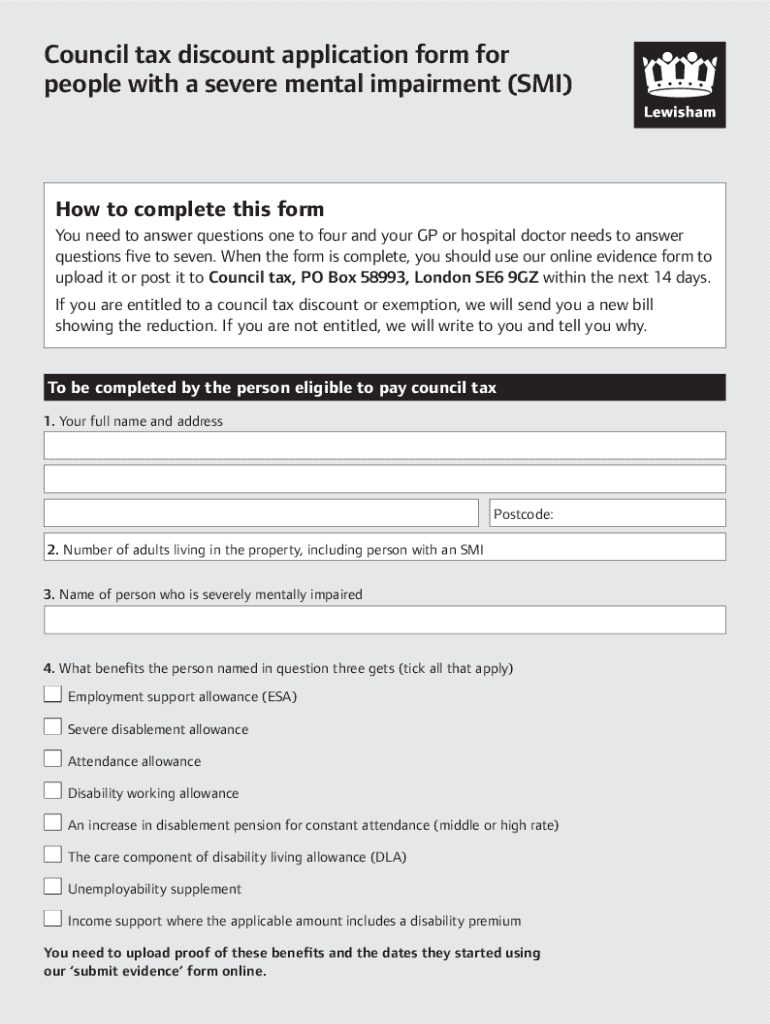

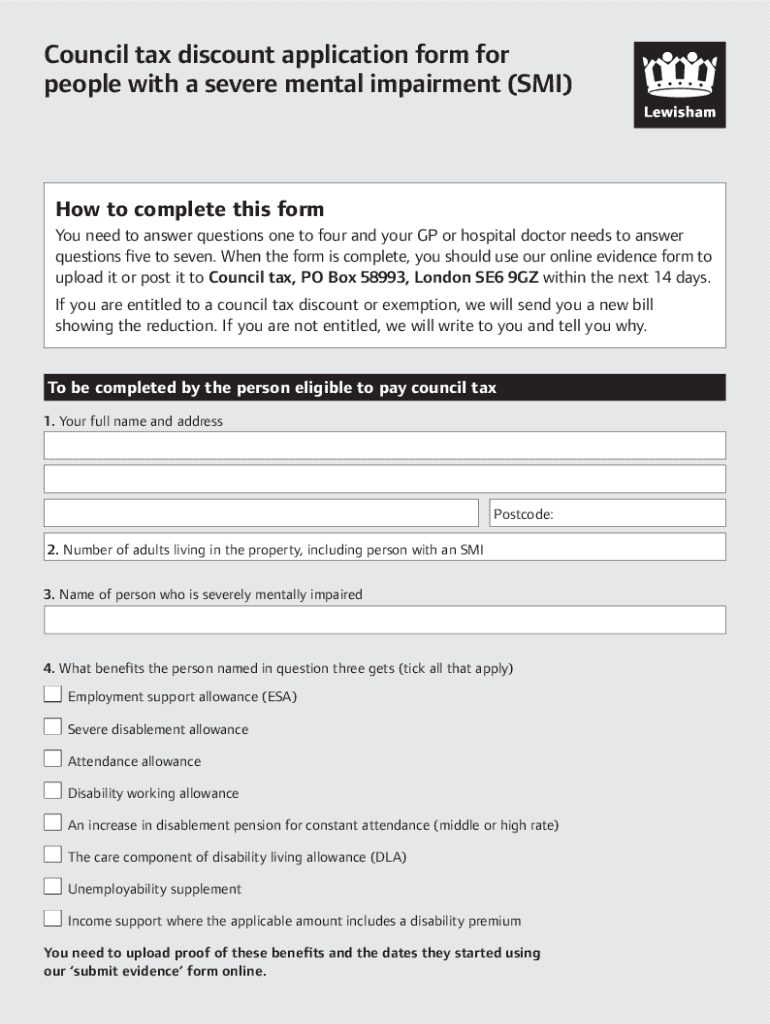

Get the free Council Tax Discount Application Form for People With a Severe Mental Impairment (smi)

Get, Create, Make and Sign council tax discount application

How to edit council tax discount application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax discount application

How to fill out council tax discount application

Who needs council tax discount application?

Council Tax Discount Application Form - How-to Guide

Understanding council tax discounts

Council tax discounts are financial reductions available to individuals and households based on specific criteria set by local councils. These discounts can significantly lower the amount payable, easing financial burdens for those who qualify. Understanding these discounts is crucial for eligible individuals as they can provide substantial relief, allowing for better budgeting and financial planning.

Eligibility for council tax discounts varies, making it essential for applicants to be well-informed about their potential entitlements. By taking the time to assess eligibility and apply, individuals can ensure they are not overpaying their council tax, which can be particularly important for those on fixed incomes or experiencing financial hardships.

Types of council tax discounts available

Local councils offer an array of discounts tailored to different circumstances. Knowing which discounts you may qualify for can streamline the application process and optimize your potential savings.

Key information before you apply

Before diving into the council tax discount application form, it is essential to gather all necessary documentation and gain a clear understanding of local regulations. Your eligibility may hinge on specific criteria established by your local council, and awareness of these nuances can save time and effort in the application process.

Steps to complete the council tax discount application form

Filling out the council tax discount application form may seem daunting, but following a structured approach can make it more manageable. Here are the essential steps to consider.

What happens after submission

Once your council tax discount application is submitted, it's natural to wonder about the next steps. Typically, councils aim to process applications promptly, but timelines can vary based on local workloads and policies.

Appeals and revisions

If your application is rejected, it's important to remember that you have options. The appeals process allows applicants to challenge decisions; however, adhering to timelines and requirements is crucial.

Managing your council tax account

Once your council tax discount is approved, managing your account becomes essential. Keeping your information current ensures that you continue to receive the appropriate discounts and avoid overpayments.

Frequently asked questions (faqs)

Many applicants have similar questions regarding the council tax discount application form. Having clear, concise answers can alleviate confusion and enhance the process.

Related topics and additional resources

Understanding council tax discounts can be complex, but additional resources can further clarify available options and support. Exploring government websites or local council pages offers deeper insights into tax benefits and financial support.

How pdfFiller simplifies your document experience

Navigating the council tax discount application form can be smooth and efficient with pdfFiller. This cloud-based platform empowers users to seamlessly edit, eSign, and manage documents from anywhere, ensuring a user-friendly experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify council tax discount application without leaving Google Drive?

Can I create an electronic signature for the council tax discount application in Chrome?

How can I fill out council tax discount application on an iOS device?

What is council tax discount application?

Who is required to file council tax discount application?

How to fill out council tax discount application?

What is the purpose of council tax discount application?

What information must be reported on council tax discount application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.