Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out schedule 13d

Who needs schedule 13d?

Schedule 13D Form: A Comprehensive How-to Guide

Understanding the Schedule 13D form

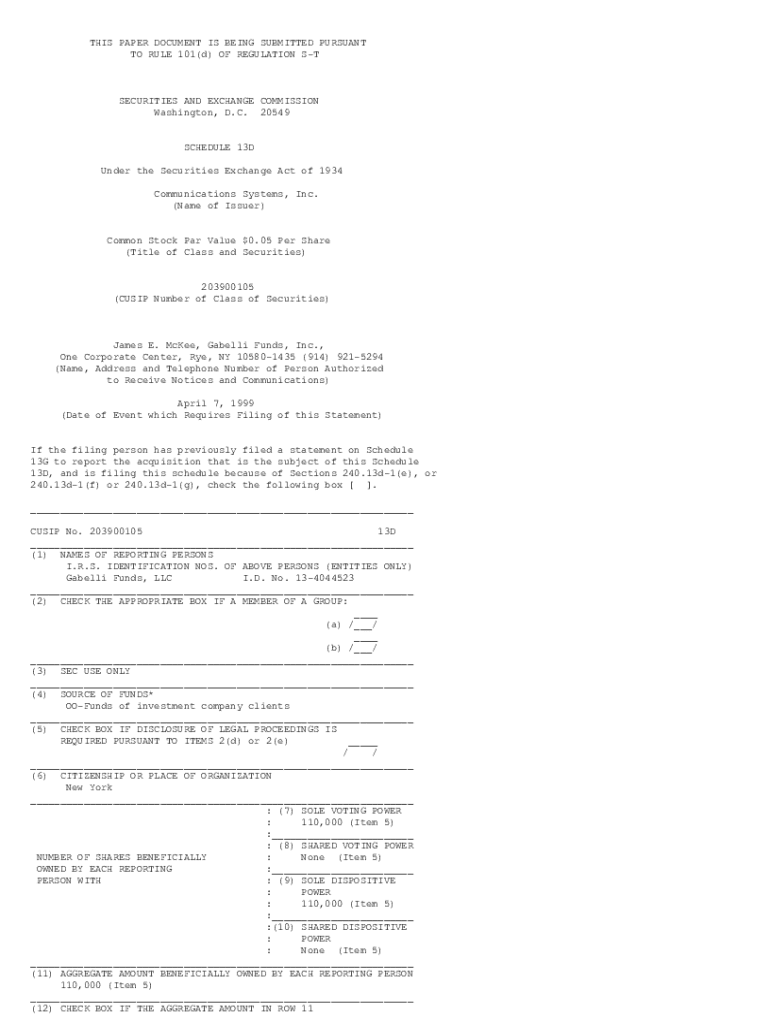

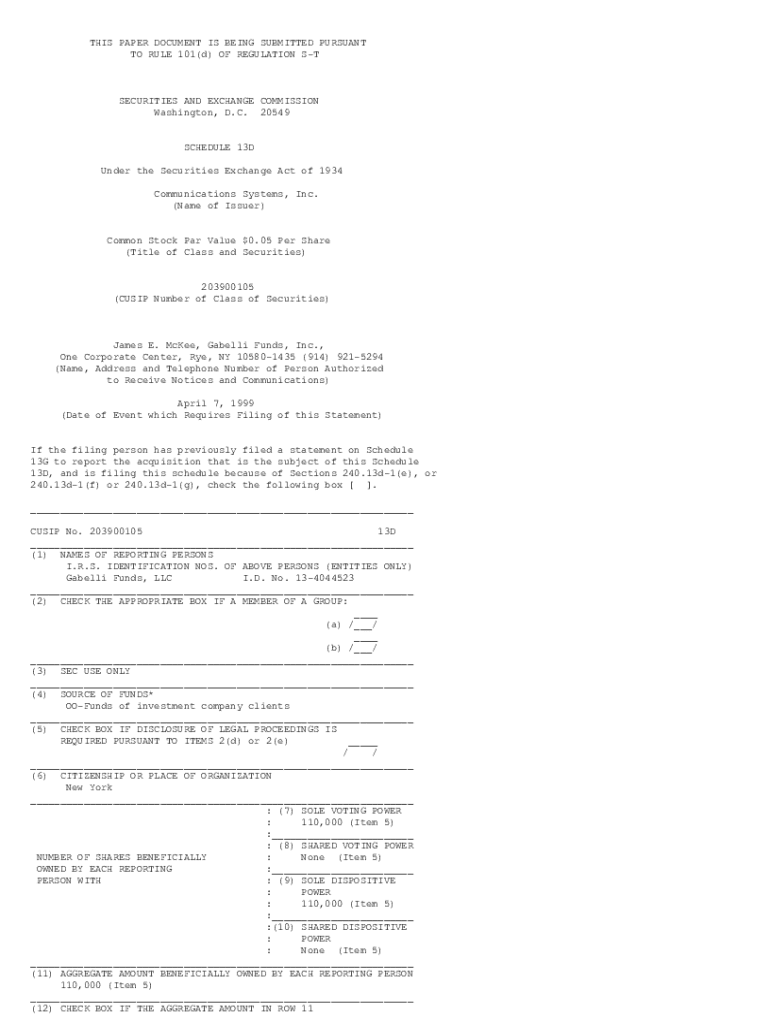

The Schedule 13D form serves as a crucial regulatory document required by the U.S. Securities and Exchange Commission (SEC). Its primary purpose is to disclose significant stake holdings in publicly traded companies. When an individual or entity acquires more than 5% of a company's securities, they must file this form within ten days, providing transparency regarding their ownership and intentions.

The importance of the Schedule 13D form in SEC regulations cannot be overstated. It ensures that investors and the public at large are aware of major shifts in shareholder composition and potential influencing factors related to corporate governance. This disclosure is essential for maintaining fair and transparent trading practices within the financial markets.

Key differences exist between Schedule 13D and Schedule 13G. While both documents are used to report ownership stakes, Schedule 13D is mandated for investors with more than 5% holdings who might influence corporate policy. Conversely, Schedule 13G is a simpler, streamlined filing for passive investors, indicating no intention to influence company operations.

Who needs to file a Schedule 13D?

Filing a Schedule 13D is not an obligation for everyone. Specifically, it is required from individuals or institutions that own more than 5% of a company's outstanding securities. This filing is especially relevant for activists, hedge funds, and other institutional investors who may attempt to influence corporate policy.

The 5% ownership threshold is vital to consider, as anyone exceeding this percentage must act swiftly to submit their filing. Failure to do so can lead to severe consequences, including fines or restrictions on the ability to vote shares.

Key components of a Schedule 13D filing

A Schedule 13D filing comprises several critical sections designed to provide full disclosure regarding the shareholder's plans. Required information includes the identity of the filers, the purpose of the transaction, and relevant financial arrangements. Investors must be thorough, ensuring that all needed disclosures are accurately represented.

Commonly included attachments to a Schedule 13D may feature articles of incorporation, bylaws, contracts, or other pertinent agreements. Additionally, understanding exhibit requirements, such as the need for specific documents that support the disclosure of holdings, is crucial for compliance with SEC regulations.

Steps to fill out the Schedule 13D form

Filling out the Schedule 13D form can seem daunting, but the process can be streamlined by following a few essential steps. Here’s a straightforward guide to ensure successful completion.

Interpreting the Schedule 13D filing

Interpreting a filed Schedule 13D is central to understanding its implications for a company and its shareholders. Investors often come across various terms and jargon within these documents, necessitating a clear understanding. Common terminology, such as 'beneficial ownership,' refers to the rights attached to the securities held, not merely their physical ownership.

Moreover, amendments are frequent as circumstances change, resulting in updated filings. Timely disclosures help ensure that all stakeholders receive accurate information about ownership changes, which can affect market perception and shareholder rights significantly.

The impact of Schedule 13D filings on companies and shareholders

The ramifications of Schedule 13D filings are significant for both companies and shareholders, as they can drastically influence market perception. When a prominent investor files a Schedule 13D, it often prompts a closer look by other investors, analysts, and journalists, which can lead to increased scrutiny and potentially affect stock prices.

Additionally, the rights of shareholders upon a 13D filing can alter fundamentally, especially if the new shareholder intends to effectuate changes in corporate governance or strategy. Such disclosures can raise awareness among other shareholders, prompting dialogue about shareholder advocacy and strategic direction.

Tools and resources for using Schedule 13D form

Managing the complexities of filing a Schedule 13D can be simplified by utilizing effective tools and resources. pdfFiller stands out as a powerful platform that streamlines the document creation process through user-friendly features. It empowers users to easily edit PDF forms, eSign documents, and collaborate across teams without any hurdles.

With interactive tools and templates available, users can work efficiently, ensuring that no step is overlooked during the filing process. The collaborative features enhance team productivity, whether working on a single document or managing multi-party filings.

Common challenges and solutions in filing Schedule 13D

When filing a Schedule 13D, various challenges may arise; however, these can be effectively addressed. One common issue is navigating complex ownership structures, especially pertinent for institutional investors managing multiple funds and investment vehicles. It is essential for each entity to individually evaluate its holdings to ensure compliance.

Avoiding frequent mistakes, such as omitting required disclosures or inaccurately reporting ownership percentages, is critical to ensuring successful filing. Expert guidance can provide valuable insights into best practices, making the process smoother for all parties involved.

Related forms and filings

Understanding the ecosystem of securities filings is vital for effective compliance. While the Schedule 13D form is essential for certain stakeholders, it’s also crucial to recognize related forms. For instance, Schedule 13G is often applicable for passive investors and requires less rigorous reporting.

Determining when to use Schedule 13G instead of Schedule 13D hinges on the investor's intent. Passive investors, intending only to hold shares without influencing corporate governance, will find Schedule 13G more suitable, streamlining their reporting responsibilities.

Supporting services offered by pdfFiller

pdfFiller offers an array of supporting services designed to enhance user experience when filing documents like Schedule 13D. With document management solutions that allow for secure storage and easy retrieval, users can effectively keep track of all related filings.

The platform also includes electronic signatures to satisfy compliance guidelines, essential for validating the authenticity of filed documents. Empowering teams with collaborative features, pdfFiller enables seamless interaction on shared documents, ensuring efficiency and clarity throughout the filing process.

Start the conversation: Connect with experts

Navigating the complexities of filing a Schedule 13D doesn't have to be a solitary journey. Scheduling a consultation with experts can provide personalized guidance, addressing specific concerns and questions you may encounter during the filing process.

Participating in Q&A sessions or webinars can also enrich your understanding of Schedule 13D filings, keeping you informed about regulatory updates and best practices to stay compliant.

Stay engaged: Follow us for updates and insights

Staying informed about developments in securities regulations is key for anyone involved in stock ownership and investment. Subscribing for news updates from authoritative sources ensures you’re always equipped with the latest information regarding regulatory changes affecting filings like the Schedule 13D.

Accessing upcoming webinars and workshops can provide deeper insights into the filing process and the criteria for compliance, empowering you with knowledge to navigate the SEC landscape efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in pdffiller form without leaving Chrome?

How do I edit pdffiller form straight from my smartphone?

How do I fill out pdffiller form on an Android device?

What is schedule 13d?

Who is required to file schedule 13d?

How to fill out schedule 13d?

What is the purpose of schedule 13d?

What information must be reported on schedule 13d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.