Get the free Ct-706/709

Get, Create, Make and Sign ct-706709

Editing ct-706709 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-706709

How to fill out ct-706709

Who needs ct-706709?

A comprehensive guide to the CT-706709 form

Overview of the CT-706709 form

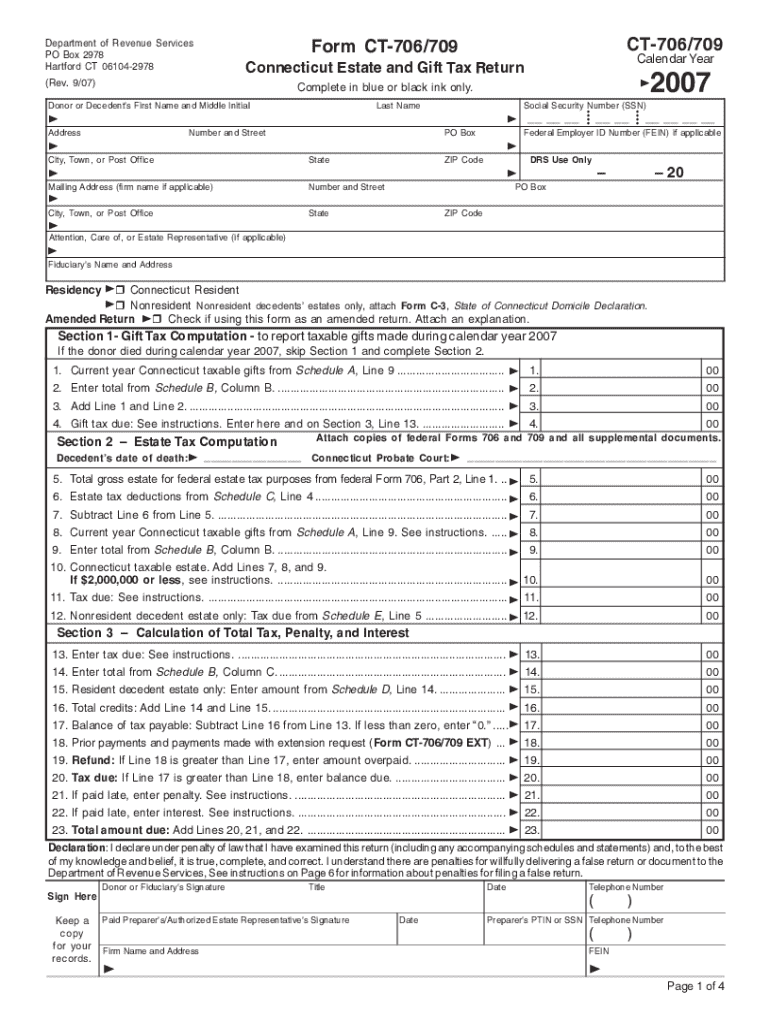

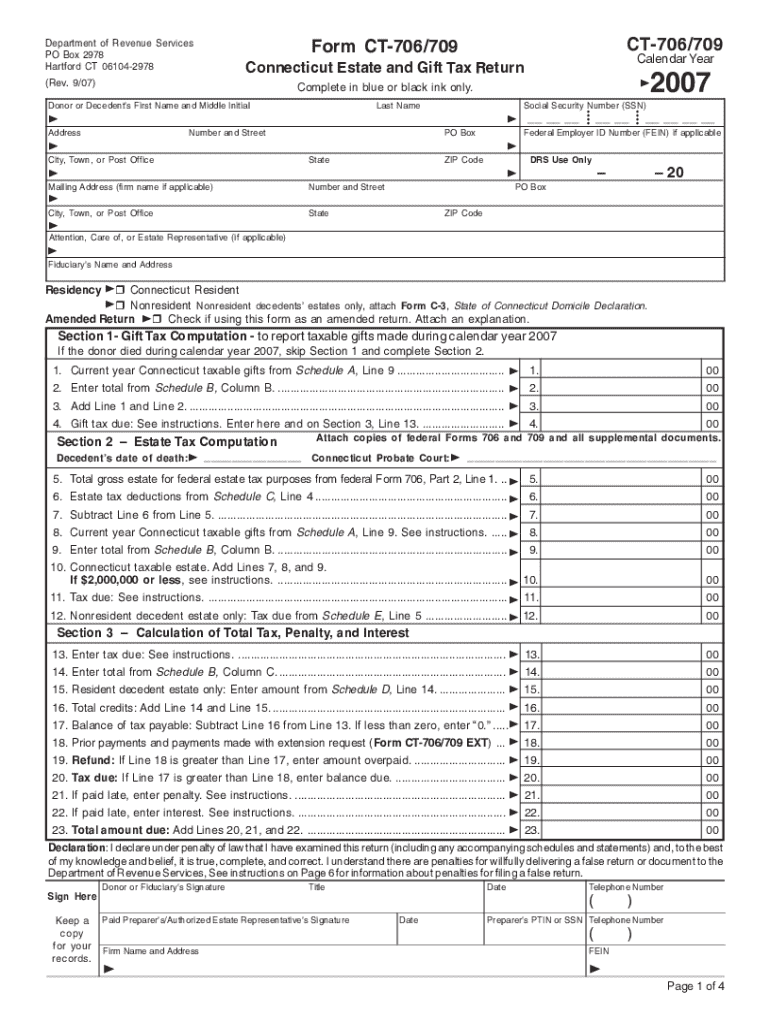

The CT-706709 form is a critical document utilized in the administration of estate and gift tax returns in the state of Connecticut. This form allows executors and individuals to report the taxable assets of an estate or a sizeable gift. Proper completion of the CT-706709 form is vital for ensuring compliance with Connecticut's tax regulations, preventing potential penalties or audits from the Department of Revenue Services. It serves as an official declaration of the estate's or gift's value, making it crucial for tax calculations and determining liabilities.

Who needs to use the CT-706709 form?

Understanding who must use the CT-706709 form is essential for compliance. Primarily, this form is applicable to two groups: executors of estates and individuals who gift amounts exceeding state-defined exemption limits. For instance, an executor handling an estate valued over the threshold must complete the CT-706709 form to report all applicable assets and their corresponding values accurately.

Gift givers who exceed the exemption limit also need to utilize this form. For example, if an individual gifts a family member property valued at $20,000, well above the annual exclusion amount of $16,000, the giver must file the CT-706709 form. These scenarios illustrate the importance of the form in both estate administration and tax compliance.

Key elements of the CT-706709 form

The CT-706709 form comprises several vital sections that facilitate a comprehensive assessment of the estate's or gift's value. Key components include personal information requirements, asset valuation details, and deduction allowances, which collectively shape the taxpayer's responsibilities. Each segment plays a pivotal role in ensuring you report accurate data to avoid penalties and securely navigate the state's tax landscape.

Interactive tools to assist with CT-706709 form completion

Using interactive tools like pdfFiller can significantly enhance your experience when completing the CT-706709 form. pdfFiller's platform boasts several features designed to make form-filling more efficient. One of the most notable tools includes editable fields, allowing users to input data seamlessly without worrying about misprints or missing information.

In addition, the collaborative tools facilitate team input and review, ensuring that all necessary parties can contribute effectively. For instance, if an executor is working with a tax advisor, both can access and edit the form simultaneously, promoting teamwork and enhancing accuracy.

Step-by-step instructions for filling out the CT-706709 form

To successfully complete the CT-706709 form, adequate preparation and a structured approach are key. Begin by gathering all necessary documents and information needed for accurate reporting. This may include wills, financial statements, and prior tax returns.

Once prepared, follow these detailed instructions to fill out the CT-706709 form:

Watch out for common pitfalls, such as neglecting to include all taxable assets or failing to sign the form, as these oversights can lead to complications down the line.

Tips for editing and signing your CT-706709 form

After completing the initial draft of your CT-706709 form, leveraging pdfFiller's editing tools is a straightforward way to make revisions efficiently. The platform allows for easy navigation to correct errors without starting from scratch. For example, if you need to adjust an asset's value, simply click on the field and input the correct amount.

Additionally, pdfFiller provides secure eSignature options, which offer legal convenience. Electronic signatures eliminate the need for physical paperwork and streamline the filing process, ensuring that your signed form is submitted promptly.

Managing your CT-706709 form post-completion

Once you have completed the CT-706709 form, properly managing it is crucial. Start by saving your finished documents securely within pdfFiller. The platform provides a user-friendly interface where you can organize your completed forms by category, making future retrieval easy.

In addition, sharing your file with stakeholders such as accountants or tax advisors is straightforward through pdfFiller's sharing features. You can send the document via email or provide direct access for them to review or annotate, ensuring everyone stays informed and aligned throughout the process.

Finally, familiarize yourself with the submission guidelines to the Connecticut Department of Revenue Services. Ensure you meet all specific requirements set forth by the agency for successful filing.

Frequently asked questions (FAQs) about the CT-706709 form

Navigating the CT-706709 form can raise many questions. Here are some common queries along with crucial answers:

By proactively addressing these questions, you can better manage the submission process and mitigate any issues that may arise.

Contact information for further assistance

Should you need additional assistance while filling out the CT-706709 form, pdfFiller support is readily available. Their dedicated support team can answer technical questions regarding the platform and provide advice on utilizing its features effectively.

Moreover, consider connecting with tax professionals who specialize in Connecticut tax law for personalized advice related to your specific situation, ensuring that you navigate this process effectively.

Preview and download options for the CT-706709 form

Accessing the CT-706709 form directly within pdfFiller is seamless. Users can navigate to the forms section, locating the CT-706709 form with ease. Once found, you have the option to preview the document or download and print it for offline use.

The platform’s user-friendly features enable smooth downloads and easy navigation, enhancing your overall experience while managing necessary paperwork.

Additional considerations

When dealing with the CT-706709 form, it is imperative to be aware of crucial deadlines. The state requires timely submission of the form, ensuring all pertinent tax documentation is filed by the due date set by the Connecticut Department of Revenue Services.

Additionally, staying updated on changes in tax laws affecting the CT-706709 form is vital to ensure compliance and successful filing. Regularly review guidelines set by the Department of Revenue Services and consult tax professionals for insights into any alterations in requirements or processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ct-706709?

How do I edit ct-706709 on an iOS device?

How do I complete ct-706709 on an Android device?

What is ct-706709?

Who is required to file ct-706709?

How to fill out ct-706709?

What is the purpose of ct-706709?

What information must be reported on ct-706709?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.