Get the free Council Tax Refund Request Form

Get, Create, Make and Sign council tax refund request

How to edit council tax refund request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax refund request

How to fill out council tax refund request

Who needs council tax refund request?

Your Complete Guide to the Council Tax Refund Request Form

Understanding council tax refunds

Council tax is a local taxation system in England, Scotland, and Wales, designed to help local councils cover services such as education, healthcare, waste management, and community safety. Each year, residents are assessed and assigned a council tax band based on their property's value. However, circumstances arise where individuals may be entitled to a council tax refund, either due to overpayments, discounts that weren’t applied, or changes in their residency status.

Eligibility for these refunds can hinge on specific criteria, and it's crucial to file requests promptly. Failing to submit a request within the stipulated timeframe might lead to lost opportunities.

Preparing your refund request

Before diving into the refund application process, ensure you’ve gathered all necessary documents. A well-prepared application can significantly speed up the process and increase your chances of a successful claim.

Additionally, familiarize yourself with the information required on the application form, including your personal identification details, proof of residence, and evidence of any financial overpayment.

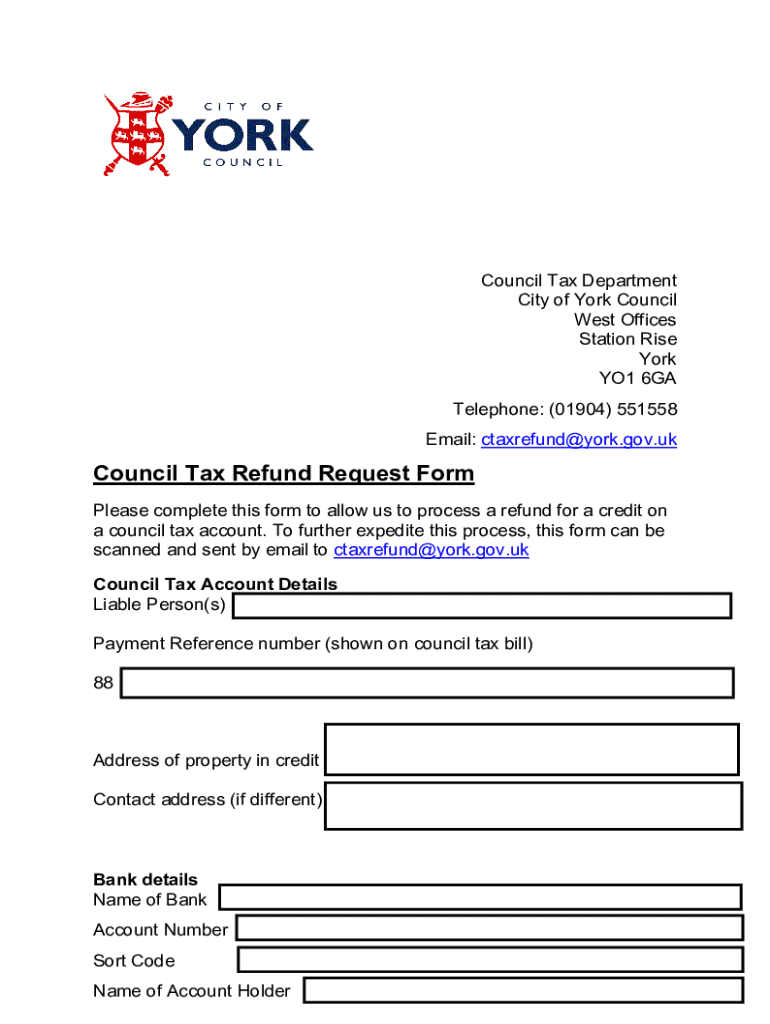

Completing the council tax refund request form

Accessing the council tax refund request form can usually be done through your local council’s website or pdfFiller, which streamlines the process. When completing the form, it’s essential to provide accurate and complete information to avoid unnecessary delays.

Take care to double-check every detail before submission. Errors can delay processing times or result in rejected claims.

Uploading supporting documents

Once you’ve filled out the request form, the next step is to upload supporting documents. Make sure to adhere to guidelines regarding document submission to avoid complications. Acceptable file formats generally include PDFs, JPGs, and PNGs.

Utilizing tools like pdfFiller can help consolidate all your documents in one place, streamlining the submission process.

Submitting your refund request

Submitting the completed council tax refund request form requires understanding of your options. Most councils now support online submissions through platforms like pdfFiller, which is preferable for its convenience and efficiency.

After submission, monitoring the processing timeline is crucial. Typically, councils will process refunds within a set period, and tracking your refund status can help manage expectations.

Collaboration and updates

If you are collaborating with representatives or stakeholders during the refund request process, tools like pdfFiller prove invaluable. They enable multiple users to interact with the document seamlessly, ensuring everyone stays informed of any updates or changes.

Maintaining open lines of communication through these platforms can result in a smoother, more efficient refund process.

Common issues and solutions

While the refund process is straightforward, common challenges arise. Knowing these ahead of time can prepare you and help in addressing them effectively. Issues may range from miscommunication about eligibility to simple clerical errors on submitted forms.

Being proactive in addressing these issues will save time and yield better results.

Feedback and follow-up

Providing feedback post-process is not only helpful for councils but also invaluable for future applicants. Offering insights into your experience can assist in improving the system for everyone.

Your insights can contribute to better service delivery and enhance the refund process for others.

Final insights and best practices

When navigating council tax refund claims, a few best practices can make the experience smoother. Keeping personal records organized can drastically simplify future claims. With ongoing digital solutions like pdfFiller, managing your forms and documents becomes hassle-free.

By leveraging technology and best practices, you can simplify the management of your council tax responsibilities.

Additional services related to council tax

Beyond council tax refunds, councils provide several fiscal services that can impact your finances. Staying in touch with local council services is essential. Potential implications could relate to housing benefits or discounts for low-income residents.

Ensuring your records are up-to-date with local councils can result in smoother financial management overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send council tax refund request for eSignature?

How do I make edits in council tax refund request without leaving Chrome?

Can I sign the council tax refund request electronically in Chrome?

What is council tax refund request?

Who is required to file council tax refund request?

How to fill out council tax refund request?

What is the purpose of council tax refund request?

What information must be reported on council tax refund request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.