Get the free Notary Public Bond

Get, Create, Make and Sign notary public bond

Editing notary public bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notary public bond

How to fill out notary public bond

Who needs notary public bond?

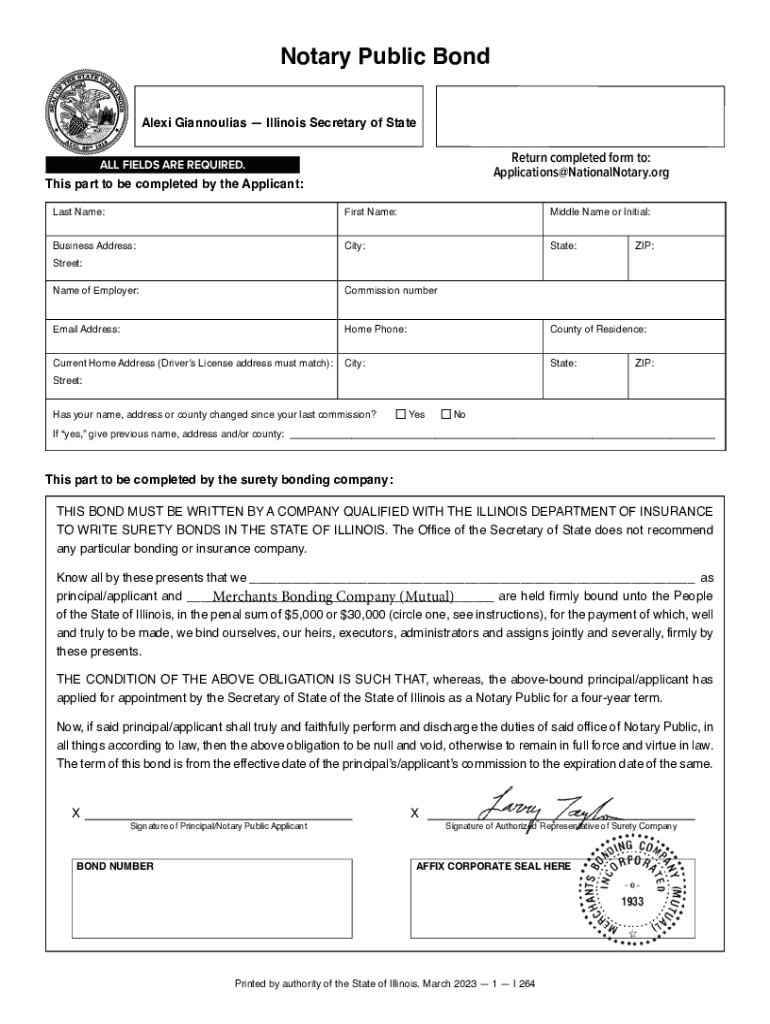

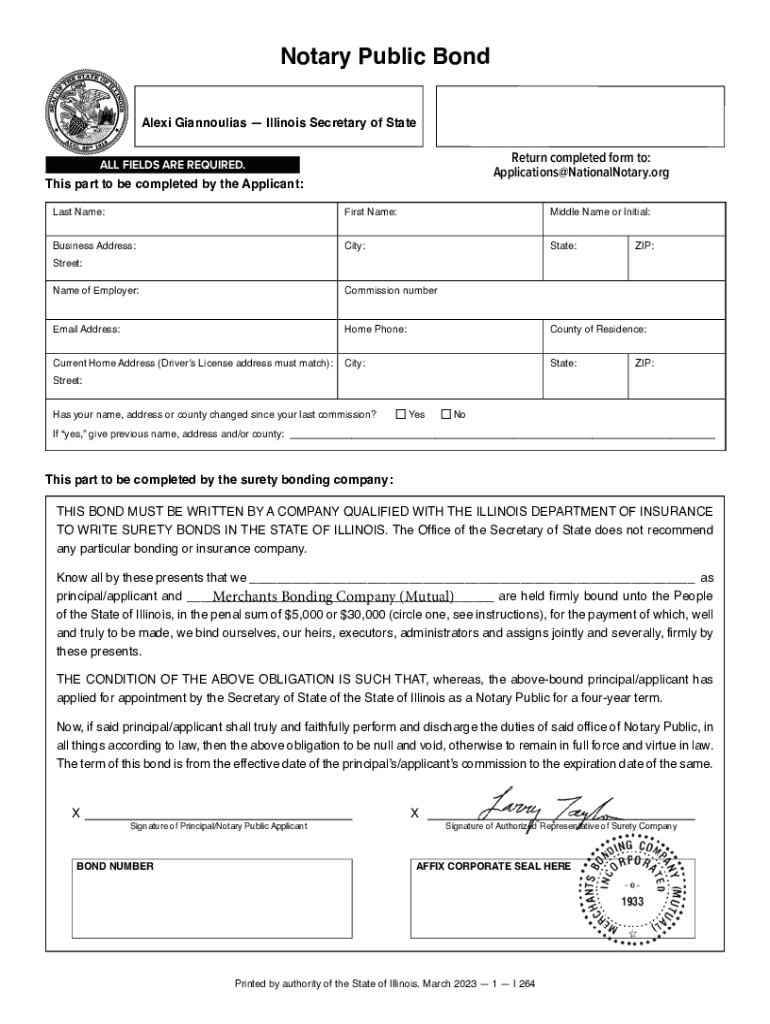

Understanding the Notary Public Bond Form

Understanding notary public bond

A notary public bond is essentially an insurance policy that protects the public from potential misconduct by a notary. It guarantees that if a notary fails to perform their duties correctly or engages in fraudulent activities, the bond provides financial compensation to the affected parties. The importance of notary public bonds lies in the trust they instill in the public, ensuring that notaries perform their duties ethically and in accordance with the law.

In legal contexts, these bonds act as a safeguard that helps maintain the integrity of notarizations. If a notary public were to make an error or intentionally defraud a signatory, the bond serves as a financial backstop, often up to a specified limit, protecting individuals who suffer a loss as a result.

Legal requirements by state

Notary public bond requirements can vary significantly across different states in the U.S. Most states mandate that notaries obtain a bond before they can officially begin their services. It's essential to understand the specific requirements of your state to ensure compliance.

Importance of the notary public bond form

The notary public bond form is crucial for notaries and the public alike. It serves as a contractual agreement between the notary, bond provider, and the state, ensuring that all parties understand the terms and the protections involved. This form encapsulates the responsibilities and liabilities tied to the notarization process, echoing the importance of trust in legal transactions.

One key role of notary public bonds is to protect members of the public from malpractice. If a notary public fails to uphold their duties properly, the financial implications can be severe. The bond provides a layer of financial security, allowing individuals to seek redress through the bond provider instead of facing losses directly.

Common misconceptions about notary bonds

Despite their critical role, there are prevalent misconceptions about notary public bonds. One common myth is that having a bond equates to being insured against all legal liabilities. In reality, a notary bond does not provide coverage for acts of negligence; it only protects against fraudulent or dishonest practices.

Steps to obtain a notary public bond

Obtaining a notary public bond requires following specific steps tailored to your state’s requirements. First, it's crucial to ascertain what documents are necessary to begin the bonding process. This may include proof of identification, a completed application form, and an understanding of the state bond requirements.

Determine your state's requirements

Every state has different regulations governing notary public bonds. Check with your state’s notary commissioning office to gather the specific documentation and information you need to move forward successfully.

Choose a reputable bond provider

Selecting a reliable bond provider is vital. Look for companies with positive reviews, clear terms, and competitive rates. Ensure the provider is licensed to operate in your state and has a good reputation within the industry.

Complete the notary public bond form

Once you've chosen your provider, you'll need to complete the notary public bond form. Pay close attention to the instructions, as accurate details are essential for compliance. Many forms will require you to provide personal information, notary commission details, and more.

Submitting your notary public bond

After filling out the notary public bond form, the next step is submission. Depending on your state's requirements, bonds can often be submitted online, by mail, or in person at designated offices. Familiarize yourself with your state-specific submission rules to ensure proper handling.

Where to submit your bond

Always refer to your local notary commissioning office for specific submission guidelines. Some states allow electronic submission through a portal, while others may require physical documents to be sent via mail or delivered in person.

Required accompanying documents

When submitting your bond form, there are typically accompanying documents that you will need to include. This may include your notary application, proof of identity, and sometimes additional references or signatures.

Managing your notary public bond

Once you have successfully submitted your bond, managing it is just as crucial. Knowing how to renew your bond and when updates are necessary can help you remain compliant and protect yourself from potential liabilities.

Bond renewal process

Typically, bonds have a term of one to two years, depending on state regulations. To renew, you will likely need to undergo a similar process to obtaining your initial bond, including submitting a renewal application and possibly a new bond form.

Changes to your bond

Various circumstances may require you to update your bond, such as address changes or name changes following marriage or legal proceedings. Be proactive about keeping your information current to prevent lapses in coverage.

Frequently asked questions (FAQs)

What happens if you don’t have a notary bond?

Not having a notary bond can prevent you from legally acting as a notary public in many states. It can lead to legal ramifications and diminished trust among clients and the public. There is also the potential for personal liability without the protection offered by a bond.

Can you be a notary without a bond?

In most states, obtaining a notary bond is a prerequisite for becoming a notary public. If you do not have a bond, your application to become a notary will be rejected.

How does a claim against my bond work?

If someone suffers a loss due to your actions as a notary, they can file a claim against your bond. The bond company will investigate the claim, and if valid, they will compensate the claimant, after which you will be responsible for repaying that amount to the bond company.

Additional resources for notaries

Educational resources

To improve your knowledge and skills as a notary, consider enrolling in courses offered by reputable educational firms. Many provide certification programs that can bolster your credentials and keep you informed about best practices.

State notary associations and agencies

Each state has notary associations and agencies dedicated to providing support, resources, and updates on legislation impacting notaries. These organizations are typically the best point of contact for information on state-specific requirements.

Tools for notary publics

Using innovative tools can streamline your notarial duties. For example, the pdfFiller platform provides interactive tools that allow notaries to manage documents, eSign forms, and collaborate efficiently with clients.

Getting started with pdfFiller

Create and edit your notary bond form online

With pdfFiller, creating and editing your notary public bond form online is seamless and user-friendly. Start by selecting an appropriate template from the platform, and fill it out according to your specific needs. The interface allows for easy customization and adjustment of details.

eSigning and collaborating on documents

The eSigning feature on pdfFiller is designed for efficiency. You can invite clients to sign documents electronically, minimizing paper waste while keeping things straightforward. Collaboration tools even allow you to share documents securely and receive feedback in real-time.

Secure document management features

One of the standout features of pdfFiller is its secure document management. Store all your completed and pending forms in the cloud, ensuring accessibility from anywhere. With robust sharing options, you can manage your notary files securely and efficiently.

Notary public bond form template available on pdfFiller

Downloadable and editable templates

pdfFiller offers a variety of downloadable and editable templates for notary public bonds. These templates are customizable and ensure you’re meeting your state’s requirements effortlessly. Users can tailor headers, bond amounts, and their personal information easily.

Example filled-out forms

Visual examples of filled-out forms are available to guide users through completing the notary public bond form. These examples ensure you fully understand how to fill out all necessary sections, reducing the risk of errors.

Support and contact information

Customer support options

pdfFiller provides extensive customer support through various channels. Access live chat for immediate assistance, or send inquiries via email or phone. The support team is knowledgeable about notary forms and ready to help.

Feedback and suggestions

Users are encouraged to provide feedback on their experience with pdfFiller. This continuous improvement process enriches the services offered, ultimately leading to better tools and resources for all users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my notary public bond directly from Gmail?

How do I complete notary public bond online?

Can I create an electronic signature for the notary public bond in Chrome?

What is notary public bond?

Who is required to file notary public bond?

How to fill out notary public bond?

What is the purpose of notary public bond?

What information must be reported on notary public bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.