Get the free Salary Reduction Agreement

Get, Create, Make and Sign salary reduction agreement

Editing salary reduction agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out salary reduction agreement

How to fill out salary reduction agreement

Who needs salary reduction agreement?

Understanding Salary Reduction Agreement Forms: A Comprehensive Guide

Understanding salary reduction agreements

A salary reduction agreement is a formal document that outlines the terms under which an employee agrees to have their salary reduced for a specified period. These agreements serve multiple purposes, from helping companies navigate financial difficulties to providing individuals with flexibility in their work arrangements. By explicitly detailing the terms of the salary reduction, both employers and employees can ensure clarity, legality, and mutual understanding.

These agreements are particularly relevant in scenarios where businesses face unexpected downturns or when employees voluntarily request modifications to their hours or pay. The reduction can allow companies to retain staff and manage costs without resorting to layoffs. Moreover, the agreement may cover various types of compensation adjustments, including hourly rates, base salaries, or commission-based earnings.

Key legal considerations

Employers should consult relevant labor laws to ensure that any salary reduction agreement they implement complies with federal and state regulations. It's critical to understand the Fair Labor Standards Act (FLSA) and any specific state laws that might dictate terms related to salary adjustments. Failure to adhere to these regulations can lead to serious penalties and potential legal disputes.

Employees have rights and protections in relation to salary reductions. They must provide their informed consent to any changes in their compensation structure. Additionally, it is essential that the reduction is not discriminatory or retaliatory; any perceived unfair treatment can lead to grievances and litigation. By keeping an open line of communication and ensuring legal compliance, businesses can foster a more trusting workplace environment.

When to use a salary reduction agreement

Salary reduction agreements are commonly utilized in various scenarios. One prevalent situation is when a business grapples with financial constraints, such as during economic downturns or unexpected expenses. In these instances, reducing employee salaries can be a strategic approach to managing cash flow while preserving the workforce. Employers may opt for temporary salary cuts over layoffs to keep skilled employees who contribute significantly to the company's success.

Another scenario arises when employees themselves request a reduction in pay or hours. This could be for various personal reasons, including health concerns, childcare responsibilities, or pursuing further education. By accommodating these requests through a formal salary reduction agreement, employers can demonstrate flexibility and understanding, which fosters a positive work culture.

Impacts of salary reduction on employees

While salary reductions may be necessary, they can also have significant implications for employees. One of the primary concerns involves benefits. Many benefits, including retirement contributions and health insurance premiums, may be directly tied to salary levels. A reduction in pay could lead to decreased contributions to retirement accounts, affecting employees’ long-term financial health.

Furthermore, reduced salaries can impact employee morale and retention. While some employees may appreciate the opportunity to remain employed, especially during tough economic times, others may feel undervalued or overworked. Clear communication about the reasons behind salary reductions and the potential for future recovery is vital to maintaining team morale. Employers should encourage feedback and offer support to navigate any challenges arising from the agreement.

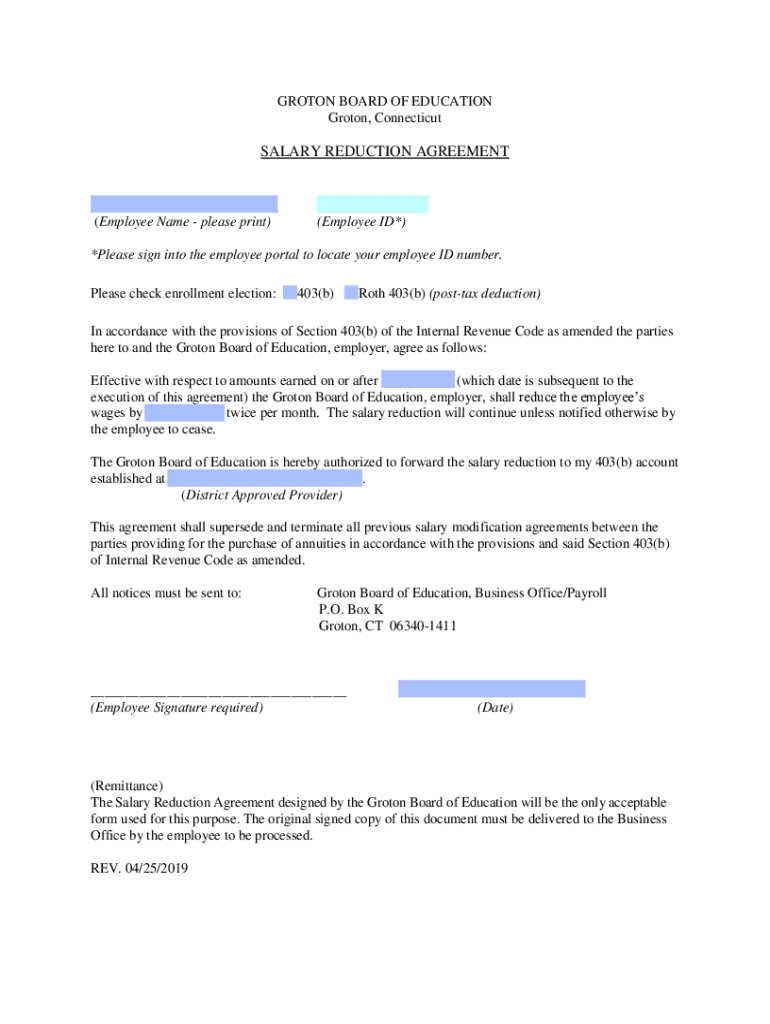

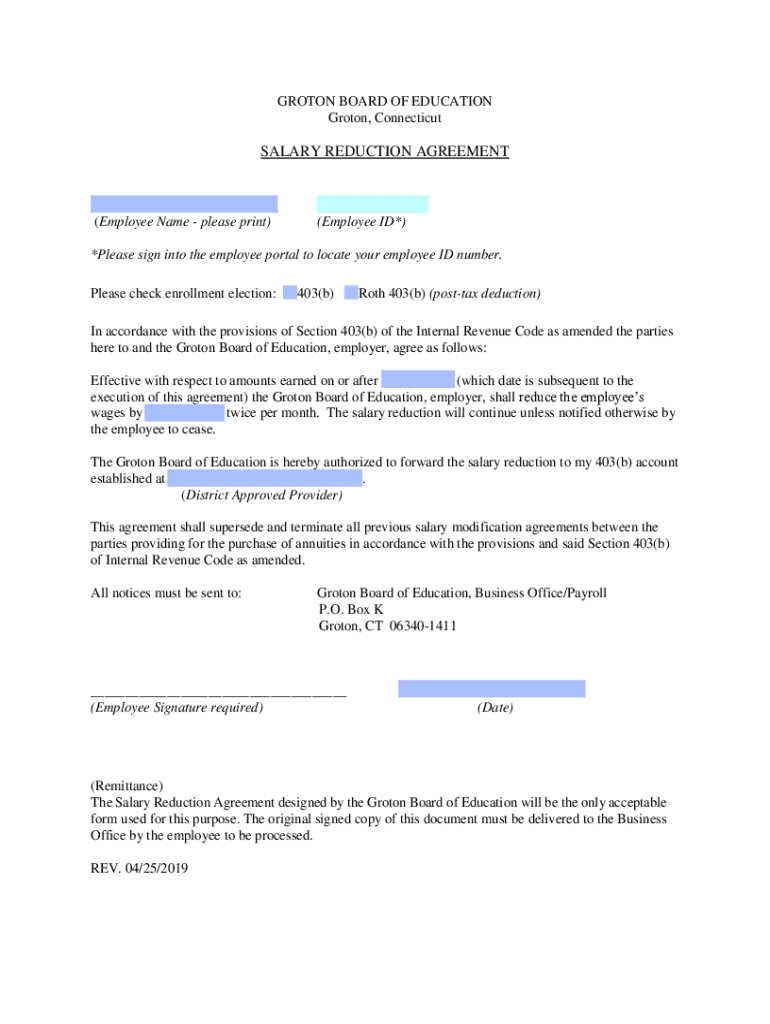

Essential components of a salary reduction agreement

Creating a thorough salary reduction agreement requires including key elements that clearly detail the terms of the arrangement. Essential components typically include the employee's name and identification details, the date of the agreement, the current salary level, and the proposed reduction terms. Clearly specifying the duration of the salary reduction is imperative, as it sets expectations for both parties.

In addition to the fundamental elements, optional clauses might enhance the agreement’s effectiveness. For instance, clauses addressing the conditions under which an employee's salary may revert to the original amount upon the recovery of the business or a specific timeline could provide additional clarity. Including confidentiality clauses can also protect sensitive employment information.

Optional clauses for consideration

While the essential components outline the basic framework of the agreement, optional clauses can enhance its robustness. Conditions for reversion to the original salary provide clarity about potential future changes, ensuring employees understand under which circumstances they might see a return to previous earnings. Confidentiality clauses may also help protect sensitive corporate data from being disclosed inappropriately, fostering a sense of security.

How to draft a salary reduction agreement

Drafting a salary reduction agreement requires a structured approach. Begin by gathering all necessary employee information, such as personal identification details, job title, and current salary. Next, clearly define the reduction amount and its duration, specifying any specific conditions for revisiting the terms. If uncertainties exist regarding legal implications, consult with legal counsel to ensure the agreement aligns with local regulations.

After gathering the essential information and consulting with legal advisors, utilize a document template to streamline the drafting process. pdfFiller offers customizable templates for various agreements, allowing you to create professional documents without starting from scratch. This ensures that you represent your business professionally while simplifying the document creation.

Utilizing pdfFiller for document creation

pdfFiller provides an efficient platform for creating and managing salary reduction agreements, offering a variety of document templates tailored for different needs. Users can quickly input necessary information and customize agreements to align with their specific circumstances. The easy-to-navigate interface simplifies the process of document editing, allowing users to create agreements that are both professional and compliant.

Moreover, pdfFiller features tools for collaboration, so teams can review proposals and suggest changes in real time. This collaborative approach reduces the chance of miscommunication and further streamlines the drafting process.

Completing and signing the salary reduction agreement

Before finalizing the salary reduction agreement, it is crucial to review the document with employees thoroughly. Engaging in a dialogue about the terms and addressing any questions they may have demonstrates consideration and reinforces transparency. Being clear about the reasons for the reduction and its anticipated duration can help alleviate concerns and foster a sense of security among your team.

Once both parties are satisfied with the terms, proceed with signing the agreement. pdfFiller provides a convenient platform for eSigning, allowing users to sign documents securely online. This eliminates the need for physical paperwork and enables quick turnaround times for finalizing the agreement.

eSigning with pdfFiller

The benefits of electronic signatures extend beyond convenience; they enhance security and ensure that documents are easily accessible. By utilizing pdfFiller's eSigning capabilities, businesses can ensure that signed documents are stored securely in the cloud, reducing paperwork clutter and improving organization. Employees can sign from anywhere, making it an ideal solution in an increasingly remote working environment.

Additionally, the platform allows for tracking who has signed and when, providing a clear audit trail that can be invaluable during disputes or for compliance purposes.

Managing salary reduction agreements

Effective record keeping is a key component of managing salary reduction agreements. All signed documents should be stored securely, easily retrievable for future reference. A robust document management system helps businesses track changes, monitor compliance, and facilitate communication regarding contractual obligations. Establishing standardized practices for how agreements are stored and accessed promotes efficiency and clarity within the organization.

As circumstances evolve, salary reduction terms may need to be revisited. It is advisable to periodically assess agreements to determine if modifications are needed. This could involve extending the terms, reverting to original salary levels, or adjusting conditions based on company performance or employee feedback. Having clear procedures for updating agreements ensures that both parties remain informed and aligned.

Updating agreements as needed

Understanding when and how to revisit salary reduction agreements is crucial for both employers and employees. Determining when to modify existing arrangements should consider various factors, such as business recovery, employee performance, and feedback regarding the reduction's impact on morale and productivity. Setting regular reviews, for instance semi-annually, can help proactively identify areas of concern and opportunities for improvement.

Engaging employees in discussions about their experiences can provide insights into how the arrangement impacts their work and overall job satisfaction. This collaborative approach not only empowers employees but also strengthens the employer-employee bond, fostering a more resilient workplace.

FAQs about salary reduction agreements

Navigating salary reduction agreements can raise many questions for both employees and employers. One common concern is what to do if an employee does not agree to the reduction. In this scenario, it may be beneficial to have an open dialogue with the employee, discussing the reasons for the reduction and any potential alternatives. Transparency can lead to productive discussions that address their concerns while still meeting the business's needs.

Other inquiries include what happens if the business recovers before the agreement ends. In such cases, an employer can reassess the situation and possibly revert to original pay levels if both parties agree. Additionally, many employers contemplate whether salary reductions are temporary or permanent. This decision often depends on the company's financial health and restructuring plans.

Case studies: Successful implementation of salary reduction agreements

Many companies have successfully utilized salary reduction agreements during financial crises, showcasing the importance of strategic decision-making. For example, during the 2008 financial crisis, certain organizations opted for salary reductions as a method to keep employees onboard while avoiding layoffs. These decisions not only allowed them to maintain adequate staffing levels but also preserved employee morale, leading to enhanced loyalty and commitment to the company.

In another case, a small tech startup faced significant revenue loss due to market fluctuations. Management approached employees with a proposal for temporary salary reductions in exchange for an equity stake in the company. This arrangement not only kept the team intact but also created a sense of ownership among employees, encouraging them to work diligently towards recovery. Such creative solutions highlight the potential benefits of salary reductions when handled transparently and positively.

Conclusion: Crafting effective salary reduction agreements

Navigating salary reduction agreements requires careful consideration of both employee needs and organizational objectives. By understanding the fundamental components, legal considerations, and the potential impacts on employee morale, employers can create effective agreements that benefit both parties. Utilizing a tool like pdfFiller simplifies the process, enabling efficient documentation creation, editing, and signing.

As businesses continue to adapt to changing economic landscapes, leveraging salary reduction agreements strategically can be an essential component of workforce management. By fostering open communication and maintaining a supportive approach, companies can navigate these complex situations while preserving strong relationships with their employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit salary reduction agreement from Google Drive?

How do I edit salary reduction agreement online?

How do I edit salary reduction agreement straight from my smartphone?

What is salary reduction agreement?

Who is required to file salary reduction agreement?

How to fill out salary reduction agreement?

What is the purpose of salary reduction agreement?

What information must be reported on salary reduction agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.