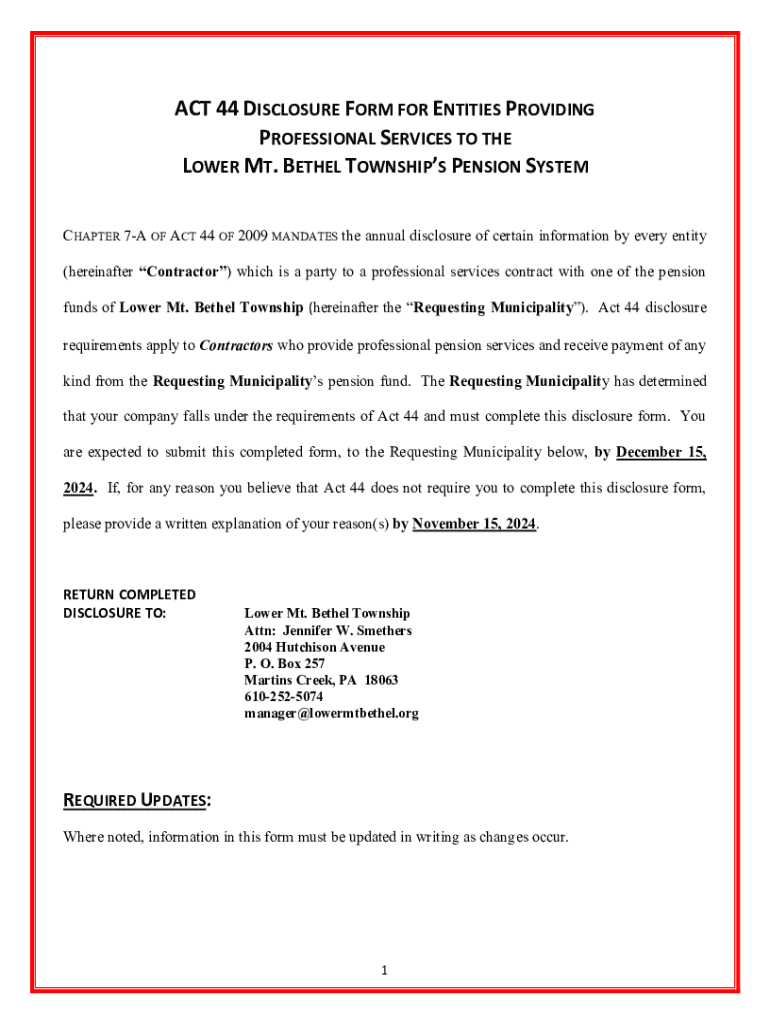

Get the free Act 44 Disclosure Form

Get, Create, Make and Sign act 44 disclosure form

Editing act 44 disclosure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out act 44 disclosure form

How to fill out act 44 disclosure form

Who needs act 44 disclosure form?

Understanding the Act 44 Disclosure Form: A Comprehensive Guide

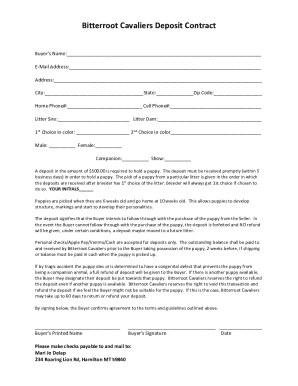

Understanding the Act 44 Disclosure Form

The Act 44 Disclosure Form plays a crucial role in ensuring transparency within various public entities in Pennsylvania. This form is mandated under Act 44, which focuses on the governance of financial disclosure requirements for specific officials and employees in public agencies. It serves as a mechanism to prevent conflicts of interest and ensure accountability among those who are entrusted with public resources.

The importance of the Act 44 Disclosure Form cannot be overstated. By requiring individuals to disclose their financial interests and employment history, it provides a formal process that aims to safeguard public trust. This form is essential in promoting ethical conduct and openness within organizations funded by taxpayer dollars.

In summary, the Act 44 Disclosure Form is not merely a formality; it is a vital tool in promoting integrity and ethical governance across Pennsylvania.

Who needs to use the Act 44 Disclosure Form?

The Act 44 Disclosure Form is primarily intended for a specific audience composed of individuals and organizations involved in public service in Pennsylvania. Typically, elected officials, appointed officials, employees of public agencies, and board members of certain public organizations are required to use this form.

Moreover, these requirements often extend to team leaders and supervisors within public organizations. It’s crucial for organizations that receive state funds to be aware of their obligations under this act. Situations that require disclosure include the acceptance of gifts, financial interests in businesses that conduct business with a public entity, and any employment history that could present a conflict of interest.

Ultimately, understanding who must use the Act 44 Disclosure Form is essential for anyone involved in public service to ensure compliance and maintain ethical standards.

Key components of the Act 44 Disclosure Form

The Act 44 Disclosure Form includes several critical sections designed to collect pertinent information about the filer's financial interests and history. Each section serves a purpose in evaluating potential conflicts and ensuring ethical compliance.

Typically, the form is divided into the following sections:

Each section of the Act 44 Disclosure Form is significant in promoting transparency. Personal information establishes the identity of the filer, while financial interests offer insight into possible discrepancies. Employment history is crucial in revealing any previous affiliations with organizations that might conflict with the public role.

Step-by-step guide to completing the form

Completing the Act 44 Disclosure Form can seem daunting at first, but with proper preparation and guidance, the process can be made straightforward. Begin by gathering necessary documents, such as financial statements and employment records, to ensure an accurate filing.

Here is a detailed approach to filling out the form:

While filling out the form, it's important to be thorough and truthful. Some common mistakes to avoid include omitting significant interests, inaccuracies in provided information, or failing to disclose prior employment that may impact your current position.

Editing the Act 44 Disclosure Form

Editing your Act 44 Disclosure Form can sometimes be necessary due to changes in your financial situation or employment. Fortunately, updating the form is a straightforward process, especially with tools like pdfFiller that enable easy editing.

Here are a few tips for making updates and revisions:

By leveraging appropriate tools, editing the Act 44 Disclosure Form becomes less labor-intensive, allowing users to keep their information current efficiently.

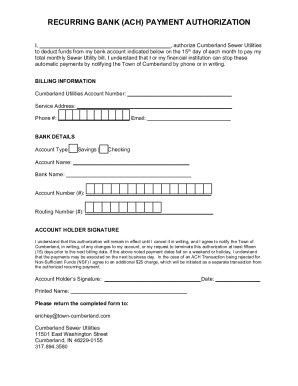

Signing the Act 44 Disclosure Form

E-signatures are becoming increasingly popular and accepted for signing documents, including the Act 44 Disclosure Form. This method streamlines the signing process, especially for those relying on a fast and efficient workflow.

There are several options available for e-signatures, including tools that offer secure signing processes. It's crucial to understand the legal validity of e-signatures and how they can expedite filing.

To e-sign the Act 44 Disclosure Form, follow these simple steps:

E-signing not only saves time but also enhances the efficiency of document management, allowing users to focus on more pressing duties.

Managing your completed Disclosure Form

Once you have completed and signed your Act 44 Disclosure Form, the next step is effective management of your document. Proper storage and access strategies are essential for ensuring that your form remains confidential and secure.

Here are some best practices for managing your completed disclosure form:

By following these practices, you can effectively manage your Act 44 Disclosure Form, ensuring compliance while also prioritizing confidentiality.

Frequently asked questions about the Act 44 Disclosure Form

Navigating the requirements associated with the Act 44 Disclosure Form can invite questions and concerns. Addressing these common inquiries can help users feel more confident in the process.

By addressing these specifics, individuals can better navigate the nuances of the Act 44 Disclosure Form and enhance their understanding of their obligations.

Case studies: Real-world applications of the Act 44 Disclosure Form

Understanding the practical implementation of the Act 44 Disclosure Form can be better grasped through real-world examples. Several organizations have effectively utilized this form to foster a culture of transparency and accountability.

For instance, a local school district in Pennsylvania adopted this form and saw a substantial increase in community trust and engagement as a direct result of their transparency efforts. By regularly disclosing their financial interests, they built a strong relationship with parents and community members.

These case studies exemplify how appropriate use of the Act 44 Disclosure Form can have positive consequences for public organizations and the communities they serve.

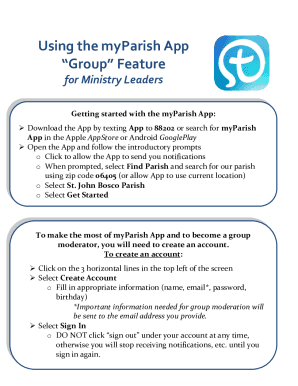

Conclusion: Simplifying your Act 44 disclosure process with pdfFiller

Utilizing pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. As you navigate the complexities of the Act 44 Disclosure Form, remember that you don’t have to do it alone.

pdfFiller streamlines the process by providing interactive tools designed to facilitate a seamless experience for users. From filling out the form to managing completed documents securely, pdfFiller has everything you need to efficiently handle the Act 44 Disclosure Form.

Take advantage of these functionalities to ensure that your document management processes remain organized, accessible, and compliant with the regulations set forth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify act 44 disclosure form without leaving Google Drive?

Where do I find act 44 disclosure form?

How do I edit act 44 disclosure form online?

What is act 44 disclosure form?

Who is required to file act 44 disclosure form?

How to fill out act 44 disclosure form?

What is the purpose of act 44 disclosure form?

What information must be reported on act 44 disclosure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.