Get the free Coverdell Education Savings Account Ira Application

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Navigating the Coverdell Education Savings Account Form: A Comprehensive Guide

Understanding the Coverdell Education Savings Account (ESA)

A Coverdell Education Savings Account (ESA) is a tax-advantaged savings account designed specifically for education expenses. This financial tool allows families to set aside funds for future educational costs, offering a way to alleviate the burden of tuition and other related expenses. Coverdell ESAs are not only versatile but also allow contributions to grow tax-free, making them an attractive option for anyone planning for education.

The key benefits of using a Coverdell ESA include tax-free growth and tax-free withdrawals for qualified education expenses. This can significantly reduce the overall cost of education when compared to traditional savings methods, where interest earned may be taxable. Additionally, funds can be used for elementary, secondary, and post-secondary education, providing extensive flexibility.

Eligibility requirements

To open a Coverdell ESA, certain eligibility criteria must be met. The beneficiary must be under the age of 18 at the time the account is established, ensuring that the funds are available for primary or secondary education. Additionally, contributors face income limitations; individuals with modified adjusted gross incomes above $110,000 and married couples filing jointly with income over $220,000 are ineligible to contribute.

Contribution limits and guidelines

Coverdell ESAs have specific contribution limits. The maximum contribution is capped at $2,000 per beneficiary per year. This contribution must be made before the tax filing deadline of the year in which the contributions are intended for. It is crucial to note that any contributions exceeding this limit may incur penalties, which can affect your overall investment strategy.

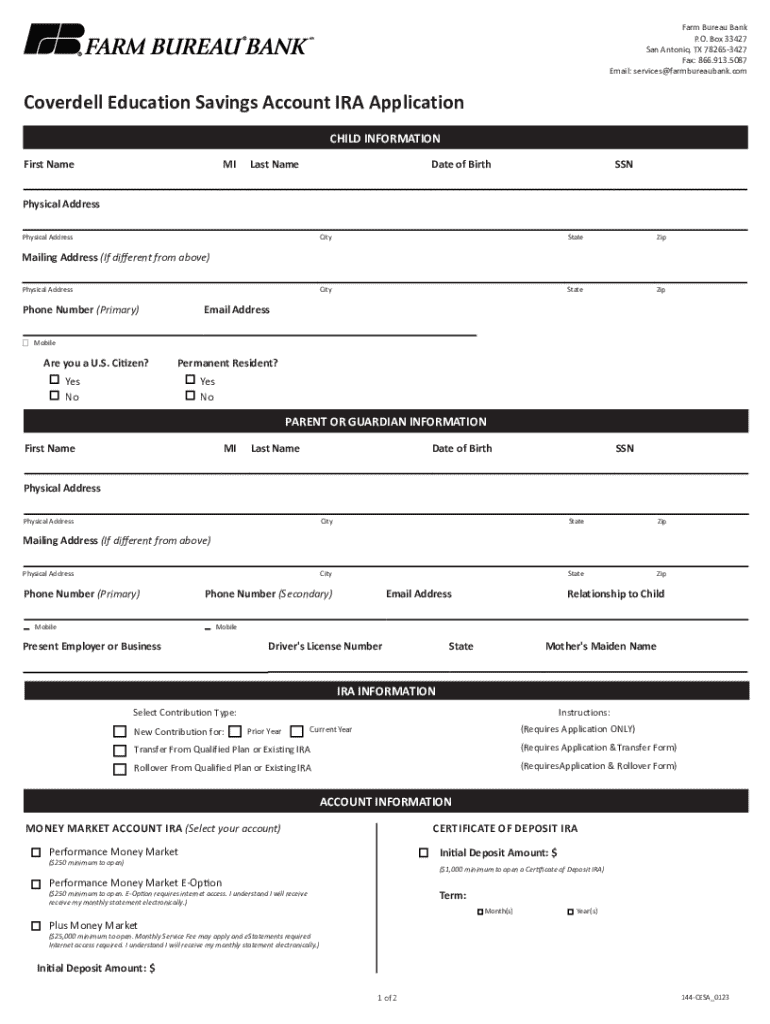

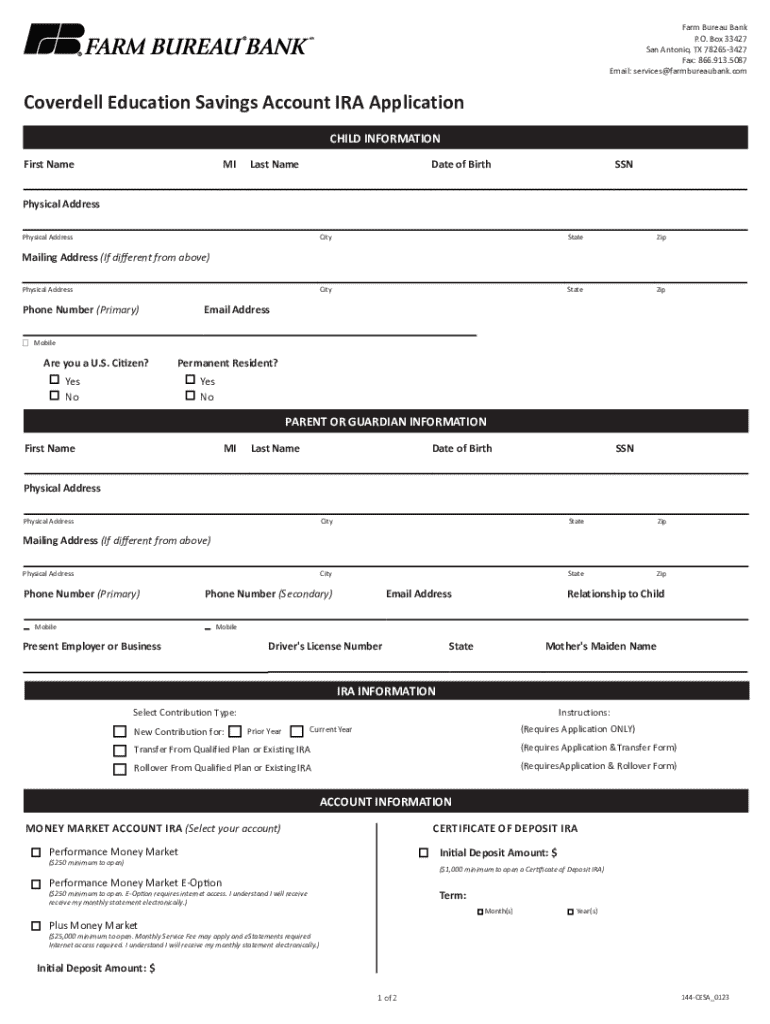

Overview of the Coverdell ESA form

The Coverdell ESA form is an essential document in the account setup and management process. It serves as the official way for individuals to establish an account, allowing them to document contributions, change beneficiaries, or withdraw funds when necessary. Understanding the form's purpose is vital for successful management of the account.

Common scenarios that require this form include opening a new ESA account, changing account details, and making distributions for educational expenses. Proper completion of the form ensures compliance and helps maintain the tax-advantaged status of the account.

Where to find the form

Accessing the Coverdell ESA form is convenient through pdfFiller. The platform provides various options for users to find and download the necessary documents. Simply navigating to the pdfFiller website, you can access the form in a user-friendly format, either by viewing it online or downloading and printing it for offline use.

Step-by-step instructions for filling out the Coverdell ESA form

Filling out the Coverdell ESA form successfully requires careful attention to detail. Start by gathering all necessary information, such as personal identification details, Social Security numbers, and any prior account information if applicable. Collecting these documents before beginning ensures a smooth process.

Here's a breakdown of the sections on the form:

To avoid common mistakes, double-check that all information is accurate, and ensure the form is signed before submission. Reviewing the details can prevent delays and potential compliance issues.

How to edit the form using pdfFiller

Using pdfFiller, you can easily edit pre-filled information on the Coverdell ESA form. Access editing features through the intuitive interface to make changes directly. This can be particularly useful if you discover errors or need to update beneficiary information swiftly.

Signing and submitting the Coverdell ESA form

Once the form is filled out, it is essential to understand the signature requirements. Depending on your preference, you can use either an electronic signature or a physical one. Electronic signatures offer convenience and speed, while physical signatures may be required for certain institutions.

Utilizing electronic signature tools on pdfFiller simplifies the signing process. The platform enables you to add your signature electronically by following these steps:

After signing, submission options vary. You can typically submit your completed form either online or through mailing it to the designated financial institution. Be sure to track your submission status to confirm receipt and processing.

Managing your Coverdell ESA after form submission

After your Coverdell ESA form has been submitted and the account is active, keeping track of contributions and growth becomes crucial. Monitoring the investment performance allows you to make informed decisions about future contributions and withdrawals.

Understanding distribution rules is equally important. Qualified expenses can include tuition, fees, and other necessary educational costs. Taking distributions before the beneficiary turns 18 may lead to tax implications, so it's essential to be cautious and ensure withdrawals align with IRS guidelines.

Making changes to your ESA

Life circumstances often necessitate updates to your Coverdell ESA. This may include changing beneficiary information or altering contribution plans. These changes can be executed by filling out the appropriate forms available from your financial institution or online through platforms like pdfFiller.

Common FAQs about the Coverdell ESA form

As with any financial form, queries often arise regarding common concerns. Here are some frequently asked questions about the Coverdell ESA form:

Interactive tools and resources on pdfFiller

pdfFiller enhances your experience managing the Coverdell ESA form through various interactive tools. Utilizing document templates can streamline the process of creating new forms or managing existing ones. These templates are tailored to ensure you don't miss any key details.

Collaboration is made easy on pdfFiller. Sharing the ESA form with financial advisors or family members allows for effective teamwork in managing educational funds. You can simply invite others to view or edit the document securely.

Accessing customer support features through pdfFiller ensures that any issues you encounter can be addressed promptly, providing added peace of mind as you manage your educational savings.

Final tips for optimizing your Coverdell ESA experience

To maximize the benefits of your Coverdell ESA, follow best practices for effective management. Regularly review contributions and investment performance to make informed decisions. Adjustments based on your financial goals and educational plans are essential to maintaining alignment with your long-term objectives.

Staying informed on regulatory changes concerning ESAs is also crucial. Resources are available through the Department of Education and financial institutions to help you navigate changes in tax laws, contribution limits, and distribution rules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my coverdell education savings account in Gmail?

How can I send coverdell education savings account for eSignature?

How do I edit coverdell education savings account on an iOS device?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.