Employee wage payments to form: A comprehensive guide

Understanding employee wage payments

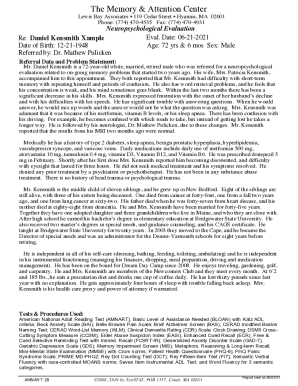

Employee wage payments refer to the compensation provided by employers to their employees in exchange for the work performed. These payments are a fundamental aspect of labor relations and are indicative of respect for the employee’s effort and time. Properly documenting these payments not only ensures transparency but also builds trust between employers and employees.

Documentation of wage payments is integral for several reasons. It helps in record-keeping for tax purposes, serves as evidence in case of disputes, and can safeguard against legal penalties. Understanding the labor laws, including those related to wage payment, is crucial for employers to comply with regulations and to protect the rights of their workforce.

Definition of Employee Wage Payments

Importance of Proper Documentation in Wage Payments

Overview of Relevant Labor Laws Governing Wage Payments

Legal framework for wage payments

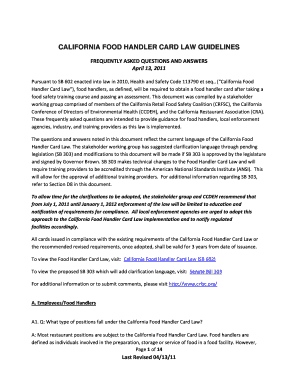

The legal framework governing employee wage payments is rooted in labor codes, which outline not only the rights of employees but also the obligations of employers. Regulations concerning wage payments are typically detailed in the labor code of each jurisdiction, encompassing rules on wage calculations, payment methods, and timelines.

Key articles often address vital aspects such as minimum wage standards, overtime pay, and record keeping. Additionally, employers must adhere to specific guidelines regarding the intervals at which wages must be paid, whether weekly, bi-weekly, or monthly, thereby ensuring that employees receive their wages in a timely fashion.

Overview of Labor Code Regulations

National Minimum Wage Guidance

Payment Methods Allowed by Law

Steps to complete wage payment forms

Completing wage payment forms accurately is essential for ensuring proper payroll processing. Selecting the correct form is the first step. Various forms cater to different employment structures, such as full-time, part-time, or contract work. The choice of form can impact everything from tax withholding to eligibility for certain benefits.

Required information typically includes employee identification details like name, social security number, work period and hours worked, as well as the calculated wage rate. Employers should also factor in tax withholdings and deductions, ensuring that all calculations are precise to avoid discrepancies.

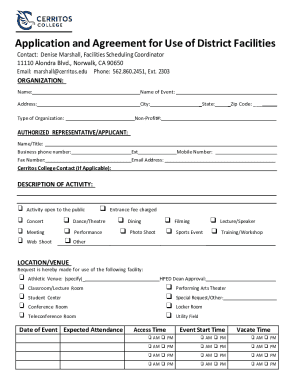

Selecting the Right Wage Payment Form

Required Information for the Form

Providing Additional Information

Timing and frequency of wage payments

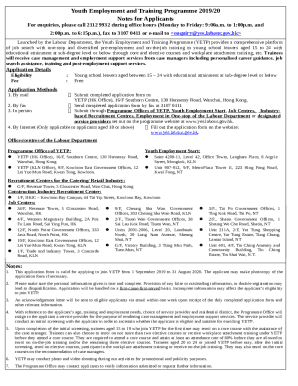

Wage payment frequency is not just a matter of company policy; it also needs to comply with legal requirements. Standard payment frequencies commonly range from weekly to monthly, each having its implications on cash flow management for both employees and employers. Understanding these timelines is crucial for maintaining compliance with labor laws.

Employers must also be vigilant about deadlines for wage payments, as delays can result in penalties. Additionally, unexpected situations like natural disasters or economic downturns may have to be addressed with specific procedures to ensure that employees are still compensated without undue delay.

Standard Payment Frequencies

Legal Requirements for Payment Timing

Handling Delays and Force Majeure Situations

Compliance and record-keeping

Retention of wage records is critical, not just for compliance with labor laws but also for effective management of potential disputes. Employers are generally required to maintain these records for a specified duration, often several years, to ensure that they can respond to any inquiries or audits by regulatory bodies.

Regular monitoring through internal audits can provide assurance that compliance is maintained. Furthermore, establishing clear procedures for addressing employee queries regarding wage payments can enhance transparency and trust in the employer-employee relationship.

Importance of Document Retention

Monitoring and Assurance of Compliance

Managing Employee Queries Regarding Wage Payments

Common issues in employee wage payments

Wage deductions are a common concern among employees, and it's essential for employers to clearly differentiate between permissible and prohibited deductions. Legislation often requires obtaining employee consent for deductions that go beyond regular tax obligations or mandated benefits.

In instances where wage disputes arise, employees must know the steps to take to make a claim for owed wages. Employers have a responsibility to address these disputes promptly and fairly, understanding the legal channels available for both parties ought to ensure just resolutions.

What to Do in Cases of Wage Disputes

Handling Unpaid Wages and Claims

Innovative solutions for wage management

With technological advancements, cloud-based solutions like pdfFiller have revolutionized wage management processes. These platforms empower users to create, edit, and manage wage payment forms efficiently. By utilizing such innovative tools, businesses can reduce administrative burdens and enhance accuracy in payroll processing.

eSigning capabilities further streamline the process, allowing for quick approvals and reducing paperwork. Collaborative tools also foster improved communication within HR teams, enabling them to address wage-related queries swiftly and effectively, ensuring a smoother payroll cycle.

Utilizing Cloud-Based Document Solutions

eSigning and Document Workflow Automation

Collaboration Tools for HR Teams

Challenges and best practices

Processing wage payments can be riddled with challenges, from administrative errors to compliance risks. Employers should establish standard operating procedures (SOPs) to streamline the process, reducing the likelihood of mistakes and ensuring alignment with legal requirements. Regular employee training on these procedures can enhance awareness and mitigate errors.

Best practices also necessitate clear communication on wage matters and providing resources for employees to understand their compensation better. This transparency not only aids in building trust but also empowers employees to engage constructively in their workplace environments.

Common Challenges in Processing Wage Payments

Best Practices for Efficient Wage Management

Resources for ongoing support

Navigating the legal and compliance landscape surrounding wage payments can be daunting. Employers can benefit from engaging with legal and regulatory bodies that oversee wage payments, ensuring they remain informed about the latest regulations and best practices. Knowing where to access help and support when issues arise is also integral to maintaining compliance.

Additionally, a range of educational resources and tools exist to assist employers in mastering wage payments management. Tools like pdfFiller simplify the process of creating, editing, and managing wage-related documentation, promoting compliance and efficiency.

Legal and Regulatory Bodies

Accessing Support and Assistance

Educational Resources and Tools for Employers

Future trends in employee wage payments

The landscape of employee wage payments is evolving with the advent of digital payments and the growing acceptance of technologies like cryptocurrency. Employers increasingly need to adapt to these changes, ensuring that their payment methods not only comply with current laws but also align with employee expectations for speed and convenience.

Moreover, innovations in payroll technologies such as the integration of artificial intelligence (AI) promise to further streamline wage management tasks, enhancing accuracy and efficiency. Staying ahead of anticipated regulatory changes is essential for businesses to remain compliant and responsive to both market and employee needs.

Emergence of Digital Payments

Innovations in Payroll Technologies

Anticipating Changes in Labor Laws