Get the free Form I-829

Get, Create, Make and Sign form i-829

How to edit form i-829 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form i-829

How to fill out form i-829

Who needs form i-829?

Form -829: How to Guide for Individuals and Teams

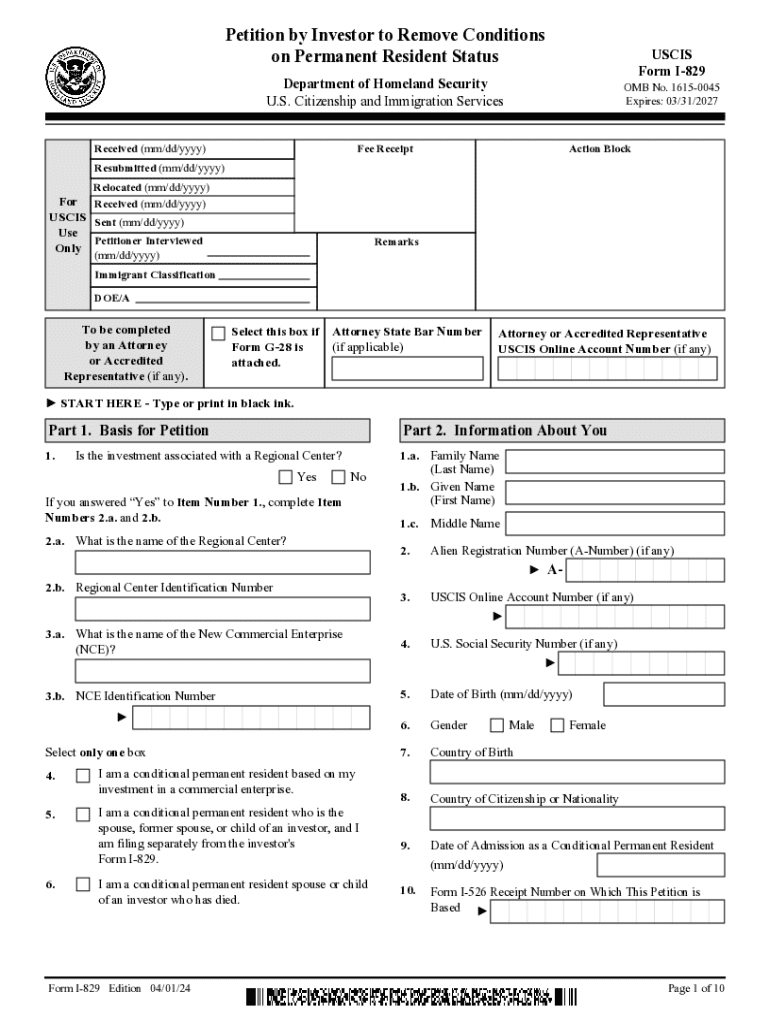

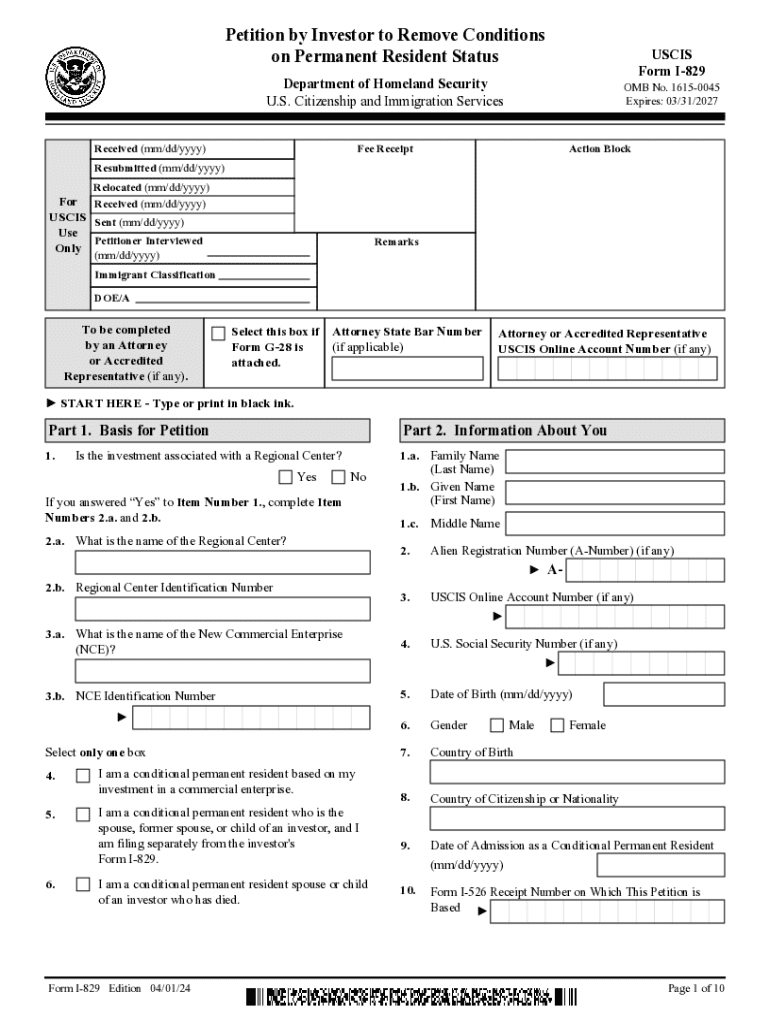

Understanding the form -829

Form I-829 is an integral part of the EB-5 immigration process, specifically designed for individuals seeking to remove the conditions on their permanent residency in the United States. This petition is essential for EB-5 investors who wish to transition from conditional to lawful permanent resident status.

The primary purpose of Form I-829 is to demonstrate that the investor has fulfilled the requirements of their investment, particularly in creating jobs and sustaining the necessary investment amount. Conditional residency is granted for a period of two years, after which this form must be filed to secure permanent residency.

Key terms associated with Form I-829 include: - **EB-5 program**: A program that allows qualified foreign investors to obtain a U.S. green card by investing in a U.S. business. - **Conditional resident**: A status granted for a limited period dependent on the investor meeting certain criteria. - **Petitioner**: The individual filing the I-829 form.

Who needs to file form -829?

Only individuals who hold conditional residency through the EB-5 program are required to file Form I-829. Eligibility generally extends to any principal investor who has made the necessary investment and is seeking the removal of conditions on their residency.

Categories of individuals who need to file include: - **Principal investors**: Individuals who directly invested in the EB-5 project. - **Spouses**: Individuals whose spouses gained conditional residency based on the investor's petition. - **Children**: Dependents under 21 years of age at the time of filing.

It’s crucial for petitioners to include eligible family members in the filing as it could impact their residency status. Failure to do so may delay processing or result in the denial of their applications.

Important considerations before filing

Before submitting Form I-829, it’s vital to thoroughly review your EB-5 investment to ensure that all requirements are met. This involves verifying that the investment has generated the necessary employment opportunities as stipulated by the EB-5 program.

Understanding your conditional permanent residency status is also essential. You must file the I-829 form prior to the expiration of your conditional status; otherwise, you risk losing your residency.

The optimal timing for submitting Form I-829 typically falls within the 90 days leading up to the second anniversary of your conditional residency grant. Early filing is encouraged to avoid potential complications or delays.

Step-by-step guide on filing form -829

Step 1: Gather necessary documentation

Compiling the right documentation is crucial for a successful I-829 petition. Key requirements include:

Step 2: Complete form -829

Filling out Form I-829 requires careful attention to every section:

Step 3: Pay the filing fee

As of the latest updates, the filing fee for Form I-829 is $3,835. Payment can be made by credit card, check, or money order.

Step 4: Submit your petition

Submissions can be sent by mail to the appropriate USCIS lockbox locations based on your state, or through authorized online platforms.

Step 5: Attend the biometrics appointment

Once submitted, you will receive a notice for a biometrics appointment. Be prepared to provide fingerprints and photographs. Bring your appointment notice and applicable ID.

Step 6: Responding to requests for evidence (RFE)

In instances where additional information is required, USCIS may issue an RFE. Respond promptly with the requested evidence to avoid delays.

Step 7: Awaiting USCIS’s decision

After submission, you can expect notification regarding your case status within six to twelve months. Stay informed by checking your status online.

Common challenges in filing -829

Filing Form I-829 does not come without its hurdles. Common challenges include issues with documentation, misunderstanding the requirements set forth by USCIS, and potential case denials.

Key issues to watch out for include: - **Insufficient job creation**: Misreporting jobs created can lead to complications. - **Documentation errors**: Inconsistencies or missing documents may delay processing. - **Denials and appeals**: If a case is denied, understanding the reasons and options for appeal is crucial for the applicant.

Utilizing pdfFiller for form -829

pdfFiller offers a streamlined solution for creating and managing Form I-829. With its user-friendly interface, individuals can efficiently edit PDF documents, ensuring accurate completion of the form.

The editing and collaboration features allow team members to work together seamlessly on the petition, making necessary adjustments and ensuring all documentation adheres to USCIS requirements.

Moreover, pdfFiller's eSignature capabilities facilitate compliance and convenience, allowing for quick approvals necessary in the filing process.

Tools and resources for -829 filers

A variety of tools are established to assist in the I-829 filing process. Key resources include: - **National TEA Map**: A critical resource for understanding targeted employment areas crucial for investors looking for strategic investment opportunities. - **EB-5 Job Creation Calculator**: This tool helps investors assess and validate the job creation impact of their investment, reassuring they meet the EB-5 criteria. - **Official EB-5 Guidebook**: Access comprehensive details about the EB-5 program, including updated legislation and procedural guidelines.

Recent developments and trends in the EB-5 program

The EB-5 program is dynamic, with continuous updates impacting the filing of Form I-829. Recent legislative changes aim to revise the investment thresholds and streamline the application process.

For instance, proposed adjustments may influence the eligibility criteria for targeted employment areas (TEAs), potentially reshaping investment strategies for many. Staying updated on such changes is crucial for all potential investors and file submitters.

FAQs about the -829 filing process

Navigating the I-829 filing process can lead to several common questions, such as: - **How long does the I-829 process take?** Generally, response times can vary, but expect notifications within six to twelve months after filing. - **What if my I-829 is denied?** Applicants have the right to appeal the decision, but must address the specific reasons for the denial to succeed in reapplication.

Real-world scenarios can vary significantly based on individual circumstances, emphasizing the importance of compliance with USCIS guidelines.

Connecting with professionals

For a smooth and successful I-829 filing experience, it’s advisable to consult experienced professionals. Seeking out an EB-5 immigration attorney can provide tailored legal guidance through the complexities of immigration law.

Additionally, engaging with EB-5 regional centers opens up opportunities for collective investment ventures, which can lighten the documentation burden on individual investors. Networking with other investors and developers can also offer insights into the process and cultivate collaborative opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form i-829?

How can I edit form i-829 on a smartphone?

Can I edit form i-829 on an Android device?

What is form i-829?

Who is required to file form i-829?

How to fill out form i-829?

What is the purpose of form i-829?

What information must be reported on form i-829?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.