Get the free Tax Law - Wisconsin State Law Library - docs legis wisconsin

Get, Create, Make and Sign tax law - wisconsin

How to edit tax law - wisconsin online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax law - wisconsin

How to fill out tax law - wisconsin

Who needs tax law - wisconsin?

Tax Law - Wisconsin Form: Your Complete Guide to Compliance and Filing

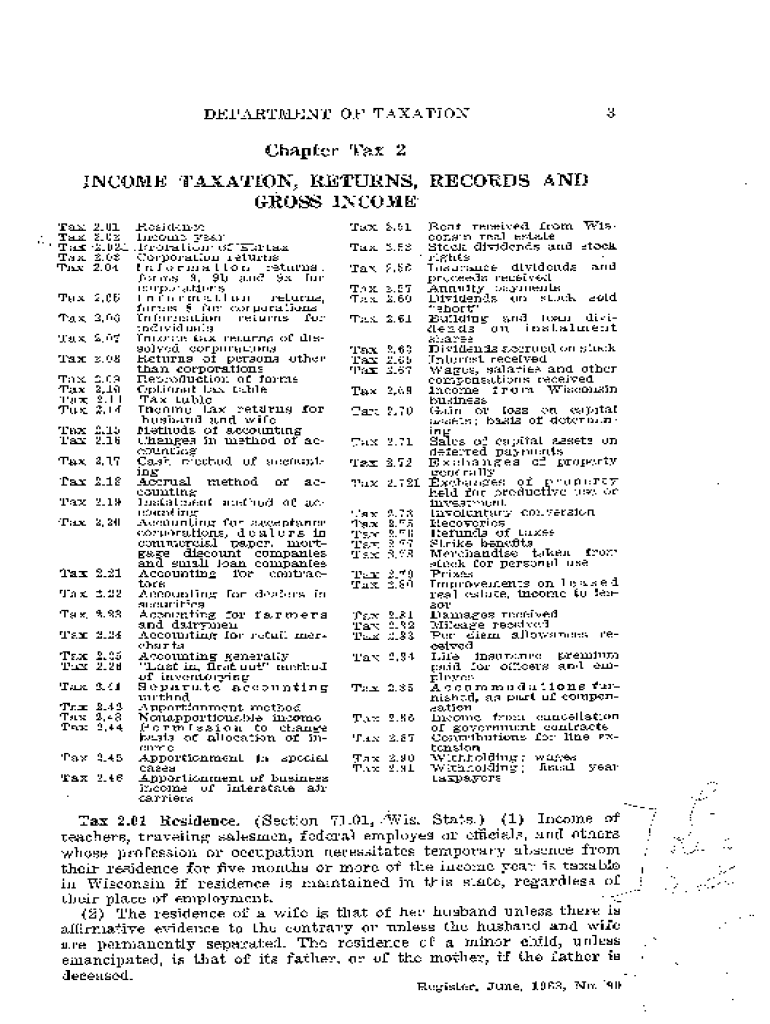

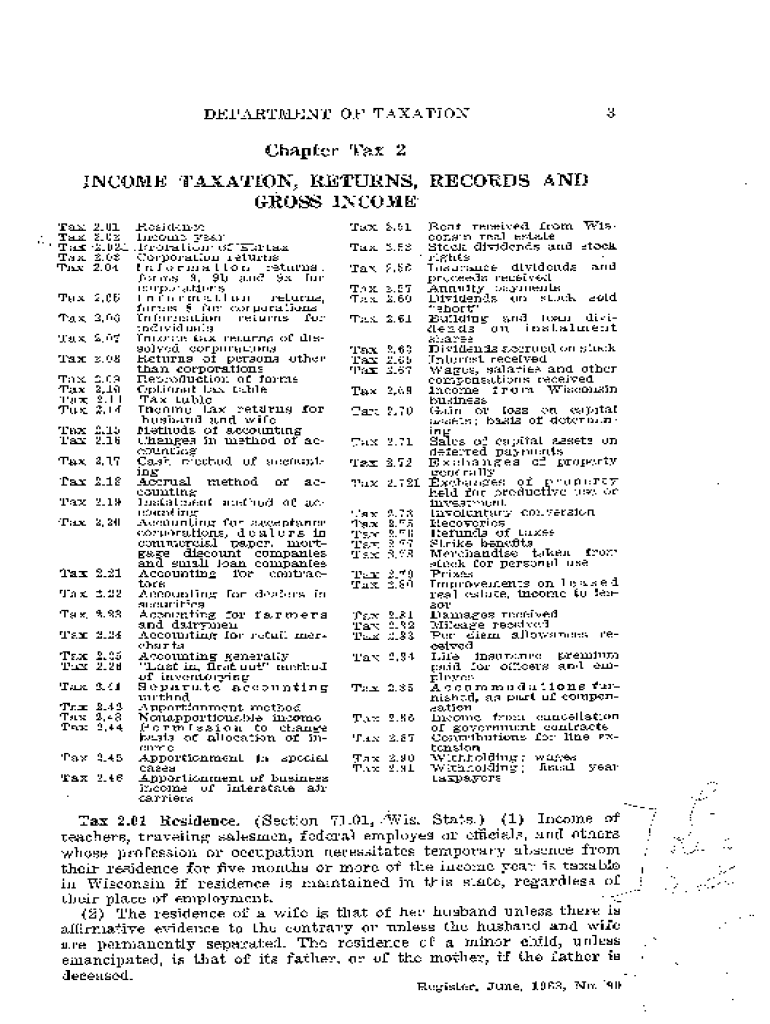

Understanding Wisconsin tax law

Wisconsin's tax laws are designed to provide a framework for collecting revenue that funds state services while encouraging economic growth. The Wisconsin Department of Revenue is the primary authority that governs tax regulations in the state. Adhering to these laws is crucial not only to avoid penalties but also to benefit from available deductions and credits.

Tax laws impact individuals and businesses in various ways. For individuals, understanding state income tax brackets can significantly affect your overall tax bill. For businesses, recognizing the nuances of corporate tax regulations, sales and use taxes, and property taxes is essential for compliance and planning. Staying informed about these laws ensures you can navigate the complexities of filing accurately.

Types of tax forms in Wisconsin

Wisconsin offers a variety of tax forms tailored to different tax obligations. Understanding which forms to use is vital to ensure accurate reporting. The most common types include income tax forms, sales and use tax forms, and property tax forms, among others.

### Income Tax Forms: These are essential for both individuals and corporations. Individual income tax forms include Wisconsin Form 1 for residents and Form 1NPR for nonresidents. Corporations use Wisconsin Form 2 to report corporate income. Additionally, S corporations and partnerships file Form 3 and 3A respectively. Sales and use tax forms are required for businesses collecting sales tax, while property tax forms are used to assess local property taxes.

Essential resources for Wisconsin tax forms

Accessing the necessary tax forms is clear-cut when you leverage the resources provided by the Wisconsin Department of Revenue's official website. The website hosts a comprehensive forms repository that allows users to find, download, and print forms seamlessly.

To navigate the forms repository effectively, visit the Wisconsin Department of Revenue website and look for the 'Forms' section. Here, you'll find categories such as Individual Income Taxes, Corporate Taxes, and Sales and Use Taxes. It’s vital to choose the right category to avoid any misfilings.

Filling out Wisconsin tax forms: step-by-step guide

Filling out your Wisconsin tax forms can be straightforward with the right approach. Start by gathering all necessary documentation, including W-2s, 1099s, and any receipts for deductions. Ensuring you have this information organized will streamline the process.

When filling out individual forms like Wisconsin Form 1, pay attention to the sections detailing credits and deductions. Many individuals overlook opportunities for deductions, such as medical expenses and property taxes. Form 2 for corporations also requires meticulous attention, as it involves calculating net income, deductions, and credits.

Editing and managing your Wisconsin tax forms

Using digital tools like pdfFiller can significantly enhance your ability to edit tax forms. With pdfFiller, you can upload your completed forms and make necessary adjustments easily. This digital platform allows users to not only edit but also sign and collaborate on forms without the hassle of dealing with paper.

To use pdfFiller, simply upload a PDF version of your tax form, and use the editing features to fill out information or correct any mistakes. You can also sign documents electronically, which saves time and keeps your filing compliant.

Tracking your tax filing status

After submitting your forms, knowing your filing status is essential for peace of mind. The Wisconsin Department of Revenue allows you to check your filing status online. This helps ensure your return has been processed correctly and identifies any issues that may need resolution.

To check your status, visit the Wisconsin Department of Revenue’s website and use their online tool, which provides real-time updates. If you encounter problems, such as a missing return, they provide resources to assist taxpayers in rectifying issues swiftly.

Collaborating on tax forms with teams

If your tax preparation involves a team, leveraging tools like pdfFiller can optimize collaboration. With its cloud-based features, multiple team members can access, edit, and review documents simultaneously, ensuring everyone is on the same page.

Managing access and permissions is another critical function, as you can designate who can edit, view, or approve documents. This minimizes the risk of unauthorized alterations and enhances the security of sensitive tax information.

Tax law changes and updates in Wisconsin

Tax laws are not static; changes in legislation can significantly affect filing processes and requirements. Staying informed about recent modifications can help you adapt your filing accordingly and ensure compliance with current laws.

For example, Wisconsin has seen modifications in its income tax brackets and regulations regarding sales taxes. Reviewing updates regularly on the Wisconsin Department of Revenue’s site can keep you aware of what’s new and how it might impact your tax return for previous or upcoming years.

Frequently asked questions about Wisconsin tax forms and law

Navigating tax filing can lead to many questions, especially concerning deadlines and consequences of missed submissions. Wisconsin law stipulates specific deadlines for various forms, and being aware of these can save you from unnecessary stress and penalties.

In cases of missed deadlines, there are processes to follow, such as filing for an extension or amending returns. Additionally, understanding the framework surrounding tax audits in Wisconsin can prepare you for potential inquiries from the Department of Revenue.

Further learning and research opportunities

For those seeking deeper knowledge of Wisconsin tax law, various resources are available. The state Department of Revenue provides literature and online resources that can enhance understanding of tax complications.

Local libraries also typically contain tax law guides and publications, while websites like pdfFiller offer templates and instructional content that help demystify tax forms and the filing process. Engaging with these materials supports ongoing education and preparedness.

Contact information for Wisconsin tax support

When faced with complexities in filing or questions regarding your tax situation, seeking professional help is essential. The Wisconsin Department of Revenue provides support through various channels.

You can also find valuable online resources and FAQs on their official site that address common tax concerns. Understanding where to seek help is vital for accurate and compliant tax submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax law - wisconsin to be eSigned by others?

How can I get tax law - wisconsin?

How do I complete tax law - wisconsin on an iOS device?

What is tax law - wisconsin?

Who is required to file tax law - wisconsin?

How to fill out tax law - wisconsin?

What is the purpose of tax law - wisconsin?

What information must be reported on tax law - wisconsin?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.