Get the free Managed Portfolio Service Application Pack for a Self Invested Personal Pension (sipp)

Get, Create, Make and Sign managed portfolio service application

How to edit managed portfolio service application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out managed portfolio service application

How to fill out managed portfolio service application

Who needs managed portfolio service application?

Comprehensive Guide to the Managed Portfolio Service Application Form

Understanding Managed Portfolio Services (MPS)

Managed Portfolio Services (MPS) offer investors a tailored investment approach where portfolio managers handle investment decisions on behalf of clients. This service is especially beneficial for individuals seeking to grow their wealth without the necessity of actively managing their holdings. By leveraging professional expertise, investors can achieve diversified portfolios aligned with their risk tolerance and investment objectives.

The advantages of investing through managed portfolios include professional asset management, ongoing portfolio monitoring, and the potential for higher returns due to strategic investments. Moreover, MPS can cater to specific goals, such as retirement funding or wealth preservation, making them a versatile choice for investors. Key features often associated with managed portfolios are risk assessment tools, regular performance reviews, and personalized investment strategies.

The importance of the application form

The application form is a critical component of the process to access Managed Portfolio Services. It helps establish a clear understanding of a client's financial background, investment preferences, and risk tolerance, which are essential for tailoring investment strategies. A well-completed application ensures that portfolio managers have the necessary information to create a portfolio that aligns with the client's goals.

Key information usually required in the application form includes personal details, financial status, investment experience, and specific investment goals. Understanding the paperwork is crucial, as it provides insight into what is expected from clients and helps streamline the onboarding process. Applicants can anticipate questions about their investment history, expected returns, and willingness to take on risk.

Step-by-step guide to completing the managed portfolio service application form

Preparation before you begin

Before diving into the application, it’s essential to gather all required documentation. This might include proof of identity, financial statements, tax documents, and any other pertinent financial details. Having these documents at your fingertips will make the process smoother and more efficient.

Additionally, it’s crucial to understand the different types of managed portfolios available. Familiarize yourself with discretionary fund management, passive strategies, and specialized funds, as these choices will influence the selection process for your portfolio manager.

Filling out the application form

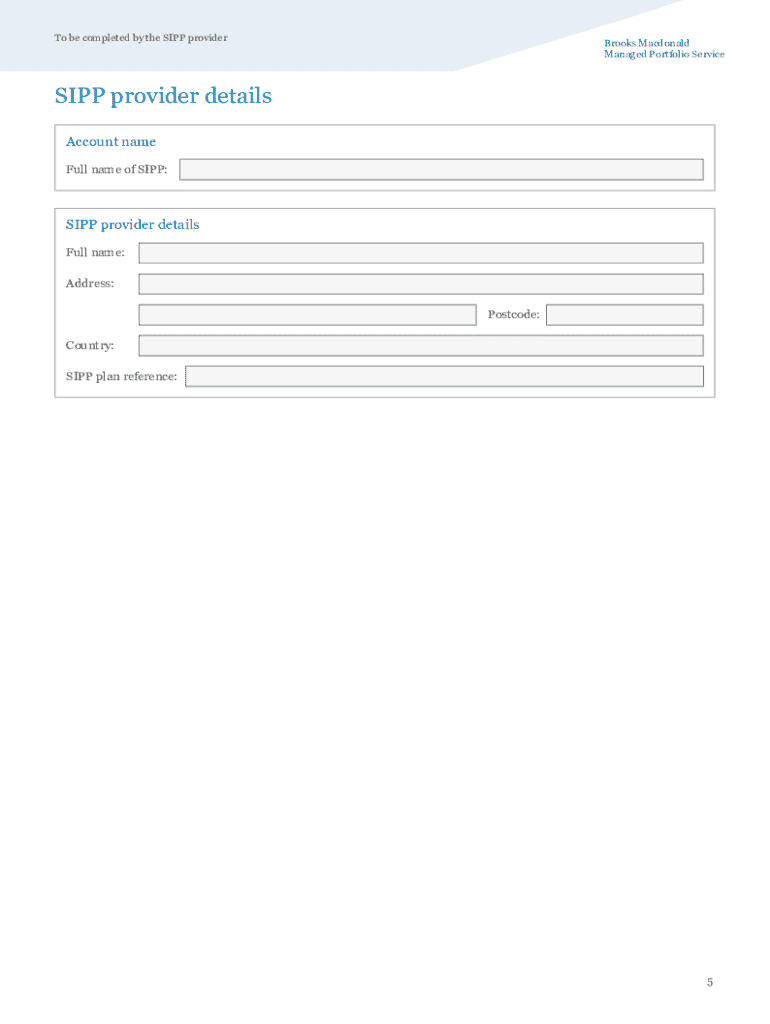

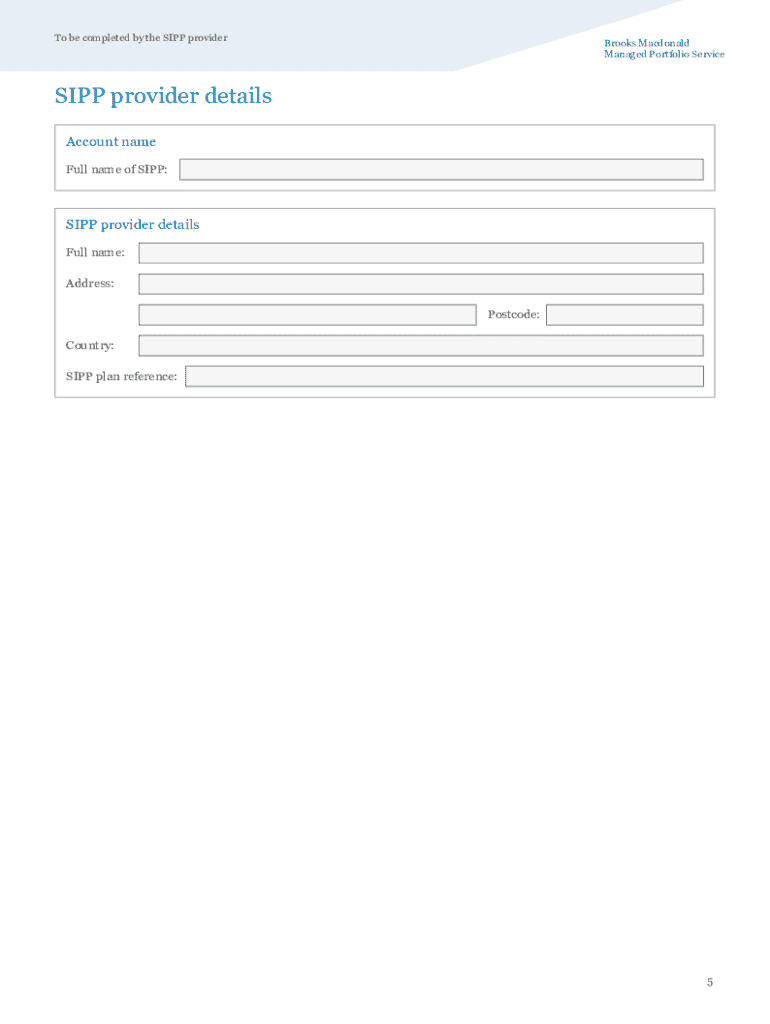

The application form is typically divided into several sections. Start with the Personal Information Section, where you'll enter your name, contact details, and identification. This information is vital for setting up your account and ensuring smooth communication with your portfolio manager.

Next, complete the Financial Information Section. Detail your income, assets, liabilities, and existing investments. This section helps the portfolio manager gauge your financial health and ability to invest. In the Investment Goals and Objectives Section, clearly outline your aims—whether it’s capital appreciation, income generation, or risk reduction.

Furthermore, a Risk Tolerance Assessment is often included to evaluate how much risk you are willing to accept. This may include questionnaires to gauge your comfort with different levels of volatility and investment outcomes.

Review and double-check

Once you’ve filled out the application, take the time to review it. Common mistakes often involve typos, incorrect financial details, or incomplete sections. To avoid issues, refer back to the documentation you gathered earlier to ensure accuracy.

Utilizing checklists can be an effective way to verify the completeness of your application. Look through each section carefully, and make any necessary adjustments before submission.

Submitting the application

Decide on your submission method: will you opt for an online application or a paper form? Online submission is typically faster and allows you to receive immediate confirmation. After submitting the application, anticipate correspondence from the portfolio management team, informing you of the next steps and any further requirements.

Editing and managing your application form

After submission, you may find that you need to make changes to your application. Utilizing pdfFiller’s platform allows you to edit documents easily, ensuring that your information is always accurate and up-to-date. Once edited, remember to save frequently and securely store your completed application in a dedicated, cloud-accessible location.

Additionally, pdfFiller offers the option to share your application with advisors or team members, facilitating collaboration and ensuring everyone involved is informed and aligned throughout the investment process.

E-signature options for your application

The importance of digital signing cannot be understated in today’s fast-paced investment landscape. By choosing to sign your application digitally, you minimize the delays associated with physical signatures while enhancing security. Digital signatures are legally binding and can be executed seamlessly through tools available on platforms like pdfFiller.

Using the e-signature feature in pdfFiller, you can easily apply your signature to your application, ensuring that it meets the requirements laid out by financial institutions. Once signed, your document will go through verification, ensuring both parties have authorized the application, thus maintaining the integrity of the process.

Frequently asked questions (FAQs) about managed portfolio service applications

Best practices for successful application submission

To aid in your successful application submission, gaining a thorough understanding of managed portfolio industry standards is beneficial. Knowing what to expect allows for smoother interactions with portfolio managers and ensures compliance with necessary regulations.

Strengthening communication with your financial advisor is essential. Be clear about your investment goals, and don’t hesitate to ask for clarification on any part of the application or service details. Also, keeping your documentation up-to-date is vital, as financial situations can change, affecting investment choices.

Additional insights on managed portfolio services

A variety of managed portfolio options are available, including discretionary fund management and passive strategies. It’s beneficial to understand these different types to choose an approach that aligns with your financial preferences. After your application is approved, maintain regular contact with your portfolio manager, and request performance updates.

Establishing clear communication channels with your management team will help you make informed decisions. If concerns arise at any point, reach out proactively to address them and adjust your investment strategy accordingly.

Our commitment to transparency and client support

pdfFiller is dedicated to ensuring security and privacy in document management, making it easier for you to focus on your financial goals without worrying about data leaks. Our platform invests in up-to-date technology to safeguard your information and maintain compliance with industry regulations.

Access our resource hub for ongoing support and information regarding Managed Portfolio Services. Staying informed means you can make strategic decisions that benefit your financial future. From tutorials to expert insights, we provide a wealth of information at your fingertips.

Interactive tools available on pdfFiller

Utilizing interactive tools can enhance your investment experience on pdfFiller. Document comparison tools are essential for understanding changes between versions, while risk assessment calculators can assist in determining your risk appetite. Additionally, portfolio performance trackers allow you to monitor your investments' progress, ensuring that you are on track toward achieving your goals.

These tools integrate seamlessly with your managed portfolio journey, providing insights and analytics that empower you to make informed decisions.

Final thoughts on your managed portfolio service journey

As you prepare for your first investment experience, remember that building a solid relationship with your financial advisor is crucial. Open dialogue encourages transparency and trust, allowing for a more fruitful partnership in managing your portfolio.

Also, investing is a continuous learning process. Stay engaged and be willing to adapt as markets change to remain aligned with your objectives and strategies. This proactive approach will bolster your confidence and pave the way for a successful investment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit managed portfolio service application on a smartphone?

How do I fill out the managed portfolio service application form on my smartphone?

How do I fill out managed portfolio service application on an Android device?

What is managed portfolio service application?

Who is required to file managed portfolio service application?

How to fill out managed portfolio service application?

What is the purpose of managed portfolio service application?

What information must be reported on managed portfolio service application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.