Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

The Complete Guide to the W-9 Form

Understanding the W-9 form

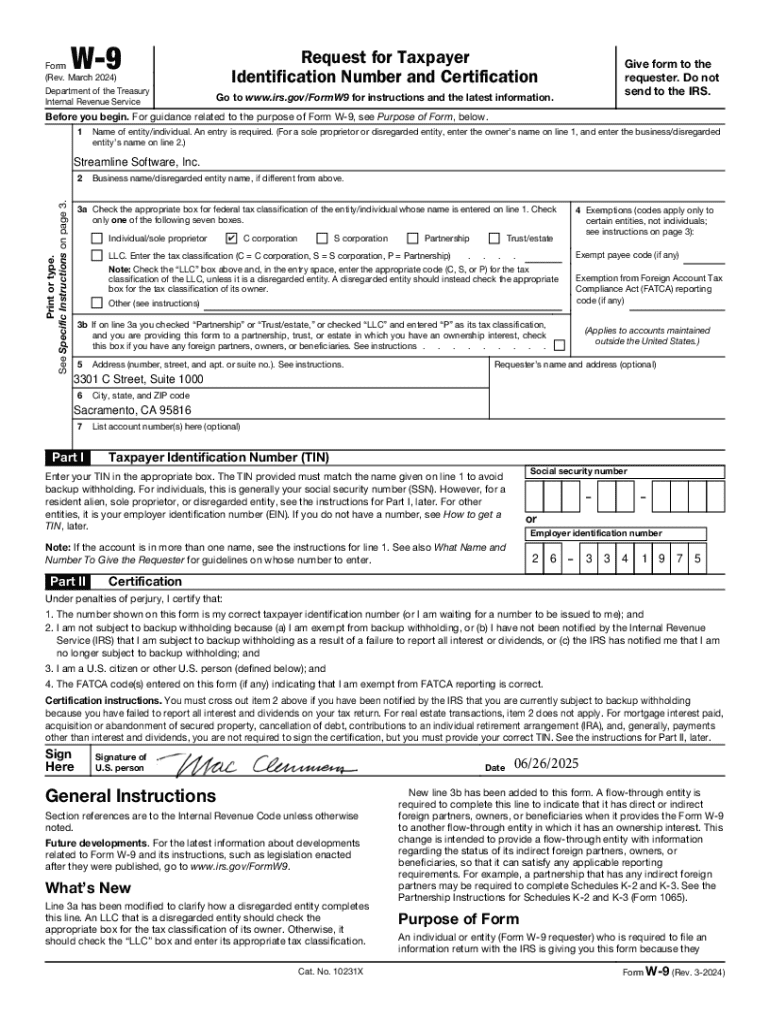

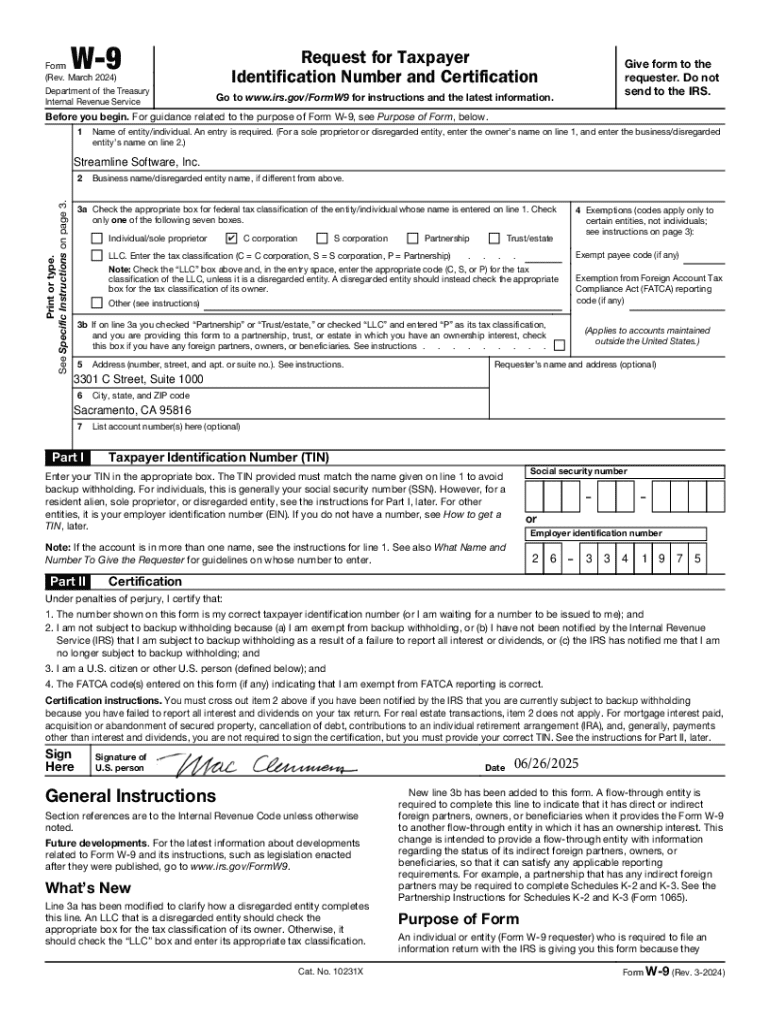

The W-9 form is a crucial tax document utilized primarily in the United States. This form serves a critical purpose in the realm of taxation, allowing businesses and individuals to request the Taxpayer Identification Number (TIN) of their payees, such as independent contractors or freelancers. Understanding the W-9 form is essential for ensuring legal and tax compliance, and it helps organizations correctly report income paid to non-employees.

Components of the W-9 form

The W-9 form comprises several key components that must be accurately filled out. The primary sections include: 1. **Name**: The legal name of the individual or business. 2. **Business Name**: If applicable, the DBA (Doing Business As) name. 3. **Address**: Contact information, including street address, city, state, and zip code. 4. **Taxpayer Identification Number**: This can be a Social Security Number (SSN) or Employer Identification Number (EIN). Each of these components requires careful consideration to ensure compliance with IRS requirements.

Purpose and uses of the W-9 form

The W-9 form plays a vital role in various business transactions. Understanding when and why to use this form can prevent confusion and potential tax liabilities. Notably, the W-9 is essential in situations where payments are made to independent contractors, freelancers, and certain vendors. Without this form, businesses may struggle to correctly report payments to the IRS.

Common use cases

Additionally, the W-9 form is intimately linked with IRS compliance through the 1099 reporting process, instrumental for documentation related to income that is not subject to withholding taxes.

Who is required to complete a W-9 form?

Identifying who must fill out a W-9 form can seem daunting, but the requirements are straightforward. Typically, the following parties are required to complete a W-9 form: - **Individuals**: Sole proprietors or freelancers must provide their personal TIN. - **Sole proprietors**: Small business owners working independently are also obliged to submit a W-9. - **Partnerships and corporations**: Any business entity receiving payment must comply with this requirement.

Exceptions and exemptions

It's crucial to know who is exempt from filing a W-9. Generally, tax-exempt organizations, certain government entities, and international entities may not need to submit this form. That said, most U.S.-based entities engaging in business transactions must comply with W-9 requirements to ensure proper IRS documentation.

Step-by-step guide: How to fill out the W-9 form

Filling out the W-9 form accurately is vital to ensure smooth processing. Before you begin filling it out, gather the necessary information, including your TIN, business name, and contact details.

Filling out section by section

Avoid common mistakes such as entering an incorrect TIN, failing to sign the form, or omitting to specify whether you are an individual or entity. Such errors can lead to unnecessary complications.

Different methods of submission

Once your W-9 form is filled out, you need to submit it to the requester. There are different methods to do this, depending on what works best for you.

Electronic submission options

Submitting your W-9 electronically can be a fast and efficient method. Using platforms like pdfFiller allows you to fill out the form digitally and send it directly via email, expediting the entire process. This method has gained traction for its convenience, especially for remote workers and freelancers.

Paper submission guidelines

If you opt to mail the W-9, ensure you send it to the requester’s address. It’s advisable to use a secure mailing method to track your document, preventing any potential delays or losses in transit.

W-9 form deadlines and timing

Understanding submission timelines for the W-9 form is crucial to avoid complications. Generally, you should submit the W-9 form as soon as you are engaged for work or anticipatory payments are incoming. Delaying the submission could lead to increased withholding adjustments, affecting your overall tax liabilities.

Implications of late submissions

Failure to submit the W-9 form on time can result in backup withholding. This means that the payer may be required to withhold a percentage of payments due to your non-compliance, creating unnecessary financial strain.

Importance of the W-9 form in tax compliance

The W-9 form is not just a formality; it plays a pivotal role in ensuring proper tax compliance. By providing accurate information, you help avoid issues such as backup withholding, where the IRS might require payers to withhold a significant percentage from payments made to you.

IRS requirements and oversight

The IRS uses the data collected from W-9 forms to ensure payees are recording their income accurately. This oversight not only helps maintain the integrity of the tax system but also protects individuals and businesses from future hassles with tax reporting.

Best practices for managing your W-9 form

Managing your W-9 effectively is essential for smooth business operations. Utilizing digital tools can offer significant advantages in handling your documents. Platforms like pdfFiller allow for easy editing, signing, and secure document management, ensuring that your W-9 remains current.

Maintaining your W-9 information

It is vital to keep your information updated. Changes in your address, name, or business structure necessitate a new W-9 submission. Always maintain an updated copy of your W-9 to facilitate future transactions.

Security considerations

Since the W-9 contains sensitive information, it is imperative to employ strict security measures. Always store documents securely, whether digitally or physically, and use strong encryption methods when sharing electronically to protect your personal data.

Additional considerations and FAQs

As with any tax-related topic, questions often arise regarding the W-9 form.

Frequently asked questions about the W-9 form

Related forms and resources

Understanding your tax forms is essential in managing financial obligations efficiently. Commonly, individuals confuse the W-9 form with the W-4 form.

The W-4 vs. W-9: Understanding key differences

While both forms are important in the context of employment and taxation, they serve very different purposes. The W-4 is used by employees to indicate their tax withholding preferences, while the W-9 is for providing TINs to report non-employee compensation.

Other important tax forms for freelancers and contractors

Freelancers and contractors should also familiarize themselves with other key tax documents such as the 1099 form, which reports income received from clients, and the W-2 form, which is used by employers to report wage and tax information for employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my w-9 directly from Gmail?

How do I fill out w-9 using my mobile device?

How do I complete w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.