Get the free Business Loan Application Form

Get, Create, Make and Sign business loan application form

Editing business loan application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application form

How to fill out business loan application form

Who needs business loan application form?

The Complete Guide to Business Loan Application Forms

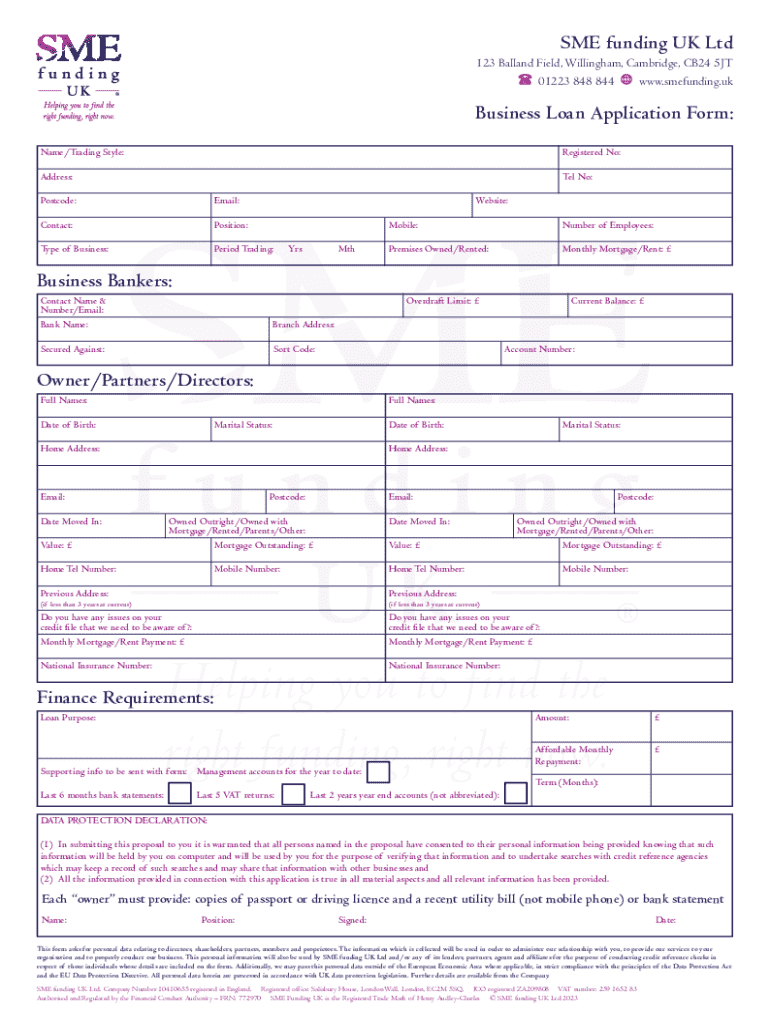

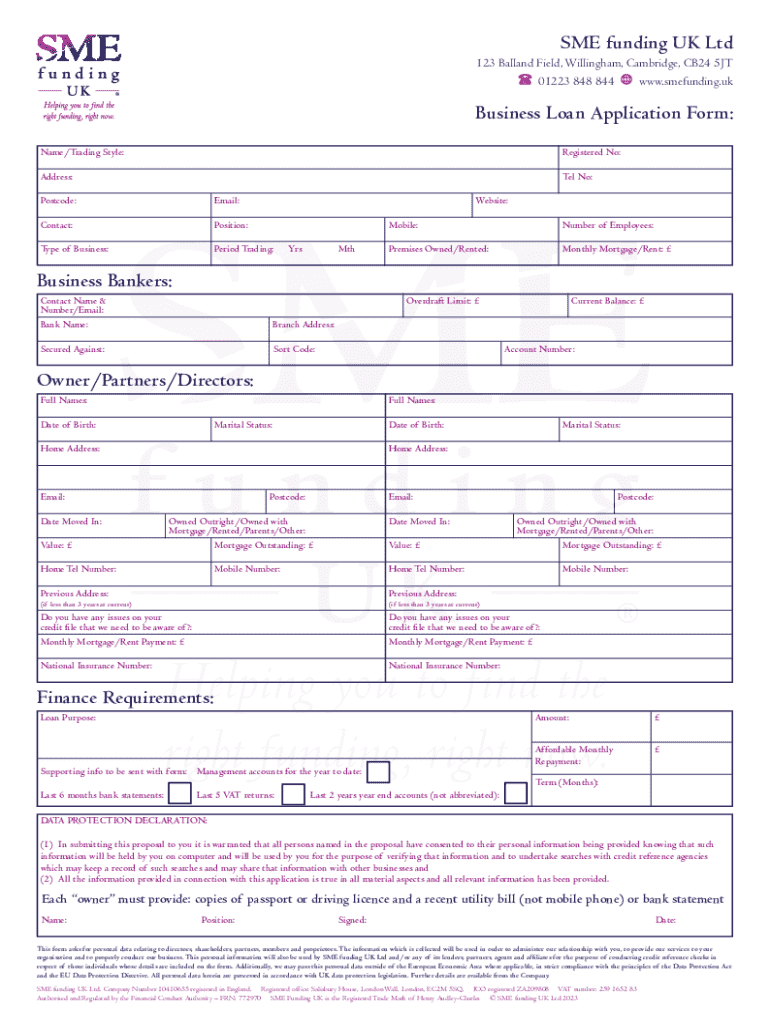

Understanding the business loan application process

A business loan is a sum of money borrowed to support the purchase of equipment, inventory, or other expenses related to operating a business. Understanding the business loan application process is vital for entrepreneurs seeking capital to fuel their growth or manage their operations.

The business loan application form plays an essential role in this process, serving as the first step in establishing a relationship with a lender. It collects necessary information about your business, its financial health, and your funding requirements.

Several types of business loans are available, each catering to different needs. Understanding these can help you choose the best approach for your business.

Preparing for the application

Before filling out a business loan application form, it’s crucial to assess your business financial needs. Determine the specific amount you require, what the funds will be used for, and how it will impact your business operations. Be realistic with your estimates as lenders value transparency and accuracy.

Gathering key documents is the next step. Each lender may have different requirements, but commonly required documents include:

Additionally, understanding your credit score and its impact on your application is essential. A higher credit score increases your chances of approval and can lead to better loan terms.

Navigating the business loan application form

Once you have the necessary documents, you can proceed to fill out the business loan application form. Familiarizing yourself with its structure will make the process smoother.

Typically, the form consists of several sections that collect essential information from your business.

Common mistakes to avoid while filling out the form include rushing through sections, failing to provide documentation, and not being forthright with information. Accuracy and thoroughness can enhance your application’s chances of success.

Editing and managing your application with pdfFiller

Utilizing pdfFiller can simplify the process of editing and managing your business loan application. The cloud-based platform allows you to make real-time changes, ensuring your application is always up to date.

Collaborating with team members is also effortless. You can share your application and work together on revisions and feedback seamlessly.

Once finalized, you can securely eSign your application through the platform, eliminating the hassle of printing and scanning documents. Moreover, pdfFiller allows you to save and store your application in the cloud for easy access and retrieval.

After submission: next steps

After submitting your business loan application form, it’s crucial to understand what happens next. Lenders typically conduct a thorough review of your application, including assessing your financial health and creditworthiness.

Being prepared for a lender follow-up is essential. This may include providing additional documentation or clarification regarding your application. Keeping open lines of communication with your lender can strengthen your case and build trust.

If your application is approved, understand the terms and conditions of the loan clearly before closing the deal. Ensure you’re comfortable with the repayment schedule and interest rates to avoid future financial strain.

Frequently asked questions (FAQs)

The business loan application process raises many questions. Here are answers to some commonly asked concerns:

Conclusion

Accurate information is critical when filling out a business loan application form. Take your time to ensure every detail is correct, as inconsistencies can negatively affect your application.

By following these guidelines, leveraging tools like pdfFiller, and staying organized, you can enhance your odds of success in obtaining the financing needed for your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business loan application form?

How do I fill out the business loan application form form on my smartphone?

How do I complete business loan application form on an Android device?

What is business loan application form?

Who is required to file business loan application form?

How to fill out business loan application form?

What is the purpose of business loan application form?

What information must be reported on business loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.