Get the free F 1596

Get, Create, Make and Sign f 1596

How to edit f 1596 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f 1596

How to fill out f 1596

Who needs f 1596?

Understanding the f 1596 Form: A Comprehensive Guide

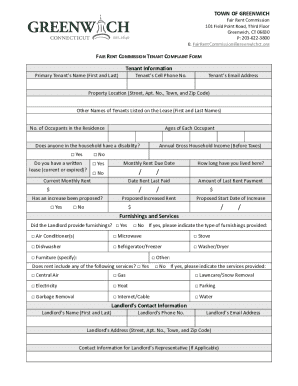

Overview of the f 1596 form

The f 1596 form is an essential document in the realm of finance and administrative processes. It is typically utilized by individuals and businesses to report specific financial information to regulatory authorities. Understanding its purpose and significance is crucial, especially in compliance-heavy environments.

The main purpose of the f 1596 form is to ensure transparency and accountability in financial reporting. It serves as a medium for collecting data necessary for tax assessments, audits, or other legal requirements. Recognizing when and how to use this form can significantly affect your financial outcomes and compliance status.

Who needs to use the f 1596 form?

The f 1596 form is primarily designed for entities engaged in financial transactions that require reporting to governmental organizations. This includes small business owners, freelancers, and large corporations alike. Anyone responsible for financial documentation could benefit from understanding this form's requirements.

Common scenarios for using the f 1596 form arise during tax season or when applying for loans or grants. Individuals applying for relief programs or financial assistance may also find this form relevant. Ensuring proper submissions can be vital for funding approvals or accurate tax assessments.

Accessing the f 1596 form

Finding the f 1596 form has become increasingly convenient, thanks to the digital era. Users can easily access this form online from various government or finance-related websites. It's essential to ensure that you're downloading the latest version to comply with current regulations.

The form is typically available in multiple formats, including PDF and Word documents. PDF is ideal for maintaining the integrity of formatting, while Word documents could be more suitable for editing and filling out information easily. You can download them directly from platforms such as pdfFiller for quick access and management.

Step-by-step instructions for filling out the f 1596 form

Preparation

Before filling out the f 1596 form, it's vital to prepare adequately. Start by gathering all relevant information and documents. This might include income records, expense receipts, and identification details, depending on the form's specific requirements. Taking time to organize these documents can streamline the filling process.

Understanding the requirements of each section of the form is equally important. Familiarize yourself with what information is needed so you’re not scrambling to find data while completing the form.

Completing the form

With the necessary information at your fingertips, start filling out the f 1596 form methodically. The personal information section typically requests details such as your name, address, and contact information. Ensure that these details are accurate to avoid future complications.

Next, navigate to the financial details section, which may require exact figures related to income and expenses. Exercise caution here — inaccuracies can lead to disputes or penalties. Don’t forget the signature sections; they may require you to validate the information provided, confirming its authenticity.

Reviewing your form

Never underestimate the power of proofreading. Reviewing your f 1596 form before submission is a critical step. Look for common mistakes like typos, incorrect figures, or incomplete sections. These trivial errors can have significant implications down the road.

Editing and managing the f 1596 form

Utilizing tools like pdfFiller can greatly enhance your efficiency when working with the f 1596 form. The platform allows users to edit the document easily, making it simple to correct any mistakes or add new information without needing to start over.

Collaboration features are especially useful for teams. You can invite others to review, suggest changes, or add additional input directly onto the form. This ensures that all relevant stakeholders have a say, leading to more accurate and comprehensive submissions.

Signing the f 1596 form

Adding your signature to the f 1596 form is not just a formality; it validates the information you've provided. In today's digital world, eSigning has gained popularity for its convenience and security. Utilizing pdfFiller's eSigning feature, you can add your digital signature effortlessly.

It’s important to recognize the legal considerations surrounding electronic signatures. Ensure that the eSigning process adheres to your local jurisdiction’s laws regarding electronic documentation, which have evolved to accommodate the digital age.

Submitting the f 1596 form

Filing your f 1596 form can typically be done through various methods: online, by mail, or in person. The option you choose may depend on the guidelines provided for your specific situation and the urgency of your submission.

When submitting online, ensure you follow the specific submission guidelines outlined on the website. If mailing, double-check that the form is sent to the correct address. Keeping proof of submission, such as a receipt or confirmation email, is always recommended to track the status of your form.

Frequently asked questions (FAQs) about the f 1596 form

Understanding the common inquiries surrounding the f 1596 form can greatly ease the filling out process. Many users often seek clarification on issues like eligibility, particular requirements for submission, or how to amend a submitted form.

Addressing these questions can provide users with the confidence needed to handle the form effectively. While personal inquiries can vary, general questions are often linked to deadlines, filing status, or necessary documentation.

Conclusion on the importance of using the f 1596 form

Utilizing the f 1596 form properly can streamline your financial reporting and ensure compliance with necessary regulations. By following the outlined steps and leveraging tools from pdfFiller, users can manage document completion and submission effectively.

The importance of accurate form handling is paramount; it mitigates potential penalties and supports smooth financial processes. As you continue to navigate financial documentation, consider using comprehensive platforms like pdfFiller for a seamless experience.

Interactive tools and resources

To further assist you in handling the f 1596 form, various interactive tools and resources are available. Platforms like pdfFiller offer calculators that can assist in determining necessary inputs, which can be especially useful when dealing with complex financial data.

In addition, templates and examples are often provided to help users understand how to fill out the form appropriately. Utilizing available support can enhance your comfort with these forms and improve accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my f 1596 in Gmail?

How do I edit f 1596 online?

How do I edit f 1596 on an iOS device?

What is f 1596?

Who is required to file f 1596?

How to fill out f 1596?

What is the purpose of f 1596?

What information must be reported on f 1596?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.