Get the free Ct-1040nr/py

Get, Create, Make and Sign ct-1040nrpy

Editing ct-1040nrpy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1040nrpy

How to fill out ct-1040nrpy

Who needs ct-1040nrpy?

A Comprehensive Guide to the CT-1040NRPY Form

Understanding the CT-1040NRPY Form

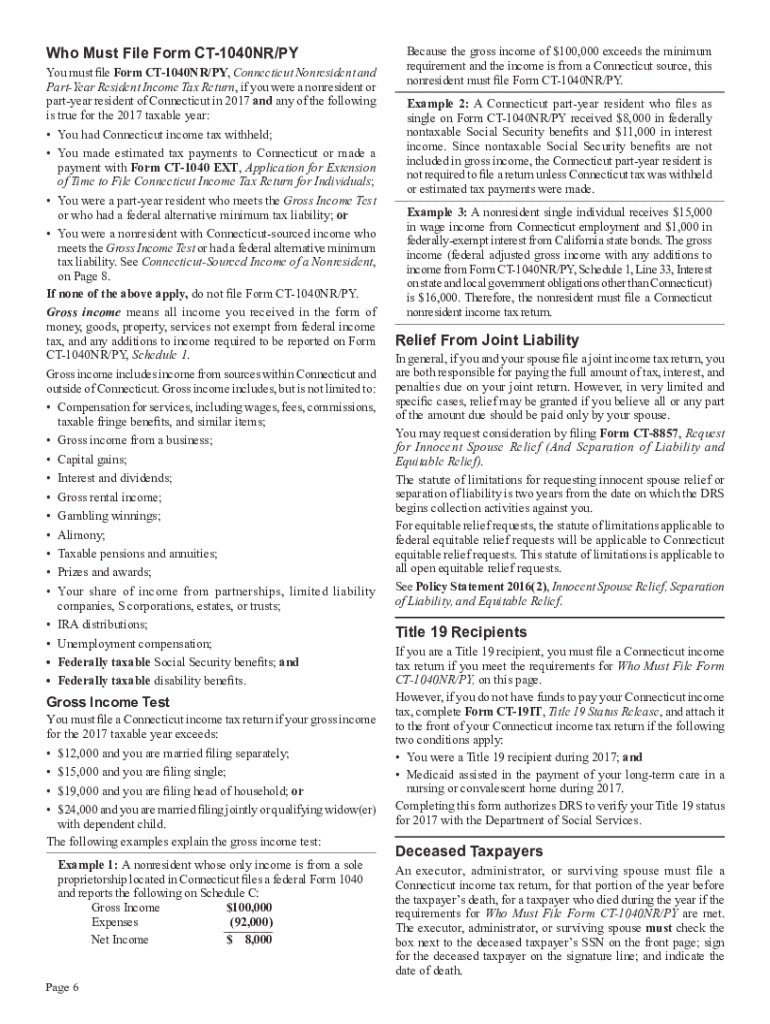

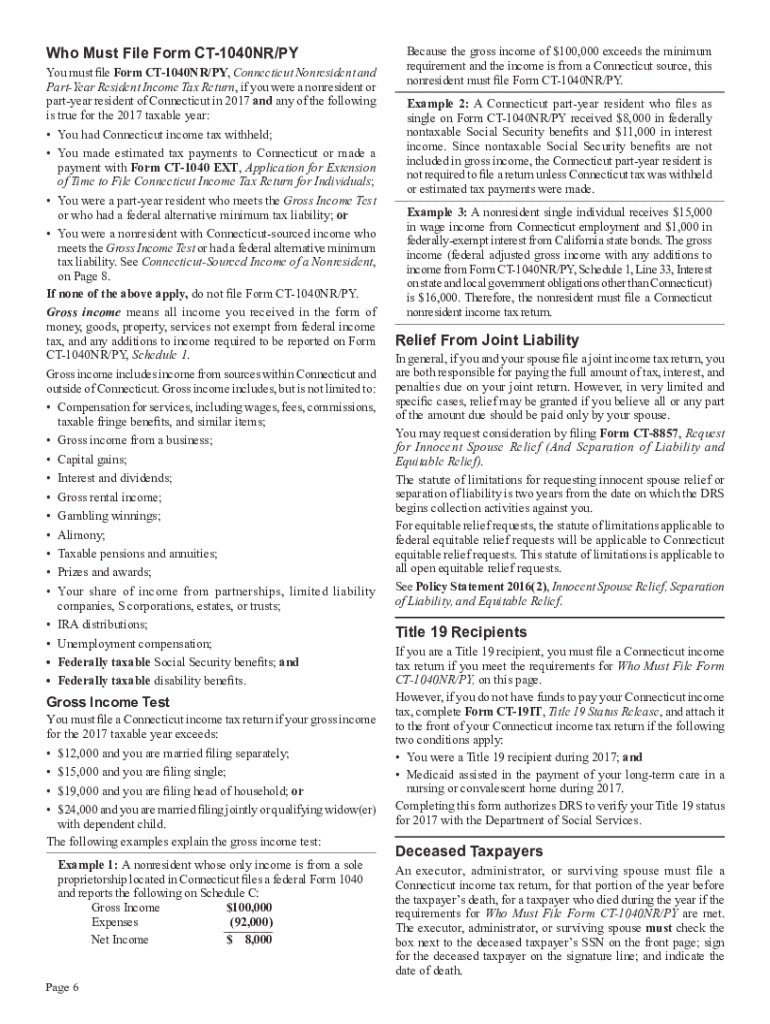

The CT-1040NRPY form is the Connecticut non-resident personal income tax return form, specifically designed for individuals who earn income from Connecticut sources but do not reside in the state. This form serves the crucial purpose of ensuring that non-resident taxpayers comply with state tax laws regarding income earned within Connecticut. Understanding the nuances of this form is essential, as it directly impacts the tax liabilities of non-resident individuals.

For non-resident taxpayers, the CT-1040NRPY form is not just a mere obligation but a vital document that can influence their financial standing. Filing this form correctly can prevent penalties for underreporting income and ensures that the taxpayer contributes their fair share towards state-funded services they benefitted from while working in the state.

Eligibility criteria for filing the CT-1040NRPY

Not everyone who earns an income from Connecticut sources is required to file the CT-1040NRPY form. The primary criterion is that the individual must be a non-resident of Connecticut and must have income that is taxable in the state. Typical examples include individuals who live in neighboring states but perform work, such as freelancers or commuters, for companies located in Connecticut.

Moreover, it's important to consider special cases where exceptions might apply. For instance, if an individual’s total income from Connecticut sources is below a certain threshold—generally $15,000 for residents—it may not necessitate filing. Commuters or individuals engaged in temporary work assignments should review these thresholds to ascertain their eligibility.

Key components of the CT-1040NRPY Form

The CT-1040NRPY consists of several key components that need careful consideration when filing. Each line of the form is designed to extract specific information from taxpayers, ensuring compliance with Connecticut tax regulations. Below, we provide a line-by-line breakdown of the CT-1040NRPY form.

When filling out the CT-1040NRPY, non-residents often make common mistakes, such as misreporting income or failing to sign the form. It’s crucial to double-check for accuracy before submission to avoid delays or audits.

Step-by-step instructions for completing the CT-1040NRPY Form

Completing the CT-1040NRPY form requires careful attention to detail and the gathering of essential documents. Start by assembling all necessary paperwork, including personal identification and income documentation, such as W-2s or 1099 forms.

Following these detailed steps makes your submission process smoother and minimizes errors.

E-filing vs. paper filing the CT-1040NRPY Form

When it comes to filing the CT-1040NRPY form, taxpayers can choose between e-filing or paper filing. E-filing offers a more efficient way to submit your tax return, often delivering confirmations faster and reducing processing times.

Tax software typically guides you through filling out the CT-1040NRPY and can automatically calculate your tax due. For those opting for paper filing, it’s advisable to keep photocopies of your completed form and to use certified mail when sending documents to ensure delivery.

Important deadlines for the CT-1040NRPY

Being mindful of deadlines is crucial when it comes to tax filing. The due date for filing the CT-1040NRPY form typically aligns with the federal income tax deadline, which is usually April 15th each year. For those who fail to file by the due date, penalties may apply.

Failing to meet these deadlines can lead to penalties and interest on unpaid taxes, emphasizing the need for timeliness in tax obligations.

Frequently asked questions (FAQs) about the CT-1040NRPY Form

Taxpayers may have several queries regarding the CT-1040NRPY form, including what constitutes taxable income, how to obtain copies of previous returns, and clarifications on residency rules. Understanding the subtleties of non-resident taxation is crucial for accurate reporting.

For further assistance, taxpayers can directly contact the Connecticut Department of Revenue Services (DRS) or consult a tax professional specializing in state taxation to ensure proper filing.

Interactive tools and resources

Using interactive tools can greatly enhance your experience while working with the CT-1040NRPY form. Various resources are available that can simplify the process of calculating taxes and filing returns.

Integrating these tools into your filing process can lead to a more streamlined experience, making handling your tax obligations easier.

Managing your tax documents after filing

After filing the CT-1040NRPY form, managing your tax documents is crucial. Establishing a robust record-keeping system will ensure you can easily retrieve necessary documents for future reference or audits.

Adopting best practices ensures your tax information remains private and accessible whenever needed.

Testimonials and user experiences

Many individuals find success stories related to filing the CT-1040NRPY form inspiring. For instance, freelancers who once faced uncertainties in tax filing have turned to user-friendly tools like pdfFiller, transforming their taxing experience into a manageable process.

These testimonials underscore the value of utilizing effective tools for tax preparation, enabling smoother filing experiences for non-residents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ct-1040nrpy directly from Gmail?

How can I send ct-1040nrpy to be eSigned by others?

How do I edit ct-1040nrpy on an Android device?

What is ct-1040nrpy?

Who is required to file ct-1040nrpy?

How to fill out ct-1040nrpy?

What is the purpose of ct-1040nrpy?

What information must be reported on ct-1040nrpy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.