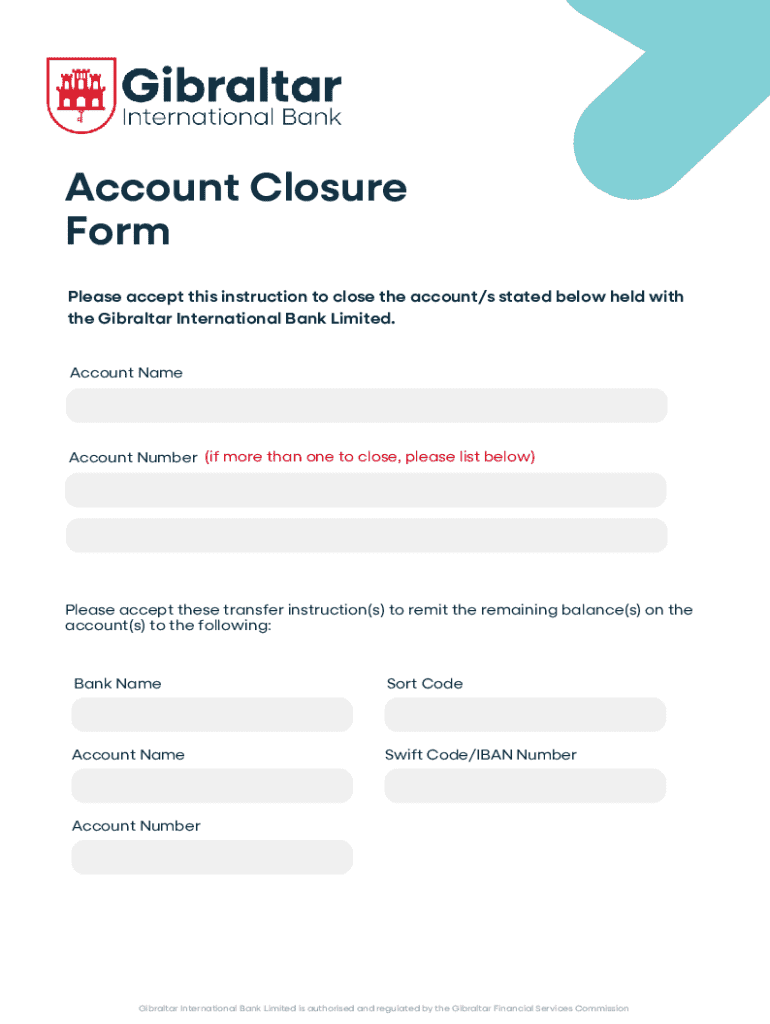

Get the free Account Closure Form

Get, Create, Make and Sign account closure form

Editing account closure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account closure form

How to fill out account closure form

Who needs account closure form?

Comprehensive Guide to the Account Closure Form

Understanding the need for an account closure form

An account closure form is a formal document used to initiate the process of closing a financial or service-related account. This form ensures that both the user and the service provider have a clear record of the closure request. In some cases, completing this form is a requirement to finalize the closure of an account.

Common reasons for account closure often include personal decisions, such as dissatisfaction with services or financial priorities shifting. Other reasons may reflect organizational changes that necessitate account adjustments, or switching providers to take advantage of better offerings or rates. Regardless of the reason for closure, there are significant consequences associated with not submitting the official account closure form, such as continued fees and unclosed access to personal data.

If an official form is not submitted, users may face ongoing charges, loss of access to important information, and potential complications with financial records. Therefore, it’s crucial to understand why and how to properly use an account closure form.

Preparing to fill out your account closure form

Before filling out your account closure form, certain preparations are essential to expedite the process. Start by gathering the required information, which generally includes personal identification details such as your name, address, and account number. Additionally, you will need to specify your reason for closure, as providing context can be helpful for the service provider.

Next, take the time to review the terms and conditions of your account. Understanding the implications of closure is important, especially concerning how it affects any remaining balances, rewards, or contractual obligations. Additionally, confirming any outstanding balances or obligations will prevent complications down the line. This preparation ensures that your closure request is accurate and complete, minimizing the chance of follow-up inquiries that may delay the process.

Steps to fill out the account closure form

Filling out the account closure form should be a straightforward process if you follow the right steps. First, access the form via pdfFiller, where it’s available for direct use. You can typically find it on the specific service provider’s website or via a reliable PDF template platform.

Once you have the form, adhere to these step-by-step instructions for completion:

After filling in the details, review your responses for accuracy. An incomplete or incorrect form can result in unnecessary delays or complications in processing your request.

Editing and customizing your account closure form

Once you’ve completed your form, you might want to customize or edit it before final submission. pdfFiller offers robust editing tools that allow you to make necessary adjustments easily. Features such as adding annotations, notes, or additional explanations can personalize your request and improve clarity.

When customizing, follow these best practices to ensure a professional appearance. Use clear and concise language for any comments, maintain a formal tone, and ensure any modifications maintain the integrity of your original responses. Effective customization can enhance the readability of your document and ensure your points are clearly conveyed.

Signing your account closure form

The importance of signing your account closure form cannot be understated. A signature confirms your request and protects both parties involved in the closure process. Utilizing the eSignature features in pdfFiller streamlines this aspect significantly, allowing you to apply your signature electronically without printing the document.

To apply your eSignature, simply follow these steps: First, navigate to the eSignature feature on pdfFiller and create your signature, if you haven't done so already. Next, select the location on your account closure form where the signature is required and apply the eSignature. Remember that electronic signatures are legally recognized and should hold the same weight as traditional signatures, as long as they comply with relevant legal standards.

Submitting your account closure form

After signing your account closure form, the next step is submission. You have several options for submitting your request, depending on the preferences of the service provider. Generally, you can submit your form through online submission via pdfFiller, by mailing a printed hard copy, or by personally delivering it to a local office.

Once submitted, it’s wise to track your submission and seek confirmation. Tracking the status of your request can often be done through the provider's online portal or by contacting customer service. Being proactive in confirming that your request has been received can help prevent any miscommunication or unexpected extensions of account access.

Post-submission considerations

After submitting your account closure form, you should know what to expect. The timeline for processing can vary depending on the organization, but it typically ranges from a few days to several weeks. During this period, stay alert for any follow-up communications from your service provider, as they may reach out for clarification or additional information to process your request.

In some cases, you might encounter rejections or requests for further information. Understanding the reasons behind potential rejections is essential for addressing issues promptly. Having documentation, such as confirmation of submission, can bolster your case if you need to appeal a decision or clarify any misconceptions.

Maintaining records

Keeping a copy of your closure form is crucial for your records. It serves as tangible proof of your closure request and provides details if there are any disputes or follow-ups needed in the future. Utilizing pdfFiller for document storage and management ensures your copies are organized and easily accessible.

To maintain your documents efficiently, establish a filing system within pdfFiller that categorizes forms and keeps track of important deadlines. Accessing digital copies in the future will be straightforward, allowing you to lead a paperless lifestyle while ensuring that all your documents remain intact and safe.

FAQs regarding the account closure process

Several common questions often arise when users navigate the account closure process. For instance, many want to understand what happens to their data after account closure. Typically, service providers will retain certain information for compliance reasons but should inform users about data handling per their privacy policies.

Another frequent inquiry is whether an account can be reopened after closure. While some providers offer this option, others may have policies that prevent reopening accounts, making it essential to confirm this prior to closure. Additionally, users commonly ask how long the closure process takes, which can vary significantly from one provider to another. Checking directly with customer service can provide accurate timelines specific to your service provider.

Support and assistance with the account closure form

If you encounter challenges while filling out your account closure form, accessing customer support through pdfFiller can provide valuable assistance. pdfFiller offers live chat options and a comprehensive Help Center where you can find answers to your questions or directly contact support representatives for personalized help.

When navigating complex situations, such as disputes over closure requests or misunderstandings with service providers, it can be beneficial to seek professional guidance. Consulting with a legal expert or a financial advisor can provide clarity and assist in ensuring that your rights are protected throughout the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get account closure form?

How do I edit account closure form in Chrome?

Can I edit account closure form on an Android device?

What is account closure form?

Who is required to file account closure form?

How to fill out account closure form?

What is the purpose of account closure form?

What information must be reported on account closure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.