Get the free Dr 729

Get, Create, Make and Sign dr 729

Editing dr 729 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 729

How to fill out dr 729

Who needs dr 729?

A Comprehensive Guide to the DR 729 Form

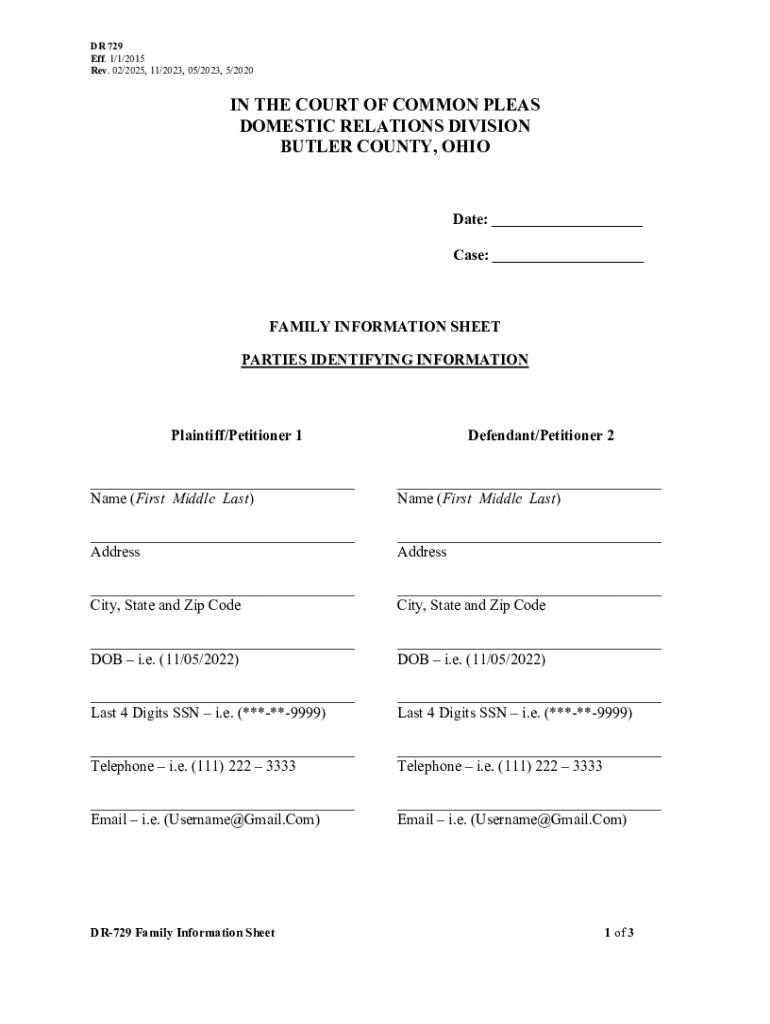

Overview of the DR 729 Form

The DR 729 Form serves as a critical document for various administrative processes, specifically within the realm of tax reporting and compliance. This form is primarily utilized for state-level tax submissions, ensuring that taxpayers comply with their obligations while facilitating the efficient processing of tax returns.

Individuals or businesses engage with the DR 729 Form when they need to report specific tax-related information either annually or quarterly, depending on their financial status and local regulations. Recognizing the correct instances for its usage is vital to staying compliant and avoiding any potential penalties that may arise from incorrect submissions.

Step-by-step instructions for completing the DR 729 Form

Completing the DR 729 Form accurately is essential to prevent delays in processing and ensure compliance with tax requirements. Here’s a systematic approach to filling it out.

Firstly, gather all necessary information that may be required to fill in the form. This includes identification details, such as your Social Security Number or Tax ID, and account information if applicable, such as your bank details for direct deposit of refunds.

Detailed breakdown of each field

Understanding each field on the form is crucial. Below is a breakdown of typical fields and their requirements.

Common mistakes that individuals make include incomplete information or misinterpretation of field requirements, which can lead to filing delays. Always double-check each section before submission.

Editing and customizing the DR 729 Form with pdfFiller

Using pdfFiller’s suite of editing tools can simplify the process of completing your DR 729 Form. This platform allows easy document adjustments while adhering to all compliance standards.

To begin, upload your DR 729 Form onto the pdfFiller platform. Once it’s uploaded, you can integrate required text, add annotations for clarity, and insert signatures where needed.

Moreover, pdfFiller's verification features help to ensure your document’s accuracy before submission, minimizing the risk of errors.

Signing the DR 729 Form

Signing your DR 729 Form is a straightforward procedure with pdfFiller. Utilize the platform's electronic signature tool to ensure your document is signed securely and efficiently.

In addition, the platform allows for sending signature requests to other parties. This is particularly useful for businesses where multiple approvers are required. Utilize best practices by ensuring that each signatory receives the document in a secure manner to maintain document integrity.

Submitting the DR 729 Form

Once your DR 729 Form is complete and signed, the next step is submission. It’s crucial to understand the specific guidelines related to where and how to file your form.

Typically, completed forms should be sent to the designated tax office or body indicated by your state’s tax department. Ensure you're aware of any applicable deadlines to avoid late fees or penalties.

Utilizing pdfFiller also presents options for eSubmission directly via its platform or provides guidance on printing and mailing if physical submission is necessary.

Managing and storing your DR 729 Form

Once your DR 729 Form is submitted, managing and storing your documents securely should be the next priority. pdfFiller offers robust organization tools that help maintain a tidy digital workspace.

Utilizing a structured folder system and tagging documents appropriately ensures that all essential forms can be retrieved effortlessly whenever required.

Frequently asked questions about the DR 729 Form

Questions surrounding the DR 729 Form often arise, especially for first-time users. Here are some commonly asked questions and their answers.

Additional tools and resources available on pdfFiller

To complement your experience with the DR 729 Form, pdfFiller provides additional resources that can enhance your workflow.

Stay informed: updates and changes to the DR 729 Form

Tax forms can be subject to periodic updates that may affect how you complete or submit your DR 729 Form. Being proactive about these updates is essential.

Regularly checking official sources or subscribing to notifications from your state’s tax website can ensure you stay informed about any recent changes.

Contact support for assistance with the DR 729 Form

Should you encounter issues while filling out your DR 729 Form, pdfFiller's dedicated support is readily available. Multiple channels are provided for your convenience.

Whether seeking assistance via live chat, email, or telephone, customer support is designed to help guide you through any challenges you may face during the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in dr 729?

How do I edit dr 729 on an iOS device?

How do I complete dr 729 on an Android device?

What is dr 729?

Who is required to file dr 729?

How to fill out dr 729?

What is the purpose of dr 729?

What information must be reported on dr 729?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.