Get the free Sbi New Rtgs Form 2025

Get, Create, Make and Sign sbi new rtgs form

How to edit sbi new rtgs form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sbi new rtgs form

How to fill out sbi new rtgs form

Who needs sbi new rtgs form?

Understanding and Completing the SBI New RTGS Form: A Comprehensive Guide

Understanding RTGS and its importance

Real-Time Gross Settlement (RTGS) is a vital payment system that enables the instant transfer of funds between banks. Unlike other methods such as NEFT, RTGS transactions are settled in real-time, meaning that the payment is processed immediately, without any waiting periods. This feature makes RTGS crucial for high-value transactions requiring immediate clearance.

Key features of RTGS include its ability to facilitate transactions without any limits on the amount, making it suitable for large fund transfers. Furthermore, RTGS operates on a secure platform, ensuring that all transactions are executed safely and efficiently, which is essential for both banks and customers.

The benefits of using RTGS for fund transfers extend beyond just speed; it also provides enhanced security, minimizes settlement risk, and improves liquidity for participating banks. As a result, businesses and individuals prefer RTGS for transactions that need to be completed swiftly and safely.

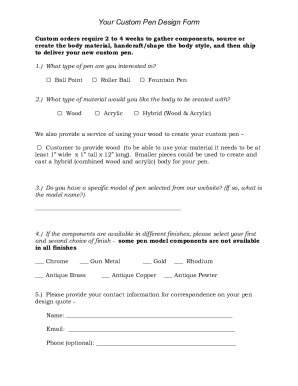

Overview of SBI's new RTGS form

SBI has recently launched a new RTGS form aimed at streamlining the fund transfer process for its users. This new form serves to simplify the submission procedure, reduce errors, and improve the overall customer experience when making large transactions.

Key updates in the new RTGS form include a more user-friendly layout and clearer instructions on filling out the essential fields. These changes are designed to ensure that users can complete the form accurately without confusion, ultimately enhancing the efficiency of the transaction process.

The importance of this new format lies in its potential to minimize mistakes in submissions, which can cause delays in fund transfers, and enhance user satisfaction through its intuitive design. By adopting this new RTGS form, SBI is making a significant step toward improving its banking services for customers.

Step-by-step guide to filling out the SBI new RTGS form

Required information

When filling out the SBI new RTGS form, users must provide specific required information. This includes personal details such as the sender's name, contact information, and account number. It is equally important to include comprehensive beneficiary account details, which consist of the beneficiary's name, account number, bank name, and IFSC code.

Additionally, users must state the amount to be transferred and the purpose of the transfer. This information is critical for both the sender and the receiving bank to ensure clarity and compliance with regulatory requirements.

Detailed instructions for each section

**Section 1: Personal details** - Users should include their full name as registered with the bank, along with their contact number and address, ensuring accuracy to avoid discrepancies during processing.

**Section 2: Beneficiary information** - Double-check the beneficiary's account details, including accurate spelling of the name, correct account number, and IFSC code to ensure funds reach the right destination.

**Section 3: Transfer details** - Clearly indicate the amount being transferred and specify the purpose of the transaction. Be mindful to match the signature with that on record to avoid rejection.

Common mistakes to avoid

Interactive tools available for SBI new RTGS form

To facilitate the completion of the SBI new RTGS form, pdfFiller offers an online form filling assistance. This platform allows users to fill out forms electronically, which can save time and reduce errors. Thanks to its user-friendly interface, individuals can navigate through the process easily without the hassle of dealing with paper forms.

pdfFiller enhances document management through numerous features, such as the ability to save your form progress and access it from anywhere. The platform also allows for smooth transitions between editing and signing, ensuring the entire process is efficient.

Additionally, eSigning tools integrated within pdfFiller streamline the completion process, allowing users to sign their documents quickly without needing to print and scan them. Such functionalities are particularly valuable for businesses or teams that need to manage multiple documents simultaneously.

Editing and managing your RTGS form with pdfFiller

pdfFiller makes uploading and editing existing PDF forms a breeze. Users can simply upload their completed or partially completed SBI new RTGS form to the pdfFiller platform and make the necessary edits right from their devices. This functionality is especially helpful for users who might need to revisit and update their forms before submission.

Once edits are complete, users can easily save and share their RTGS form with others, be it for collaboration or for obtaining approvals. Teams can use pdfFiller's collaboration features to provide feedback or make joint edits, ensuring that everything is complete and accurate before finalization.

eSigning the SBI RTGS form

Adding electronic signatures to the SBI new RTGS form is simple with pdfFiller. To do this, users can follow a straightforward process: upload the form, navigate to the eSignature feature, and insert their digital signature. This guarantees that the document is legally binding and recognized by banking institutions.

There are significant advantages to eSigning documents, especially in banking contexts where security and efficiency are paramount. The built-in security features of pdfFiller’s eSigning process protect sensitive information from unauthorized access and ensure the integrity of the document throughout the signing process.

Finalizing and submitting your RTGS form

Before submitting the SBI new RTGS form, a review checklist can help users ensure everything is in order. Check that all mandatory fields are filled out, verify the accuracy of the beneficiary information, and confirm that all signatures are in place. These steps are crucial for avoiding potential delays in transaction processing.

Best practices for ensuring successful transactions include keeping a track of the RTGS transfer status by maintaining a record of the transaction reference number. Monitoring the transaction until its completion can provide peace of mind and confirm that funds have been received by the beneficiary.

FAQs about the SBI RTGS form

What if I made an error in my submitted RTGS form? In such cases, you should contact your bank immediately to rectify the error, as they may assist in cancelling the transaction if it hasn’t already been processed.

How long does RTGS transfer take? Typically, RTGS transactions are settled instantly at the time of the transfer, provided there are no discrepancies or issues with the form submitted.

Can I cancel an RTGS transaction after submission? Once an RTGS transaction is submitted, it cannot be cancelled through normal processes, but reaching out to the bank is advisable for guidance.

Additional features of pdfFiller for enhanced document management

pdfFiller offers integrations with various cloud storage services, making it easier to access your forms whenever you need them. This feature is particularly beneficial for users who may wish to retrieve their completed SBI new RTGS form for reference or further edits.

Beyond basic form filling, pdfFiller provides advanced editing tools that allow users to modify text, images, and other elements, expanding capabilities far beyond what traditional paper forms can offer. Additionally, users can explore a wide array of other templates available on the platform to suit their document management needs.

Payment security and compliance with RTGS transactions

Security measures are paramount when it comes to RTGS transactions, and their significance cannot be overstated. The RBI has mandated various security protocols to safeguard customers against fraud. These include encrypted data transfer, strong authentication processes, and continuous monitoring of transactions to detect any suspicious activities.

Compliance checks are also rigorously implemented to ensure adherence to national and international regulations. This level of oversight instills confidence in the security and integrity of RTGS transactions. It is critical for users to recognize the importance of safeguarding personal information as they engage in fund transfers, emphasizing the need for secure passwords and digital practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sbi new rtgs form for eSignature?

Where do I find sbi new rtgs form?

Can I create an eSignature for the sbi new rtgs form in Gmail?

What is sbi new rtgs form?

Who is required to file sbi new rtgs form?

How to fill out sbi new rtgs form?

What is the purpose of sbi new rtgs form?

What information must be reported on sbi new rtgs form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.