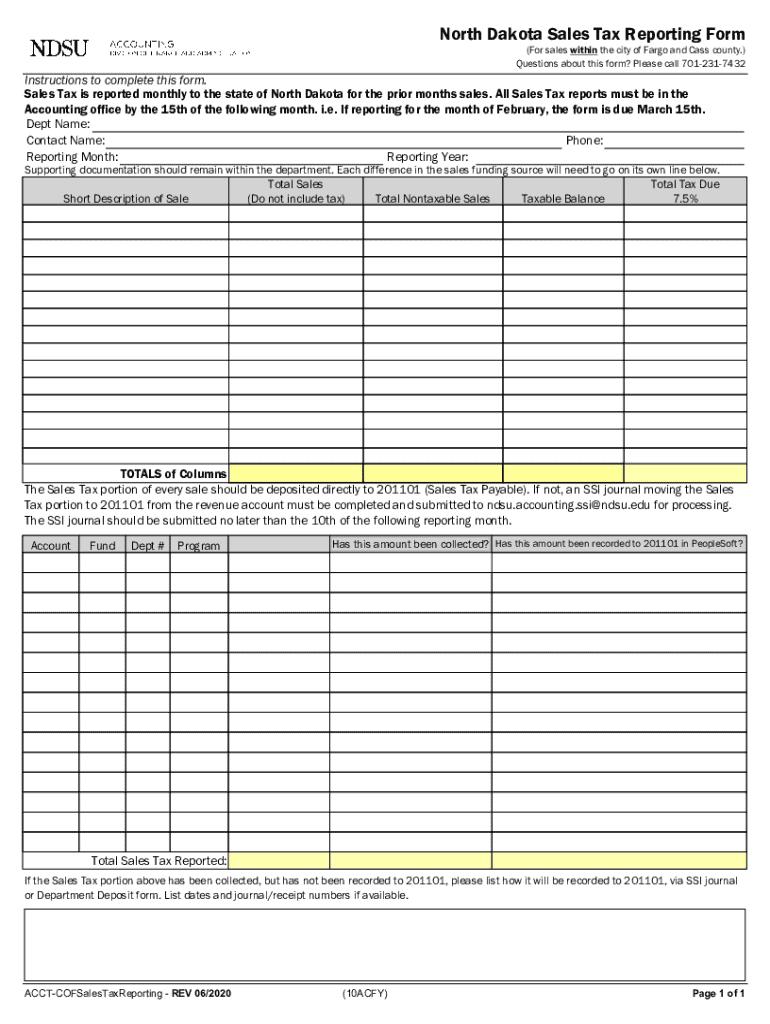

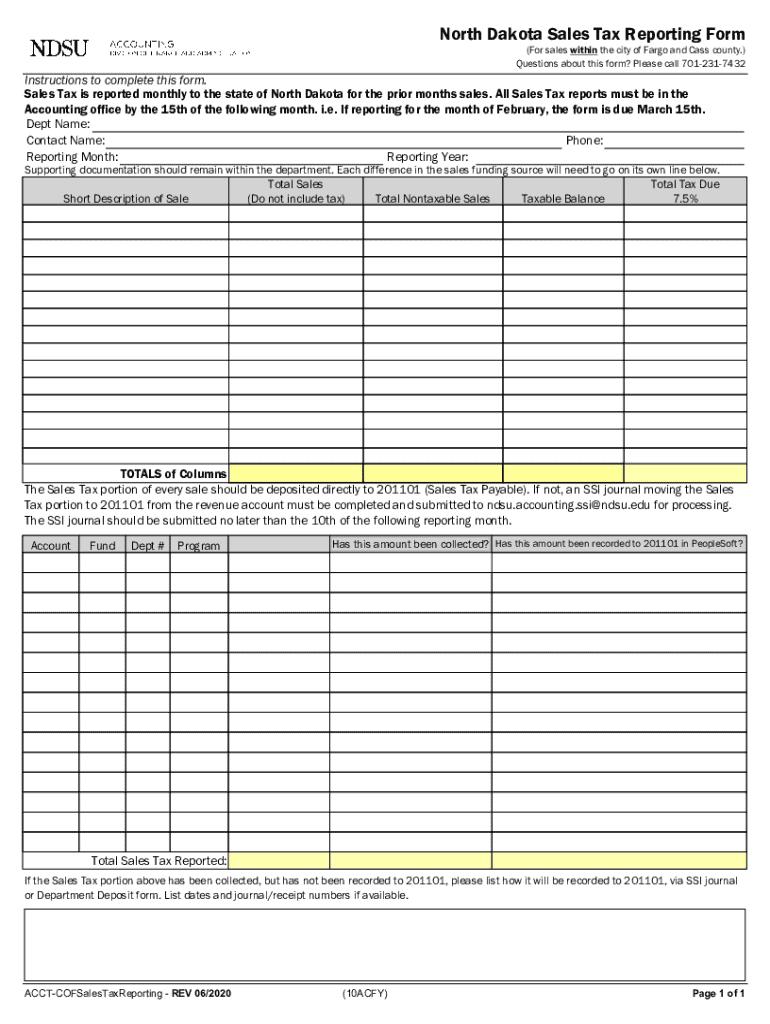

Get the free North Dakota Sales Tax Reporting Form

Get, Create, Make and Sign north dakota sales tax

How to edit north dakota sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north dakota sales tax

How to fill out north dakota sales tax

Who needs north dakota sales tax?

A Comprehensive Guide to North Dakota Sales Tax Form

Understanding North Dakota sales tax

Sales tax in North Dakota is a critical source of revenue for the state, collected on the sale of goods and certain services. The sales tax serves not only to fund state services but also aids in infrastructure, education, and public safety programs. It essentially allows local governments to function efficiently and offer various services to citizens and businesses.

As of October 2023, the statewide base sales tax rate in North Dakota is 5%, with local jurisdictions having the ability to impose additional sales taxes. This means that total sales tax rates can vary by location, making understanding the nuances of these taxes vital for businesses operating within the state.

Navigating North Dakota sales tax forms

Choosing the correct sales tax form is essential for compliance and for avoiding issues during audits or discrepancies with reported sales. North Dakota offers several forms to cater to various tax-related needs, each of which plays a specific role in the sales tax process.

How to apply for a North Dakota sales tax permit

Applying for a sales tax permit in North Dakota involves a straightforward process that can be completed online. Follow these steps to ensure your application is accurate and compliant.

Using pdfFiller can simplify this process, allowing you to utilize cloud-based tools for seamless document management from anywhere.

Filing sales tax returns in North Dakota

Filing timely sales tax returns is crucial for compliance with North Dakota laws. The process involves several steps to ensure accuracy and adherence to deadlines.

Be mindful of important deadlines to avoid penalties. Utilize interactive tools, such as those offered by pdfFiller, to assist with calculations and ensure accurate submissions.

Understanding sales tax exemptions

Certain sales and organizations qualify for exemptions from sales tax under North Dakota law. Understanding these exemptions can save businesses significant amounts of money and ensure compliance.

To apply for an exemption certificate, you must accurately complete the North Dakota Exempt Certificate form and provide it to your supplier at the time of purchase.

Local taxes and variations

In addition to state sales tax, various cities and counties may impose their own taxes, resulting in a layered taxation system. Understanding these local taxes is essential for businesses operating in multiple locations within North Dakota.

For example, cities like Fargo and Bismarck have specific additional taxes, which can raise the total sales tax rate above the statewide base rate. Businesses must be sure to collect the correct amount based on their transaction location.

Special forms may be required for reporting local taxes, and pdfFiller provides tools to help manage these variations efficiently.

Special events and sales tax considerations

For vendors participating in events such as fairs, festivals, or trade shows in North Dakota, understanding sales tax implications is essential. Specific guidelines govern temporary sales, requiring vendors to be aware of local tax rates and compliance.

These measures help maintain compliance while allowing vendors to focus on business activities during events.

Addressing common issues in sales tax management

Common mistakes when dealing with sales tax forms can lead to audits and penalties. Being aware of frequent errors can help you navigate this complex territory.

In case of an audit, prepare by maintaining thorough records and understanding your submission process. Addressing frequently asked questions can also guide you through any uncertainties.

Tools and resources for managing sales tax

Utilizing comprehensive tools like pdfFiller can greatly enhance your experience when dealing with tax forms. The platform offers a suite of features designed to improve the efficiency of the forms process.

These features empower businesses to streamline their document management, making tax compliance much more manageable.

Moving towards a digital tax filing system

Transitioning to electronic filing can offer various advantages, including reduced paper waste, lower filing errors, and quicker processing times. As businesses increasingly move online, adapting to digital systems is not only efficient but also essential.

To move towards digital filing, ensure you have all necessary forms accessible online through verified platforms like pdfFiller, which supports this transition effortlessly.

Staying informed about future trends, including automation and integration of AI in tax management, can prepare businesses for upcoming changes in the landscape.

North Dakota sales tax responsibilities for remote sellers

For remote sellers operating in North Dakota, understanding sales tax obligations is crucial given the state's nexus laws. If your business ships goods to North Dakota residents, you are required to collect and remit sales tax.

Remote sellers must ensure they follow the correct filing schedules and reporting requirements, similar to those required for in-state sellers. It is vital to keep records of all transactions to maintain compliance.

Updates in sales tax laws in North Dakota

Sales tax laws can frequently change due to legislation or judicial interpretations. Staying updated on recent changes can nonetheless be challenging yet vital for compliance.

As of 2023, there have been noteworthy adjustments in exemption categories and reporting procedures. Businesses should proactively seek resources or utilize tools provided by pdfFiller to keep abreast of modifications in tax regulations to avoid non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my north dakota sales tax directly from Gmail?

How do I complete north dakota sales tax on an iOS device?

How do I complete north dakota sales tax on an Android device?

What is north dakota sales tax?

Who is required to file north dakota sales tax?

How to fill out north dakota sales tax?

What is the purpose of north dakota sales tax?

What information must be reported on north dakota sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.