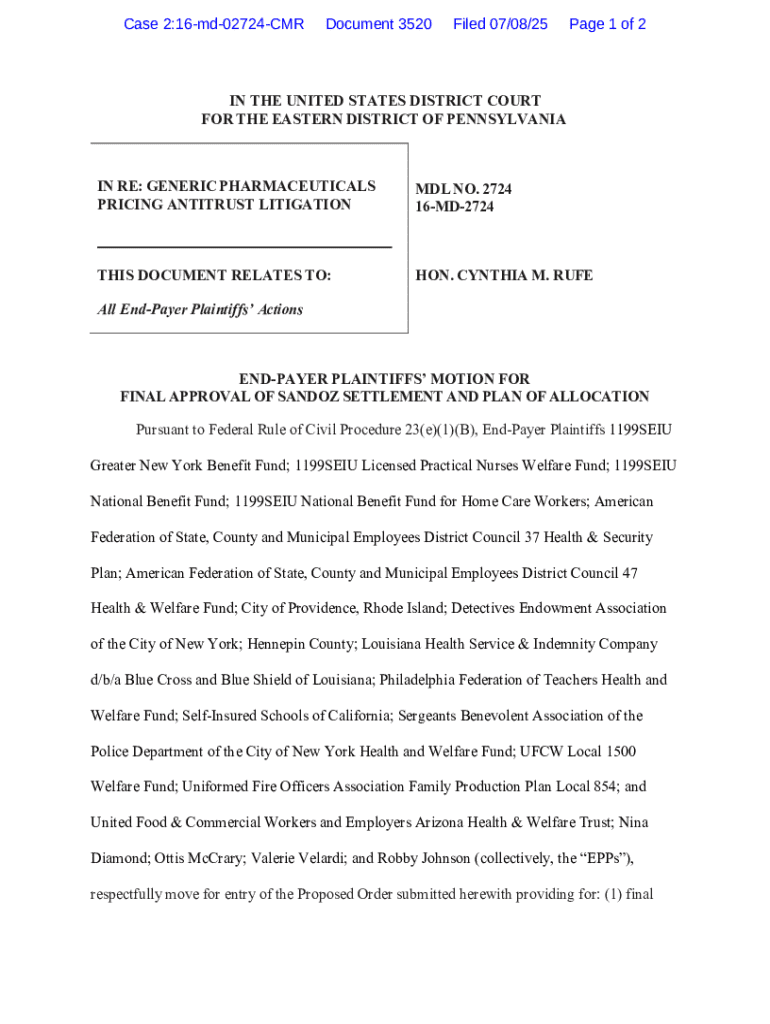

Get the free Document 3520

Get, Create, Make and Sign document 3520

How to edit document 3520 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out document 3520

How to fill out document 3520

Who needs document 3520?

Understanding IRS Form 3520: A Comprehensive Guide

Understanding IRS Form 3520

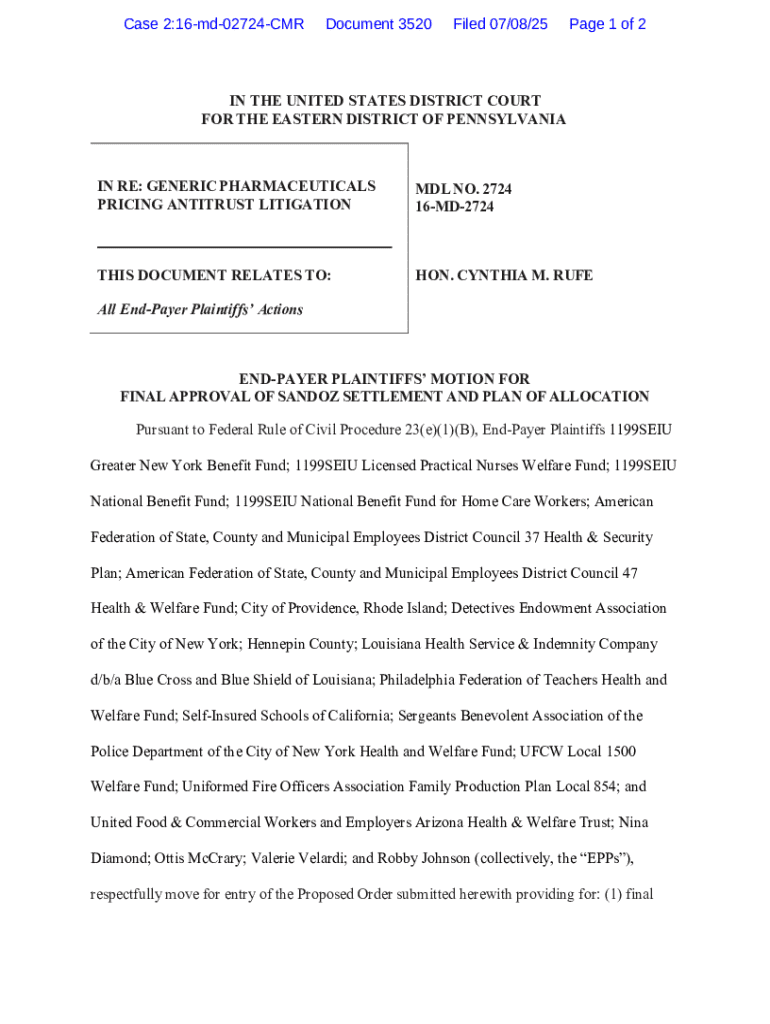

IRS Form 3520, also known as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, is crucial for taxpayers dealing with foreign trusts and gifts. This form serves several purposes including reporting transfers to foreign trusts, ownership of foreign trusts, and distributions from these trusts, as well as large gifts received from foreign entities. Complying with the IRS requirements related to this form is vital not only to adhere to residential tax obligations but also to avoid severe penalties.

Navigating the complexities of Form 3520 is essential, especially for individuals who have international dealings. Non-compliance can lead to significant financial repercussions, making it imperative to understand its requirements thoroughly.

Who must file Form 3520?

U.S. persons, including citizens and residents, must file Form 3520 when certain conditions are met. If you are a U.S. citizen or resident alien and you have transactions involving foreign trusts or you receive large gifts from foreign individuals, filing may be mandatory. This includes not only direct transfers but also inheritances, bequests, and gifts from foreign entities.

For expatriates, the responsibilities can become even more complicated due to varying tax implications and obligations under both U.S. and foreign tax laws. Individuals residing abroad must be particularly cautious about their filing requirements to maintain compliance.

When to file Form 3520

Deadlines for filing IRS Form 3520 are typically aligned with the tax return deadline, which is April 15 for most taxpayers. However, extensions to file your tax return can also lead to an extended deadline for Form 3520, but it is essential to file on time to avoid penalties.

Certain exceptions exist for special circumstances, such as the death of a foreign trust beneficiary or if the taxpayer permanently resides abroad, which may qualify the individual for additional time.

Key sections of Form 3520 explained

Form 3520 consists of several key sections outlining specific reporting requirements:

Essential information to include on Form 3520

To accurately complete Form 3520, ensuring that all required documentation is included is vital. This typically encompasses the names and addresses of involved foreign entities, detailed descriptions of transactions, and the amount of any gifts received. Common mistakes include omitting essential details or misreporting transfer amounts, which can trigger IRS scrutiny.

A good practice is to double-check all numbers and details against supporting documentation before submission. Understanding what the IRS expects can save time and prevent future issues.

Steps to complete IRS Form 3520

Completing Form 3520 can be streamlined by following systematic steps:

For example, when detailing transfers in Part I, make sure to include precise dates and amounts, along with the trust's identification information.

Consequences of non-compliance

Failing to file IRS Form 3520 can lead to steep penalties, with fines that can reach up to 35% of the value of the unreported transactions. Additionally, noncompliance can complicate future tax filings, leading to audits or additional scrutiny from the IRS.

It's crucial to recognize the importance of prompt and accurate filing as part of maintaining overall compliance with tax obligations.

Special scenarios and considerations for filing Form 3520

Certain scenarios may necessitate special considerations when filing Form 3520. For instance, when reporting foreign gifts or bequests, the details must reflect the exact nature of the relationship with the foreign donor. Expatriates should also be aware of unique rules that may apply, specifically regarding dual taxation.

Unique situations such as the death of a foreign trust beneficiary may impact filing requirements, necessitating careful evaluation of tax implications and obligations.

Filing Form 3520: Mailing instructions

Once Form 3520 is completed, it's vital to know where to send it. The form should be mailed to the appropriate address listed on the IRS website, depending on whether you are filing from inside or outside the U.S. Always consider sending your submission via certified mail to ensure it can be tracked.

Keeping a copy of the submitted form and the tracking information helps safeguard against future disputes with the IRS.

Frequently asked questions about IRS Form 3520

Individuals often have various questions regarding Form 3520:

Navigating related filings

Besides Form 3520, other related forms include Form 3520-A, which is specifically aimed at reporting the details of foreign trusts. Additionally, Form 114 (FBAR) may be required for reporting foreign bank accounts under specific thresholds.

Understanding how these forms interrelate is integral to ensuring comprehensive reporting and avoiding unexpected penalties.

Advanced insights: Understanding foreign trusts

A foreign trust is characterized as a trust that is not domestic in accordance with IRS definitions. Understanding what constitutes a foreign trust is essential for compliance with filing Form 3520.

Key differences include the tax implications affecting U.S. beneficiaries, which can differ greatly from domestic trusts. For instance, distributions from foreign trusts may be subject to complex tax rules, potentially leading to double taxation.

Leveraging pdfFiller to simplify Form 3520 management

Navigating the complexities of the document 3520 form is made significantly easier with pdfFiller. This platform allows users to create, edit, eSign, and collaborate on tax forms all from a single, user-friendly interface.

Interactive tools on pdfFiller enable seamless document creation, while features like teamwork functionalities foster collaboration among team members. These capabilities ensure that each step in managing your Form 3520 aligns with IRS requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find document 3520?

How do I execute document 3520 online?

How do I edit document 3520 on an Android device?

What is document 3520?

Who is required to file document 3520?

How to fill out document 3520?

What is the purpose of document 3520?

What information must be reported on document 3520?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.