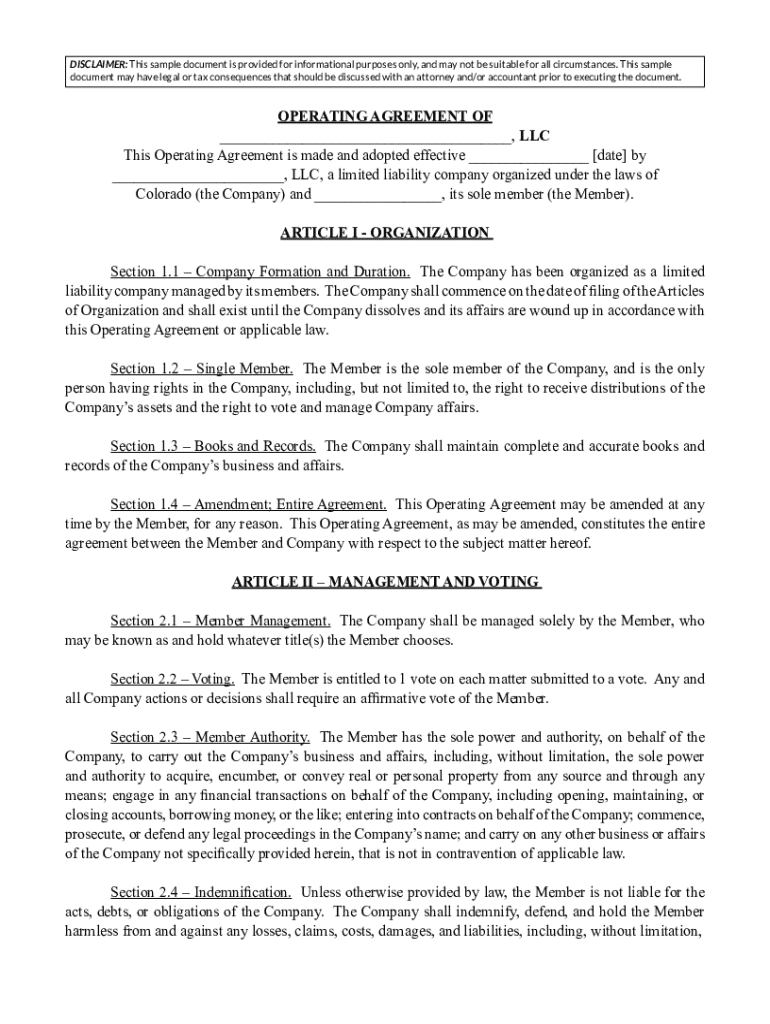

Get the free colorado llc operating agreement single member

Get, Create, Make and Sign colorado llc operating agreement

How to edit colorado llc operating agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado llc operating agreement

How to fill out colorado single-member llc operating

Who needs colorado single-member llc operating?

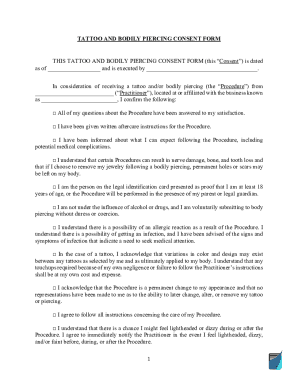

Understanding the Colorado Single-Member Operating Form

Understanding Colorado Single-Member LLCs

A single-member LLC (Limited Liability Company) is a unique business structure in Colorado that allows for one owner to operate the business distinct from its personal assets. This setup safeguards personal assets from business liabilities, creating a protective barrier.

Comparatively, multi-member LLCs have two or more owners, which can complicate management but may offer diverse perspectives. However, single-member LLCs simplify operations, allowing for quicker decision-making. They hold unique benefits such as limited liability protection to the owner, pass-through taxation, and uncomplicated management. As profits are treated as the owner's personal income, they can avoid double taxation.

Importance of an Operating Agreement

An operating agreement is a foundational document for any LLC, outlining the operational procedures and the financial arrangements of the business. Many believe that single-member LLCs do not require an operating agreement due to their singular ownership; however, this is a misconception.

Every single-member LLC in Colorado should have an operating agreement to clarify ownership structure, management processes, and financial arrangements. This document can be crucial during legal disputes or tax matters, ensuring the LLC maintains its limited liability status.

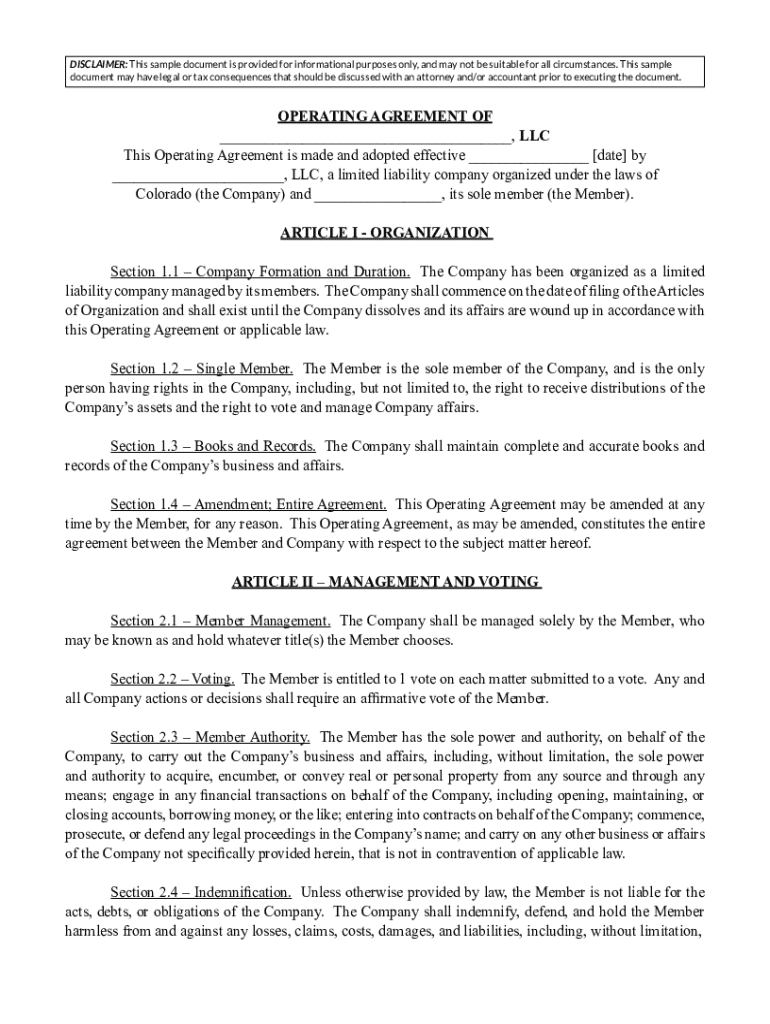

Overview of the Colorado Single-Member Operating Form

The Colorado single-member LLC operating form is designed to provide a cohesive structure for the operation of the entity. This form details all essential information, ensuring compliance with state regulations while also clarifying the internal workings of the LLC.

The form typically includes information such as the LLC's name, its purpose, capital contributions, distribution of profits and losses, and management structure. Each of these components aligns with Colorado state laws, designed to protect the business and the owner by establishing clear guidelines for operation.

Key components of a Colorado single-member operating agreement

A detailed operating agreement will consist of several essential articles, including:

How to create a Colorado single-member operating agreement

Creating an operating agreement for your Colorado single-member LLC can seem daunting, but it can be broken down into manageable steps. A structured approach will ensure all necessary information is included.

Templates for Colorado single-member LLC operating agreements are readily available online, including options on pdfFiller that cater to specific requirements.

Maintaining liability protection with an operating agreement

An operating agreement plays a critical role in maintaining the limited liability protection that a single-member LLC offers. By having a structured and clear agreement, you support the legal standing that separates personal and business assets.

Best practices involve regularly reviewing the operating agreement, documenting compliance with its terms, and ensuring that the LLC operates according to the established structure. This not only preserves the entity's liability protection but also enhances business credibility.

Navigating FAQs about Colorado single-member operating agreements

While creating an operating agreement, you may encounter various questions. Here are some frequently asked questions:

Additional considerations for a single-member in Colorado

Beyond creating an operating agreement, there are several practical steps to maintain the integrity of your single-member LLC in Colorado. It’s vital to open a business bank account in the LLC's name to separate personal and business finances effectively.

Additionally, obtaining an Employer Identification Number (EIN) for your business simplifies tax reporting, and ensuring compliance with state requirements is crucial for legal operation.

Furthermore, conducting regular reviews and updates of your operating agreement will help adjust to evolving business needs and legal requirements.

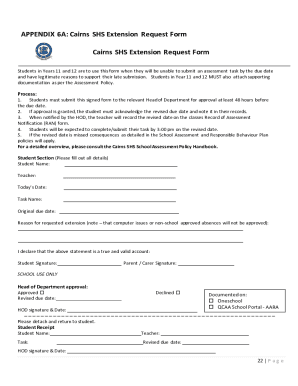

Interactive tools for editing and managing your operating agreement on pdfFiller

pdfFiller offers a robust platform for managing your operating agreement. With its document editing capabilities, you can easily customize your agreements per your requirements. The e-signature functionality ensures secure signing without the hassle of printing and scanning.

Moreover, collaborative tools enable you to share documents with advisors or legal counsel seamlessly, facilitating a productive review process and ensuring all aspects of the agreement are thoroughly vetted.

Protecting your business with a comprehensive operating agreement

A comprehensive operating agreement not only reinforces your business legitimacy but also enables you to customize operations to fit your unique business model. By setting clear rules and establishing conflict resolution mechanisms, you ensure smoother operations and reduce potential disputes.

In onboarding, consider specifying unique business operations and clearly defining the roles and expected contributions of the single member to mitigate misunderstandings. Investing the time to craft a solid operating agreement translates to long-term benefits for your company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit colorado llc operating agreement from Google Drive?

How can I send colorado llc operating agreement to be eSigned by others?

Can I edit colorado llc operating agreement on an iOS device?

What is Colorado single-member LLC operating?

Who is required to file Colorado single-member LLC operating?

How to fill out Colorado single-member LLC operating?

What is the purpose of Colorado single-member LLC operating?

What information must be reported on Colorado single-member LLC operating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.