedback provided by the tax authority, rectify any issues, and resubmit promptly. Efficiently managing multiple sales tax accounts typically requires organized documentation and regular communication with tax authorities to ensure compliance across state lines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new sales tax accounts in Chrome?

Can I edit new sales tax accounts on an iOS device?

Can I edit new sales tax accounts on an Android device?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.