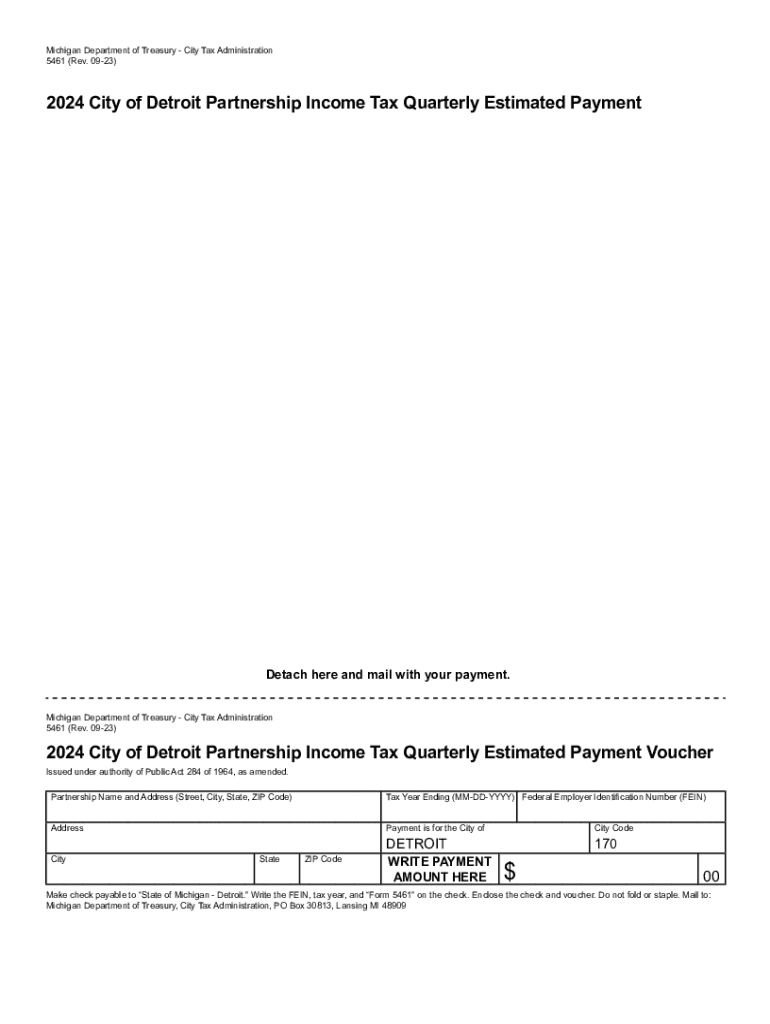

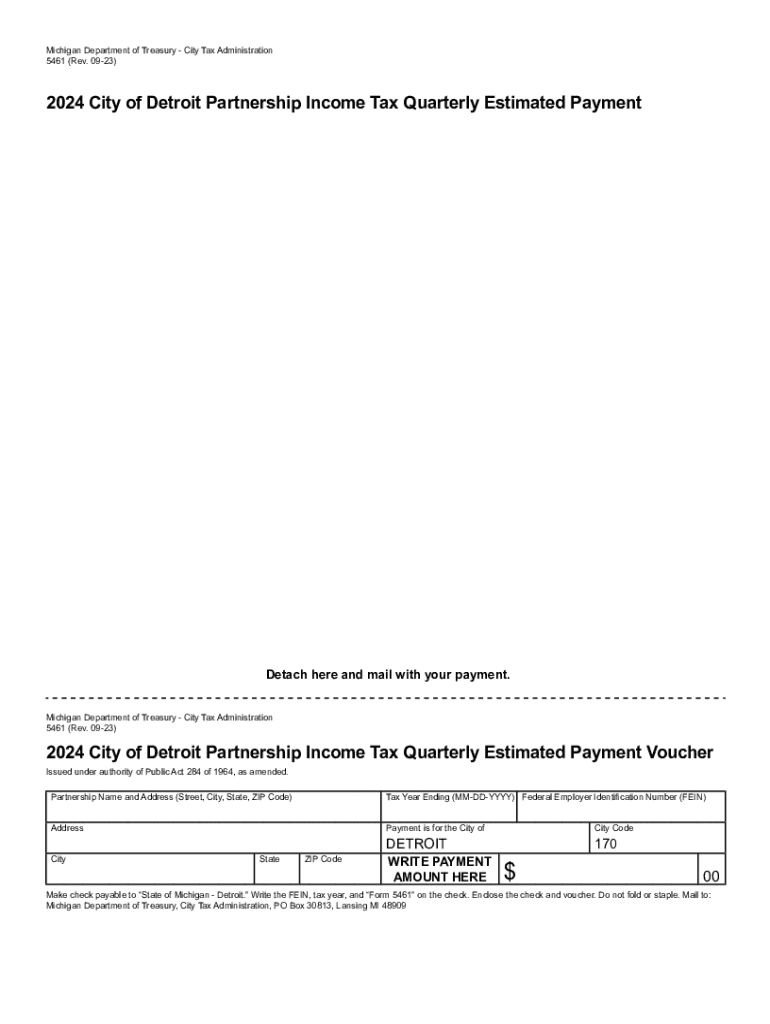

Get the free Michigan Department of Treasury - City Tax Administration 5461 (rev. 09-23)

Get, Create, Make and Sign michigan department of treasury

How to edit michigan department of treasury online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan department of treasury

How to fill out michigan department of treasury

Who needs michigan department of treasury?

Comprehensive Guide to Michigan Department of Treasury Forms

Overview of Michigan Department of Treasury forms

Michigan Department of Treasury forms serve as essential documents for individuals and businesses to report financial information, pay taxes, and fulfill state regulations. Their importance cannot be overstated, as accurate and timely submission directly impacts taxation and compliance with state laws. The forms cater to various sectors including income tax, property tax, and payroll tax, each playing a crucial role in Michigan's revenue system.

Understanding how to properly utilize these forms helps ensure compliance, avoid penalties, and streamline tax-related processes for individuals and businesses alike.

Types of Michigan Treasury forms

The Michigan Treasury offers various forms tailored to different tax responsibilities. Each form is designed to address specific reporting needs depending on one's financial activities.

Familiarity with these categories allows users to quickly identify and access the correct documents necessary for compliance with state regulations.

Navigating the Michigan Treasury website

Finding the appropriate Michigan Department of Treasury form starts with knowing where to look. The official treasury website is user-friendly and organized to help users quickly locate forms relevant to their needs.

Utilizing the search functionalities effectively can greatly reduce the time spent in locating the correct forms.

How to fill out Michigan Treasury forms

Completing Michigan Treasury forms accurately is fundamental to seamless processing. Start by gathering all documentation that may be required, such as income statements and property valuations.

Common errors include miscalculated figures and missing information. Familiarizing yourself with FAQs on form completion can also aid in preventing errors.

Interactive tools for simplifying form completion

pdfFiller offers innovative tools that simplify the process of completing Michigan Treasury forms. With a range of features, users can edit and sign forms effortlessly.

These tools enable a more efficient form-filling experience, fitting seamlessly into the user's workflow.

Filing and submitting Michigan Treasury forms

After completing the Michigan Treasury form, timely filing is paramount. Key deadlines vary by form type, so being aware of upcoming due dates can prevent penalties.

After submission, users typically receive confirmation via email or a notification on the treasury website, and knowing the processing timeline is essential for planning.

Managing your details after submission

Once the Michigan Treasury forms are submitted, tracking their status can relieve anxiety about potential errors. The website offers statuses for most submissions, helping you to stay informed.

Staying proactive after submission aids in ensuring compliance and rectifying issues promptly when they arise.

Troubleshooting common issues

Occasionally, issues arise with Michigan Treasury forms, such as rejection or processing errors. Understanding how to address these situations is crucial.

Contacting the Michigan Department of Treasury can help clarify issues. Reach out via their official contact methods, following best practices for effective communication.

Recent changes and updates to Michigan Treasury forms

Tax regulations and forms are subject to change, making it important to stay updated. Recent legislative updates may alter existing forms or introduce new ones, affecting compliance.

Understanding these updates can help individuals and businesses maintain compliance and avoid unnecessary complications during tax season.

Best practices for document management

Effective management of Michigan Treasury forms can make a significant difference in organization and peace of mind.

Using organizational strategies boosts efficiency and ensures crucial documents remain readily available.

Additional insights on using pdfFiller for Michigan Treasury forms

Transitioning from paper to digital forms using pdfFiller enriches the user experience. The cloud-based platform not only aids in editing PDFs but also supports team collaboration, making the form completion process seamless.

By leveraging pdfFiller’s tools, users can enhance their experience with Michigan Department of Treasury forms and improve overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my michigan department of treasury in Gmail?

How can I fill out michigan department of treasury on an iOS device?

How do I edit michigan department of treasury on an Android device?

What is michigan department of treasury?

Who is required to file michigan department of treasury?

How to fill out michigan department of treasury?

What is the purpose of michigan department of treasury?

What information must be reported on michigan department of treasury?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.