Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out irs form 433- f

Who needs irs form 433- f?

IRS Form 433-F: Comprehensive How-to Guide

Understanding IRS Form 433-F

IRS Form 433-F is a crucial document for taxpayers seeking assistance with their tax liabilities. This form is primarily a Collection Information Statement, which provides the IRS with in-depth financial information about your income, expense, and assets. The primary purpose of Form 433-F is to assist individuals in negotiating tax relief options, such as installment agreements or offers in compromise.

Understanding the importance of IRS Form 433-F is essential for any taxpayer facing financial hardship. It acts as a declaration of financial standing presented to the IRS to facilitate debt resolution. Ultimately, the information submitted can significantly affect the outcome of any relief application.

Form 433-F is required by individuals who owe back taxes, are facing liens, or wish to start discussions with the IRS regarding their tax obligations. If your finances have taken a downturn and you're unable to pay your tax debts, this form is your gateway to negotiating a manageable solution.

When to use IRS Form 433-F

IRS Form 433-F must be utilized in various scenarios where taxpayers find themselves in financial distress. Situations that necessitate the completion of this form include applying for an Installment Agreement, an Offer in Compromise, or if you anticipate a potential lien or levy due to unpaid taxes. Additionally, you may need this form when communicating with the IRS about your ability to pay your liabilities.

It is crucial to differentiate IRS Form 433-F from similar forms like Form 433-A and Form 433-B. While Form 433-F is generally smaller and designed for individual taxpayers, Form 433-A applies to individuals with more complex financial circumstances, such as self-employed individuals. On the other hand, Form 433-B is tailored for business entities, requiring additional documentation and financial details.

Preparing to fill out IRS Form 433-F

Before tackling IRS Form 433-F, gathering the essential documents and financial information is crucial. You'll need to compile any and all documentation detailing your financial status, including income statements, bank statements, and records of your monthly expenses. This includes pay stubs, rental agreements, and any relevant tax information that will substantiate your claims.

It's equally important to understand IRS financial standards for expenses and necessary living costs. Knowing these benchmarks will help ensure you accurately report your financial situation. For instance, understanding the allowable living expenses associated with families of different sizes—or particular regional standards—will help paint a true picture of your financial health.

Step-by-step guide to completing IRS Form 433-F

Section A: Personal information

In this section, provide personal details such as your name, address, and Social Security number. It is essential to ensure this information is accurate, as any discrepancies can prolong the processing of your form.

Section B: Employment and income

Next, report your current employment status, including your employer's name, address, and type of employment. You must also list all sources of income, including wages, self-employment, or other non-traditional income streams like alimony or government assistance.

Section : Banking and asset information

Here, you will need to detail your bank accounts and any assets you own, such as vehicles, real estate, or savings accounts. This section requires a comprehensive view of your financial holdings.

Section : Monthly income and expenses

Categorizing your monthly income and necessary living expenses is a vital part of this form. In this section, accurately describe your typical monthly expenses, ensuring to itemize necessities such as rent/mortgage, utilities, groceries, and transportation.

Section E: Debts and obligations

Lastly, you will provide a breakdown of your outstanding debts. This includes credit cards, loans, and any other liabilities that may impact your financial standing. A thorough list helps the IRS gauge your financial capacity and how you may handle tax obligations.

Common mistakes to avoid when filing Form 433-F

Submitting IRS Form 433-F can be straightforward, but common pitfalls can lead to unnecessary delays. One such misstep is submitting inaccurate information; ensure all figures and details reflect your financial situation honestly, as discrepancies can lead to penalties or denials of relief applications.

Another mistake includes omitting necessary attachments. Supporting documents, such as income statements or tax documents, create credibility for your claims. Lastly, stay aware of the timing of your submission—filing late can impact your standing with the IRS and hinder your relief options.

Tips for successful submission of Form 433-F

To enhance the likelihood of a smooth approval process, always double-check all entries for accuracy, consistency, and completeness before submitting your IRS Form 433-F. A meticulous review minimizes the chances of errors that may necessitate clarification from the IRS.

Consider submitting the form using certified mail to ensure that you have proof of submission. This adds an extra layer of security, confirming that the IRS received your documentation. Lastly, if you're feeling overwhelmed, enlisting the help of a tax professional can provide valuable insight and assist you through the process of negotiating tax relief.

FAQs surrounding IRS Form 433-F

Navigating IRS Form 433-F can raise several questions, particularly around submission and processing. One common concern is whether you can submit Form 433-F online. As of now, the form needs to be submitted by mail, so you’ll need to physically send it to the appropriate IRS address.

Another frequent inquiry is the potential outcomes if you don’t file Form 433-F. Failing to file could lead to enforced collections actions, including wage garnishment or bank levies. Processing time for the IRS can vary; however, expect a few weeks for verification once the form is submitted.

While it's possible to complete the form independently, consulting with a tax professional can simplify the process and improve the accuracy of your submission. Lastly, many taxpayers wonder why both forms 433-F and 433-D might be requested; this is often due to differing requirements for information based on the type of relief sought.

Navigating IRS communication

Once IRS Form 433-F is submitted, it's essential to understand how to communicate effectively with the IRS regarding your tax situation. The IRS may send notices related to your application, requesting clarifications or additional documentation. Always respond promptly to any inquiries, as promptness can help demonstrate your commitment to resolving tax issues.

Maintain records of all correspondence with the IRS, including date, time, and individuals you spoke with, as this information could be beneficial in future communications. Clear documentation helps both you and the IRS navigate your case without unnecessary confusion.

Advanced considerations

In some cases, you may find yourself exceeding the allowable expenses as determined by the IRS. If this occurs, it's crucial to justify these additional expenses correctly with solid documentation to show why your situation is unique. Adapting your approach while filing can make a significant difference, especially when trying to demonstrate financial need effectively.

Case studies reveal individuals who have successfully utilized Form 433-F range from wage earners facing temporary hardships to self-employed individuals experiencing inconsistent income. Understanding their strategies can provide valuable lessons to others in similar situations, from meticulous preparation to seeking professional guidance.

Conclusion: The impact of properly filing IRS Form 433-F

Filing IRS Form 433-F accurately carries significant weight in obtaining tax relief. Ensuring your submission is complete and truthful not only paves the way for potential agreements with the IRS but also brings peace of mind knowing you’ve taken steps toward financial resolution. A responsible and informed approach to filling out this form can lead to significant impact.

Mastering the complexities of IRS Form 433-F can lead to greater financial harmony, allowing individuals to navigate their obligations responsibly while seeking relief in challenging times.

Resources for filling out IRS Form 433-F

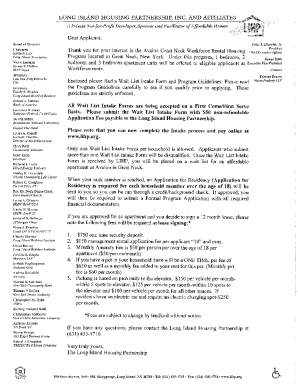

For comprehensive guidance, links to IRS websites and official instructions can be a valuable resource when filling out IRS Form 433-F. Platforms like pdfFiller provide tools and templates that streamline the document management process, offering services for editing, signing, and managing this crucial form securely online.

Additionally, various support services are available that specifically cater to tax relief needs, whether you require assistance in document preparation or negotiating with the IRS.

Related topics to explore

Exploring strategies for effective tax debt management can provide further insights into navigating similar issues. Understanding other IRS forms relevant to tax relief applications, as well as gaining insight into IRS collection procedures, will prepare you to handle any future tax-related challenges with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdffiller form?

How do I execute pdffiller form online?

Can I edit pdffiller form on an Android device?

What is irs form 433- f?

Who is required to file irs form 433- f?

How to fill out irs form 433- f?

What is the purpose of irs form 433- f?

What information must be reported on irs form 433- f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.