Get the free Current and Savings Account Opening Form For Non ...

Get, Create, Make and Sign current and savings account

How to edit current and savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out current and savings account

How to fill out current and savings account

Who needs current and savings account?

Current and savings account form: A comprehensive how-to guide

Understanding current and savings accounts

Current and savings accounts serve as fundamental tools in managing personal and business finances. A current account is primarily designed for frequent transactions, making it ideal for managing everyday expenses. It allows unlimited deposits and withdrawals, and often comes with features like checkbooks and overdraft facilities. On the other hand, a savings account is focused on growth, earning interest on deposited funds while limiting withdrawal frequency. Each account type is tailored for distinct financial activity, influencing how individuals or businesses manage their cash flow.

Individuals seeking a day-to-day banking solution will benefit most from a current account, while those looking to save money and earn interest should opt for a savings account. For small businesses, current accounts help streamline daily transactions, while savings accounts can serve as a reserve for future investments. Corporate entities often use both types to balance operational liquidity with long-term capital growth.

Choosing the right account for your needs

Selecting the right account hinges on several factors. Firstly, consider transaction volume; if you anticipate frequent transactions, a current account may be more suitable. Evaluating interest rates and fees is crucial; savings accounts generally offer higher interest but can impose restrictions on withdrawals. Accessibility is also key—look for online banking features that provide seamless account management.

A comparison chart of features can also help clarify options. Key factors include interest rates, minimum balance requirements, and overdraft capabilities, which vary widely among banks. Assess these features based on your financial habits and goals.

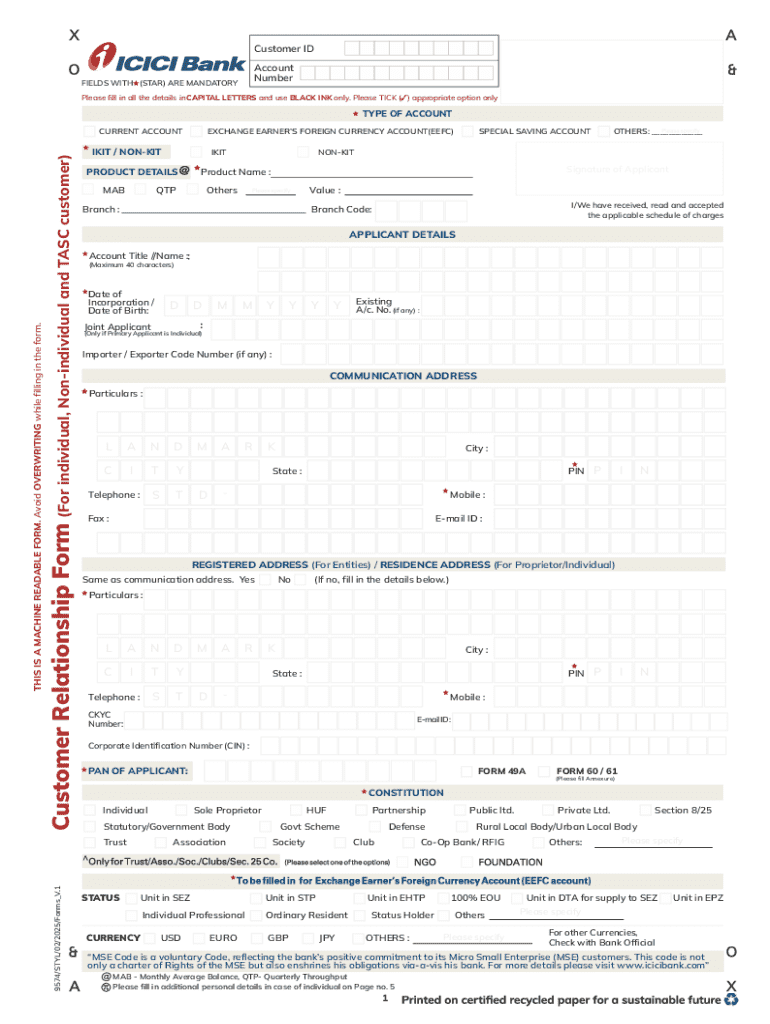

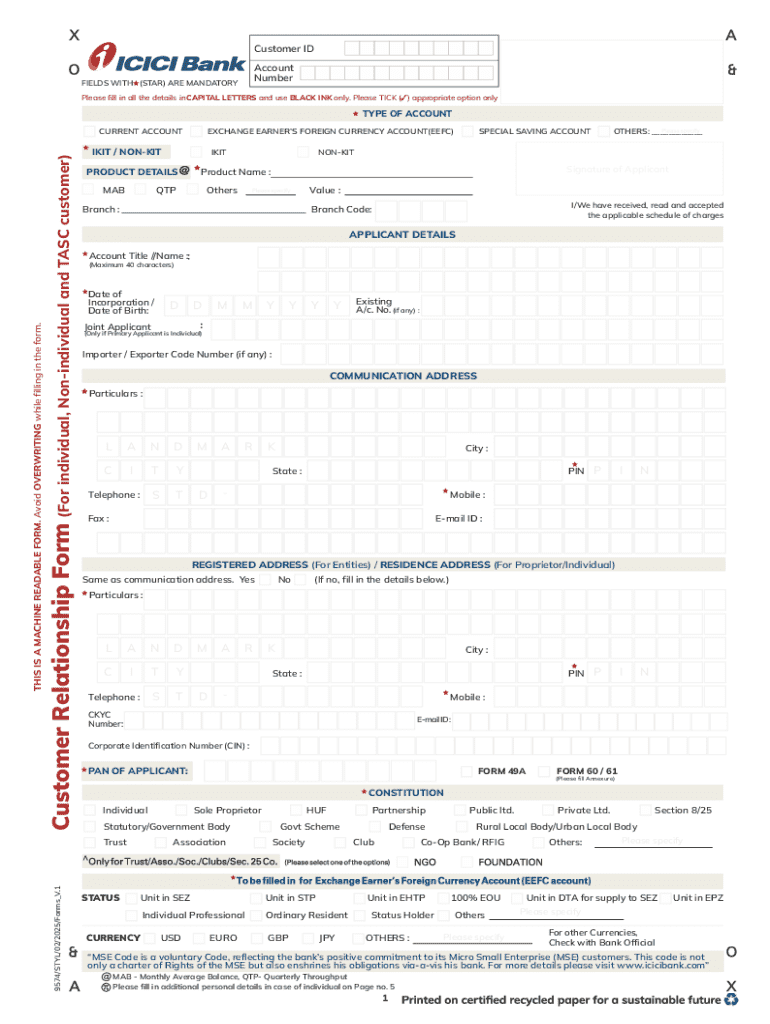

Filling out the current and savings account form

When you’re ready to open an account, the first step is to prepare all necessary information. Essential documents include identity proof, address proof, and your tax identification number. Understanding what's required beforehand can streamline the process and prevent delays.

You’ll typically find that the account form consists of several sections. Start with the personal information section where you’ll provide your name, address, and contact details. Next, designate the type of account you wish to open, whether a current or savings account. It’s also wise to consider naming a beneficiary in the designated section, providing peace of mind regarding your assets.

Editing and managing your account form

Once you've filled out your current and savings account form, you might want to make edits or adjustments. Using pdfFiller for document editing is highly recommended for a streamlined experience. With this tool, you can access a variety of editing functions, adding text where needed or inserting signatures conveniently.

Collaborating with others is equally effortless. The cloud-based platform enables multiple users to contribute or verify the document as necessary. When you've finalized the form, you can save or download it in various formats such as PDF or DOCX, providing flexibility for your record-keeping.

Signing your current and savings account form

An electronic signature can simplify the process of signing your current and savings account form. This method is not only legally binding but also offers numerous benefits, such as faster processing times and enhanced convenience. It's essential to ensure that your eSignature complies with legal standards, as this ensures that the document holds validity.

Using pdfFiller to eSign your form is straightforward. After completing the document, navigate to the eSigning feature and follow the step-by-step process to apply your signature securely. The platform prioritizes security, providing verification measures to ensure your signature's integrity.

Submitting your account form

The submission process for your current and savings account form can vary. Many banks allow for online submission directly through their website, which can often be faster than traditional methods. Be aware of any confirmation you might receive, and follow-up to ensure your application is being processed correctly.

If you choose to submit the form in person, prepare for the visit by reviewing the documents required. When you arrive at the bank, look forward to the staff guiding you through any additional queries they might have regarding your application.

Managing your account post-submission

After submitting your account form, stay proactive in managing your new account. Common issues can arise, such as delays in account activation or problems with documentation. Monitoring your application status through your bank's online portal can help alleviate uncertainty.

Tools for ongoing account management can include online banking options that allow you to access your account anywhere. You can set alerts and notifications for transactions, ensuring you stay informed about your financial activity.

Understanding bank policies and compliance

Navigating the world of current and savings accounts also involves understanding bank policies. Know Your Customer (KYC) regulations require banks to verify customers' identities to prevent fraud. Similarly, Anti-Money Laundering (AML) policies are designed to protect financial institutions and ensure compliance with federal regulations.

These measures are not merely bureaucratic; they play a critical role in safeguarding your privacy and ensuring the security of your financial data. Familiarizing yourself with these policies will equip you with a better understanding of how your bank operates and what that means for you as an account holder.

FAQs on current and savings account forms

It's common to have questions regarding the current and savings account form process. One frequent query is what to do if you make a mistake on the form; most banks allow corrections if you act quickly, so don't hesitate to reach out to customer service for guidance.

Customer support for your document needs

If you encounter issues while filling out your current and savings account form or using pdfFiller, excellent customer support is available. pdfFiller offers multiple contact methods, including live chat, email, and phone support, ensuring you have access to help whenever needed.

The platform also provides guidance on troubleshooting common document issues, so you won’t feel lost in the process. If you have feedback on how to improve your experience, customer support is receptive to suggestions, aiming to enhance service across the board.

Integrating your current and savings account with other financial products

Linking your current and savings accounts with other financial products can provide a more holistic view of your financial health. For instance, integrating your accounts with investment accounts allows for efficient fund transfers and accessibility to various financial assets.

Additionally, understanding how to manage loans and credit cards in conjunction with your bank accounts helps in maintaining an organized financial portfolio. Several free financial tools can assist you in comprehensive management, ensuring that every penny works for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in current and savings account?

Can I create an electronic signature for signing my current and savings account in Gmail?

How do I fill out the current and savings account form on my smartphone?

What is current and savings account?

Who is required to file current and savings account?

How to fill out current and savings account?

What is the purpose of current and savings account?

What information must be reported on current and savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.