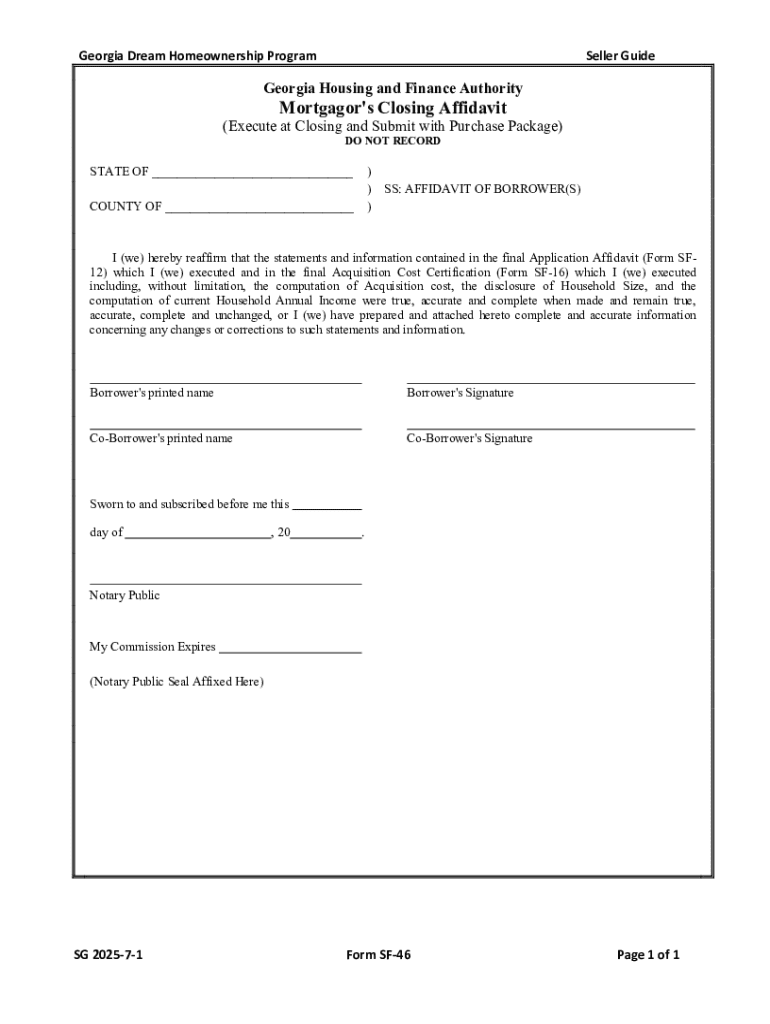

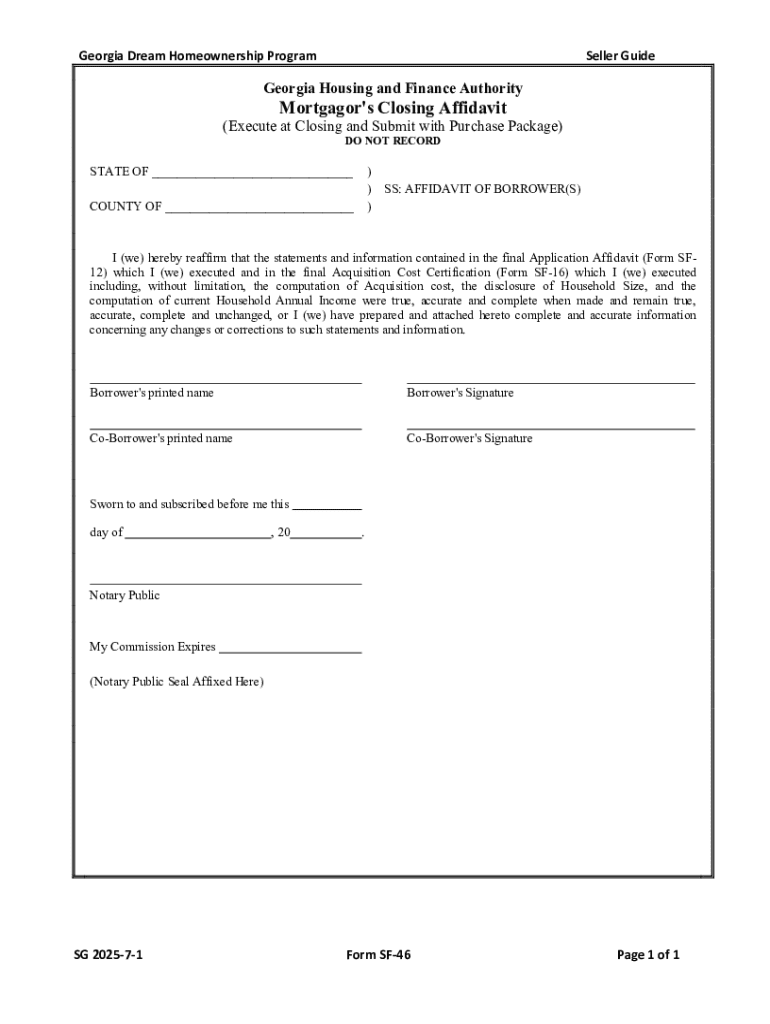

Get the free Georgia Dream Homeownership Program Seller Guide

Get, Create, Make and Sign georgia dream homeownership program

Editing georgia dream homeownership program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out georgia dream homeownership program

How to fill out georgia dream homeownership program

Who needs georgia dream homeownership program?

Georgia Dream Homeownership Program Form: Your Complete Guide

Overview of the Georgia Dream Homeownership Program

The Georgia Dream Homeownership Program is a state initiative designed to provide affordable homeownership opportunities for residents of Georgia. With the primary goal of making homeownership accessible, the program offers financial assistance in the form of down payment and closing cost assistance to eligible first-time homebuyers. This initiative not only aids in purchasing homes but also promotes long-term financial stability among participants.

The target audience for this program primarily includes first-time homebuyers in Georgia, particularly those who seek to achieve financial stability through homeownership. By addressing the common hurdles faced by potential homeowners, such as high down payments and qualifying loans, the Georgia Dream Homeownership Program stands as a supportive pillar in the community.

Applying for the Georgia Dream Homeownership Program

Navigating the application process for the Georgia Dream Homeownership Program is straightforward when you understand the necessary steps. First, you must evaluate your eligibility based on income, credit score, and residency requirements. Once you’ve verified your qualifications, you can proceed with the application.

To find the application form, visit the Georgia Department of Community Affairs website. The interactive guide helps users navigate the application portal efficiently, ensuring that no critical steps are missed. Keeping your documents ready in advance can significantly streamline the submission process.

Eligibility requirements

Understanding eligibility is crucial for potential applicants. Generally, the program is designed for first-time homebuyers, with specific eligibility criteria that include income and credit score parameters. Typically, applicants must demonstrate a stable income and maintain a credit score that meets minimum requirements as set by the program.

Moreover, special considerations exist for first-time homebuyers, veterans, and single parents. The program often prioritizes these demographics, offering additional support to ensure they can achieve their homeownership goals.

Documentation needed

To ensure a successful application for the Georgia Dream Homeownership Program, applicants need to prepare specific documentation. Essential documents include proof of income, such as pay stubs and W-2 forms, alongside valid identification like a driver’s license and social security card.

Optional supporting documents can also bolster your application. Bank statements, tax returns, and letters explaining any credit issues may provide additional context to lenders and enhance the chances of approval.

Qualification process

Before applying, understanding the qualification process can help determine your readiness for homeownership. This begins with evaluating your financial health, assessing income stability, and ensuring you meet credit requirements. Many potential buyers use pre-qualification tools available online to gauge their financial standing.

It’s essential to differentiate between pre-qualification and pre-approval. Pre-qualification provides a basic estimate of how much you can afford, while pre-approval involves a more in-depth analysis by a lender, resulting in a letter that can enhance your credibility in the home-buying process.

Steps after submission

After you submit your application for the Georgia Dream Homeownership Program, it’s crucial to understand what happens next. Applicants generally receive confirmation of receipt shortly after submission, followed by a processing timeline that varies depending on the volume of applications.

Common delays stem from incomplete information or documentation. To avoid holdups, carefully review all requirements and prepare your documents thoroughly before submission.

Program features and benefits

The Georgia Dream Homeownership Program offers several features that significantly benefit eligible participants. One of the most impactful elements is the down payment assistance, which varies based on the type of loan product selected. This assistance can substantially reduce the upfront costs associated with purchasing a home.

In addition to financial assistance, participants are usually required to complete homebuyer education courses. These courses aim to equip potential homeowners with the knowledge necessary to manage their financial responsibilities and understand the home-buying process. Resources for these educational courses can be found through the Georgia Department of Community Affairs' network.

Frequently asked questions (FAQ)

Navigating the Georgia Dream Homeownership Program can generate numerous questions. Common inquiries often revolve around the application process, eligibility criteria, and specific loan repayment conditions.

Addressing these questions is critical, as it provides clarity and encourages prospective applicants to engage in the program fully. Additionally, troubleshooting any application issues promptly can enhance the experience and outcome.

Interactive tools and resources

To assist applicants, various interactive tools and resources are available. Online calculators can help estimate home affordability, ensuring potential buyers understand what they can realistically afford.

These tools streamline the application process, enhancing user experience and empowering potential homebuyers by providing immediate feedback and support.

Contact information

For personalized assistance, reaching out to the Georgia Department of Community Affairs is invaluable. They can provide updated information on the program, offer help with the application process, and clarify any lingering questions.

Additionally, pdfFiller offers support for filling out and managing the Georgia Dream Homeownership Program form, enhancing the applicant's experience with document management.

Related services and links

Exploring related services can further assist individuals seeking homeownership in Georgia. Accessing local housing authorities or community resources can provide additional support tailored to specific needs and situations.

Staying informed and having a thorough understanding of available resources is essential in the journey to homeownership.

Popular searches related to homeownership in Georgia

Individuals interested in the Georgia Dream Homeownership Program often search for related programs and services tailored towards homeownership. These may include inquiries about state grants, affordable housing developments, or specialized assistance for low-income families.

By utilizing these popular searches, prospective homeowners can uncover additional pathways to achieving their dream of owning a home in Georgia.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send georgia dream homeownership program for eSignature?

How do I make changes in georgia dream homeownership program?

How do I edit georgia dream homeownership program in Chrome?

What is georgia dream homeownership program?

Who is required to file georgia dream homeownership program?

How to fill out georgia dream homeownership program?

What is the purpose of georgia dream homeownership program?

What information must be reported on georgia dream homeownership program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.