Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

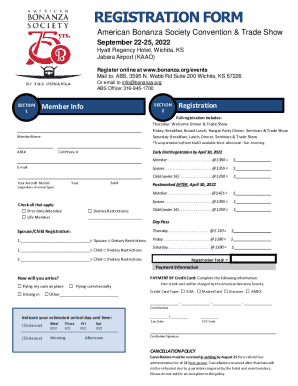

How to fill out 2024-2025 retiree benefits guide

Who needs 2024-2025 retiree benefits guide?

2 Retiree Benefits Guide Form: A Comprehensive Overview

Understanding the 2 retiree benefits guide

The 2 retiree benefits guide is a crucial resource for individuals preparing for retirement or recently transitioned into retirement. This guide outlines all the benefits that retirees can access, providing clarity on essential programs and services that will impact their financial and healthcare decisions.

For current and future retirees, understanding this guide is paramount as it assists them in navigating available options and making informed choices. The ability to parse through sections detailing health insurance, pension funds, and additional perks can significantly affect both short-term well-being and long-term financial security.

Types of benefits covered in the guide

Understanding the different types of benefits covered in the 2 retiree benefits guide is crucial as it allows retirees to make informed decisions regarding their health and financial future. The guide encompasses a range of benefits tailored to address both medical and financial needs.

Health insurance options are a primary focus, highlighting Medicare enrollment processes, supplementary plans, and prescription drug coverage to ensure retirees are adequately covered. Equally important are pension and retirement account insights, detailing how to navigate Social Security benefits along with comparing defined benefit and defined contribution plans.

Additionally, retirees may enjoy various perks, including discounts on services and wellness initiatives aimed at promoting a healthy lifestyle. Knowing what benefits one is eligible for is not just beneficial; it is essential.

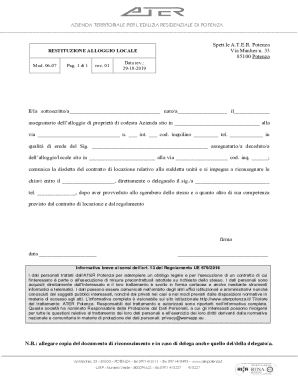

Navigating the 2 retiree benefits guide form

Accessing the 2 retiree benefits guide form is easier than ever, ensuring that retirees have the tools at their fingertips to engage with their benefits. Retirees can find the guide online through pdfFiller’s platform, which is especially designed for seamless access and management.

To start, navigating to the specific page for the guide form on pdfFiller is straightforward. Users simply need to follow the step-by-step instructions for accessing the form online, which includes creating an account if necessary, before proceeding to download or print the guide as needed.

Once you have the form, understanding its layout is essential. Each section is clearly categorized, and annotations are included to clarify the purpose of each field. This breakdown facilitates a more streamlined and manageable completion of the form.

Completing the 2 retiree benefits guide form

Completing the 2 retiree benefits guide form requires attention to detail and an understanding of what information is crucial. First and foremost, essential personal identification details including full names, addresses, and Social Security numbers must be accurate to avoid issues in processing benefits.

Additionally, having a record of one’s employment history handy is beneficial. This includes knowing previous job titles, dates of employment, and employers—information that may be necessary for different benefits, especially when accessing pension or health plans.

Filling out the personal information section is fairly straightforward, but retirees should take care when selecting benefits and coverage options. Each selection can have significant implications in terms of coverage and costs; hence understanding each option is imperative.

Editing and customizing your guide form

pdfFiller offers powerful tools that allow retirees to edit and customize their 2 retiree benefits guide form. Through the intuitive editing interface, users can easily add or delete sections, rearranging the layout to better suit their needs.

Furthermore, inserting text and images can help clarify certain details or personalize the document. Once the form is edited to satisfaction, retirees can choose to save their work in cloud storage, ensuring that their documents are accessible from anywhere, and facilitating collaboration with family or financial advisors.

Signing and submitting the 2 retiree benefits guide form

Once the form is completed and customized, securely signing the 2 retiree benefits guide form is the next step. With pdfFiller's eSignature feature, signing the document is streamlined. Users simply follow the step-by-step eSignature process to securely sign the document, ensuring it’s ready for submission.

Regarding submission, retirees have options for electronic submission through pdfFiller or could opt for traditional mail-in methods. It’s essential to understand the different methods available, as retirees may also want to track their submission status to ensure the form has been received and processed.

FAQs about the 2 retiree benefits guide

Frequently asked questions about the 2 retiree benefits guide address common concerns surrounding eligibility, coverage periods, and enrollment deadlines. Clarifications on these points are vital for ensuring retirees don’t miss out on important opportunities for benefits.

For instance, understanding the nuances of when to enroll in Medicare or how to switch plans can save money and improve healthcare coverage. Many retirees also find it helpful to clarify their eligibility for different types of programs within the guide, allowing them to maximize their benefits and ensure they are covered.

Utilizing additional features of pdfFiller

PDFfiller provides several additional features that go beyond just editing the 2 retiree benefits guide form. Users can take advantage of robust document management tools to organize and store their forms securely, ensuring easy access whenever needed.

Collaboration features also stand out, allowing retirees to work with financial advisors or family members on their documents effectively. Security measures within the platform ensure that all personal information and documentation are protected.

Real user experiences and testimonials

Real user experiences with the 2 retiree benefits guide and pdfFiller showcase the efficiency and effectiveness of this platform. Many retirees have shared success stories illustrating how using the retiree benefits guide enabled them to secure better healthcare coverage and optimize their pension plans.

Feedback on user-friendliness is overwhelmingly positive; retirees often highlight how intuitive the form interface is, allowing even those less familiar with technology to navigate the guide form successfully. These testimonials provide insight into the tangible benefits derived from leveraging pdfFiller's offerings.

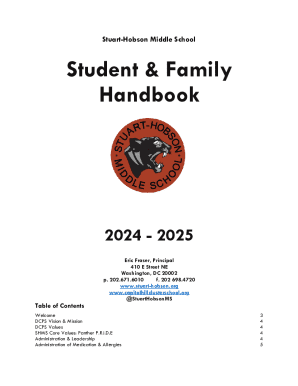

Future updates and staying informed

As benefit requirements and options are subject to change, staying informed post-2025 is crucial for retirees. Monitoring updates to the 2 retiree benefits guide ensures that individuals are aware of any changes that may impact their benefits, especially in relation to enrollment periods and benefit eligibility.

Utilizing resources such as newsletters, official communications, and the pdfFiller platform can enhance understanding and keep retirees engaged. Being proactive about future updates empowers retirees to adapt to changes in their benefits landscape, ensuring their time in retirement is both enjoyable and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

How do I make edits in pdffiller form without leaving Chrome?

Can I sign the pdffiller form electronically in Chrome?

What is retiree benefits guide?

Who is required to file retiree benefits guide?

How to fill out retiree benefits guide?

What is the purpose of retiree benefits guide?

What information must be reported on retiree benefits guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.