Get the free Bussq Mysuper Pds

Get, Create, Make and Sign bussq mysuper pds

Editing bussq mysuper pds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bussq mysuper pds

How to fill out bussq mysuper pds

Who needs bussq mysuper pds?

Comprehensive Guide to BUSSQ MySuper PDS Form

Understanding MySuper and its importance

MySuper is a streamlined superannuation product designed to facilitate better retirement outcomes for Australians. Established as part of the Superannuation Legislation Amendment (MySuper Core Provisions) Act 2012, MySuper aims to simplify super choices for individuals, especially those who may not have the time or knowledge to select an investment option. It’s crucial within the Australian retirement system as it offers a default product for individuals who do not wish to actively choose their super fund.

The primary purpose of MySuper products is to provide a balanced, low-cost superannuation option that automatically invests contributions for members. This means that funds will typically have diversified investment strategies, ensuring that your money works effectively towards your retirement. Key features include life insurance coverage, a set fee structure, and transparent investment performance updates.

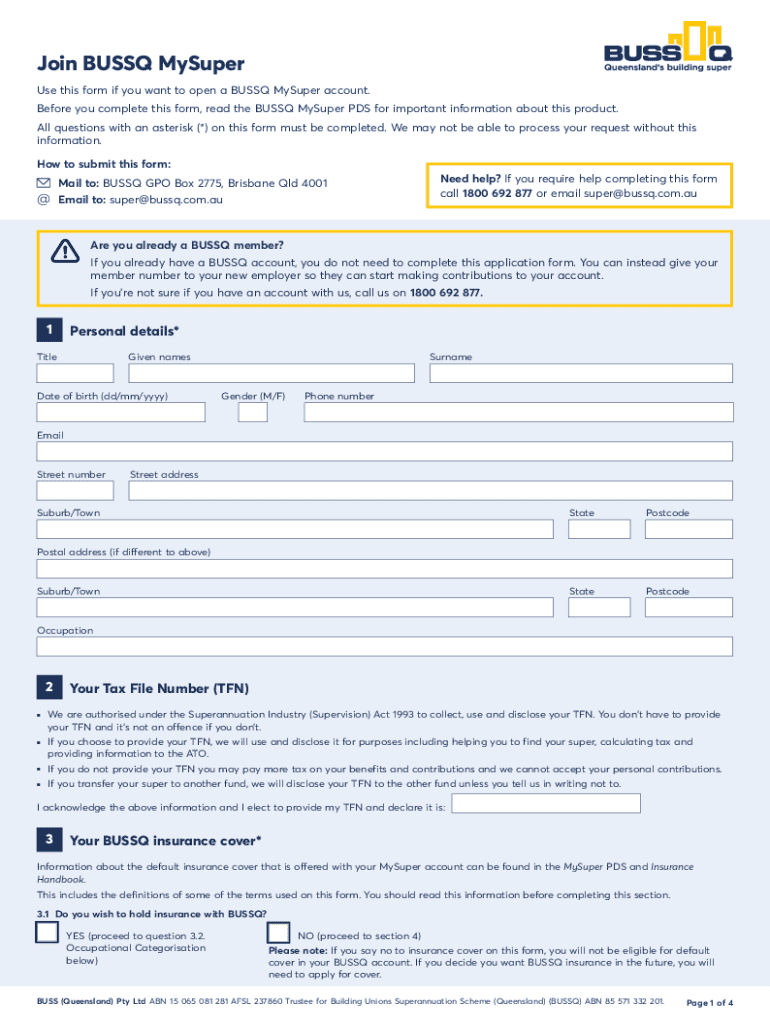

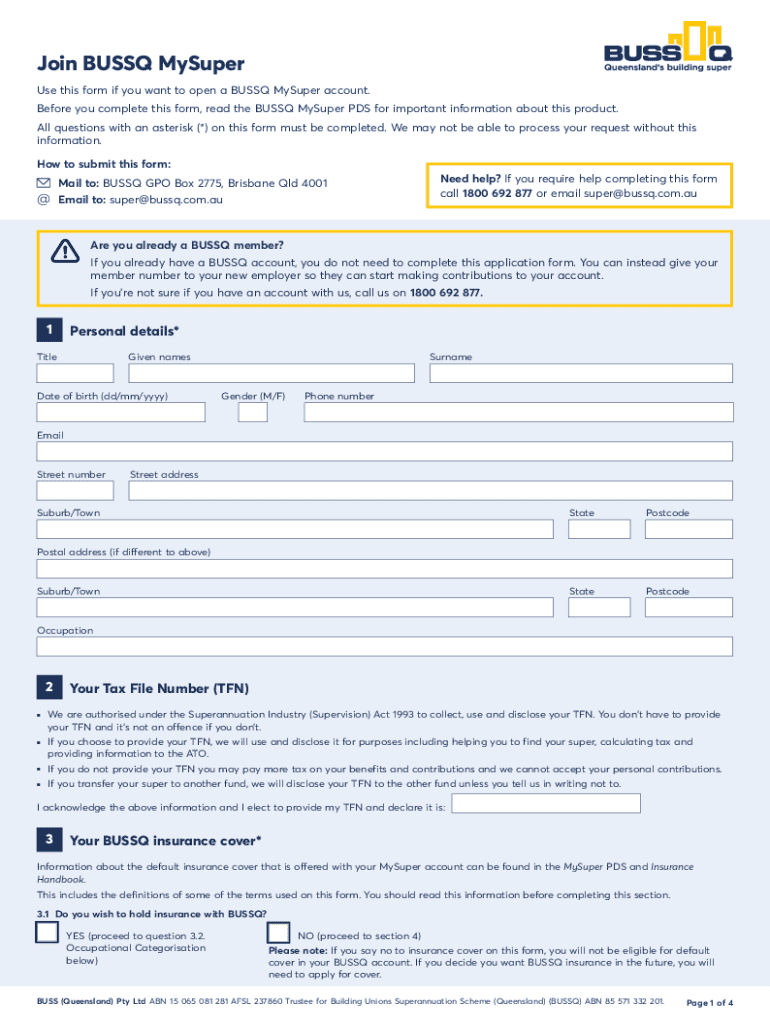

Overview of the BUSSQ MySuper PDS form

A Product Disclosure Statement (PDS) is a legal document that provides essential information about a financial product. For BUSSQ MySuper, the PDS outlines important details regarding fund objectives, investment options, fees, and risks associated with the super fund. It serves as a fundamental resource for individuals to make informed decisions about their retirement savings.

The BUSSQ MySuper PDS form is vital as it allows potential members to understand precisely what they are selecting. Features covered in the PDS include detailed insights about investment performance, fees and costs, insurance offer details, and the investment strategies employed by BUSSQ. This element of transparency is designed to empower individuals, so they feel confident in their choices.

Navigating the BUSSQ MySuper PDS form

To fully grasp the BUSSQ MySuper PDS, it’s essential to know how to navigate its various sections. The form is structured to provide clarity and detail, allowing individuals to find the information needed easily. Each segment plays a crucial role in helping you understand different aspects of the super fund.

The critical sections within the BUSSQ MySuper PDS include the following:

Step-by-step instructions for completing the BUSSQ MySuper form

Before filling out the BUSSQ MySuper PDS form, it is crucial to prepare adequately. Gathering the necessary documents, such as identification and financial details, will streamline the process. Understanding eligibility and requirements is also essential to ensure a smooth application.

Here’s a detailed step-by-step guide to completing the form:

Additional tools and tips for managing your MySuper account

Managing your BUSSQ MySuper account effectively requires access to the right online tools. The BUSSQ website offers members the ability to view their account balances, update personal details, and monitor investment performance. For enhanced document management, tools like pdfFiller can greatly facilitate the process.

Using pdfFiller’s interactive tools, you can edit your PDS form, sign it electronically, and share your documentation with ease. Additional features like eSignature options provide secure methods to approve documents while ensuring data privacy.

Common questions about BUSSQ MySuper

After submitting the BUSSQ MySuper PDS form, you may have questions about what to expect next. Typically, once submitted, the BUSSQ team will process your application and send confirmation regarding your membership status. It’s important to keep records of your submission for future reference.

Individuals may wonder how to update details if circumstances change, such as personal information or investment preferences. Most often, you can make these updates online through the BUSSQ member portal or by directly contacting their customer service.

Comparisons and insights

When comparing BUSSQ MySuper with other MySuper options, evaluating factors such as fee structures, performance history, and insurance coverage is critical. BUSSQ offers competitive fees that help maximize investment returns without compromising on service and support.

Understanding the performance of BUSSQ MySuper funds can be achieved by reviewing periodic performance reports available through the PDS. Assessing various funds based on these reports will help you choose a MySuper fund that suits your financial goals best.

FAQs about BUSSQ MySuper and the PDS form

MySuper funds often come with misconceptions. Common myths include the notion that all super funds are the same or that higher fees always mean better service. It is essential to break these myths to make informed decisions about your retirement savings.

Clarifying complex terms found in the BUSSQ PDS is equally important; terms such as 'asset allocation,' 'investment horizon,' and 'risk tolerance' may be confusing. Should you have questions surrounding these terms or need further clarification, various resources are available, including the BUSSQ website, financial advisors, and even community forums.

Utilization of pdfFiller tools

Employing pdfFiller in your PDS form process can significantly enhance the user experience. With the ability to fill out, edit, and electronically sign documents, it streamlines what can often be a laborious task into a more manageable one.

The collaboration tools available also benefit teams and individuals alike—enabling users to share documents and work together seamlessly. This can facilitate faster processing times and reduces the risks of errors during form submission.

Key considerations when choosing a super fund

Before choosing a super fund, it's critical to assess your retirement needs and goals. Consider factors such as how much you will need in retirement, your current savings, and your risk tolerance for investments. Regularly evaluating and reviewing your super fund’s performance is essential to ensure your investments align with your retirement strategy.

Aligning your investment choice with personal values is increasingly important. Do you prefer funds that emphasize ethical investing, environmental sustainability, or social good? Such considerations have become integral to how many Australians approach their superannuation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find bussq mysuper pds?

How do I edit bussq mysuper pds online?

How do I complete bussq mysuper pds on an Android device?

What is bussq mysuper pds?

Who is required to file bussq mysuper pds?

How to fill out bussq mysuper pds?

What is the purpose of bussq mysuper pds?

What information must be reported on bussq mysuper pds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.