Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

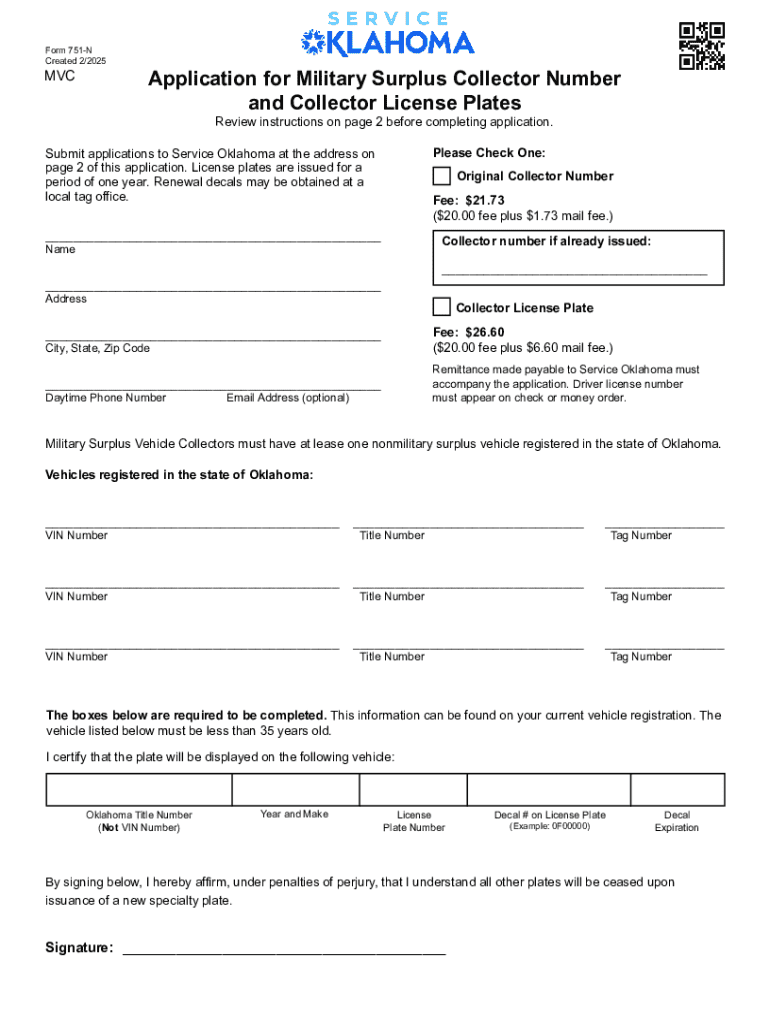

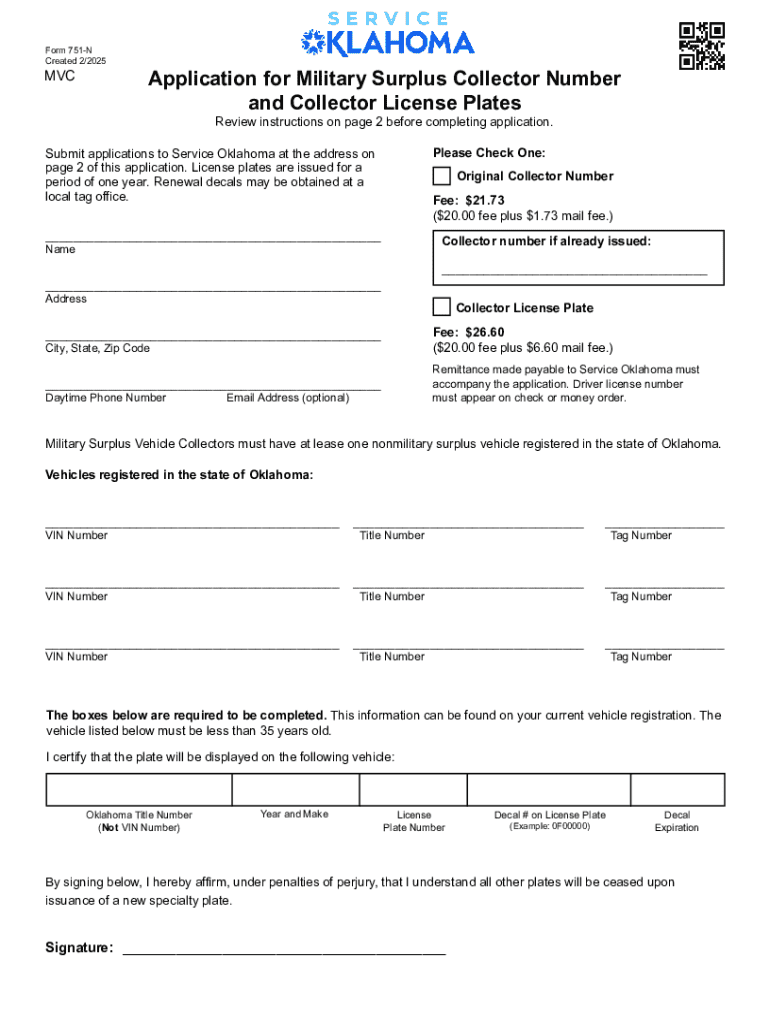

How to fill out form 751-n

Who needs form 751-n?

Comprehensive Guide to Filling Out Form 751-N

Understanding form 751-N

Form 751-N is a crucial document used primarily for requesting a refund for overpaid taxes or seeking an adjustment concerning employment status. This form serves a specific purpose within the realm of tax administration, particularly for individuals and entities that have inadvertently paid excess taxes. Understanding its nuances is essential for effective tax compliance and financial management.

Those who should consider utilizing Form 751-N include individuals who have encountered discrepancies in their tax records or believe they are entitled to a refund due to overpayments. Moreover, businesses that have had changes in employee compensation often need to submit this form to rectify taxation issues arising from these changes. Knowing the rules and regulations surrounding this form is vital to ensure compliance and avoid potential penalties.

Preparing to complete form 751-N

Before diving into the specifics of completing Form 751-N, it’s essential to gather all the necessary documents and information. This preparation phase is crucial for ensuring a smooth filling process and avoiding errors that could delay your submission.

Key documents required typically include tax returns for the year in question, pay stubs, W-2 forms, and any correspondence with tax authorities. It's advisable to have these documents organized and easily accessible to streamline your filling process. Furthermore, careful organization of your financial records can also prevent mistakes and ensure you present accurate information.

For successful preparation, create a checklist based on the required documents to ensure nothing is overlooked. Use tools such as pdfFiller to help in organizing your documents digitally, thereby facilitating easier access during the form completion process.

Step-by-step instructions for filling out form 751-N

Filling out Form 751-N can seem daunting; however, following a systematic approach makes the task manageable. Here’s a breakdown of the sections you will encounter.

Section 1: Personal information

Start by entering your personal information accurately. This section typically requires your full name, address, Social Security Number (SSN), and date of birth. Ensure all details are typed correctly, as mistakes in this section could lead to complications later.

Section 2: Employment information

Next, document your employment information. Include your employer's name, address, and the duration of your employment. Pay close attention to the dates to avoid discrepancies; common mistakes here include incorrect employment periods or misspellings of employer names.

Section 3: Tax information

This section addresses your income and any deductions. Being precise in reporting your income is essential, as inconsistencies can lead to audits or refund delays. List any deductions you are claiming, and keep in mind that accurate records will support your claims.

Section 4: Additional documentation

Finally, you will need to include supporting documentation. This may consist of additional tax forms or proof of your claims. Organize these documents meticulously to ensure a clean and professional presentation.

Editing and reviewing your form 751-N

Once your Form 751-N is filled out, it's crucial to revise it before submission. Reviewing your form helps catch errors that could affect your application’s processing time. A meticulous check of all sections will not only fortify your application but also serve to reassure you of its accuracy.

For ease of editing, consider using pdfFiller, which offers interactive editing tools that simplify the review process. This platform allows for collaborative features, enabling team members to provide feedback for collective accuracy, thereby enhancing the overall quality of your submission.

Signing and submitting form 751-N

After finalizing your edits, you will then need to sign your Form 751-N. There are several options for electronic signatures available, and understanding the eSign process is vital for compliance. Be sure to follow the instructions for electronic signing carefully to avoid invalidating your form.

When it comes to submission, you can choose between submitting your form online or sending it via postal mail. Each method has its advantages, but online submission tends to be faster. Be mindful of any important deadlines regarding your submission to ensure you remain compliant with tax regulations.

Managing your submitted form 751-N

After submitting your Form 751-N, the next step is managing your submission status. You can typically track your submission online through the tax authority's website, allowing you to stay updated on your refund status or any additional requests for information.

Common issues post-submission may include delayed responses or requests for additional documentation. Preparing in advance for these scenarios by knowing where to find and retrieve necessary documents can save time and reduce stress. Utilizing pdfFiller's secure storage option allows easy access to your forms if you need to retrieve them swiftly.

Frequently asked questions about form 751-N

Prospective filers often have queries related to the process of filling out Form 751-N. Common questions revolve around understanding specific fields in the form or addressing errors made during submission. Knowing where to find resources can make the process smoother.

For troubleshooting issues, check up-to-date FAQs provided by the IRS or your state’s tax authority. Community forums and tax professionals can also provide valuable support, helping you navigate specific challenges you might encounter.

Real-life applications and case studies

Learning from others can be invaluable when filling out Form 751-N. Success stories of individuals who navigated the process efficiently demonstrate the positives of understanding the form's intricacies. These experiences reveal how proper documentation and thorough preparation can lead to smoother refunds and resolutions.

Moreover, businesses can benefit from documenting their learning experiences with Form 751-N to develop protocols for handling future complications in tax matters. This proactive approach aids in building a more knowledgeable team adept at managing taxes effectively.

Leveraging pdfFiller for seamless form management

pdfFiller offers an array of tools that streamline the process of managing Form 751-N. Its cloud-based platform allows users to edit, eSign, collaborate, and store documents securely all in one place. This holistic approach to document solutions enhances productivity and mitigates the stress attached to document management.

The integration of pdfFiller with other productivity tools means that users can enjoy a seamless experience while managing their forms. By incorporating pdfFiller’s comprehensive functionalities, individuals and teams can ensure they are well-equipped to address their documentation needs efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pdffiller form?

Can I create an eSignature for the pdffiller form in Gmail?

How do I fill out the pdffiller form form on my smartphone?

What is form 751-n?

Who is required to file form 751-n?

How to fill out form 751-n?

What is the purpose of form 751-n?

What information must be reported on form 751-n?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.