Get the free Ifta-105

Get, Create, Make and Sign ifta-105

How to edit ifta-105 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ifta-105

How to fill out ifta-105

Who needs ifta-105?

Comprehensive Guide to the IFTA-105 Form

Understanding the IFTA-105 form

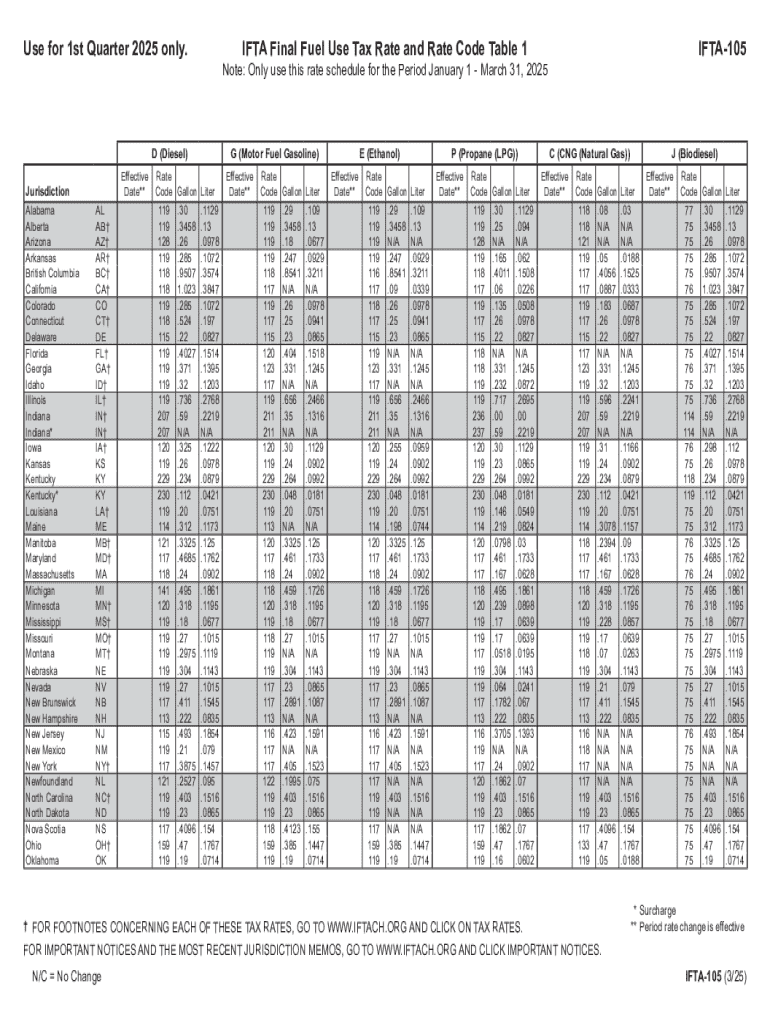

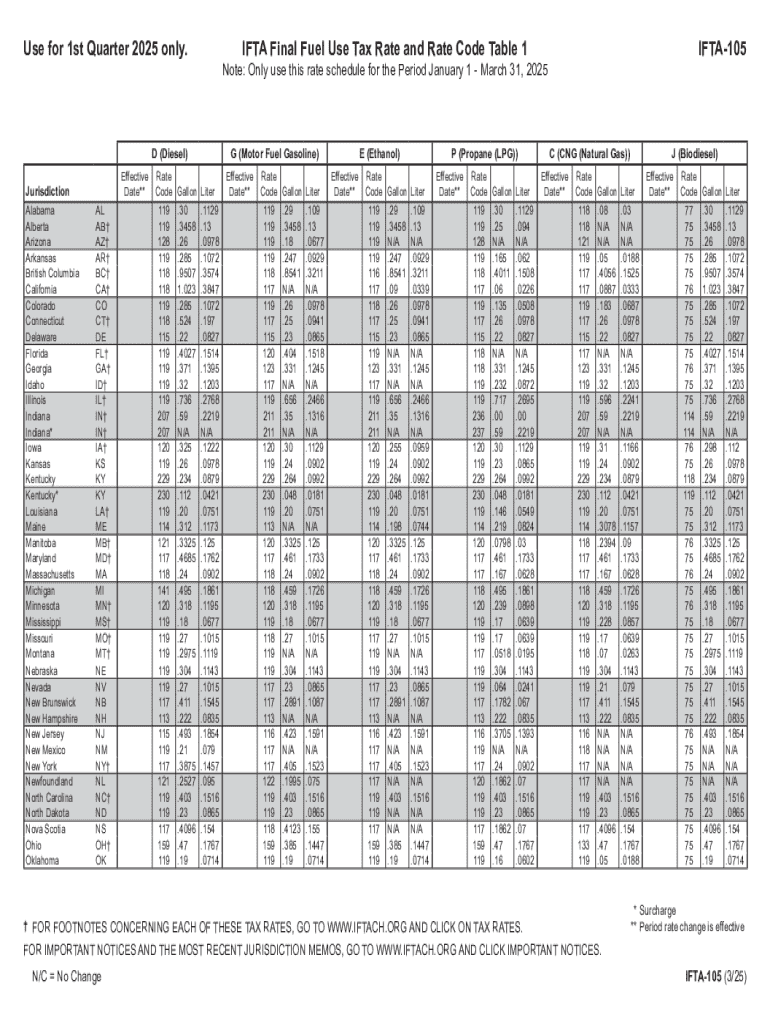

The IFTA-105 form is a critical document for interstate vehicle operators, primarily used for reporting fuel consumption and calculating taxes owed per jurisdiction under the International Fuel Tax Agreement (IFTA). This form ensures that operators pay the appropriate fuel taxes for every state in which they operate, preserving state revenues and maintaining equitable taxation of fuel usage regardless of where a vehicle is driven.

By participating in the IFTA, operators streamline their reporting duties, submitting a single form instead of multiple state-level filings. The purpose of the IFTA-105 form is not only to simplify tax reporting but to ensure compliance with various state regulations. All parties involved must adhere to the IFTA's stringent guidelines for accurate reporting and effective tax management.

Key components of the IFTA-105 form

The IFTA-105 form is structured into several key components, which include vital sections and fields. Understanding each part allows operators to fill out the form accurately. The first section features identification information, capturing crucial data about the vehicle and operator, including name, business address, license plate number, and the jurisdiction of registration.

Another essential component focuses on fuel tax calculations, where operators report fuel purchases and distances traveled in different jurisdictions. Finally, the jurisdictional breakdown section allows operators to outline fuel used per state, ensuring a transparent allocation of taxes owed based on where fuel was consumed. Utilizing common codes and terminologies is crucial for clear reporting, indicating engine types and fuel types properly.

How to fill out the IFTA-105 form

Filling out the IFTA-105 form correctly is vital for compliance and avoiding penalties. Here’s a step-by-step guide to help you through the process effectively. Start by gathering necessary information such as your license plate number, fuel purchase receipts, and mileage data for each jurisdiction. This data is critical for the accuracy of your submission.

Once you have your information, input identification details, ensuring all entries are accurate and up to date. Next, document your fuel usage data, calculating the total gallons purchased in each jurisdiction throughout the reporting period. After entering all fuel consumption data, proceed to calculate the tax owed or any refunds due based on your state's rates. Remember to double-check your entries to minimize errors.

Editing and managing your IFTA-105 form with pdfFiller

pdfFiller provides an excellent platform to upload, edit, and manage your IFTA-105 form seamlessly. Start by uploading your completed form to pdfFiller. Once uploaded, utilize interactive tools specifically designed for document editing, where you can change any details as needed to ensure accuracy before submission.

Key features include robust text editing capabilities that allow you to adjust details easily and add electronic signatures directly on the document. Additionally, pdfFiller offers collaboration features, making it easier for teams to work together. By sharing access, team members can review and provide input directly, enhancing accuracy and efficiency.

Common mistakes to avoid when filling out the IFTA-105 form

Filling out the IFTA-105 form can seem straightforward, yet many people still make mistakes that can cause problems. One common error is in reporting fuel usage, where operators might underestimate or over-report their fuel consumption, leading to inaccuracies in tax calculations. Ensure that your records are meticulously kept to avoid these pitfalls.

Another frequent issue arises from misunderstanding jurisdictional rates. Each state has varied tax rates, and knowing which rates apply to your specific routes is vital. Lastly, failing to sign or submit the form on time can also lead to penalties, so it's essential to be aware of deadlines and ensure all necessary actions are taken promptly.

Submitting your IFTA-105 form

Submitting your IFTA-105 form can be done through various methods, primarily online or via mail. Online submissions are often preferred due to their speed and convenience, allowing operators to file their forms quickly without delay. Ensure you verify the submission methods accepted by your jurisdiction, as some states may still require paper forms.

For a successful submission, always review your completed form thoroughly to ensure that all information is accurate and complete. Also, make note of submission deadlines, which can differ based on your reporting period. Timely submission is often critical for maintaining compliance and avoiding unnecessary penalties.

Calculating your IFTA taxes: A detailed guide

Calculating your IFTA taxes involves understanding key factors such as fuel consumption, miles traveled across jurisdictions, and the tax rates specific to each state. Start by collating mileage data and fuel consumption records for the reporting period in question. Accurate records will allow you to apply the tax rates to your reported figures without confusion.

To demonstrate, let's say your vehicle traveled through three states with varying tax rates. Input your data accordingly, calculate the total gallons purchased in each jurisdiction, and apply the respective rates to find your owed taxes. Utilizing a calculator or tax estimator tool can streamline this process. Resources are available for current fuel tax rates by jurisdiction, ensuring you’re always compliant.

Benefits of using pdfFiller for your IFTA-105 form

Utilizing pdfFiller for your IFTA-105 form streamlines the entire process of document management. The platform offers features tailored specifically for IFTA forms, enabling you to create, edit, and manage essential documents with ease. Access your forms anywhere and anytime ensures you can maintain compliance and stay updated regardless of your location.

Security measures integrated into pdfFiller further solidify its advantage, as it guarantees that your sensitive data remains protected during the filing process. This protection is crucial for any transportation operator who handles substantial amounts of sensitive information. With pdfFiller, operators will find convenience, security, and efficiency in every interaction.

Additional resources for IFTA filers

As an IFTA filer, having access to relevant resources can significantly ease the process of navigating requirements. State-specific IFTA resources are indispensable; they provide guidelines, deadlines, and support that are directly applicable to you. Check your state’s transportation or taxation website for the latest updates, FAQs, and detailed instructions relevant to the IFTA-105 form.

For hands-on help, utilize contact information of experts available through associated state agencies. FAQs available online can also address common concerns and queries, streamlining your filing experience while ensuring you stay informed.

Stay informed: Updates on IFTA regulations

Regulations surrounding IFTA reporting can evolve, making it crucial for operators to stay informed about potential changes. Upcoming changes in IFTA reporting requirements may include adjustments to calculation methods, shifts in jurisdictional tax rates, or changes in operational guidelines. Continuously monitoring updates will ensure that you remain compliant with the latest frameworks.

Regular engagement with industry associations or tax advisory groups can provide early insight into these developments, allowing operators to prepare for adjustments accordingly. Staying compliant means being proactive about understanding new rules and guidelines that affect your filing practices.

Language assistance and accessibility options

Recognizing the diverse needs of operators, pdfFiller offers language assistance and accessibility features for those who may require them. Multilingual support can enhance comprehension for non-English speakers, enabling them to navigate the IFTA-105 form and its requirements confidently.

Accessibility features within pdfFiller ensure that all users can engage with the platform, regardless of any physical limitations. By prioritizing inclusivity, pdfFiller enhances the overall user experience, allowing every operator to fulfill their filing responsibilities.

Get help with your IFTA-105 form

Getting the necessary help with your IFTA-105 form is easier than ever through pdfFiller. Customer support options available include live chat, email, and phone assistance, ensuring you have direct access to experts when needed. If you have specific inquiries, consulting with IFTA specialists can provide targeted insights and advice tailored to your situation.

In addition, community forums and user support groups can be invaluable resources. Engaging with peers who have faced similar challenges can yield practical solutions and best practices that further enhance your understanding of the IFTA-105 form process.

Interactive tools for enhanced IFTA filing experience

Interactive tools provided by pdfFiller enhance the IFTA filing experience significantly. Utilizing calculators for estimating fuel taxes can save time and minimize errors in calculations. These tools allow you to input your specific data and receive immediate feedback on what taxes may be owed based on jurisdiction, thus aiding in more accurate reporting.

Furthermore, the platform's collaboration features empower teams to seamlessly work together on the IFTA-105 form, allowing real-time updates, comments, and edits. This collaborative environment ensures that everyone involved in the filing process is on the same page, leading to a more efficient outcome.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the ifta-105 in Gmail?

How can I fill out ifta-105 on an iOS device?

How do I fill out ifta-105 on an Android device?

What is ifta-105?

Who is required to file ifta-105?

How to fill out ifta-105?

What is the purpose of ifta-105?

What information must be reported on ifta-105?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.