Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

Editing beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form: A how-to guide

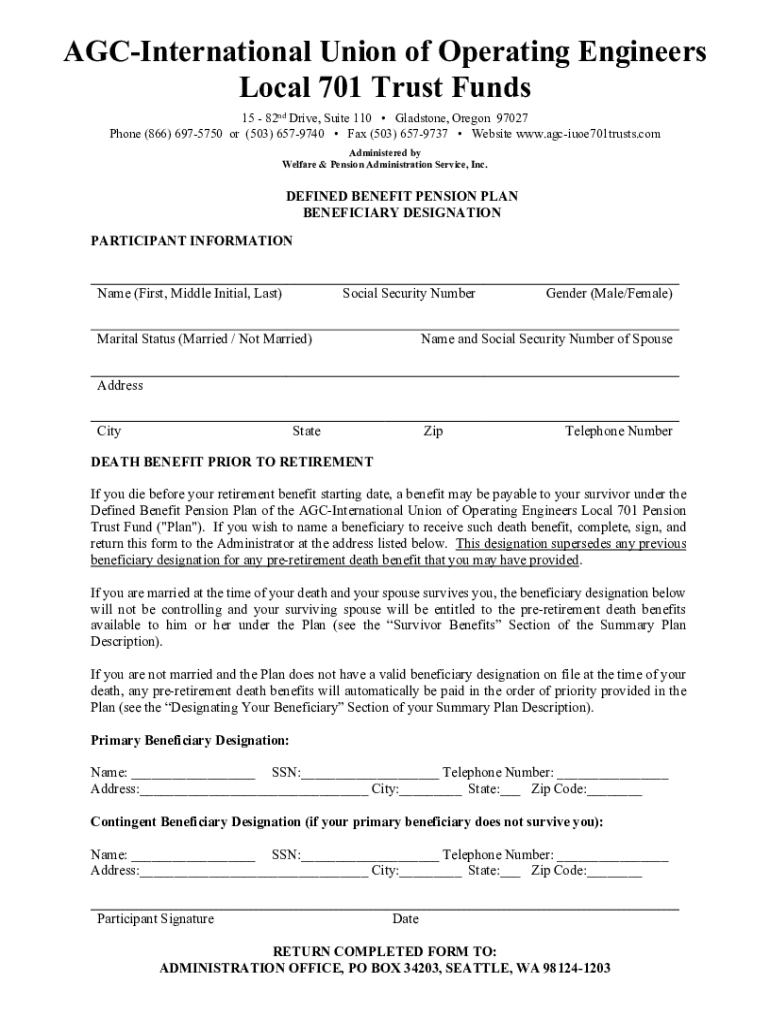

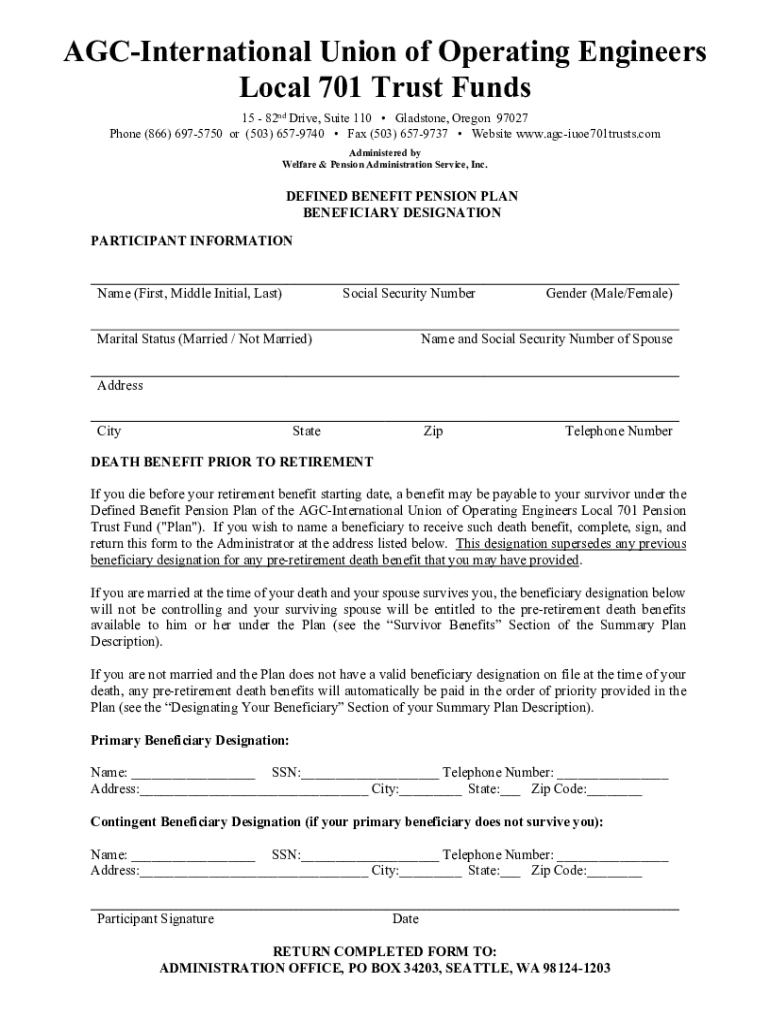

Understanding the beneficiary designation form

A beneficiary designation form is a key document that designates who will receive an asset upon the death of the account holder. This form plays a crucial role in the realm of estate planning, as it allows individuals to specify their wishes clearly without the need for probate. For example, life insurance policies and retirement accounts often require a beneficiary designation form to dictate the recipient of those assets.

Implementing a beneficiary designation is essential for ensuring that your assets are distributed according to your preferences, bypassing potential friction or delays in the probate process. This streamlining can save families time and money, making it a vital component of sound estate planning.

Key terminology

Types of beneficiary designation forms

There are several types of beneficiary designation forms, each relevant to different financial instruments and accounts. Knowing which forms apply to your assets is critical in ensuring that your intent is honored.

When to use a beneficiary designation form

Life events significantly impact beneficiary choices. Major milestones — such as marriage, divorce, or the birth of a child — often necessitate a review and potential update of your beneficiary designation. Each of these events may lead to shifts in priorities or relationships that could affect who you wish to designate as your beneficiary.

Additionally, financial changes such as asset acquisition or loss, changes to retirement plans, or even changes in tax law can also create a need for updates in your beneficiary designations. Regularly updating your designation ensures that it continues to reflect your current wishes and circumstances.

How to fill out a beneficiary designation form

Filling out a beneficiary designation form requires careful attention to detail. Start by gathering essential information about yourself and potential beneficiaries to simplify the process and reduce errors.

Next, carefully follow these steps: Select your primary and contingent beneficiaries (someone who inherits if the primary beneficiary is unavailable), specify the shares or percentages they will receive, and comprehensively review the legal requirements for signatures and witnesses. Ensure all necessary fields are filled out completely to avoid pitfalls.

Editing and modifying your beneficiary designation form

Circumstances change, and so can your beneficiary designations. Being able to edit and modify your existing forms is essential to keeping your estate plan relevant. Using pdfFiller, you can easily access interactive tools that allow you to revise your documents online.

Modifying your designation is necessary in cases such as a change in marital status or a significant shift in your financial situation. These events may prompt you to adjust who will inherit your assets, and timely updates can help prevent future conflicts or misunderstandings.

Signing and finalizing the beneficiary designation form

Once the beneficiary designation form is filled out, signing and finalizing it properly is imperative to ensure its validity. Using electronic signatures has become commonplace, and platforms like pdfFiller facilitate this process efficiently.

After signature, be sure to understand submission considerations: Confirm where to send the completed forms, whether to the insurance company, retirement plan administrator, or a financial institution. Additionally, retain copies for personal records to track any future updates.

Managing your beneficiary designation over time

Long-term management of your beneficiary designation form is crucial. Regularly revisiting this document helps to ensure that it accurately reflects your wishes and current family dynamics. Establishing a periodic review schedule can prevent lapses in judgment and keep your documentation current.

Consider accessing resources for further assistance, whether estate planning professionals or utilizing pdfFiller's tools to manage your document history. Keeping everything organized is paramount.

FAQs about beneficiary designation forms

Questions often arise regarding beneficiary designation forms, and it’s essential to address common concerns to avoid complications later on. A prevalent question is: What if my beneficiary predeceases me? It’s a crucial consideration, and often, a contingent beneficiary should be named to ensure that your assets have a designated heir, even if the primary beneficiary cannot accept them.

Moreover, misconceptions about beneficiary designation forms can lead to mistakes. Clarifying these myths is vital to ensure that all designators have a clear understanding of the expectations and procedures involved in the beneficiary designation process.

Using pdfFiller to simplify your document management

Utilizing a cloud-based document solution such as pdfFiller significantly simplifies the management of essential documents like beneficiary designation forms. The platform empowers users to create, edit, eSign, collaborate, and store documents without the usual logistical burdens of paper forms.

In summary, leveraging pdfFiller to handle your beneficiary designation forms not only streamlines the process but also provides peace of mind knowing that your essential documents are readily available and effectively managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find beneficiary designation?

Can I sign the beneficiary designation electronically in Chrome?

How do I complete beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.