Get the free Verification of Other Untaxed Income From 2016

Get, Create, Make and Sign verification of oformr untaxed

Editing verification of oformr untaxed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of oformr untaxed

How to fill out verification of oformr untaxed

Who needs verification of oformr untaxed?

Verification of Oformr Untaxed Form: A Comprehensive Guide

Understanding oformr and untaxed forms

Oformr refers to a specific document template used to report income or deductions that are not subject to taxation. These forms are integral for individuals and businesses, particularly when dealing with unique financial situations. Untaxed forms come into play when a taxpayer needs to declare income that hasn't been taxed upfront or to document other particular circumstances influencing tax obligations.

In the context of tax compliance, untaxed forms are of paramount importance. They ensure that all income is accounted for accurately and can help reduce the chance of audits and penalties from tax authorities. Verifying untaxed forms before submission is crucial to maintain compliance and accuracy in one's financial reporting.

The verification process: Step-by-step

The verification process of the oformr untaxed form can be a straightforward endeavor if approached systematically. The first step relies on collecting the necessary documentation that validates the income or deductions being reported.

Gather these documents in a secure, organized manner as they will facilitate a smooth verification process. Once those are ready, you can begin identifying the correct untaxed form according to your specific circumstances.

Several types of untaxed forms exist, each designed for different scenarios, such as freelance income, rental income, or investment income. It's essential to select the appropriate form based on your unique financial situation, ensuring that the reporting aligns with your specific obligation.

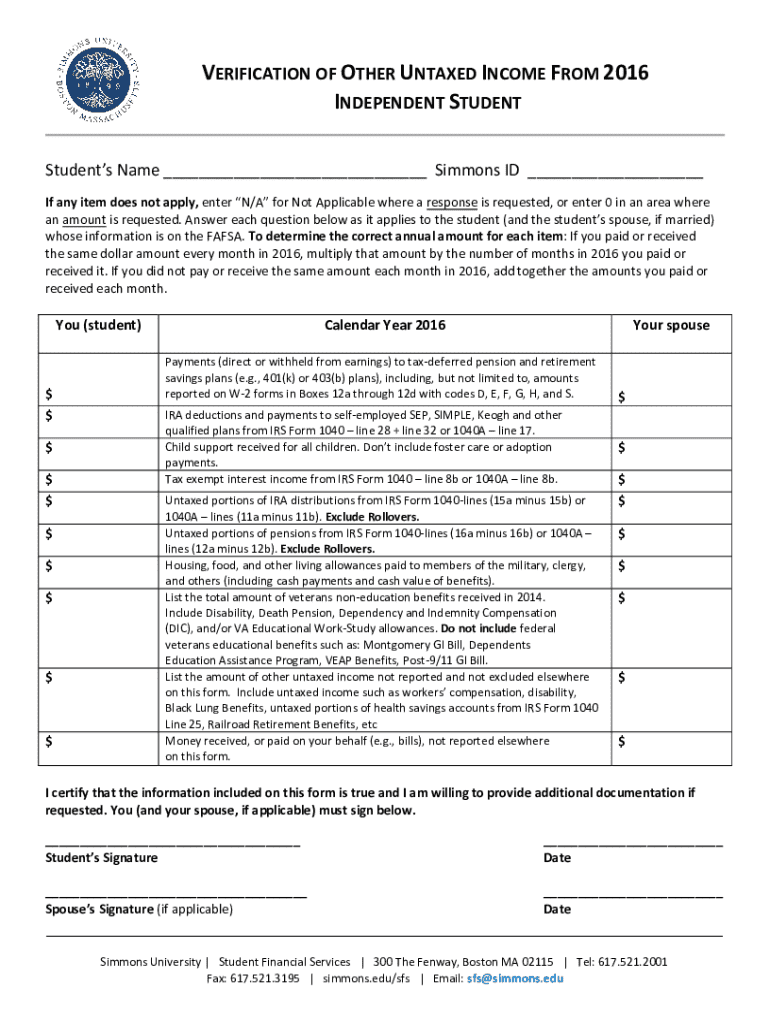

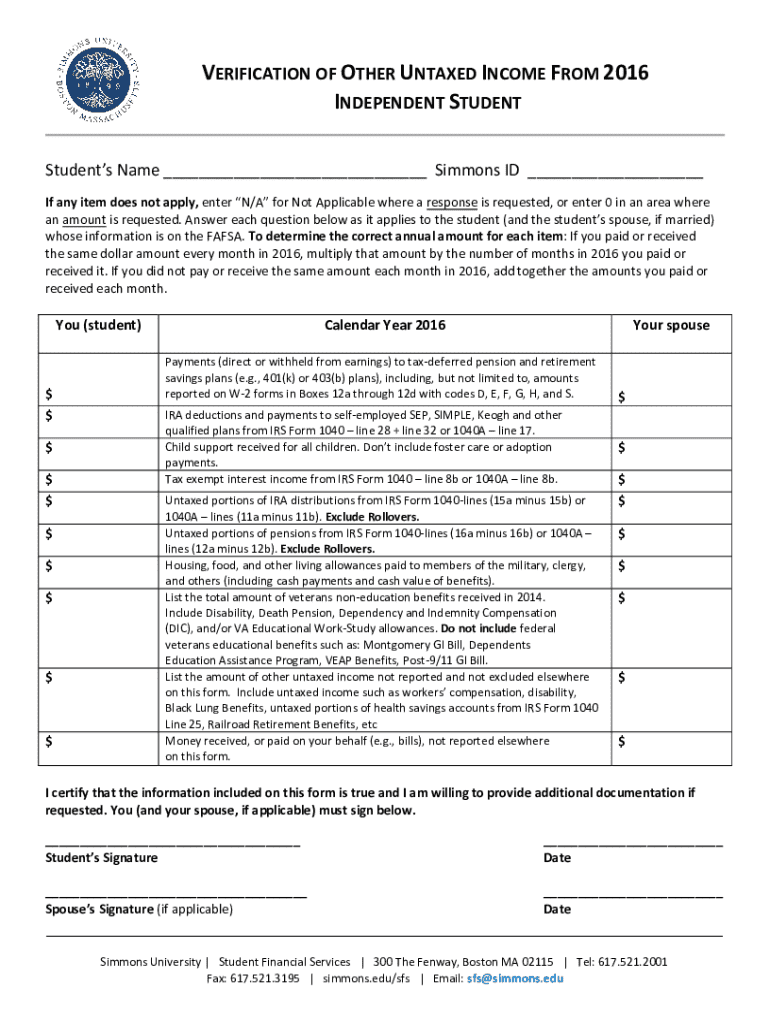

Detailed instructions for filling out the oformr untaxed form

Filling out the oformr untaxed form correctly is vital for accurate reporting. Start with the basic applicant information, including name, Social Security number, and contact details. Each section of the form requests specific data tailored to your tax situation.

Below is an example of a completed oformr untaxed form. This visual representation serves to guide users through the completion stages, highlighting key fields and the information required.

Interactive tools for verification

Utilizing pdfFiller's interactive platform can vastly simplify the verification of your untaxed forms. Accessible online, this platform enables users to manage documents with ease. You can quickly gain access to the verification tools designed specifically for the oformr untaxed form.

The cloud-based features provided by pdfFiller offer advantages that go beyond mere document submission. Managing forms online allows users to access their documents from various devices without the worry of lost files.

Legal implications of untaxed forms

Failing to verify untaxed forms can lead to significant legal complications. Misreporting income or deductions can attract scrutiny from tax authorities, resulting in audits, fines, or even criminal charges in extreme cases. This underlines the gravity of ensuring every detail is correct and verified.

If you discover any mistakes in your submitted forms, promptly addressing them is critical. You may need to submit an amendment or correction form to rectify the discrepancies. Documenting these changes and keeping records of all correspondence with tax authorities is equally important.

Troubleshooting common issues

Throughout the verification process, you may face several common issues. Identifying these early on can save you substantial time and effort.

For additional support, customer service is often available to assist in resolving these issues. Many platforms, such as pdfFiller, offer help guides or live chat options for real-time assistance.

Ensuring compliance with tax regulations

Staying informed about current tax regulations related to untaxed forms is crucial for compliance. Tax laws are subject to change, and unawareness can lead to erroneous submissions.

Websites like pdfFiller often provide updates on changes to forms and regulations. Subscribing to newsletters or alerts can also ensure that you receive timely information.

Case studies: Real-world applications

Insights from individuals who successfully verified their untaxed forms through pdfFiller demonstrate the efficacy of the platform. For instance, a freelancer who previously encountered issues with tax submissions learned how to navigate and verify their documents efficiently using pdfFiller.

By adopting best practices—such as utilizing the platform's editing features and interactive guides—they managed to streamline their submission process and confidently comply with tax regulations.

Frequently asked questions (FAQ)

Many users have queries surrounding the verification process of untaxed forms. Common questions include how to retrieve the correct form and guidelines for filling it out accurately.

Next steps after verification

After successfully verifying your oformr untaxed form, retaining thorough records is invaluable. Save copies of submitted documents and any accompanying correspondence to maintain an evidentiary trail.

Considering future actions, explore how to continuously optimize your document management with solutions like pdfFiller. Future submissions become easier with organized records and fast access to verification tools.

Enhancing document management with pdfFiller

PdfFiller not only aids in the verification of untaxed forms but also encompasses a variety of additional features, including document archiving and user collaboration tools. These enhance the overall experience of document management.

With pdfFiller’s cloud-based solutions, users enjoy seamless integration across devices, ensuring that managing documents becomes an effortless task.

Final thoughts on verification of oformr untaxed form

Verification of your oformr untaxed form is a fundamental aspect of effective tax compliance. Thoroughly reviewing and validating your information before submission can save you time, resources, and legal troubles.

Embrace the tools and resources provided by pdfFiller, and take the initiative to ensure your document management is as smooth and efficient as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit verification of oformr untaxed on an iOS device?

Can I edit verification of oformr untaxed on an Android device?

How do I complete verification of oformr untaxed on an Android device?

What is verification of oformr untaxed?

Who is required to file verification of oformr untaxed?

How to fill out verification of oformr untaxed?

What is the purpose of verification of oformr untaxed?

What information must be reported on verification of oformr untaxed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.