Get the free Business Occupation Tax Certificate

Get, Create, Make and Sign business occupation tax certificate

How to edit business occupation tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business occupation tax certificate

How to fill out business occupation tax certificate

Who needs business occupation tax certificate?

Business Occupation Tax Certificate Form: A Comprehensive Guide

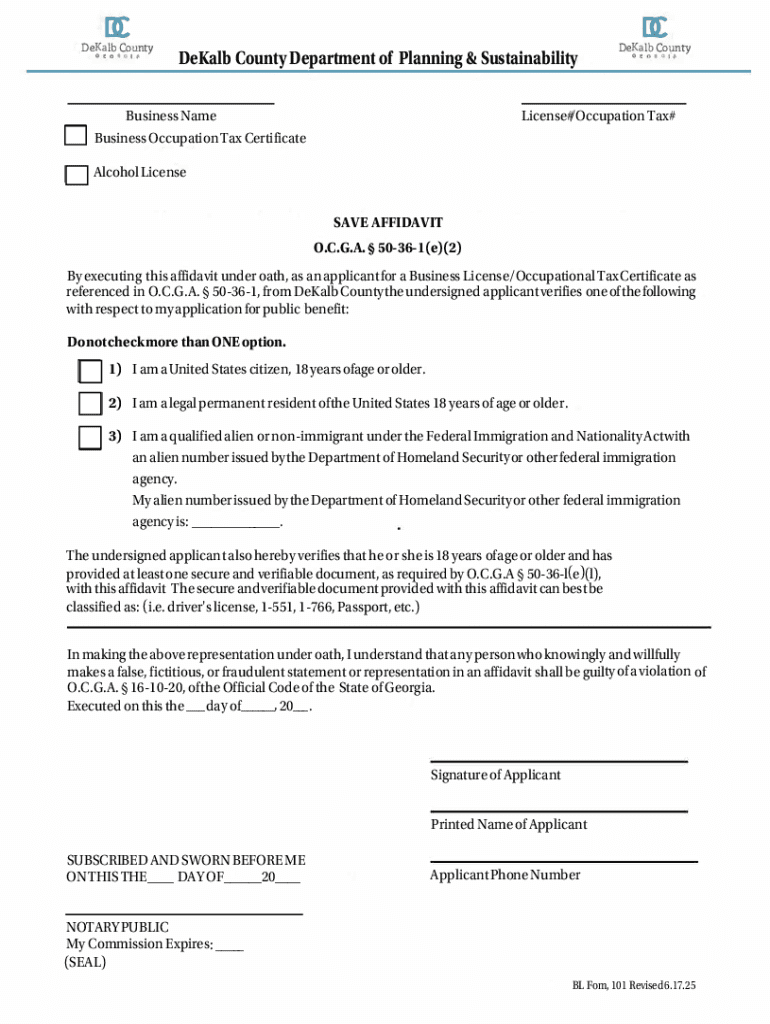

Understanding the business occupation tax certificate

A business occupation tax certificate, often referred to as a business license or business tax receipt, is a legal document that authorizes individuals or entities to conduct business within a particular jurisdiction. This certificate serves multiple purposes, including generating revenue for local governments and ensuring that businesses comply with applicable local regulations. Failure to obtain this certificate can result in penalties, fines, or even business closure, making it essential for compliance.

The importance of the business occupation tax certificate cannot be understated. Not only does it signify that a company has met the legal requirements to operate, but it also can enhance a business's reputation. Customers are typically more inclined to trust a business that has the necessary licenses and certifications in place.

Who needs this certificate?

Generally, any business, whether a sole proprietorship, partnership, or corporation, operating within a given local government's jurisdiction is required to obtain a business occupation tax certificate. This includes retail stores, service providers, contractors, and even home-based businesses. Additionally, freelancers and gig workers may also be required to obtain this certificate, depending on local regulations.

However, some exceptions may apply. For example, certain non-profit organizations may not need a certificate, and specific professions could be governed by different licensing requirements. It's crucial to consult local regulations before proceeding with your application to ensure compliance.

Key components of the business occupation tax certificate form

Completing the business occupation tax certificate form requires various essential pieces of information. Primarily, you'll need to provide the business name and address, along with detailed information about the owner or owners of the business. This includes names, addresses, and contact information, ensuring that authorities can easily reach the business if necessary.

Next, it is crucial to describe the business activities accurately. This detail helps local governments classify the business correctly and apply the appropriate tax rates. Business classification codes represent different types of businesses and can typically be found on the local government's website or in their documentation.

Classification codes

Classification codes play a pivotal role in determining the applicable tax rates for your business. These codes classify businesses into various categories and help local officials assess how much tax each type should pay. To find the appropriate code for your business, research your specific industry or consult the local zoning commission's guidelines, as these classifications can vary widely from one jurisdiction to another.

Tax rates and fee structures

Tax rates associated with the business occupation tax certificate can vary significantly depending on the local government’s regulations and the nature of the business activities. Some jurisdictions may charge a flat fee, while others base the fee on the size or revenue of the business. Usually, this information is available on the local government’s website, including breakdowns of common rates for various industries.

Step-by-step guide to completing the form

To ensure a smooth application process, follow these essential steps meticulously.

Step 1: Gather required documents and information

Prior to filling out the form, compile the necessary documentation. This typically includes identification, proof of business registration, and your business’s classification code. Having these documents ready will streamline the filling process and help avoid delays in submission.

Step 2: Accessing the form

You can access the business occupation tax certificate form from your local government’s website. Make sure to download it in a format that makes it easy to fill out, such as a PDF. Tools like pdfFiller can facilitate smooth PDF editing and streamline the entire process.

Step 3: Filling out the form

As you fill out the form, it is crucial to pay attention to each section carefully. Common mistakes include typos in the business name or owner information, and misclassification of business activities. Always double-check your entries against the documents collected to ensure everything aligns.

Step 4: Reviewing your submission

Before submitting the form, conduct a thorough review to catch any inaccuracies. This review helps prevent unnecessary delays and potential penalties from incorrect submissions. Check completeness, accuracy of classifications, and ensure payment information is in order.

Submitting your application

Once your form is complete and verified, you can proceed to submit your application. Each jurisdiction may have different submission methods, so be sure to check your local guidelines.

Where to submit the completed form

Typically, you can submit your business occupation tax certificate form online through your local government's website, or you may choose to submit it in person at designated offices. With pdfFiller, you can easily complete online submissions to your local authority for added convenience.

Payment methods

Payment methods for the certificate often include options such as credit or debit card transactions and checks. Online payments usually process more quickly, while checks may take longer to clear. Be sure to inquire about any additional fees associated with your chosen payment method.

Tracking the status of your application

To keep tabs on your business occupation tax certificate application, check your local government's website for a tracking service or contact their office directly. Keeping a record of your submission confirmation can help facilitate quick inquiries if needed.

Managing your business occupation tax certificate

Once you receive your business occupation tax certificate, it’s not the end of the process. Managing your certificate effectively is crucial for continued compliance.

Renewal process

Most jurisdictions require businesses to renew their business occupation tax certificate periodically, often annually. Renewal deadlines may vary, so it’s imperative to know your specific locale’s schedule to avoid lapsing or potential penalties.

Updating your information

If your business undergoes changes, such as a change in ownership, address, or activity, it is essential to update your information with the local government immediately. Failing to keep records current can result in compliance issues, which could lead to fines.

Handling violations or penalties

Businesses may incur penalties for various reasons, such as late filing or failure to maintain accurate records. Resolving violations typically involves contacting local authorities, paying any fines, and completing necessary corrective actions. Engaging with local government in a timely manner can help mitigate additional repercussions.

Additional tips for successful certification

To ensure ongoing compliance with local regulations, consider implementing a checklist for managing your business occupation tax certificate and remain informed about any changes in local laws. Periodically revisit the relevant government websites and stay aware of new updates.

Resources for assistance

Your local government office is the primary resource for questions regarding the business occupation tax certificate form. Additionally, various online resources can provide guidance tailored to your state and local jurisdiction, ensuring that you meet all requirements.

Using pdfFiller for your business occupation tax certificate

pdfFiller plays a crucial role in simplifying the completing, signing, and managing of your business occupation tax certificate form. Utilizing features like eSigning and document storage can help maintain organization and ensure that you have your certificates readily accessible whenever necessary.

Creating templates for future use

To save time for future renewals or updates, consider creating a template of the business occupation tax certificate form for quicker completion. pdfFiller offers options to save forms and create reusable templates, ensuring you remain efficient and compliant going forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business occupation tax certificate in Chrome?

How do I edit business occupation tax certificate on an iOS device?

How do I fill out business occupation tax certificate on an Android device?

What is business occupation tax certificate?

Who is required to file business occupation tax certificate?

How to fill out business occupation tax certificate?

What is the purpose of business occupation tax certificate?

What information must be reported on business occupation tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.