Get the free R-1029se

Get, Create, Make and Sign r-1029se

How to edit r-1029se online

Uncompromising security for your PDF editing and eSignature needs

How to fill out r-1029se

How to fill out r-1029se

Who needs r-1029se?

A comprehensive guide to the R-1029SE form for Louisiana event taxes

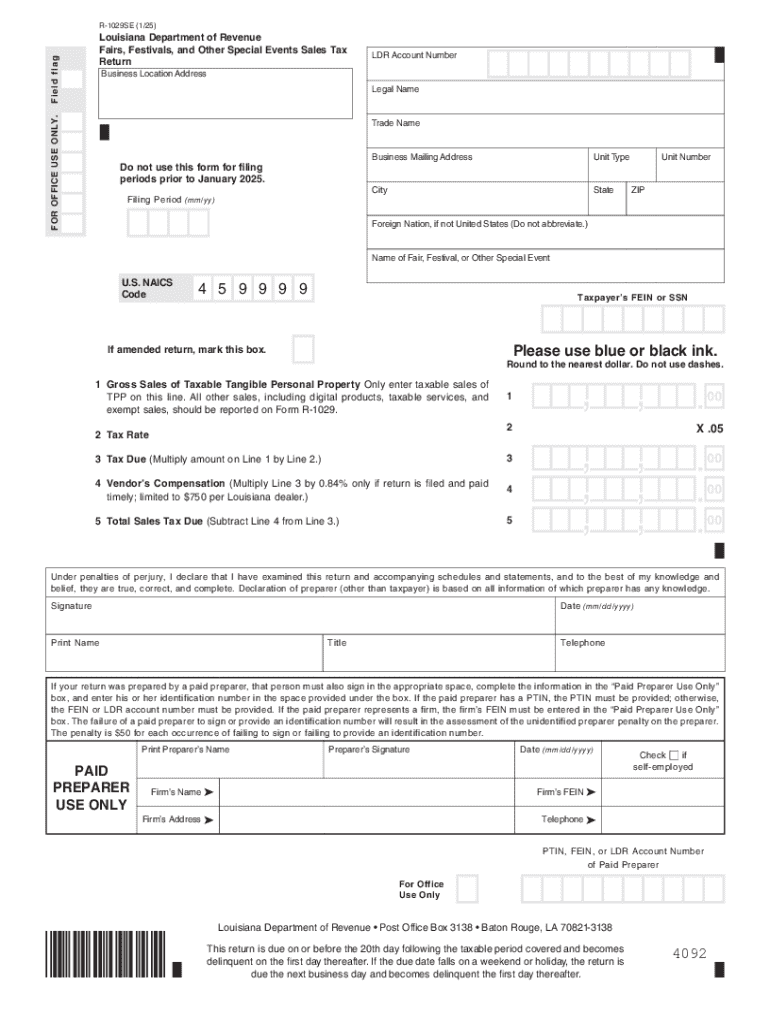

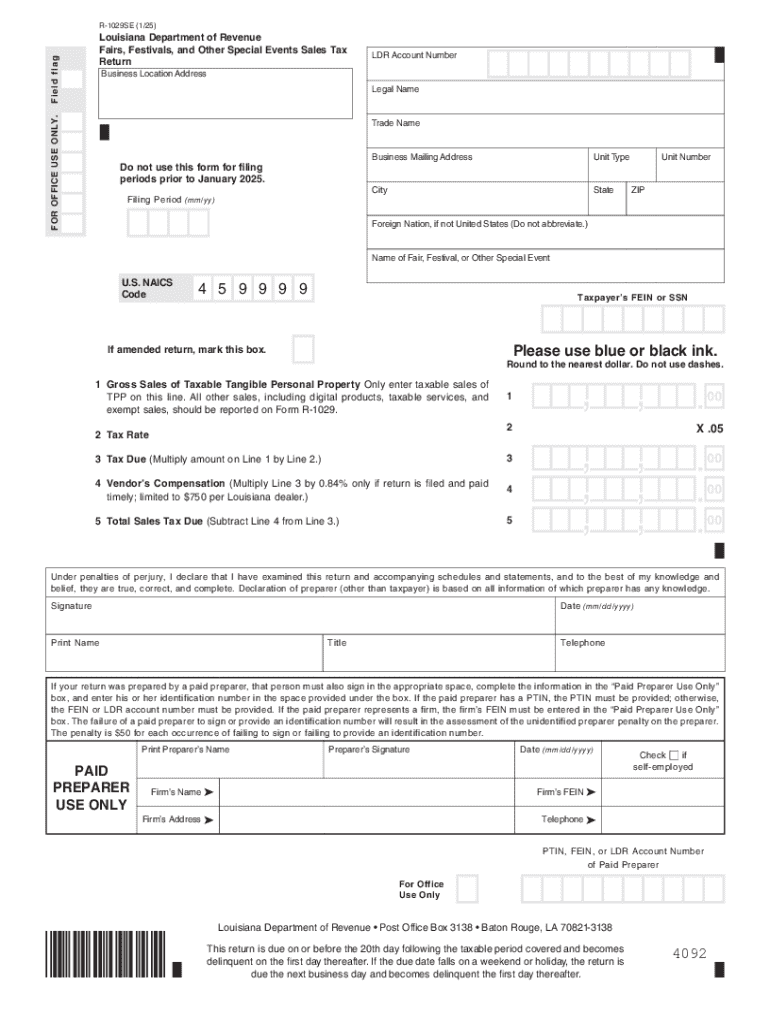

Overview of the R-1029SE form

The R-1029SE form is a crucial document for anyone organizing special events within Louisiana that involve sales tax collection. This form serves to report and remit sales taxes on specific events, ensuring compliance with state regulations. With the potential for significant penalties for non-compliance, understanding the purpose and importance of the R-1029SE form is essential for individuals and businesses alike.

Utilizing the R-1029SE form is indispensable for maintaining tax compliance if you're planning an event that features goods or services subject to Louisiana's sales tax laws. Whether you're hosting a concert, festival, or any special gathering where taxable sales occur, this form will ensure that you're adhering to state guidelines.

Who needs to utilize the R-1029SE form?

The R-1029SE form is primarily meant for individuals and companies that are event organizers, especially those planning events where tangible goods or certain services are sold. Examples include non-profit organizations, commercial businesses, or solo entrepreneurs hosting unique events like craft fairs or food festivals. Event organizers must recognize the ongoing financial responsibilities tied to sales taxes in order to fulfill their legal obligations.

Key features of the R-1029SE form

The R-1029SE form is designed to address specific tax needs for event-related sales. Primarily, it focuses on the sales tax associated with taxable items sold during these events, which can include merchandise and food items. Knowing the applicable rates and categories associated with the sales tax is vital, as they can vary significantly based on the nature of the goods or services being offered.

The layout of the R-1029SE form is intuitive but requires careful attention to detail. Each section demands specific information—from event details to financial calculations—that ensures the accuracy of the tax report being submitted. Many users mistakenly overlook sections, especially when it comes to itemizing sales and entering tax calculations correctly.

Step-by-step guide to filling out the R-1029SE form

Filling out the R-1029SE form can be a straightforward process if you follow a systematic approach. First, ensure you gather all necessary documentation related to your event. This includes event permits, sales records, and any other information pertinent to your taxable sales. Identify the specific details of your event, such as its date, location, and type, which will be crucial in the completion of the form.

Here's a detailed breakdown of the form's sections to ensure you complete it accurately:

Common mistakes to avoid when completing the R-1029SE form

Completing the R-1029SE form can seem daunting, but avoiding common pitfalls can save you time and prevent potential fines. One frequent mistake is misreporting income and sales data, either through inaccurate calculations or by failing to include all necessary information. Ensure that all figures are double-checked against your sales records before submission.

Another common error involves miscalculating taxes owed. Double-check applicable rates and use tax calculators if you're unsure. Additionally, missing required signatures can lead to delays in processing your form. Make certain that all signatures are duly acquired before submission to avoid penalties or complications.

Tips for efficient submission

Efficiency in filling and submitting the R-1029SE form can greatly simplify your tax obligations. Consider best practices such as utilizing a digital version of the form offered by platforms like pdfFiller, which allows you to fill out the form seamlessly online. When completing the form digitally, ensure you save it in formats accepted by the state, typically PDF files, to retain proper formatting.

Once submitted, tracking your application is crucial; many digital platforms provide tracking features, allowing you to confirm successful submissions and receive updates regarding processing.

Managing and storing your R-1029SE form

The importance of maintaining efficient record management associated with the R-1029SE form cannot be overstated. Proper documentation is essential not only for compliance but also for future references, especially if the state requests supporting documentation for your filed taxes. Keeping detailed records of events, sales, and subsequent submissions will facilitate a smooth auditing process if necessary.

For effective digital storage, consider platforms like pdfFiller, which excels in document management solutions. It offers features that allow users to store, share, and retrieve their documents effortlessly. The software can even enhance document handling by allowing collaborative editing and signing features, making it easier for teams to collaborate on event planning and tax compliance.

Frequent questions regarding the R-1029SE form

Navigating tax forms can raise questions, particularly concerning your responsibilities and rights. A common query is how the R-1029SE form differentiates from other tax forms. While other tax documents may pertain to annual filing, the R-1029SE specifically targets event-related sales and the associated taxes, streamlining compliance for unique sales situations.

If a mistake is made after submission, promptly contact the Louisiana Department of Revenue to understand the proper rectification steps. It's imperative to be mindful of deadlines to avoid penalties on late submissions, which could affect future event planning.

Interactive tools and resources

To support your R-1029SE form filling experience, several interactive tools are available online. These include templates that guide you through completing the form accurately, as well as calculators that help estimate sales tax based on anticipated revenue. Utilizing these resources can aid in improving both the accuracy and efficiency of your tax reporting process.

Additionally, links to related forms and documents are often provided by state tax authorities, ensuring you have access to all necessary materials surrounding your event tax obligations.

Connectivity to related documents and forms

Understanding the R-1029SE in context with other Louisiana tax forms enhances compliance efforts. Various forms exist that may relate to general sales taxes, income taxes, and specific industry regulations. Familiarizing yourself with these will provide a broader view of your obligations, ensuring no detail is overlooked.

Keep an eye on updates regarding tax legislation, as changes can impact how events are taxed in Louisiana. By staying informed about upcoming events or changes within the state's revenue department, your organization can remain proactive in tax compliance and planning.

Empowerment through pdfFiller

Utilizing pdfFiller for completing the R-1029SE form streamlines your experience in multiple ways. The platform's capabilities to edit PDFs seamlessly, engage in eSigning, and collaborate with your team ensures a more efficient workflow as you prepare your documentation for tax submission. The ability to manage everything in one place greatly simplifies the task of maintaining compliance.

With collaborative features, your team can work together in real-time, whether editing the form or confirming all necessary details are included before submission. As events can be fast-paced, having the tools ready to facilitate quick modifications can make a notable difference in your organizational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my r-1029se in Gmail?

How can I send r-1029se to be eSigned by others?

How do I make edits in r-1029se without leaving Chrome?

What is r-1029se?

Who is required to file r-1029se?

How to fill out r-1029se?

What is the purpose of r-1029se?

What information must be reported on r-1029se?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.