Get the free E 7-uk-2021

Get, Create, Make and Sign e 7-uk-2021

Editing e 7-uk-2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e 7-uk-2021

How to fill out e 7-uk-2021

Who needs e 7-uk-2021?

A Comprehensive Guide to the E 7-UK-2021 Form

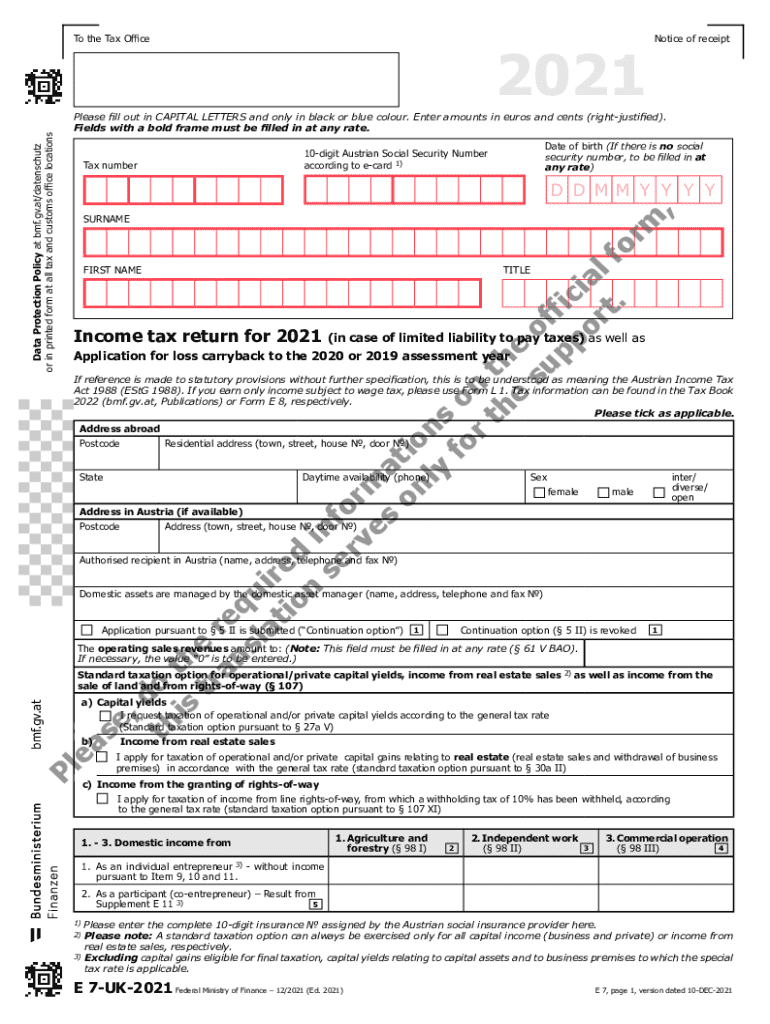

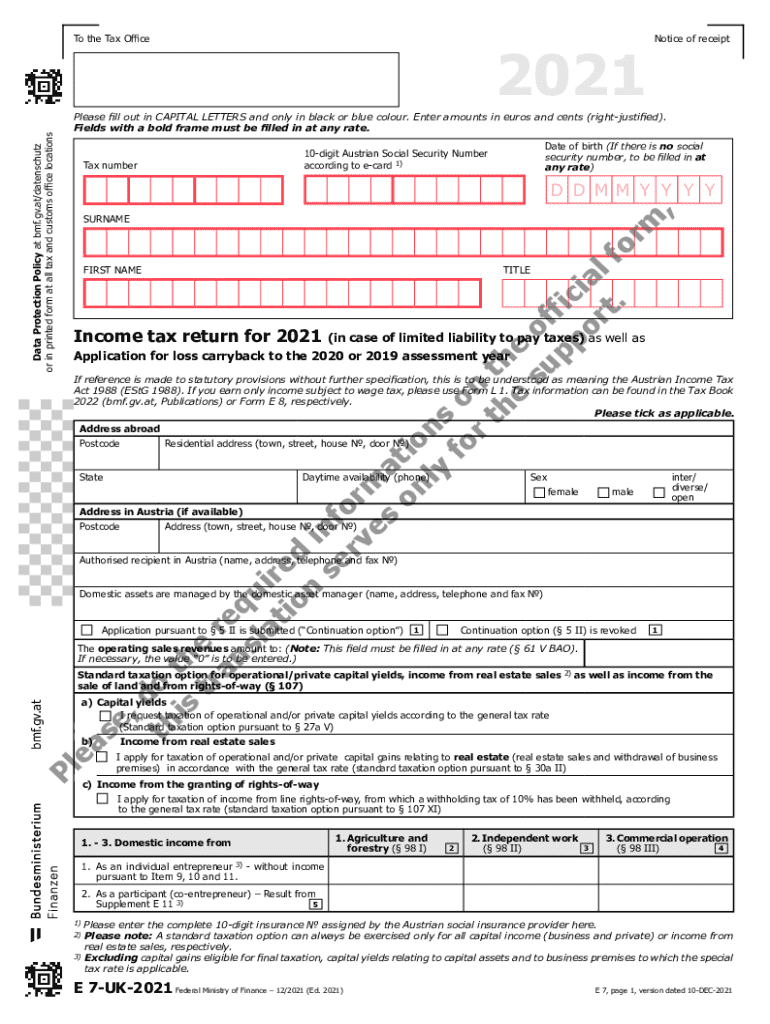

Overview of the E 7-UK-2021 Form

The E 7-UK-2021 form serves as a crucial document for individuals who are either citizens or residents of the UK and are seeking to declare their status for tax purposes. This form is significant in the processes of international tax compliance, particularly in reporting foreign income, claiming deductions, or addressing residency-related matters. Importantly, the E 7-UK-2021 form enables the HM Revenue and Customs (HMRC) to assess an individual’s correct tax obligations.

Individuals required to complete this form include UK residents with overseas income, expatriates who have lived abroad, and those entering the UK tax system for the first time. It's essential to keep track of the specific deadlines associated with filing this form to avoid potential penalties or additional scrutiny from tax authorities.

Accessing the E 7-UK-2021 Form

The E 7-UK-2021 form can be easily accessed through pdfFiller, a user-friendly platform that streamlines document management. To locate this form, simply navigate to the pdfFiller website and utilize their search feature. Typing 'E 7-UK-2021 form' will lead you directly to the document, where it is available in PDF format for your convenience.

pdfFiller also provides interactive tools that allow users to fill out and save the form directly online. For those preferring a physical copy, ensure you are downloading or printing the form from a reliable source to maintain the integrity of the document. Be cautious of printer settings to avoid scaling issues that may distort the required fields.

Completing the E 7-UK-2021 Form

Filling out the E 7-UK-2021 form involves several key sections that gather essential personal and financial information. Here’s a breakdown of how to tackle each segment.

While completing the form, be mindful of common mistakes such as misreporting income or overlooking required sections. Always double-check for clarity and accuracy, ensuring that every entry matches relevant documentation.

Editing the E 7-UK-2021 Form

Once the form is completed, it may need revisions. pdfFiller offers robust editing tools that help you adjust information as necessary. Users can easily modify or delete sections, append new content, or rectify errors. The platform is designed to ensure that changes are saved promptly to prevent loss of information.

Signing the E 7-UK-2021 Form

Signing the E 7-UK-2021 form is a critical step to formally validate your submission. pdfFiller provides options for electronic signatures, streamlining the process for remote and on-the-go users. Electronic signatures are legally binding as per regulations, making them a suitable alternative to handwritten signatures in many jurisdictions.

To eSign your document, follow these steps: Navigate to the eSign option in pdfFiller, choose how you wish to sign (typing your name, uploading an image of your signature, or drawing it using a touch device), and then apply your signature to the document. Ensure the signature captures your intent and complies with legal standards.

Managing Your E 7-UK-2021 Form

Once the E 7-UK-2021 form is filled and signed, proper management of the document is essential. pdfFiller enables users to store completed forms securely in the cloud. This feature ensures easy access and organization of all your documents, improving efficiency, especially during tax season.

You can also share your form with stakeholders or tax professionals directly from pdfFiller, facilitating collaboration and review without the hassles of traditional email attachments. Make sure to utilize folder systems for categorizing documents by year or type for streamlined retrieval.

Frequently asked questions (FAQs)

A number of questions frequently arise regarding the E 7-UK-2021 form including filing requirements, step completion, and troubleshooting errors. Addressing these common queries can save users time and ensure compliance with tax obligations.

If you are facing challenges such as how to access certain fields or make corrections, the resources provided by pdfFiller can offer considerable help. Comprehensive guides and community forums can add extra value for first-time users or those unfamiliar with tax documentation.

Additional considerations

Adapting the E 7-UK-2021 form may be necessary depending on your unique situation. For individuals filing versus business entities, the requirements and sections may vary slightly. This differentiation is critical in ensuring that all relevant information is submitted correctly.

It's also crucial to understand how to handle amendments and corrections after submission. Inaccurate details can lead to penalties or extended reviews from tax authorities, so immediate rectifications are advisable. Always consult tax professionals as needed to navigate complexities.

pdfFiller’s value proposition for document management

pdfFiller transforms document management by empowering users to manage their forms efficiently from a single platform. This cloud-based solution enhances accessibility, allowing users to edit, sign, and share documents without the need for local software installations. The flexibility of cloud storage means your documents are accessible from anywhere, at any time, reducing the risk of lost paperwork.

Users appreciate the streamlined processes that pdfFiller provides. Testimonials often highlight the ease of use and the significant time savings achieved when managing forms. Case studies reveal how businesses have improved workflow efficiency by incorporating pdfFiller into their operations.

Conclusion: Optimizing your experience with the E 7-UK-2021 form

Successfully managing the E 7-UK-2021 form requires an accurate understanding and execution of each step. Utilizing pdfFiller enhances this experience, making the process straightforward from start to finish. As you familiarize yourself with the tools available on pdfFiller, your ability to handle complex document tasks will increase, leading to better compliance and organization.

In summary, leverage the resources, templates, and cloud capabilities of pdfFiller to navigate your tax and form requirements efficiently. Simplifying your document management enriches your potential for success with the E 7-UK-2021 form and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my e 7-uk-2021 directly from Gmail?

Can I create an electronic signature for the e 7-uk-2021 in Chrome?

How can I fill out e 7-uk-2021 on an iOS device?

What is e 7-uk?

Who is required to file e 7-uk?

How to fill out e 7-uk?

What is the purpose of e 7-uk?

What information must be reported on e 7-uk?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.